Sam Bankman-Fried, the former CEO of FTX, is set to face trial in federal court in Manhattan, starting with jury selection today. The 31-year-old is accused of being the architect behind one of the largest financial crimes in U.S. history, following the bankruptcy of his crypto platform FTX.

The trial comes less than a year after FTX and its hedge fund affiliate, Alameda Research, filed for bankruptcy amid allegations of massive crypto fraud.

The legal battle is unique in its focus on a single individual who, at his pinnacle, was estimated to be worth $26 billion. The government claims that Bankman-Fried misappropriated billions from FTX, leading to its financial collapse.

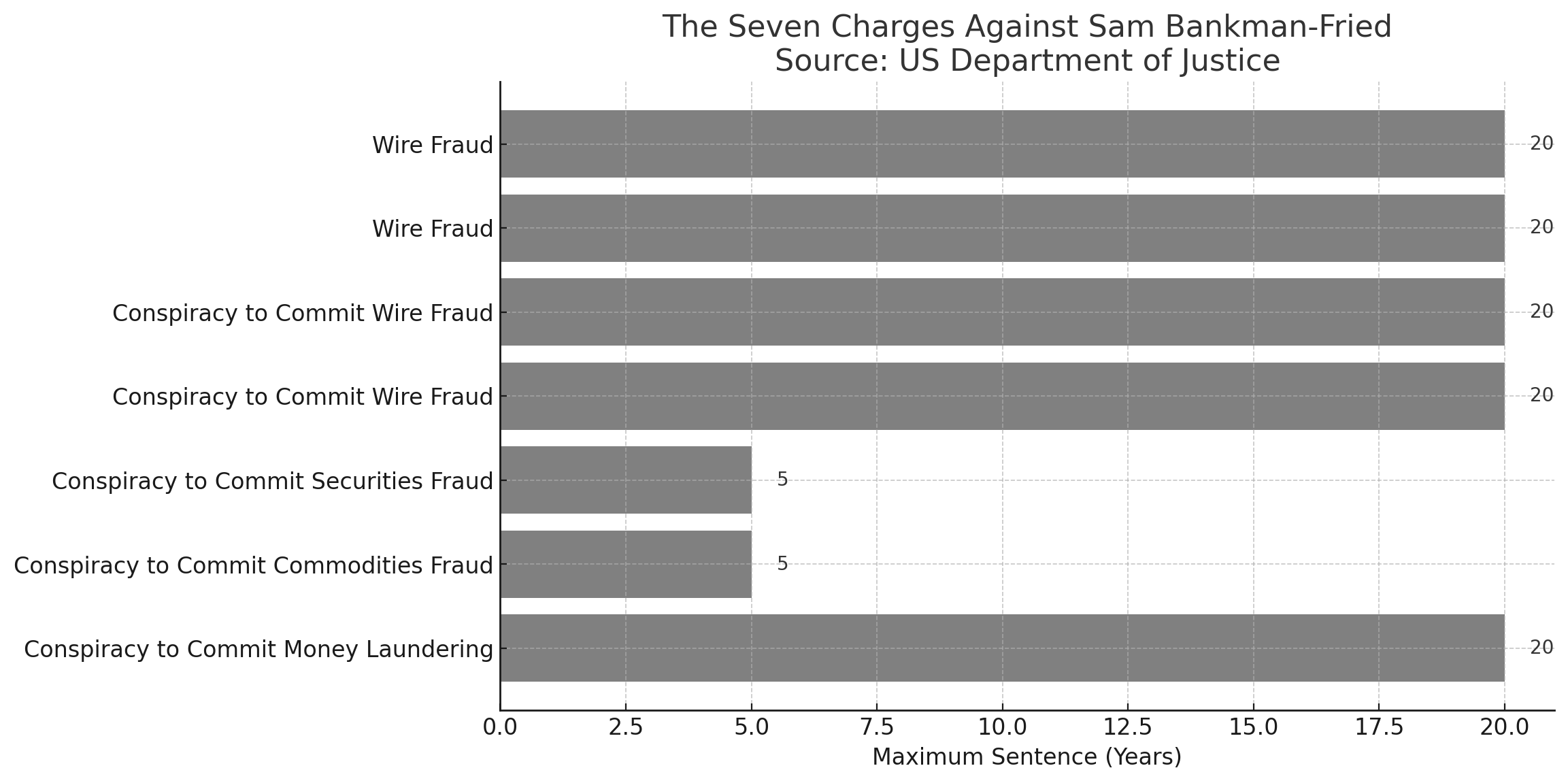

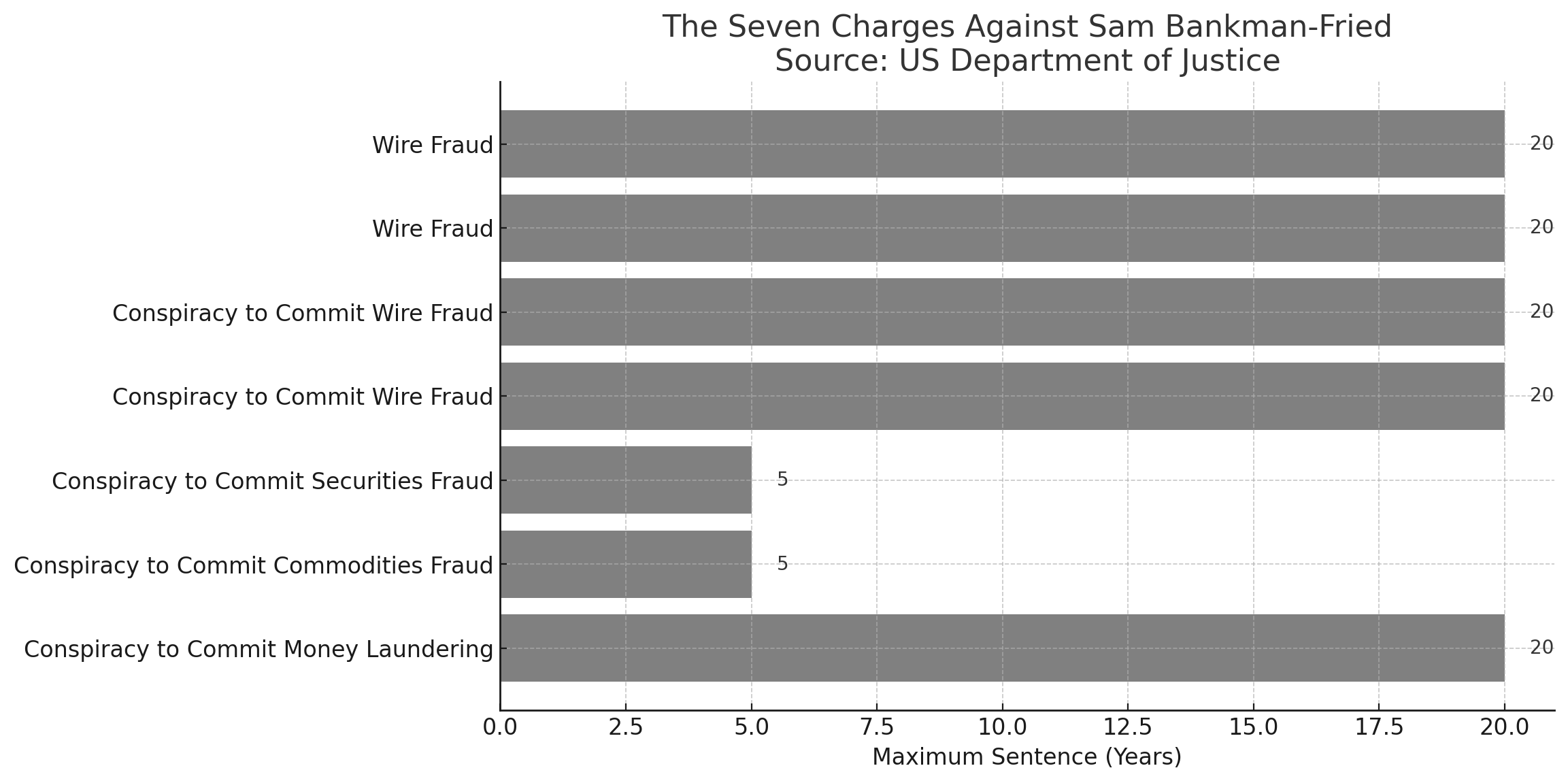

The former executive, who has been detained in a Brooklyn jail for the past two months, faces up to 20 years in prison for each of the five most serious charges.

The Charges and the Jury Selection

The Sam Bankman-Fried trial will kick off with the selection of jurors, setting the stage for a courtroom drama that promises to delve into the details of the FTX bankruptcy. The government has characterized this case as one of the most significant financial crimes in the nation’s history.

The allegations include fraud and conspiracy to commit money laundering, among others. Bankman-Fried has pleaded not guilty to all seven charges.

Before the FTX bankruptcy, Bankman-Fried was often described as the “Warren Buffet of crypto.” A graduate of MIT, he founded FTX in Hong Kong in 2019, later moving the business to The Bahamas for a more favorable regulatory climate.

At the height of his success, he managed FTX from a luxurious penthouse and was a regular visitor to Washington, D.C., where he made significant charitable donations.

Some observers, including the author of “Rich Dad Poor Dad“, Robert Kiyosaki have drawn comparisons between Sam Bankman-Fried and Bernie Madoff, who orchestrated one of the largest Ponzi schemes in history, defrauding investors out of billions of dollars.

They argue that the charges against Bankman-Fried appear less severe than those leveled at Madoff, who was sentenced to 150 years in prison.

The Controversial Defense Strategy

Bankman-Fried has opted to be vocal about his case, disregarding advice from legal experts to stay silent.

In an interview with Bloomberg, Joshua Naftalis, a former federal prosecutor, pointed out that Bankman-Fried would likely argue that any mistakes made were not intentional.

“One of the narratives he will want to present is he was the Warren Buffett of crypto,” he said. “He was the name in the game and while mistakes were made, they weren’t intentional.”

The May 2022 collapse of the Terra stablecoin ecosystem led to a crisis of confidence that affected multiple crypto firms, although FTX initially appeared to be resilient.

By November 2022, however, doubts about FTX’s solvency and its connections to Alameda Research led to a run on the exchange.

The Accusations Against Sam Bankman-Fried

Prosecutors allege that Sam Bankman-Fried misrepresented the relationship between his two companies, FTX and Alameda Research. Contrary to his public statements that the two firms operated independently, it is alleged that Alameda enjoyed an unrestricted line of credit on the FTX platform.

This was reportedly used for high-risk, illiquid investments. When these investments went awry, Alameda used additional customer funds to make up the difference, according to the prosecution.

The strength of the government’s case against Bankman-Fried relies heavily on the testimony of three key witnesses. These include former FTX engineering director Nishad Singh, ex-chief technology officer Gary Wang, and former Alameda Research CEO Caroline Ellison.

All three have pleaded guilty to fraud charges and agreed to testify against Bankman-Fried, likely in the hopes of receiving lighter sentences.

Testimony and Evidence to Expect

Based on court documents, these cooperating witnesses are expected to shed light on various aspects of the FTX operations and alleged crypto fraud. Singh and Wang are likely to discuss the FTX codebase, alleging that changes were made under Bankman-Fried’s directions.

Ellison may elaborate on how these code changes allowed Alameda to secure loans without the requisite collateral. Ellison’s role is further complicated by her past romantic relationship with Bankman-Fried, adding another layer to her testimony.

Another interesting angle to the case is Bankman-Fried’s political contributions. Singh was allegedly used as a conduit for millions in campaign donations leading up to the 2022 elections.

Although campaign finance violation charges against Bankman-Fried were dropped in July, prosecutors plan to incorporate this information into their case, suggesting these funds were proceeds from fraudulent activities.

The prosecution has assembled an extensive list of potential witnesses, including former employees, affected investors, and FBI agents.

Additionally, 1,300 exhibits have been prepared for the trial. Among the witnesses are also FTX customers who suffered substantial losses, including a man from Ukraine who lost a large portion of his life savings.

As the trial is undergoing, Bankman-Fried’s defense options appear increasingly limited. The case, officially termed as US v. Bankman-Fried, 22-cr-673, is being heard in the US District Court in the Southern District of New York, Manhattan.

The Eroding Defense Strategy

Sam Bankman-Fried’s bail was revoked in August as a consequence of his decision to share a New York Times reporter with personal writings belonging to Caroline Ellison. This move was interpreted by Judge Lewis A. Kaplan as a potential intimidation tactic.

Earlier, Bankman-Fried had engaged in extensive dialogues with journalists, logging about 1,000 phone calls while on bail, as revealed by the prosecution.

Weeks ahead of the trial, Bankman-Fried’s defense received a major blow. Judge Kaplan ruled that the defense couldn’t call upon seven expert witnesses.

Kaplan also decided that Bankman-Fried’s lawyers could not cite the involvement of FTX lawyers in key business decisions during their opening statements. Such mentions, Kaplan argued, could lead to jury confusion and government prejudice.

Technical Issues over Technicalities

Experts believe Bankman-Fried might attempt a defense based on technical ignorance. He could argue that his role did not involve understanding the platform’s coding or the operations at Alameda Research.

This aligns with his previous public statements, where he tried to portray Ellison as not competent enough to manage a hedge fund involving billions in assets.

Experts like Naftalis suggest that turning the trial into a gendered “blame-your-ex” narrative could backfire, however.

The Sam Bankman-Fried trial has commenced today with jury selection. Judge Kaplan anticipates that the trial could last up to six weeks. While the case hinges on allegations of crypto fraud, its outcome is unpredictable given the complex factors and multiple parties involved.

As the Sam Bankman-Fried trial gets underway, it marks a key moment not just for the individuals involved, but also for the broader cryptocurrency industry.

While the industry has long grappled with regulatory ambiguities, this case will serve as an example for how financial misconduct in the crypto sector will be handled by U.S. courts. With a former industry leader facing a high-profile trial, the eyes of both Wall Street and the crypto industry will undoubtedly be fixed on the courtroom in Manhattan.

Sam Bankman-Fried, the former CEO of FTX, is set to face trial in federal court in Manhattan, starting with jury selection today. The 31-year-old is accused of being the architect behind one of the largest financial crimes in U.S. history, following the bankruptcy of his crypto platform FTX.

The trial comes less than a year after FTX and its hedge fund affiliate, Alameda Research, filed for bankruptcy amid allegations of massive crypto fraud.

The legal battle is unique in its focus on a single individual who, at his pinnacle, was estimated to be worth $26 billion. The government claims that Bankman-Fried misappropriated billions from FTX, leading to its financial collapse.

The former executive, who has been detained in a Brooklyn jail for the past two months, faces up to 20 years in prison for each of the five most serious charges.

The Charges and the Jury Selection

The Sam Bankman-Fried trial will kick off with the selection of jurors, setting the stage for a courtroom drama that promises to delve into the details of the FTX bankruptcy. The government has characterized this case as one of the most significant financial crimes in the nation’s history.

The allegations include fraud and conspiracy to commit money laundering, among others. Bankman-Fried has pleaded not guilty to all seven charges.

Before the FTX bankruptcy, Bankman-Fried was often described as the “Warren Buffet of crypto.” A graduate of MIT, he founded FTX in Hong Kong in 2019, later moving the business to The Bahamas for a more favorable regulatory climate.

At the height of his success, he managed FTX from a luxurious penthouse and was a regular visitor to Washington, D.C., where he made significant charitable donations.

Some observers, including the author of “Rich Dad Poor Dad“, Robert Kiyosaki have drawn comparisons between Sam Bankman-Fried and Bernie Madoff, who orchestrated one of the largest Ponzi schemes in history, defrauding investors out of billions of dollars.

They argue that the charges against Bankman-Fried appear less severe than those leveled at Madoff, who was sentenced to 150 years in prison.

The Controversial Defense Strategy

Bankman-Fried has opted to be vocal about his case, disregarding advice from legal experts to stay silent.

In an interview with Bloomberg, Joshua Naftalis, a former federal prosecutor, pointed out that Bankman-Fried would likely argue that any mistakes made were not intentional.

“One of the narratives he will want to present is he was the Warren Buffett of crypto,” he said. “He was the name in the game and while mistakes were made, they weren’t intentional.”

The May 2022 collapse of the Terra stablecoin ecosystem led to a crisis of confidence that affected multiple crypto firms, although FTX initially appeared to be resilient.

By November 2022, however, doubts about FTX’s solvency and its connections to Alameda Research led to a run on the exchange.

The Accusations Against Sam Bankman-Fried

Prosecutors allege that Sam Bankman-Fried misrepresented the relationship between his two companies, FTX and Alameda Research. Contrary to his public statements that the two firms operated independently, it is alleged that Alameda enjoyed an unrestricted line of credit on the FTX platform.

This was reportedly used for high-risk, illiquid investments. When these investments went awry, Alameda used additional customer funds to make up the difference, according to the prosecution.

The strength of the government’s case against Bankman-Fried relies heavily on the testimony of three key witnesses. These include former FTX engineering director Nishad Singh, ex-chief technology officer Gary Wang, and former Alameda Research CEO Caroline Ellison.

All three have pleaded guilty to fraud charges and agreed to testify against Bankman-Fried, likely in the hopes of receiving lighter sentences.

Testimony and Evidence to Expect

Based on court documents, these cooperating witnesses are expected to shed light on various aspects of the FTX operations and alleged crypto fraud. Singh and Wang are likely to discuss the FTX codebase, alleging that changes were made under Bankman-Fried’s directions.

Ellison may elaborate on how these code changes allowed Alameda to secure loans without the requisite collateral. Ellison’s role is further complicated by her past romantic relationship with Bankman-Fried, adding another layer to her testimony.

Another interesting angle to the case is Bankman-Fried’s political contributions. Singh was allegedly used as a conduit for millions in campaign donations leading up to the 2022 elections.

Although campaign finance violation charges against Bankman-Fried were dropped in July, prosecutors plan to incorporate this information into their case, suggesting these funds were proceeds from fraudulent activities.

The prosecution has assembled an extensive list of potential witnesses, including former employees, affected investors, and FBI agents.

Additionally, 1,300 exhibits have been prepared for the trial. Among the witnesses are also FTX customers who suffered substantial losses, including a man from Ukraine who lost a large portion of his life savings.

As the trial is undergoing, Bankman-Fried’s defense options appear increasingly limited. The case, officially termed as US v. Bankman-Fried, 22-cr-673, is being heard in the US District Court in the Southern District of New York, Manhattan.

The Eroding Defense Strategy

Sam Bankman-Fried’s bail was revoked in August as a consequence of his decision to share a New York Times reporter with personal writings belonging to Caroline Ellison. This move was interpreted by Judge Lewis A. Kaplan as a potential intimidation tactic.

Earlier, Bankman-Fried had engaged in extensive dialogues with journalists, logging about 1,000 phone calls while on bail, as revealed by the prosecution.

Weeks ahead of the trial, Bankman-Fried’s defense received a major blow. Judge Kaplan ruled that the defense couldn’t call upon seven expert witnesses.

Kaplan also decided that Bankman-Fried’s lawyers could not cite the involvement of FTX lawyers in key business decisions during their opening statements. Such mentions, Kaplan argued, could lead to jury confusion and government prejudice.

Technical Issues over Technicalities

Experts believe Bankman-Fried might attempt a defense based on technical ignorance. He could argue that his role did not involve understanding the platform’s coding or the operations at Alameda Research.

This aligns with his previous public statements, where he tried to portray Ellison as not competent enough to manage a hedge fund involving billions in assets.

Experts like Naftalis suggest that turning the trial into a gendered “blame-your-ex” narrative could backfire, however.

The Sam Bankman-Fried trial has commenced today with jury selection. Judge Kaplan anticipates that the trial could last up to six weeks. While the case hinges on allegations of crypto fraud, its outcome is unpredictable given the complex factors and multiple parties involved.

As the Sam Bankman-Fried trial gets underway, it marks a key moment not just for the individuals involved, but also for the broader cryptocurrency industry.

While the industry has long grappled with regulatory ambiguities, this case will serve as an example for how financial misconduct in the crypto sector will be handled by U.S. courts. With a former industry leader facing a high-profile trial, the eyes of both Wall Street and the crypto industry will undoubtedly be fixed on the courtroom in Manhattan.