South Korea’s leading crypto exchanges are ready to renew their banking deals – in a sign that relations between the “big four” trading platforms and the traditional financial sector remain strong.

Per Business Post, Bithumb is close to sealing an agreement with NongHyup Bank (NH Bank). The agreement will see the two parties work together for at least another year.

Bithumb’s existing NH partnership deal is set to expire on March 24. But the renewal process now appears to be a formality. The crypto exchange said the renewal deal was now “in its final stages.”

Bithumb and NH said they had “strengthened anti-money laundering systems” and “provided stable services” since they first started collaborating. The parties first began working together five years ago. A Bithumb spokesperson stated:

“We will finalize the renewal of our real-name accounting deal with Nonghyup next week. And we will continue to do our best to create an environment where customers can trade safely and with ease.”

More South Korean Crypto Exchanges Set to Renew Their Banking Deals?

The move will come as a welcome tonic for the nation’s larger, older banks – who have risked becoming frozen out of the crypto picture by newer, IT firm-backed neobanks.

Last year, fellow “big four” exchange Coinone turned its back on NH Bank in favor of a deal with the Kakao-backed neobank Kakao Bank. Kakao is a tech giant that is most famous in South Korea for creating the KakaoTalk chat app.

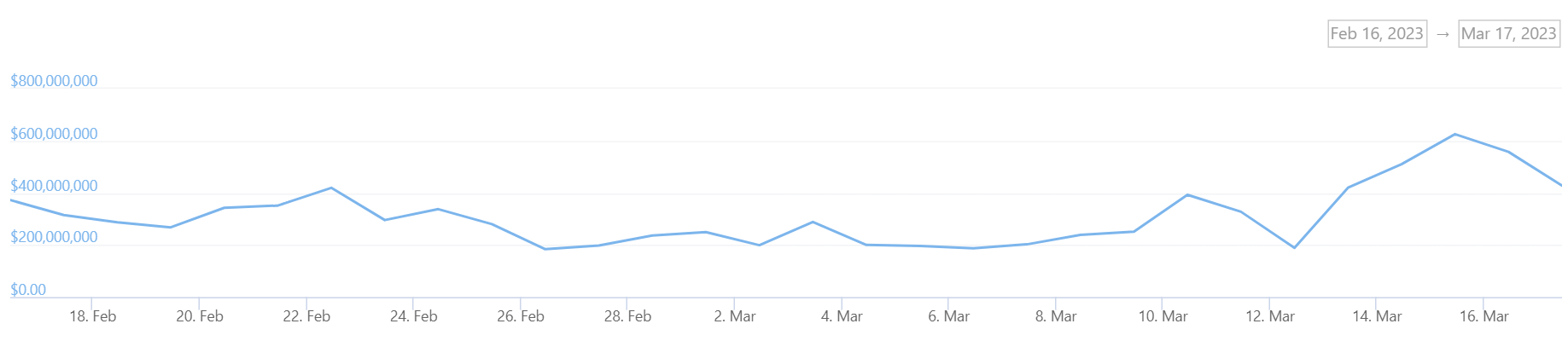

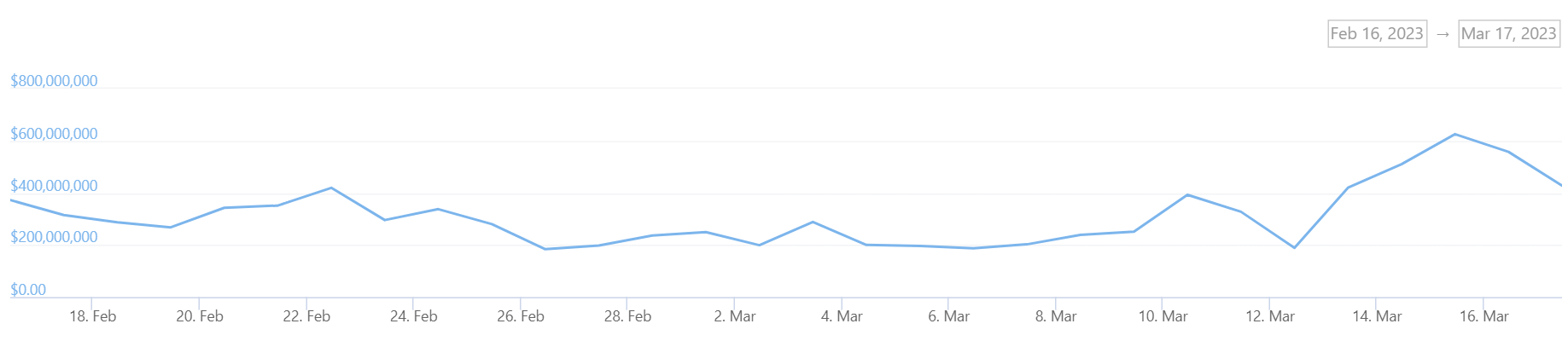

Upbit, the market-leading crypto exchange, has enjoyed a huge surge in popularity since it partnered with the Kakao Bank neobank rival K Bank. Per Blockchain Today, the latter’s profits soared by over 270% year-on-year in FY2022, thanks mainly to its Upbit partnership.

Rather than requiring customers to visit brick-and-mortar offices to create crypto exchange-linked accounts, K Bank allows new customers to open accounts via its mobile app.

Coinone and Kakao Bank are hopeful that their partnership will yield similar results.

K Bank this month announced that it was shutting down its PC services, claiming that few customers were using them. The bank stated that it wanted to focus on its mobile services.

The NH Bank rival Shinhan Bank is unlikely to depart from its own partnership deal with the Korbit exchange. Last year, the bank agreed to an investment deal that left it with a minority stake in the trading platform.

Meanwhile, the Upbit operator Dunamu has called on the government to enable greater growth in the crypto sector by lifting the ban on initial exchange offerings (IEOs).

All forms of token issuance were rendered illegal in South Korea in 2018. But Chosun Ilbo reported, the Dumanu CEO Lee Seok-woo stated that IEO legalization would promote “digital financial innovation” in the domestic crypto sector.

South Korea’s leading crypto exchanges are ready to renew their banking deals – in a sign that relations between the “big four” trading platforms and the traditional financial sector remain strong.

Per Business Post, Bithumb is close to sealing an agreement with NongHyup Bank (NH Bank). The agreement will see the two parties work together for at least another year.

Bithumb’s existing NH partnership deal is set to expire on March 24. But the renewal process now appears to be a formality. The crypto exchange said the renewal deal was now “in its final stages.”

Bithumb and NH said they had “strengthened anti-money laundering systems” and “provided stable services” since they first started collaborating. The parties first began working together five years ago. A Bithumb spokesperson stated:

“We will finalize the renewal of our real-name accounting deal with Nonghyup next week. And we will continue to do our best to create an environment where customers can trade safely and with ease.”

More South Korean Crypto Exchanges Set to Renew Their Banking Deals?

The move will come as a welcome tonic for the nation’s larger, older banks – who have risked becoming frozen out of the crypto picture by newer, IT firm-backed neobanks.

Last year, fellow “big four” exchange Coinone turned its back on NH Bank in favor of a deal with the Kakao-backed neobank Kakao Bank. Kakao is a tech giant that is most famous in South Korea for creating the KakaoTalk chat app.

Upbit, the market-leading crypto exchange, has enjoyed a huge surge in popularity since it partnered with the Kakao Bank neobank rival K Bank. Per Blockchain Today, the latter’s profits soared by over 270% year-on-year in FY2022, thanks mainly to its Upbit partnership.

Rather than requiring customers to visit brick-and-mortar offices to create crypto exchange-linked accounts, K Bank allows new customers to open accounts via its mobile app.

Coinone and Kakao Bank are hopeful that their partnership will yield similar results.

K Bank this month announced that it was shutting down its PC services, claiming that few customers were using them. The bank stated that it wanted to focus on its mobile services.

The NH Bank rival Shinhan Bank is unlikely to depart from its own partnership deal with the Korbit exchange. Last year, the bank agreed to an investment deal that left it with a minority stake in the trading platform.

Meanwhile, the Upbit operator Dunamu has called on the government to enable greater growth in the crypto sector by lifting the ban on initial exchange offerings (IEOs).

All forms of token issuance were rendered illegal in South Korea in 2018. But Chosun Ilbo reported, the Dumanu CEO Lee Seok-woo stated that IEO legalization would promote “digital financial innovation” in the domestic crypto sector.