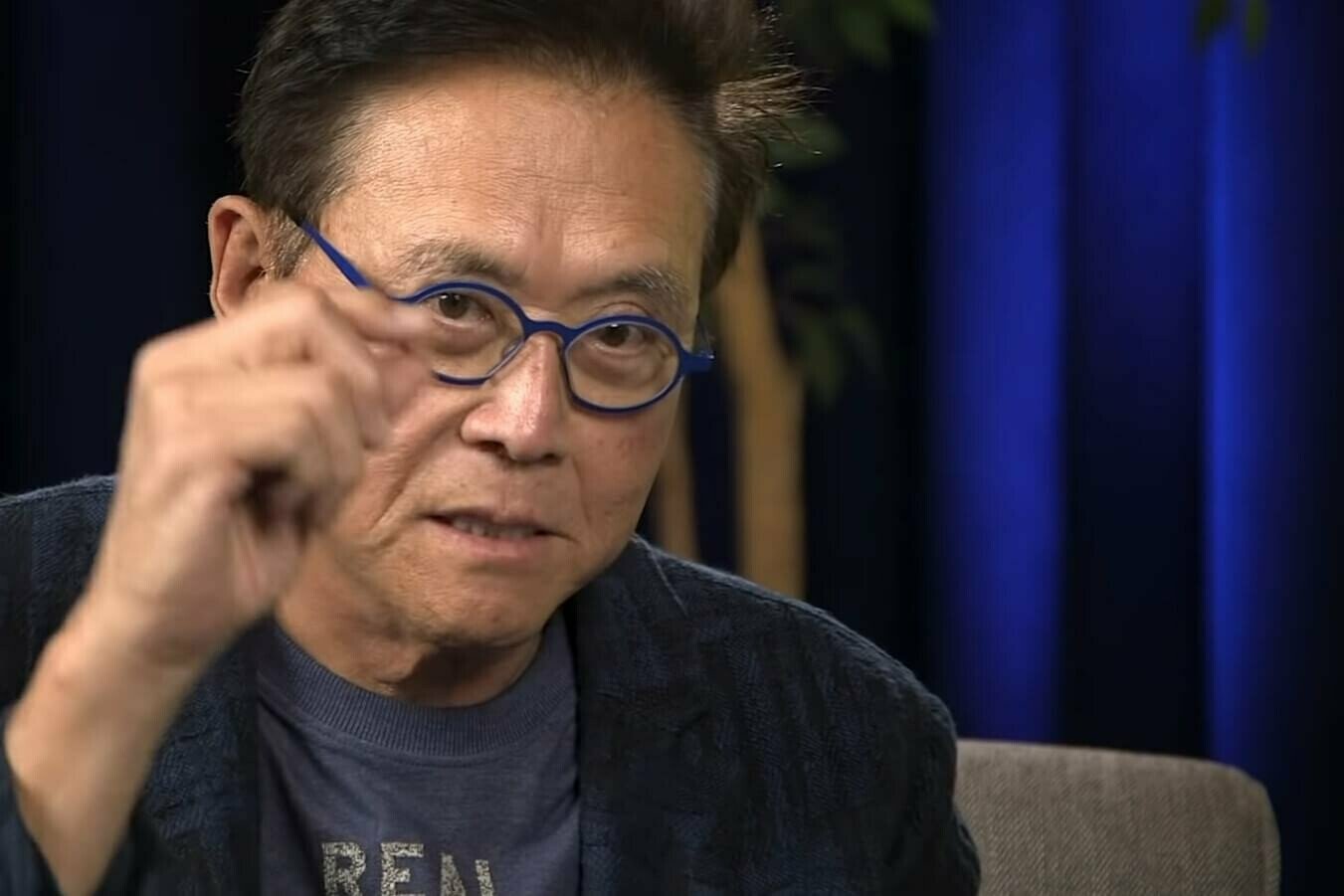

Robert Kiyosaki – author of the famous personal finance book Rich Dad Poor Dad – is bearish on the U.S. dollar after BRICS nations reportedly agreed to establish a gold-backed currency.

The agreement, reported by Russia Today (RT) last week, will supposedly be officially announced in August at an alliance summit in Johannesburg, South Africa. In response on Monday, Kiyosaki said he expects the US dollar to “die” – and for Bitcoin to surge to $120,000 per coin.

The author’s Bitcoin prediction happens to align with Standard Chartered’s latest Bitcoin price forecast for the end of 2024, up from $100,000 back in April.

Kiyosaki is known for favoring both precious metals and Bitcoin over government currency, as well as his often dramatic doomsday predictions for the U.S. economy and financial system.

Though his more apocalyptic forecasts often don’t pan out in reality, his lack of confidence in the U.S. dollar is a sentiment picking up greater steam as of late – especially in the crypto community.

In April, BitMEX co-founder Arthur Hayes predicted that the world may begin to fracture into multiple currency blocs amid USD inflationary pressures, removing the dollar’s position as world reserve currency.

That same month, Circle CEO Jeremy Allaire said there is a “very active de-dollarization taking place” due to crumbling confidence in the U.S. banking system after Silicon Valley Bank’s failure.

The End of the Dollar Standard

At the time, even former U.S. President Donald Trump – a Bitcoin skeptic – predicted that the dollar will lose its world reserve status. “Our currency is crashing and will no longer be the world standard, which will be our greatest defeat, frankly, in 200 years,” he said.

Countries have already shown tentative signs of moving away from using USD for global trade this year. For example, Chinese and French energy companies agreed in March to settle a liquified natural gas deal in CNY. Shortly afterward, Brazil and China signed a deal to trade using their own natural currencies instead of USD.

The BRICS alliance includes both Brazil and China, alongside Russia, India, and South Africa. However, according to RT, the nation’s agreement to form a gold-backed currency has 41 more countries interested in joining the alliance.

Robert Kiyosaki – author of the famous personal finance book Rich Dad Poor Dad – is bearish on the U.S. dollar after BRICS nations reportedly agreed to establish a gold-backed currency.

The agreement, reported by Russia Today (RT) last week, will supposedly be officially announced in August at an alliance summit in Johannesburg, South Africa. In response on Monday, Kiyosaki said he expects the US dollar to “die” – and for Bitcoin to surge to $120,000 per coin.

The author’s Bitcoin prediction happens to align with Standard Chartered’s latest Bitcoin price forecast for the end of 2024, up from $100,000 back in April.

Kiyosaki is known for favoring both precious metals and Bitcoin over government currency, as well as his often dramatic doomsday predictions for the U.S. economy and financial system.

Though his more apocalyptic forecasts often don’t pan out in reality, his lack of confidence in the U.S. dollar is a sentiment picking up greater steam as of late – especially in the crypto community.

In April, BitMEX co-founder Arthur Hayes predicted that the world may begin to fracture into multiple currency blocs amid USD inflationary pressures, removing the dollar’s position as world reserve currency.

That same month, Circle CEO Jeremy Allaire said there is a “very active de-dollarization taking place” due to crumbling confidence in the U.S. banking system after Silicon Valley Bank’s failure.

The End of the Dollar Standard

At the time, even former U.S. President Donald Trump – a Bitcoin skeptic – predicted that the dollar will lose its world reserve status. “Our currency is crashing and will no longer be the world standard, which will be our greatest defeat, frankly, in 200 years,” he said.

Countries have already shown tentative signs of moving away from using USD for global trade this year. For example, Chinese and French energy companies agreed in March to settle a liquified natural gas deal in CNY. Shortly afterward, Brazil and China signed a deal to trade using their own natural currencies instead of USD.

The BRICS alliance includes both Brazil and China, alongside Russia, India, and South Africa. However, according to RT, the nation’s agreement to form a gold-backed currency has 41 more countries interested in joining the alliance.