During the Asian session, Bitcoin‘s trajectory garners significant attention, with the asset flirting with the $43,000 mark. Recent developments, including BlackRock’s Bitcoin ETF climbing to the elite ranks of ETFs and MicroStrategy’s substantial acquisition, amplify the discourse around Bitcoin price prediction.

These strategic moves, coupled with a notable average return for cryptocurrency investors in 2023 and ongoing legal dramas, frame a compelling narrative. As stakeholders dissect these factors, speculation mounts over whether these catalysts could propel Bitcoin towards an ambitious $50,000 rally.

BlackRock’s Bitcoin ETF Tops 0.2% of All ETFs

With flows over $3.19 billion, BlackRock’s iShares Bitcoin ETF has risen to the top 0.16% of all US ETFs, even after a seven-day trading pause while it awaited SEC approval. At $2.51 billion, Fidelity’s Bitcoin Fund is ranked highly as well.

Bitcoin ETFs are still gaining popularity even if they got a late start in comparison to other ETFs. BitMEX Research indicates that Fidelity and BlackRock are outperforming Grayscale in terms of flows. This pattern indicates an increase in institutional interest in exposure to Bitcoin.

Due to the substantial capital that these ETFs draw, there may be a rise in demand for Bitcoin and a subsequent increase in price. Furthermore, the steady withdrawals from Grayscale point to a changing inclination in favor of ETFs, which can raise the price of Bitcoin as more money enters the market.

MicroStrategy Adds $37M BTC, Now Holds 190,000

In January, MicroStrategy added 850 Bitcoin to its portfolio, valuing its assets at $8.1 billion, or 190,000 BTC. The company’s CFO revealed during its Q4 2023 earnings call that they bought 56,650 Bitcoin in 2023 at an average cost of $33,580. MicroStrategy’s realization of Bitcoin’s potential as an institutional-grade asset class is what caused its net income to increase to $89.1 million.

MicroStrategy adds to its Bitcoin holdings, purchasing $37M worth in January, now holding a total of 190,000 BTC valued at $8.1 billion. #Bitcoin #MicroStrategy

— Ai TPL (@tradepro_labs) February 7, 2024

Chairman Michael Saylor rejects earlier criticism, arguing that the introduction of spot Bitcoin ETFs enhances Bitcoin’s standing as a store of value. Despite worries about the influence of traditional financial institutions, MicroStrategy is still optimistic and anticipates continuing to buy Bitcoin.

This continuous accumulation by a significant institutional investor such as MicroStrategy may increase demand for Bitcoin and encourage price growth.

Bitcoin Price Prediction: 2023 Crypto Investors See $887 Average Returns

According to CoinLedger, investors in cryptocurrencies saw an average return of $887 in 2023—a significant improvement over the $7,102 in losses they saw in 2022. The resurgence of the cryptocurrency market is a result of the industry’s resiliency following the failures of companies such as FTX. Though there have been disappointments in the past, hope increased when spot Bitcoin ETFs were introduced in January 2024.

CRYPTO INVESTORS AVERAGE NEARLY $900 IN NET GAINS FROM 2023 CRYPTO SALES

– Crypto investors, as analyzed by CoinLedger, reaped an average of $887.60 in net gains from crypto sales in 2023.

– The findings, based on reporting from 500,000 users, provide insights into the… https://t.co/cTVnO0lEJL pic.twitter.com/8N4oI3KGUU

— BSCN (@BSCNews) February 7, 2024

According to the research, those who own Bitcoin are more likely to keep onto their holdings, which helps to maintain market stability. This optimistic outlook would boost investor confidence in Bitcoin, which might raise demand and push prices higher.

More money may flow into the cryptocurrency market, especially Bitcoin, as more investors realize its potential, which would sustain the price trajectory of the cryptocurrency.

Bitcoin Price Prediction

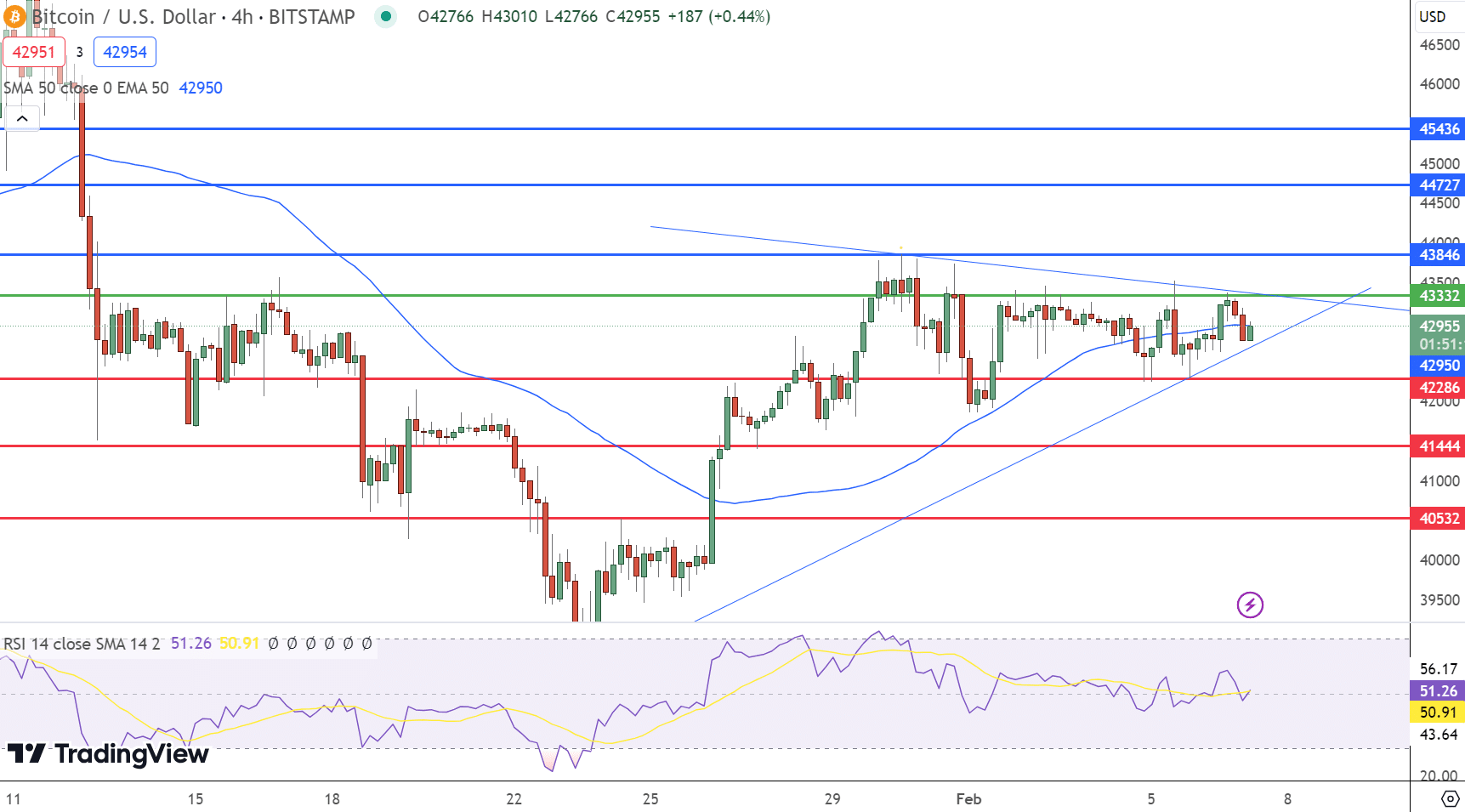

Bitcoin‘s trajectory witnessed a modest decline, slipping 0.47% to stand at $42,895. Amidst this backdrop, our analysis zeroes in on critical price thresholds and technical indicators to forecast Bitcoin’s impending movements.

The pivot point, marked at $43,332, becomes a focal point, with resistance levels staged at $43,846, $44,727, and $45,436. Support levels, pivotal for bearish reversals, are delineated at $42,286, $41,444, and $40,532.

Key Points:

- Bitcoin hovers at $42,895; eyes pivotal $43,332 for directional cues.

- RSI and 50 EMA signal a balanced, watchful market scenario.

- Symmetrical triangle pattern suggests imminent breakout potential.

The Relative Strength Index (RSI) hovers at 51, suggesting a balanced market sentiment, while the 50-day Exponential Moving Average (EMA) at $42,950 provides additional context to the prevailing market dynamics.

A notable symmetrical triangle pattern underscores Bitcoin’s current consolidation phase, hinting at potential breakouts. Our analysis leans towards a bullish outlook above the $43,000 mark, contingent on overcoming the symmetrical triangle’s resistance.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.