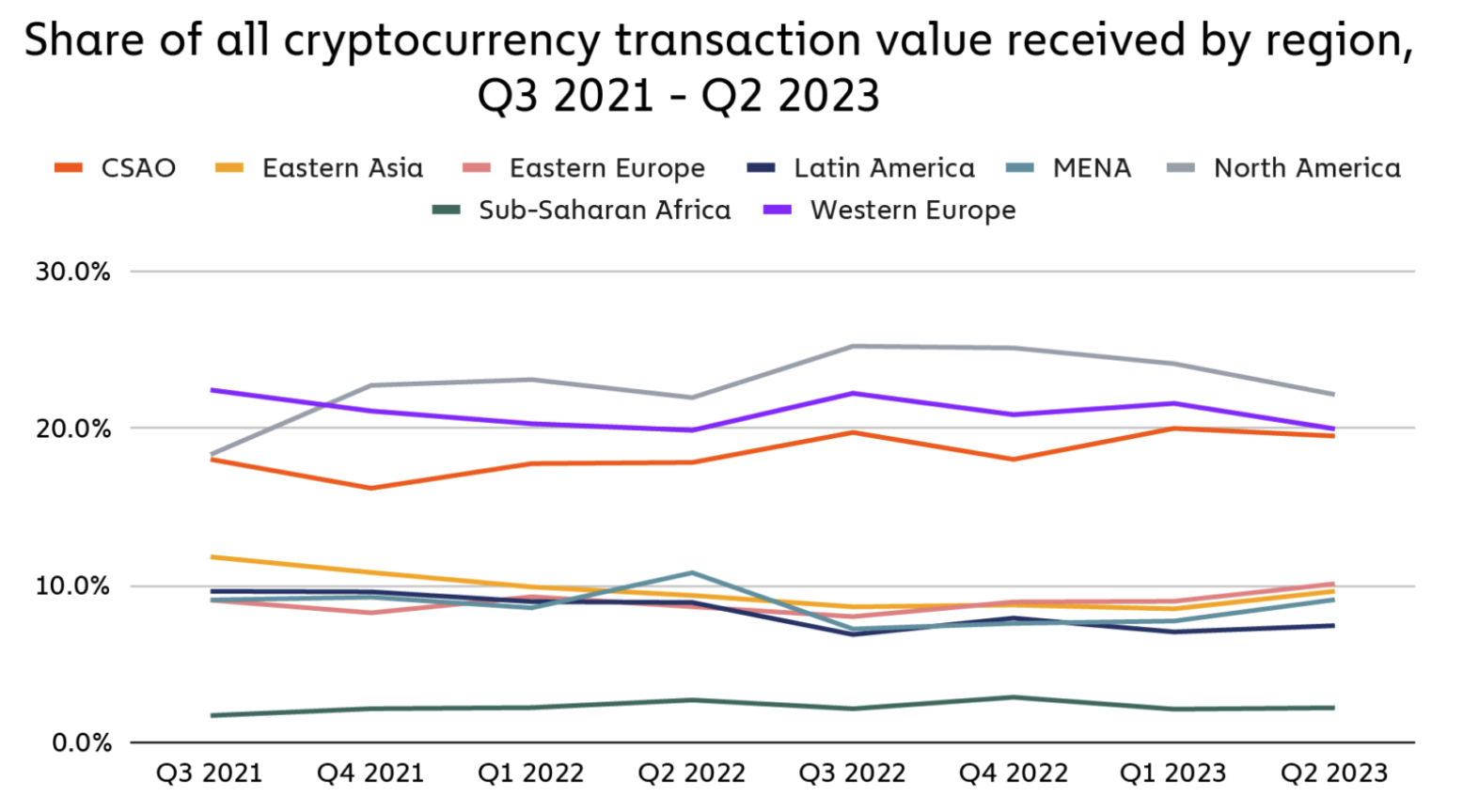

According to a recent report by blockchain intelligence firm Chainalysis, North America is leading the world in crypto usage, with the United States driving the lion’s share of activity.

The region boasted a transaction volume exceeding $1 trillion between July 2022 and June 2023, which includes a notable contribution from Canada.

In all, North America accounted for nearly a quarter of the global transaction volume, the Chainalysis report said.

The report noted that major institutional investors are the primary drivers of this activity, accounting for 76.9% of the transaction volume seen across North America

The report defined institutional activity as transactions with a fiat value of $1 million or more.

Chainalysis further said that while there was a contraction in crypto activity in the region following the FTX bankruptcy, the setback was less severe compared to the impact of the banking crisis in March when crypto-friendly banks like Silicon Valley Bank, Silvergate, and Signature all suspended their operations.

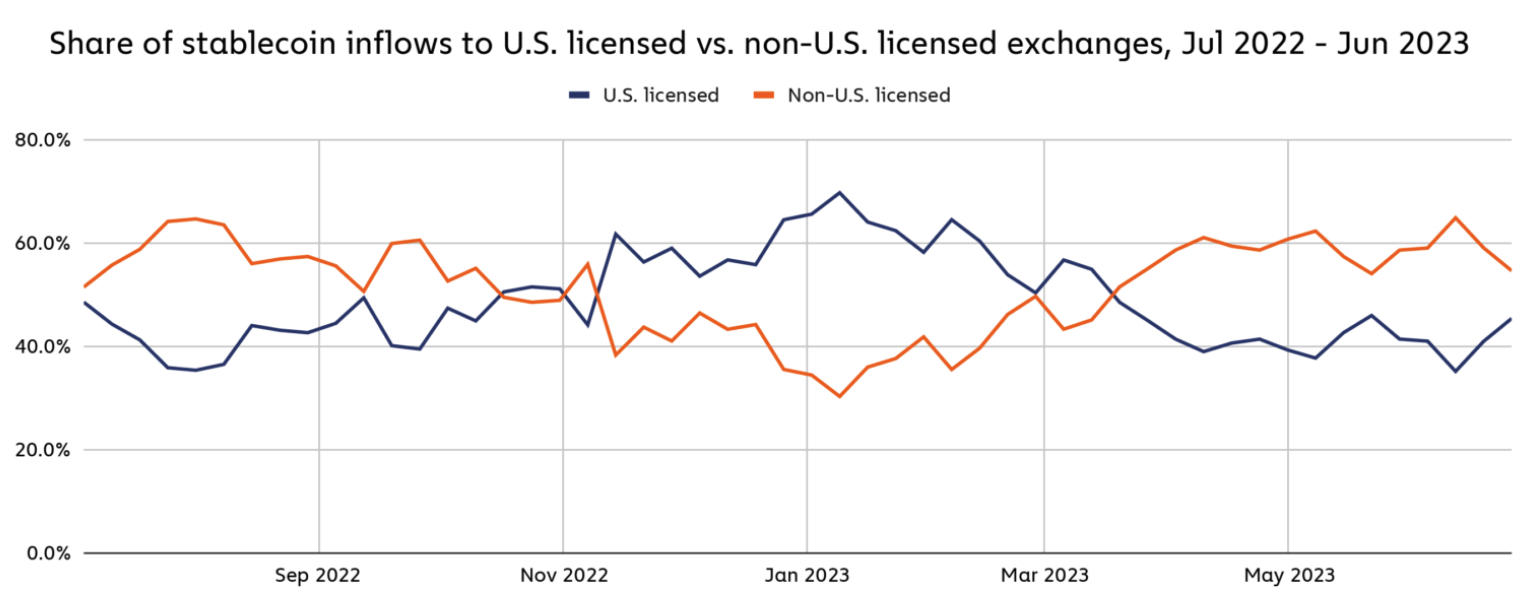

Decline in stablecoin usage in North America

Also worth noting is that the report revealed a decline in stablecoin usage in North America, with its proportion of on-chain transaction volume dropping from 70.3% to 48.8% over the past year.

Additionally, the share of stablecoin activity going to US-licensed platforms has decreased, indicating a shift toward service providers based outside of the country.

As of June this year, 54.6% of stablecoin inflows to the top 50 crypto services went to non-US licensed platforms, the report said.

The report suggested that U.S. regulators are keen to exert regulatory control over stablecoins due to their important role, and that could be a reason why more of the activity is now happening outside the United States.

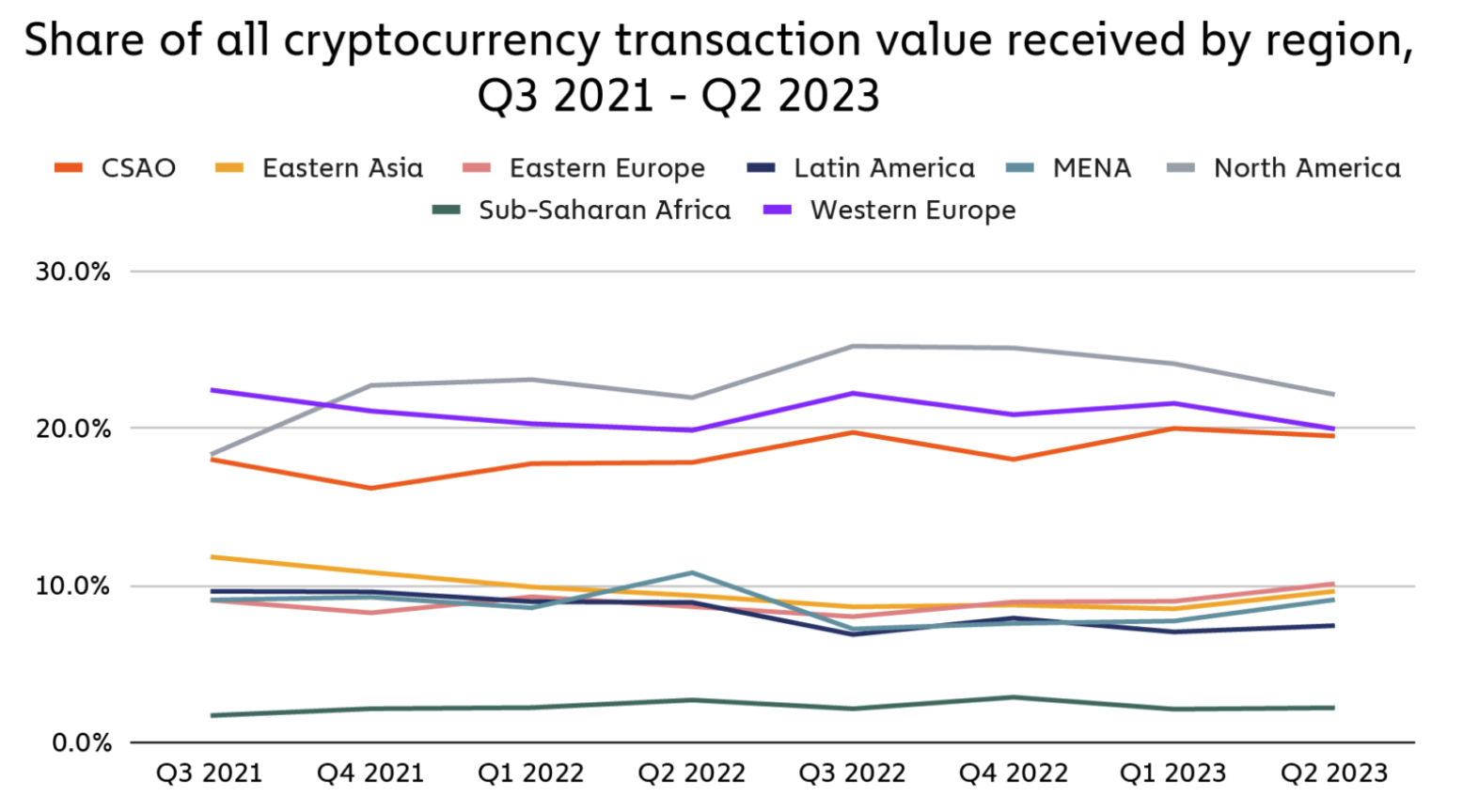

According to a recent report by blockchain intelligence firm Chainalysis, North America is leading the world in crypto usage, with the United States driving the lion’s share of activity.

The region boasted a transaction volume exceeding $1 trillion between July 2022 and June 2023, which includes a notable contribution from Canada.

In all, North America accounted for nearly a quarter of the global transaction volume, the Chainalysis report said.

The report noted that major institutional investors are the primary drivers of this activity, accounting for 76.9% of the transaction volume seen across North America

The report defined institutional activity as transactions with a fiat value of $1 million or more.

Chainalysis further said that while there was a contraction in crypto activity in the region following the FTX bankruptcy, the setback was less severe compared to the impact of the banking crisis in March when crypto-friendly banks like Silicon Valley Bank, Silvergate, and Signature all suspended their operations.

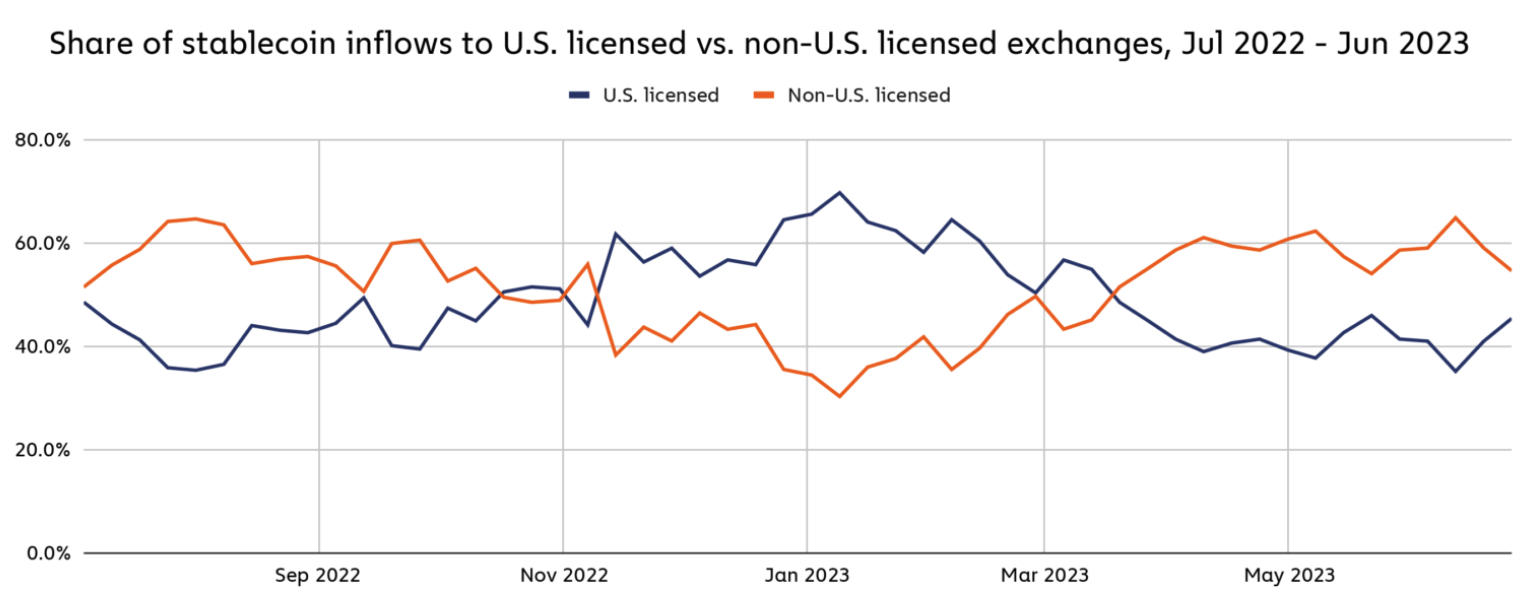

Decline in stablecoin usage in North America

Also worth noting is that the report revealed a decline in stablecoin usage in North America, with its proportion of on-chain transaction volume dropping from 70.3% to 48.8% over the past year.

Additionally, the share of stablecoin activity going to US-licensed platforms has decreased, indicating a shift toward service providers based outside of the country.

As of June this year, 54.6% of stablecoin inflows to the top 50 crypto services went to non-US licensed platforms, the report said.

The report suggested that U.S. regulators are keen to exert regulatory control over stablecoins due to their important role, and that could be a reason why more of the activity is now happening outside the United States.