301

Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

__________

Economic news

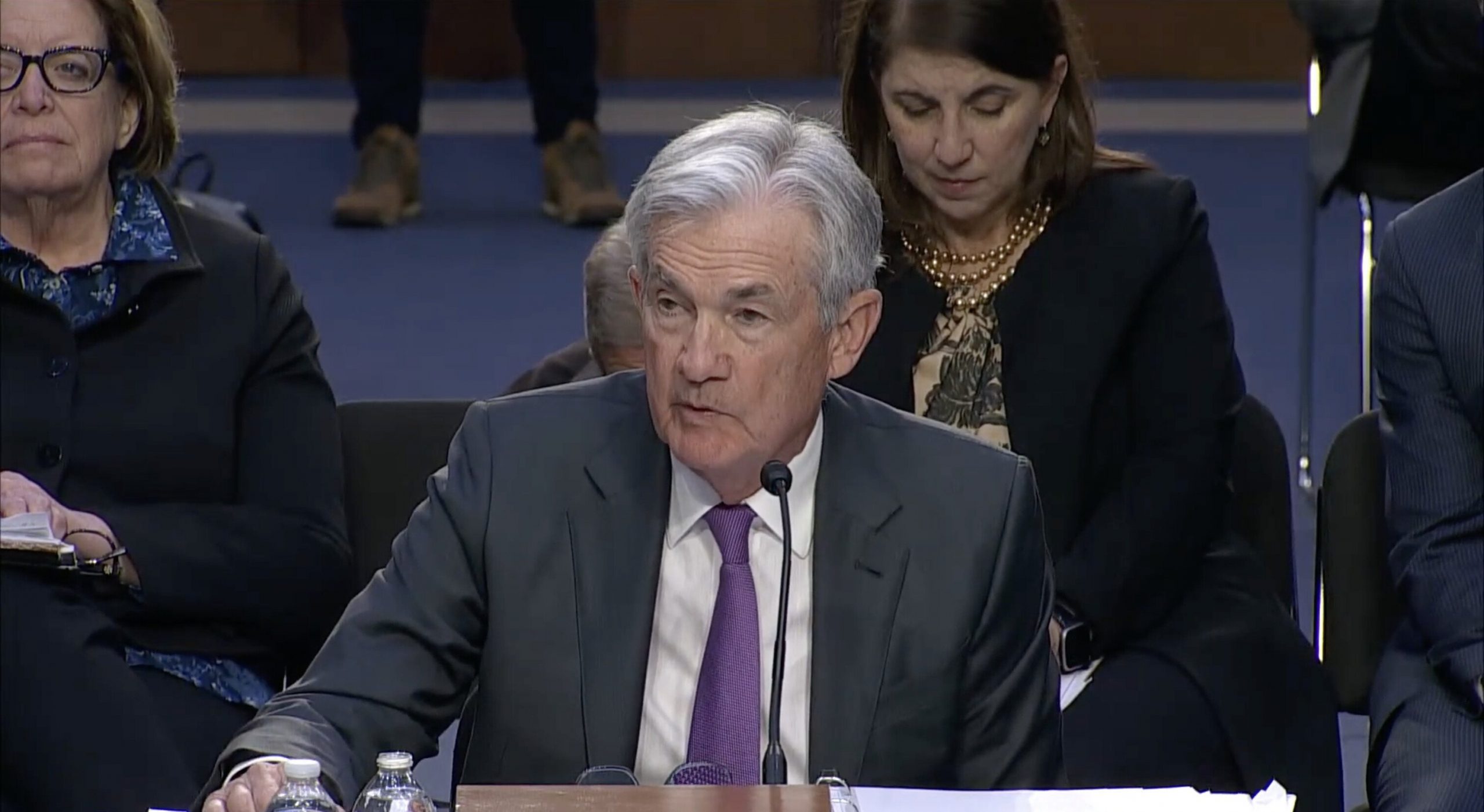

- The US Federal Reserve announced that it will keep its interest rate unchanged at 5-5.25%. Just ahead of the announcement, the CME’s FedWatch Tool estimated a is a 97% chance that the rate would remain unchanged.

- Bitcoin (BTC) traded slightly higher in the hours leading up to the Fed’s interest rate announcement. Three hours ahead of the announcement, the BTC price stood just above the $26,000 mark, up a mere 0.1% for the past 24 hours. The immediate reaction after the announcement was a slight drop in the price.

Exchange news

- Binance has withdrawn its application to be registered as a crypto service provider in Cyprus, the website of the Cyprus Securities and Exchange Commission (CySEC) shows. In a statement to CoinDesk, the exchange said it instead wants to focus on complying with the EU’s Markets in Crypto-Assets (MiCA) framework.

- Binance.US and the Securities and Exchange Commission (SEC) have been ordered by a judge to negotiate restrictions on operations as the regulator’s lawsuit against the exchange moves forward, Bloomberg reported. Binance.US said ahead of a court hearing on Tuesday that freezing the company assets would “effectively end” its business operations.

Bitcoin news

- The Bitcoin-focused payments app Strike has launched its “Send Globally” feature for Mexico, and now supports remittance payments to the country. Payments can be sent with US dollars over Bitcoin’s Lightning Network and paid out to the recipient’s bank account in Mexican pesos, a press release from Strike said.

DeFi news

- An arbitrage bot has minted and burned $200 million worth of the stablecoin DAI to generate a mere $3, blockchain data provider Arkham Intelligence said on Twitter. The operation was a so-called flashloan, which on MakerDAO can be done with up to 500 million DAI as long as the borrow and re-payment happens within the same block.

Investment news

- Blockchain interoperability protocol Connext has raised $7.5 million, bringing its total valuation to $250 million, according to a Twitter announcement. The funding round saw participation from Polychain Capital, NGC Ventures, Polygon Ventures, IOSG Ventures, Fenbushi Capital, KXVC, a_capital, No Limit Holdings, Factor, and Dokia Capital.

- Artificial intelligence (AI)-focused web3 data provider Mnemonic has raised $6 million in a funding round led by Salesforce Ventures, an announcement said. Salesforce plans to use Mnemonic’s technology in its customer relationship management (CRM) product for web3 businesses. The funding round was also joined by Polygon Ventures, Orange DAO, FIN Capital and FJ Labs.

Regulation news

- Industry association Blockchain Australia is taking a stand against restrictions imposed on the crypto industry in Australia, saying in an announcement that it will deal with the issue head-on. “We want to cultivate a shared sense of urgency and collaboration to protect those at risk of scams without losing the benefits of a growing digital currency industry,” the announcement said.

Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

__________

Economic news

- The US Federal Reserve announced that it will keep its interest rate unchanged at 5-5.25%. Just ahead of the announcement, the CME’s FedWatch Tool estimated a is a 97% chance that the rate would remain unchanged.

- Bitcoin (BTC) traded slightly higher in the hours leading up to the Fed’s interest rate announcement. Three hours ahead of the announcement, the BTC price stood just above the $26,000 mark, up a mere 0.1% for the past 24 hours. The immediate reaction after the announcement was a slight drop in the price.

Exchange news

- Binance has withdrawn its application to be registered as a crypto service provider in Cyprus, the website of the Cyprus Securities and Exchange Commission (CySEC) shows. In a statement to CoinDesk, the exchange said it instead wants to focus on complying with the EU’s Markets in Crypto-Assets (MiCA) framework.

- Binance.US and the Securities and Exchange Commission (SEC) have been ordered by a judge to negotiate restrictions on operations as the regulator’s lawsuit against the exchange moves forward, Bloomberg reported. Binance.US said ahead of a court hearing on Tuesday that freezing the company assets would “effectively end” its business operations.

Bitcoin news

- The Bitcoin-focused payments app Strike has launched its “Send Globally” feature for Mexico, and now supports remittance payments to the country. Payments can be sent with US dollars over Bitcoin’s Lightning Network and paid out to the recipient’s bank account in Mexican pesos, a press release from Strike said.

DeFi news

- An arbitrage bot has minted and burned $200 million worth of the stablecoin DAI to generate a mere $3, blockchain data provider Arkham Intelligence said on Twitter. The operation was a so-called flashloan, which on MakerDAO can be done with up to 500 million DAI as long as the borrow and re-payment happens within the same block.

Investment news

- Blockchain interoperability protocol Connext has raised $7.5 million, bringing its total valuation to $250 million, according to a Twitter announcement. The funding round saw participation from Polychain Capital, NGC Ventures, Polygon Ventures, IOSG Ventures, Fenbushi Capital, KXVC, a_capital, No Limit Holdings, Factor, and Dokia Capital.

- Artificial intelligence (AI)-focused web3 data provider Mnemonic has raised $6 million in a funding round led by Salesforce Ventures, an announcement said. Salesforce plans to use Mnemonic’s technology in its customer relationship management (CRM) product for web3 businesses. The funding round was also joined by Polygon Ventures, Orange DAO, FIN Capital and FJ Labs.

Regulation news

- Industry association Blockchain Australia is taking a stand against restrictions imposed on the crypto industry in Australia, saying in an announcement that it will deal with the issue head-on. “We want to cultivate a shared sense of urgency and collaboration to protect those at risk of scams without losing the benefits of a growing digital currency industry,” the announcement said.