The world’s most popular cryptocurrency, Bitcoin, has been steadily climbing over the past few weeks, surpassing the $26,500 level today. The Bitcoin price currently stands at $26,560, with a 24-hour trading volume of $9.6 billion.

Bitcoin has experienced a 1% increase in value over the past 24 hours. Its live market cap stands at $517 billion and is still ranked #1 on CoinMarketCap.

The circulating supply of Bitcoin is 19,487,418 BTC coins, with a maximum supply of 21,000,000 BTC coins. The recent price surge has caused many to question whether it is the ideal time to invest in Bitcoin.

Bitcoin Price Prediction

Bitcoin’s present state is analyzed technically, revealing a slightly bearish outlook. Currently, the cryptocurrency trades marginally above the $26,500 support level that was once a resistance, maintaining stability near the $26,800 resistance that forms a double-top.

Bitcoin’s potential growth may be limited by a descending trend line around $26,750, which is a positive aspect to consider. However, if BTC manages to overcome this barrier, it could aim for the $27,000 milestone.

Additionally, $27,600 poses a significant challenge. If Bitcoin surpasses this threshold, it could drive the price towards the $28,000 resistance level or higher.

Bitcoin may face a significant obstacle in the form of a descending trend line valued at $26,750. If the cryptocurrency fails to surpass this level, it could experience a decline towards $26,600 or even retest the $26,000 support level.

This could lead to increased selling pressure, potentially resulting in a drop in BTC’s value to around $25,250.

Despite this, several technical indicators, such as the 50-day exponential moving average, relative strength index, and moving average convergence and divergence, suggest a buying trend and a sustained bullish momentum.

Thus, traders must closely monitor the $26,500 level as it could be a crucial turning point. Prices above this level may indicate buying opportunities, while prices below may suggest selling possibilities.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

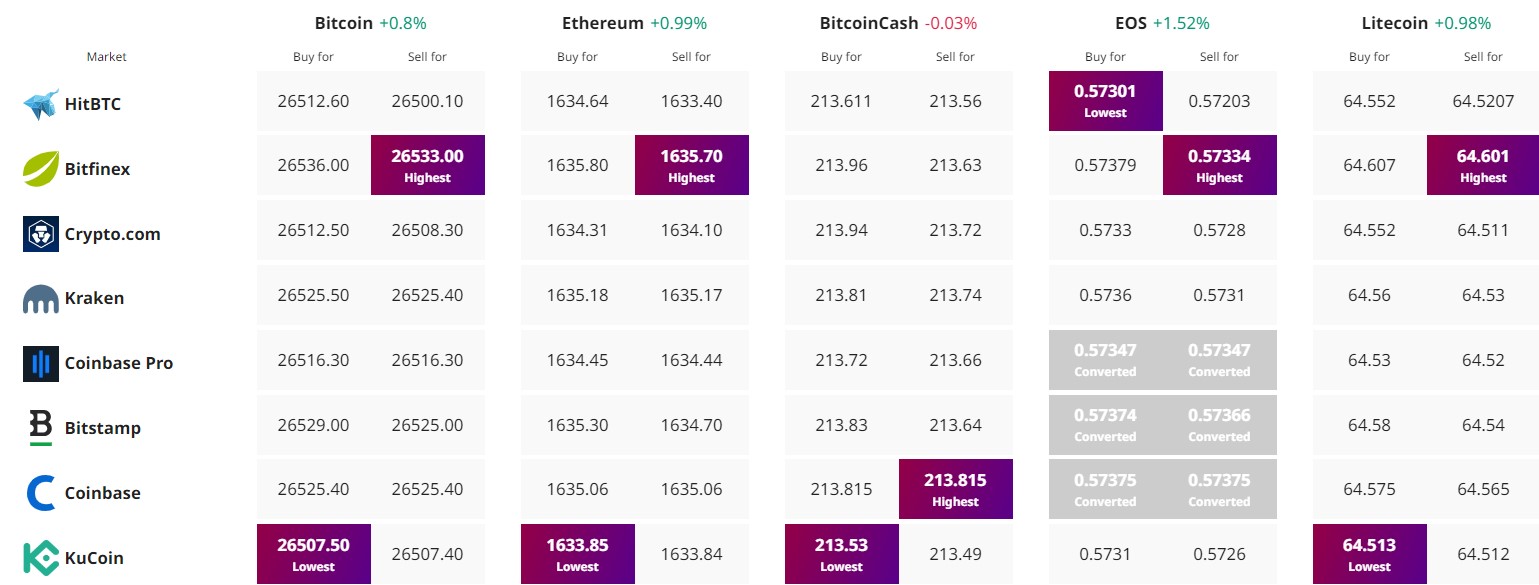

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The world’s most popular cryptocurrency, Bitcoin, has been steadily climbing over the past few weeks, surpassing the $26,500 level today. The Bitcoin price currently stands at $26,560, with a 24-hour trading volume of $9.6 billion.

Bitcoin has experienced a 1% increase in value over the past 24 hours. Its live market cap stands at $517 billion and is still ranked #1 on CoinMarketCap.

The circulating supply of Bitcoin is 19,487,418 BTC coins, with a maximum supply of 21,000,000 BTC coins. The recent price surge has caused many to question whether it is the ideal time to invest in Bitcoin.

Bitcoin Price Prediction

Bitcoin’s present state is analyzed technically, revealing a slightly bearish outlook. Currently, the cryptocurrency trades marginally above the $26,500 support level that was once a resistance, maintaining stability near the $26,800 resistance that forms a double-top.

Bitcoin’s potential growth may be limited by a descending trend line around $26,750, which is a positive aspect to consider. However, if BTC manages to overcome this barrier, it could aim for the $27,000 milestone.

Additionally, $27,600 poses a significant challenge. If Bitcoin surpasses this threshold, it could drive the price towards the $28,000 resistance level or higher.

Bitcoin may face a significant obstacle in the form of a descending trend line valued at $26,750. If the cryptocurrency fails to surpass this level, it could experience a decline towards $26,600 or even retest the $26,000 support level.

This could lead to increased selling pressure, potentially resulting in a drop in BTC’s value to around $25,250.

Despite this, several technical indicators, such as the 50-day exponential moving average, relative strength index, and moving average convergence and divergence, suggest a buying trend and a sustained bullish momentum.

Thus, traders must closely monitor the $26,500 level as it could be a crucial turning point. Prices above this level may indicate buying opportunities, while prices below may suggest selling possibilities.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

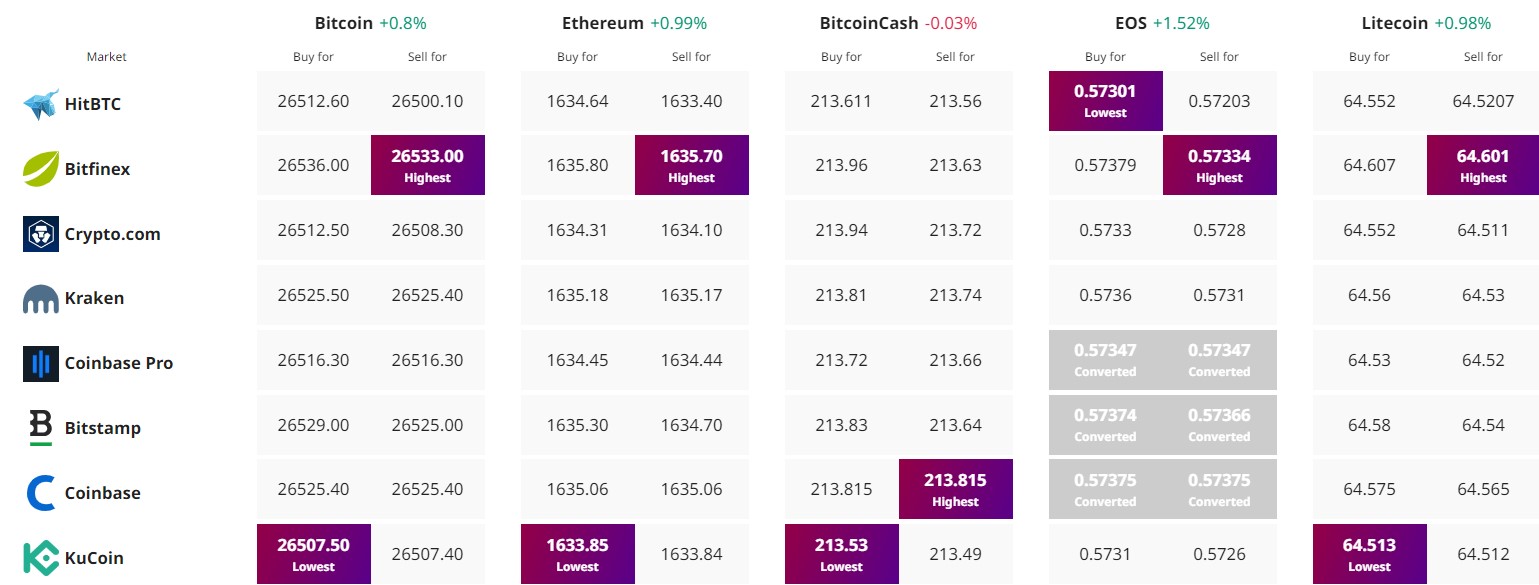

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.