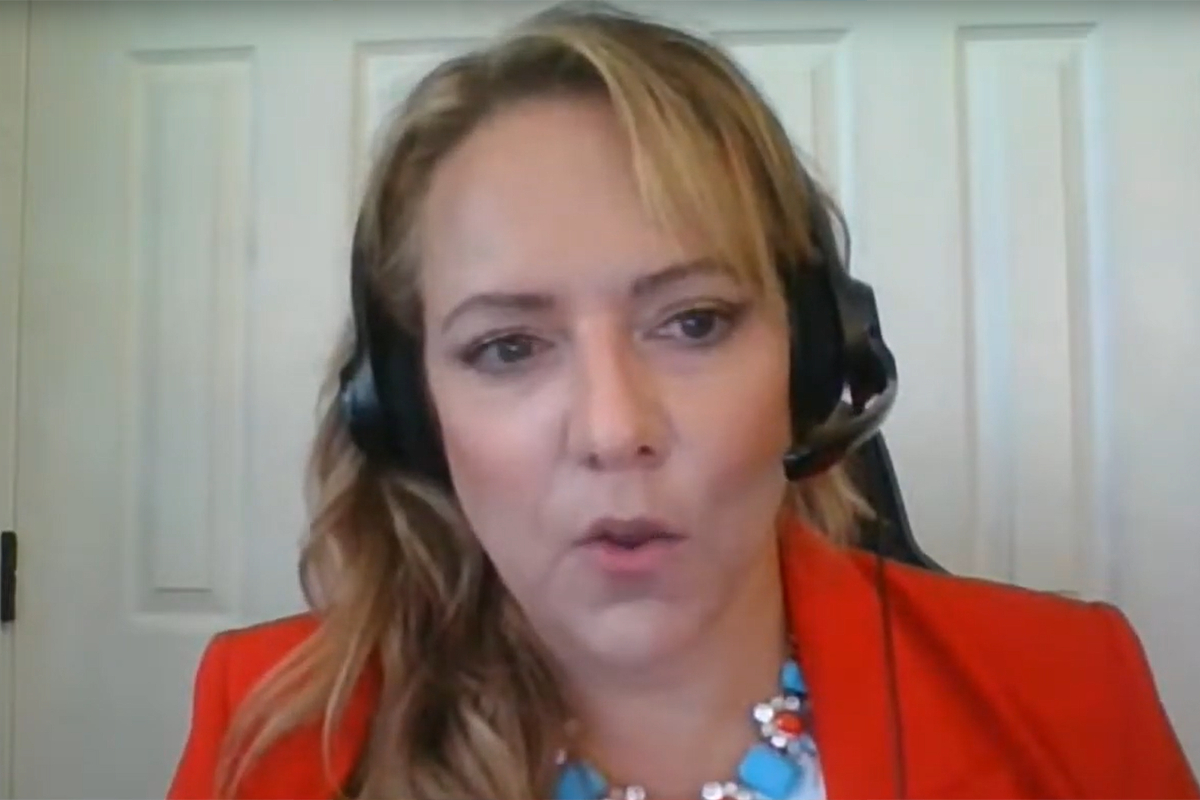

Cryptocurrency investing is rapidly breaking into mainstream financial consciousness, according to pro-crypto Commodity Futures Trading Commission (CFTC) Commissioner Summer Mersinger.

Making her thoughts heard in a special appearance on CoinDeskTV, Mersinger noted that crypto trading is no longer a fad.

According to her, several government regulators viewed cryptocurrencies as a hot topic that would fizzle out with time. However, the nascent industry has shown its mettle and is now pulling in traditional finance.

Mersinger said this gradual interaction between legacy financial institutions and the blockchain-driven economy proves that these digital assets are here to stay, and even more mainstream investors would want exposure to them.

The foremost crypto asset, Bitcoin, has stirred the crypto market awake once again with its meteoric rally following reports of an eventual spot Bitcoin exchange-traded fund (ETF).

In the last 24 hours, Bitcoin has rallied more than 12%, surging well above $35,000 with even more bullish momentum expected.

Bitcoin’s strong rally was orchestrated by reports of BlackRock’s proposed spot Bitcoin ETF, iShares Bitcoin Trust, making an appearance on a list created by the Depository Trust and Clearing Corporation (DTCC).

The DTCC is responsible for post-trade clearances, settlement, custody, and information services. This rapid turn of events has led many ETF analysts to state that the opportunity of a spot Bitcoin ETF is significantly higher than ever before.

One such analyst is Bloomberg’s senior ETF expert Eric Balchunas, who noted on X (formerly Twitter) that BlackRock’s addition to the DTCC list is a clear signal that the asset management behemoth is leading the race in securing regulatory approval in the coming months.

Commenting on the possibility of a Bitcoin ETF serenading the market, Mersinger stated that Bitcoin-based ETFs are already currently being offered.

“I think there’s a lot of interest in these products. And, you know, the market is ready for these products to be available,” she added.

Bitcoin Spot ETF Pent-up Demand Could Trigger BTC Price Rally

Mersinger is not the only one recognizing the growing relationship between the crypto space and the traditional landscape.

In a special appearance on CNBC’s StreetSigns, Ernst & Young (EY) executive Paul Brody called attention to the institutional interest in crypto.

According to Brody, there is currently a pent-up demand for the crypto asset due to the refusal of the US Securities and Exchange Commission (SEC) to approve one.

Making a case for his position, the EY executive stated that there is currently a $200 trillion asset under management (AUM) from the “Big Four” asset management firms like BlackRock and VanEck.

These asset managers are waiting impatiently on the sidelines for the SEC to give an affirmative nod to offer their services.

Providing context on why Bitcoin would be the biggest beneficiary of regulatory approval, Brody stated that several investors view the first decentralized currency as an asset and not a payment tool.

This is vastly different from Ethereum’s ETH token, which is perceived as a computing tool for enabling permissionless value transfer.

Cryptocurrency investing is rapidly breaking into mainstream financial consciousness, according to pro-crypto Commodity Futures Trading Commission (CFTC) Commissioner Summer Mersinger.

Making her thoughts heard in a special appearance on CoinDeskTV, Mersinger noted that crypto trading is no longer a fad.

According to her, several government regulators viewed cryptocurrencies as a hot topic that would fizzle out with time. However, the nascent industry has shown its mettle and is now pulling in traditional finance.

Mersinger said this gradual interaction between legacy financial institutions and the blockchain-driven economy proves that these digital assets are here to stay, and even more mainstream investors would want exposure to them.

The foremost crypto asset, Bitcoin, has stirred the crypto market awake once again with its meteoric rally following reports of an eventual spot Bitcoin exchange-traded fund (ETF).

In the last 24 hours, Bitcoin has rallied more than 12%, surging well above $35,000 with even more bullish momentum expected.

Bitcoin’s strong rally was orchestrated by reports of BlackRock’s proposed spot Bitcoin ETF, iShares Bitcoin Trust, making an appearance on a list created by the Depository Trust and Clearing Corporation (DTCC).

The DTCC is responsible for post-trade clearances, settlement, custody, and information services. This rapid turn of events has led many ETF analysts to state that the opportunity of a spot Bitcoin ETF is significantly higher than ever before.

One such analyst is Bloomberg’s senior ETF expert Eric Balchunas, who noted on X (formerly Twitter) that BlackRock’s addition to the DTCC list is a clear signal that the asset management behemoth is leading the race in securing regulatory approval in the coming months.

Commenting on the possibility of a Bitcoin ETF serenading the market, Mersinger stated that Bitcoin-based ETFs are already currently being offered.

“I think there’s a lot of interest in these products. And, you know, the market is ready for these products to be available,” she added.

Bitcoin Spot ETF Pent-up Demand Could Trigger BTC Price Rally

Mersinger is not the only one recognizing the growing relationship between the crypto space and the traditional landscape.

In a special appearance on CNBC’s StreetSigns, Ernst & Young (EY) executive Paul Brody called attention to the institutional interest in crypto.

According to Brody, there is currently a pent-up demand for the crypto asset due to the refusal of the US Securities and Exchange Commission (SEC) to approve one.

Making a case for his position, the EY executive stated that there is currently a $200 trillion asset under management (AUM) from the “Big Four” asset management firms like BlackRock and VanEck.

These asset managers are waiting impatiently on the sidelines for the SEC to give an affirmative nod to offer their services.

Providing context on why Bitcoin would be the biggest beneficiary of regulatory approval, Brody stated that several investors view the first decentralized currency as an asset and not a payment tool.

This is vastly different from Ethereum’s ETH token, which is perceived as a computing tool for enabling permissionless value transfer.