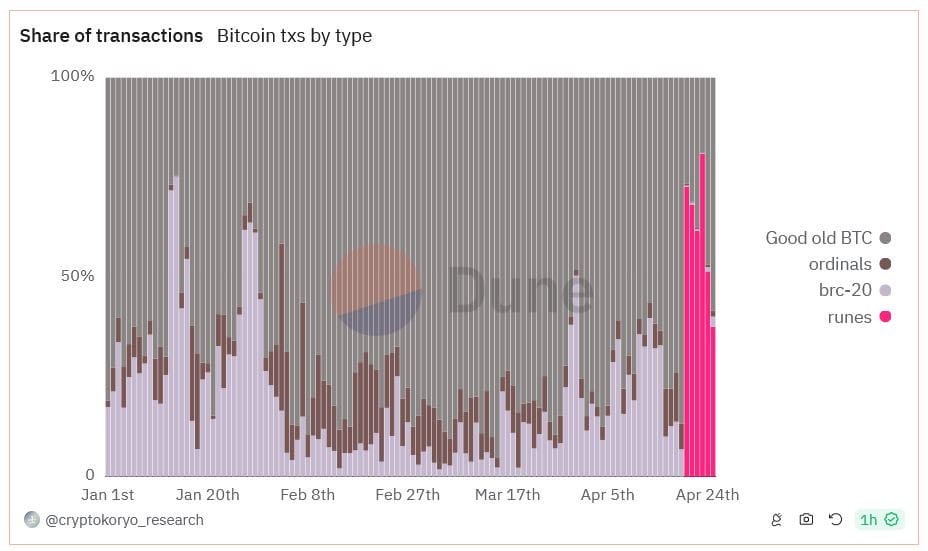

Runes have contributed to up to 68% of Bitcoin transactions since the halving, however, the fees earned by Bitcoin miners have started to dwindle.

Like BRC-20s, Runes is a protocol that uses the Bitcoin network. It pays fees in Bitcoin to generate new tokens.

However, Runes uses the Unspent Transaction Output (UTXO) model to “etch” new tokens on Bitcoin. This contrasts with Ordinals’ “inscription” account model, according to a protocol explainer from Rodarmor.

The protocol lets users inscribe individual satoshis with unique identification numbers, and embed them with arbitrary data directly into the Bitcoin blockchain.

Since its launch on April 20th, Runes has processed more than 2.38 million transactions, according to a Dune Analytics dashboard shared by blockchain research firm Crypto Koryo.

Runes accounted for 68% of all Bitcoin transactions made when pinned against Ordinary peer-to-peer Bitcoin transactions, BRC-20s, and Ordinals.

On April 23, Runes experienced its highest volume of transactions, with over 750,000. However, the following day, the number of transactions almost halved to 312,000.

Much of the initial demand came from halving block 840,000 as users competed for the most valuable piece of digital real estate in Bitcoin history – using Runes protocol to etch “rare satoshis” on the block.

Consequently, Runes contributed to more than $2.4 million in miner fees, Over 70% of the total fees on halving day.

Will Runes Save Struggling Miners?

The Bitcoin Halving saw mining rewards cut from 6.25 BTC to 3.125 BTC, a threatening hit to Bitcoin miners’ income that has left them vulnerable.

Runes Protocol was initially cited as the saving grace for miners struggling to break even. It aims to provide a new source of income. According to pseudonymous Ordinals developer Leonidas:

“Runes degens have single-handedly offset the drop in miner rewards from the halving.”

However, this has been put in question as daily total fees have fluctuated between 33% and 69% post-halving.

Community members are split on whether Runes will provide a sustainable revenue stream for Bitcoin miners.

JUST IN: Fees are back down into the 40s!

Is the runes spam losing steam? 👀 pic.twitter.com/fMx7qDUZXd

— Simply Bitcoin (@SimplyBitcoinTV) April 24, 2024

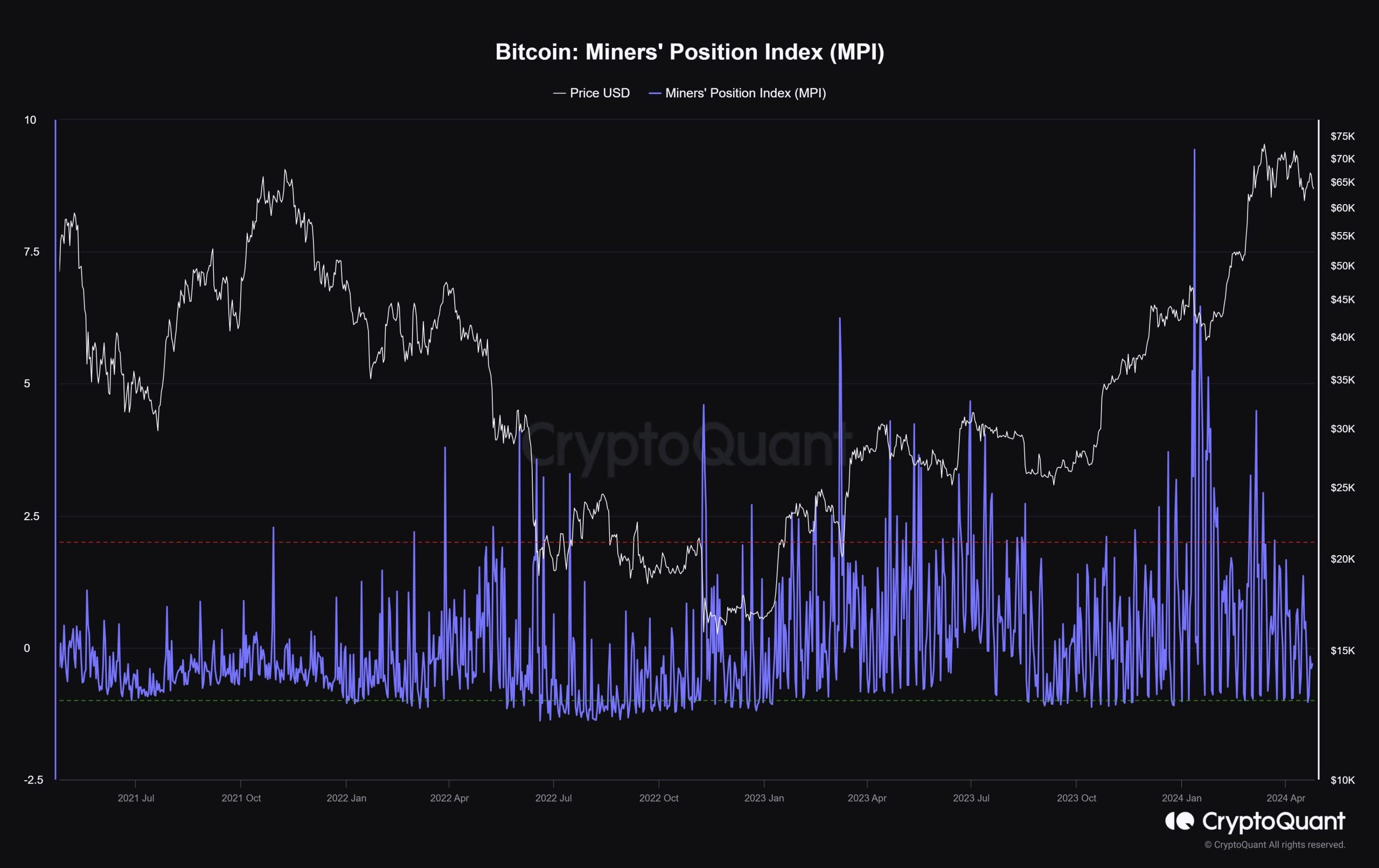

Despite these concerns, the Bitcoin Miners’ Position Index (MPI) has ranged from -1 to -0.15 post-halving, according to data from CryptoQuant. This indicates no substantial movement in Miner’s Bitcoin holdings, there is no clear intent for a sell-off.

The situation is subject to change as Runes may continue to lose steam. Especially as the initial hype surrounding its release fades.

But, it is not the only hope for miners, with recent ground-breaking developments providing potential alternate revenue sources to combat the impact of the halving.