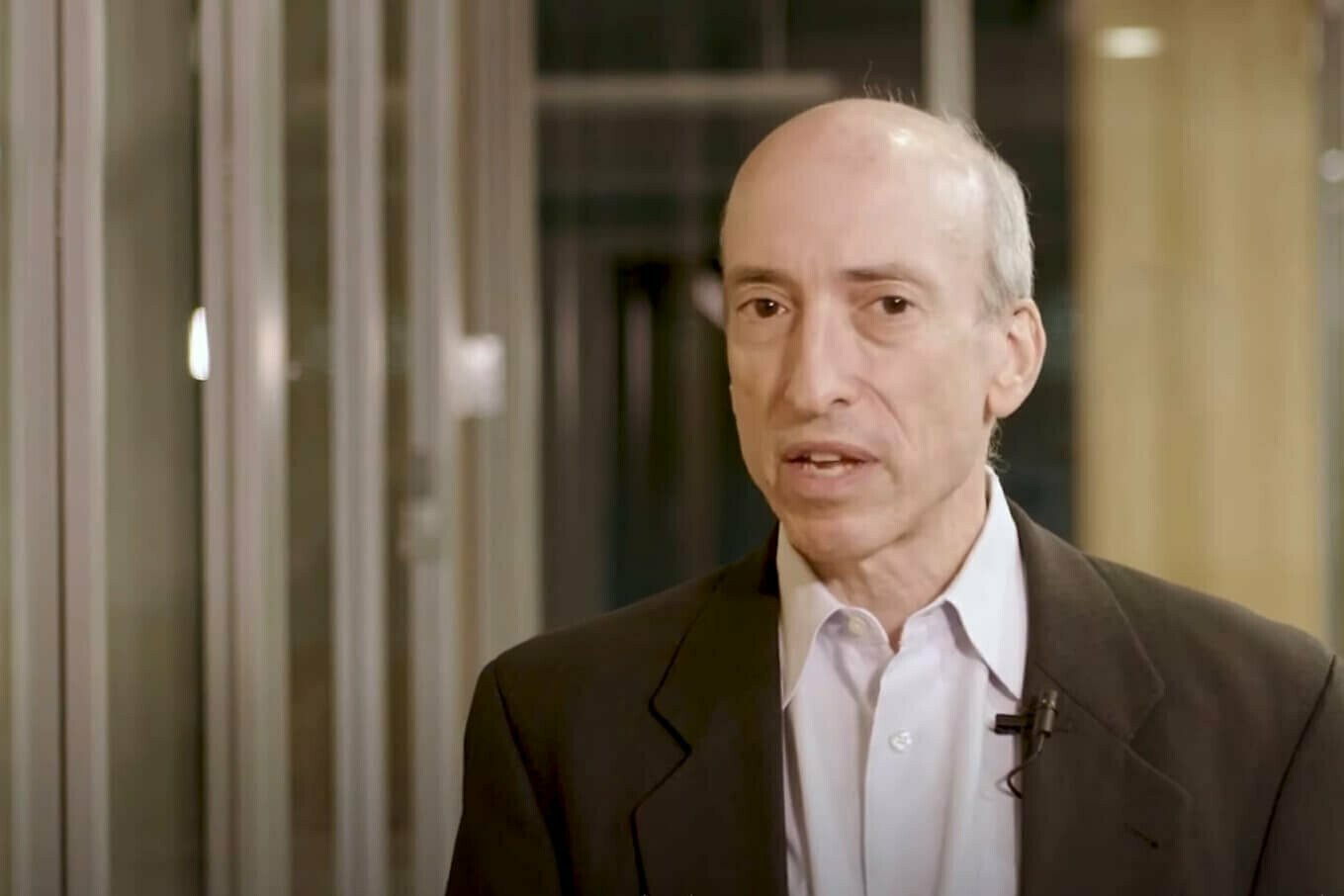

Securities and Exchange Commission (SEC) chair Gary Gensler has said he is “disappointed” in a court ruling that declared that Ripple’s XRP token is “not in and of itself” a security.

Speaking at an event hosted by the National Press Club in Washington DC on Monday, Gensler said that although he is “pleased” that the court ruling protects institutional investors by pushing back at the so-called fair notice argument in the Ripple case, he is disappointed on behalf of retail investors.

“While disappointed on what they said about retail investors, we’re still looking at it and assessing that opinion,” Gensler, who has led an aggressive crackdown on the crypto sector during his time as SEC chair, said.

The comments came on the back of a court ruling that said XRP should not necessarily be seen as an “investment contract” or security.

Instead, the ruling said the classification of the XRP token would depend on what context it is used in.

The ruling also made clear that Ripple’s “programmatic” sales of XRP, the use of trading algorithms by the firm to sell tokens it holds on exchanges, did not constitute a securities offering.

Crypto crackdown to continue

Commenting on the future, Gensler said the push to clean up the crypto sector in the US will continue regardless of the ruling.

“So what’s next? We’re going to continue to try to bring firms that may not be into compliance into compliance without prejudging any one of them and trying to ensure that we protect the investing public,” the SEC chair said.

The comments from Gensler came on the same day as the remaining issues in the case between Ripple and the SEC was referred to Magistrate Judge Sarah Netburn.

Judge Netburn is the same same judge that ordered the unsealing of the so-called Hinman documents, which contributed to the favourable ruling for Ripple.

Securities and Exchange Commission (SEC) chair Gary Gensler has said he is “disappointed” in a court ruling that declared that Ripple’s XRP token is “not in and of itself” a security.

Speaking at an event hosted by the National Press Club in Washington DC on Monday, Gensler said that although he is “pleased” that the court ruling protects institutional investors by pushing back at the so-called fair notice argument in the Ripple case, he is disappointed on behalf of retail investors.

“While disappointed on what they said about retail investors, we’re still looking at it and assessing that opinion,” Gensler, who has led an aggressive crackdown on the crypto sector during his time as SEC chair, said.

The comments came on the back of a court ruling that said XRP should not necessarily be seen as an “investment contract” or security.

Instead, the ruling said the classification of the XRP token would depend on what context it is used in.

The ruling also made clear that Ripple’s “programmatic” sales of XRP, the use of trading algorithms by the firm to sell tokens it holds on exchanges, did not constitute a securities offering.

Crypto crackdown to continue

Commenting on the future, Gensler said the push to clean up the crypto sector in the US will continue regardless of the ruling.

“So what’s next? We’re going to continue to try to bring firms that may not be into compliance into compliance without prejudging any one of them and trying to ensure that we protect the investing public,” the SEC chair said.

The comments from Gensler came on the same day as the remaining issues in the case between Ripple and the SEC was referred to Magistrate Judge Sarah Netburn.

Judge Netburn is the same same judge that ordered the unsealing of the so-called Hinman documents, which contributed to the favourable ruling for Ripple.