It’s been an ugly month so far for Ether (ETH), the cryptocurrency that powers the Ethereum network, that remains the dominant blockchain used to power most sectors within web3, including DeFi, NFTs, GameFi, GambleFi and SocialFi.

The ETH price, which was last trading just under $1,550 after hitting new seven-month lows earlier this week at $1,520, is down a little over 7.5% for the month.

The world’s second-largest cryptocurrency by market capitalization is thus on course to post its third negative month in four, having now pulled back around 28% from April’s yearly highs close to $2,150.

By contrast, Bitcoin (BTC), the world’s first and largest cryptocurrency by market capitalization, was last trading with losses of only around 0.5% for the month.

At current levels in the $26,800s, BTC is down a more conservative 16% from its earlier yearly highs near $32,000, which were hit back in June.

With the ETH/BTC pair having recent hit its lowest level in 15 months earlier this week under 0.058 following a downtrend that has lasted around one year, some investors are asking whether now might be the time to dump Ethereum and buy Bitcoin.

Here are three reasons why that might be a good idea.

The Technicals Tell a Bearish Story

ETH/BTC has been stuck within a bearish falling wedge patter for the best part of a year.

That is, until about one week ago, when the cross bearishly broke to the downside of this pattern.

ETH/BTC has since proceeded to find strong resistance at the downtrend that had formerly been offering support.

That, combined with the fact that the cross has also in recent months been finding strong resistance at its major moving averages, suggests momentum remains firmly in the hands of the bears.

Recent technical developments strongly suggest a continuation of the recent bearish market bias, and that a test of the mid-2022 lows around 0.049 remain is on the cards for the months ahead.

Ether Faces Demand Headwinds and Inflation

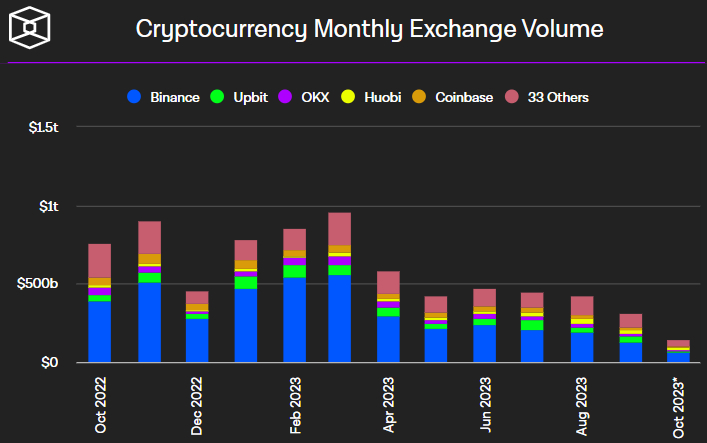

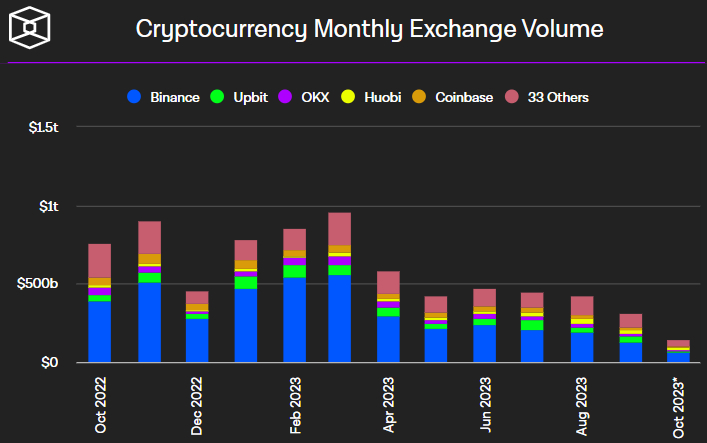

Whilst falling spot trading volumes across crypto major cryptocurrency exchanges are indicative of overall subdued demand for cryptocurrencies right now, the poor demand problem seems to be particularly acute for Ether.

A batch of Ether futures Exchange Traded Funds (ETFs) went live in the US last week, but despite a lot of hype, only managed to attract very weak trading volumes, suggesting institutions remain on the sidelines for now.

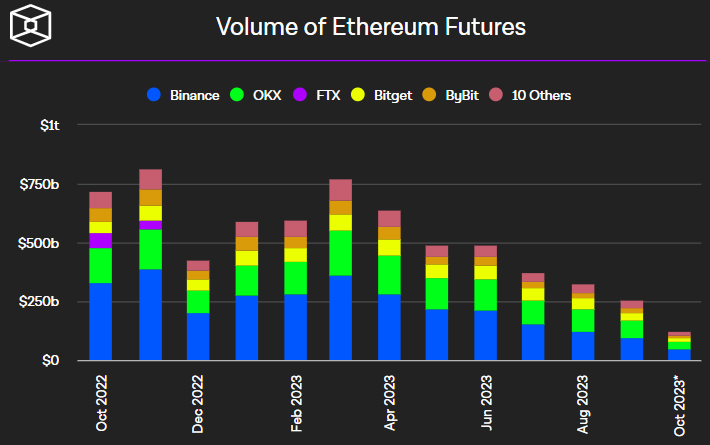

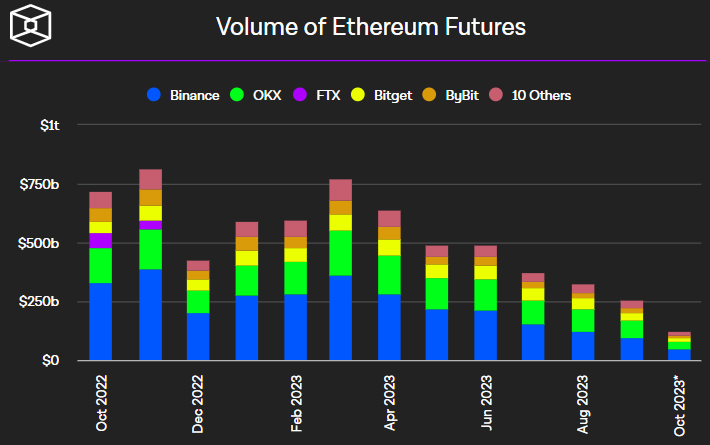

That shouldn’t be too much of a surprise given Ether future trading volumes have been shrinking sharply now since March.

As per data presented by The Block, Ether future trading volumes were only around $250 billion in September, down from around $770 billion in March.

And it’s not just trading data that suggests fading demand.

Various on-chain metrics such as active users, number of transfers, total transfer volume and new addresses have been stagnating now for some time.

That has culminated recently low gas fees and the Ether supply turning inflationary.

As per Glassnode, the Ether supply was last just over 119.98 million, up from under 119.9 million in late August.

Demand for Ether staking had been a bright spot for the token this year.

But ETH staking yields are currently consistently below 4%, as opposed to closer to 5% for long-term US government bonds.

These bonds are considered a risk-free asset, so investors may continue to prefer parking their cash in the safe haven bond market, rather than risking it with Ether for a lower yield.

Bitcoin Looks Like the Better Near-term Bet

As well as facing technical and demand headwinds, Ether also faces greater regulatory risks in the US than Bitcoin.

Bitcoin, after all, is the only cryptocurrency that the current SEC leadership has explicitly said it doesn’t think is a security.

The SEC has been on a rampage in 2023 suing major US firms and labeling cryptocurrencies as securities.

While the agency hasn’t yet explicitly stated their view that Ether is a security, SEC Chairman Gary Gensler has in the past argued that he thinks ETH is a security.

That means that investors will remain on edge about the regulatory outlook for ETH in the US until there is more certainty, which will probably only come from 1) Congress passing comprehensive crypto legislation or 2) a series of decisive defeats for the SEC in its various lawsuits against US crypto firms (which are unlikely to culminate any time soon).

Bitcoin thus remains a safe haven within the crypto space.

With bullish narratives around Bitcoin likely to grow into 2024, with the SEC expected to greenlight various spot Bitcoin ETFs and the halving coming up in April, now is probably a good time to pivot towards the world’s foremost cryptocurrency.

It’s been an ugly month so far for Ether (ETH), the cryptocurrency that powers the Ethereum network, that remains the dominant blockchain used to power most sectors within web3, including DeFi, NFTs, GameFi, GambleFi and SocialFi.

The ETH price, which was last trading just under $1,550 after hitting new seven-month lows earlier this week at $1,520, is down a little over 7.5% for the month.

The world’s second-largest cryptocurrency by market capitalization is thus on course to post its third negative month in four, having now pulled back around 28% from April’s yearly highs close to $2,150.

By contrast, Bitcoin (BTC), the world’s first and largest cryptocurrency by market capitalization, was last trading with losses of only around 0.5% for the month.

At current levels in the $26,800s, BTC is down a more conservative 16% from its earlier yearly highs near $32,000, which were hit back in June.

With the ETH/BTC pair having recent hit its lowest level in 15 months earlier this week under 0.058 following a downtrend that has lasted around one year, some investors are asking whether now might be the time to dump Ethereum and buy Bitcoin.

Here are three reasons why that might be a good idea.

The Technicals Tell a Bearish Story

ETH/BTC has been stuck within a bearish falling wedge patter for the best part of a year.

That is, until about one week ago, when the cross bearishly broke to the downside of this pattern.

ETH/BTC has since proceeded to find strong resistance at the downtrend that had formerly been offering support.

That, combined with the fact that the cross has also in recent months been finding strong resistance at its major moving averages, suggests momentum remains firmly in the hands of the bears.

Recent technical developments strongly suggest a continuation of the recent bearish market bias, and that a test of the mid-2022 lows around 0.049 remain is on the cards for the months ahead.

Ether Faces Demand Headwinds and Inflation

Whilst falling spot trading volumes across crypto major cryptocurrency exchanges are indicative of overall subdued demand for cryptocurrencies right now, the poor demand problem seems to be particularly acute for Ether.

A batch of Ether futures Exchange Traded Funds (ETFs) went live in the US last week, but despite a lot of hype, only managed to attract very weak trading volumes, suggesting institutions remain on the sidelines for now.

That shouldn’t be too much of a surprise given Ether future trading volumes have been shrinking sharply now since March.

As per data presented by The Block, Ether future trading volumes were only around $250 billion in September, down from around $770 billion in March.

And it’s not just trading data that suggests fading demand.

Various on-chain metrics such as active users, number of transfers, total transfer volume and new addresses have been stagnating now for some time.

That has culminated recently low gas fees and the Ether supply turning inflationary.

As per Glassnode, the Ether supply was last just over 119.98 million, up from under 119.9 million in late August.

Demand for Ether staking had been a bright spot for the token this year.

But ETH staking yields are currently consistently below 4%, as opposed to closer to 5% for long-term US government bonds.

These bonds are considered a risk-free asset, so investors may continue to prefer parking their cash in the safe haven bond market, rather than risking it with Ether for a lower yield.

Bitcoin Looks Like the Better Near-term Bet

As well as facing technical and demand headwinds, Ether also faces greater regulatory risks in the US than Bitcoin.

Bitcoin, after all, is the only cryptocurrency that the current SEC leadership has explicitly said it doesn’t think is a security.

The SEC has been on a rampage in 2023 suing major US firms and labeling cryptocurrencies as securities.

While the agency hasn’t yet explicitly stated their view that Ether is a security, SEC Chairman Gary Gensler has in the past argued that he thinks ETH is a security.

That means that investors will remain on edge about the regulatory outlook for ETH in the US until there is more certainty, which will probably only come from 1) Congress passing comprehensive crypto legislation or 2) a series of decisive defeats for the SEC in its various lawsuits against US crypto firms (which are unlikely to culminate any time soon).

Bitcoin thus remains a safe haven within the crypto space.

With bullish narratives around Bitcoin likely to grow into 2024, with the SEC expected to greenlight various spot Bitcoin ETFs and the halving coming up in April, now is probably a good time to pivot towards the world’s foremost cryptocurrency.