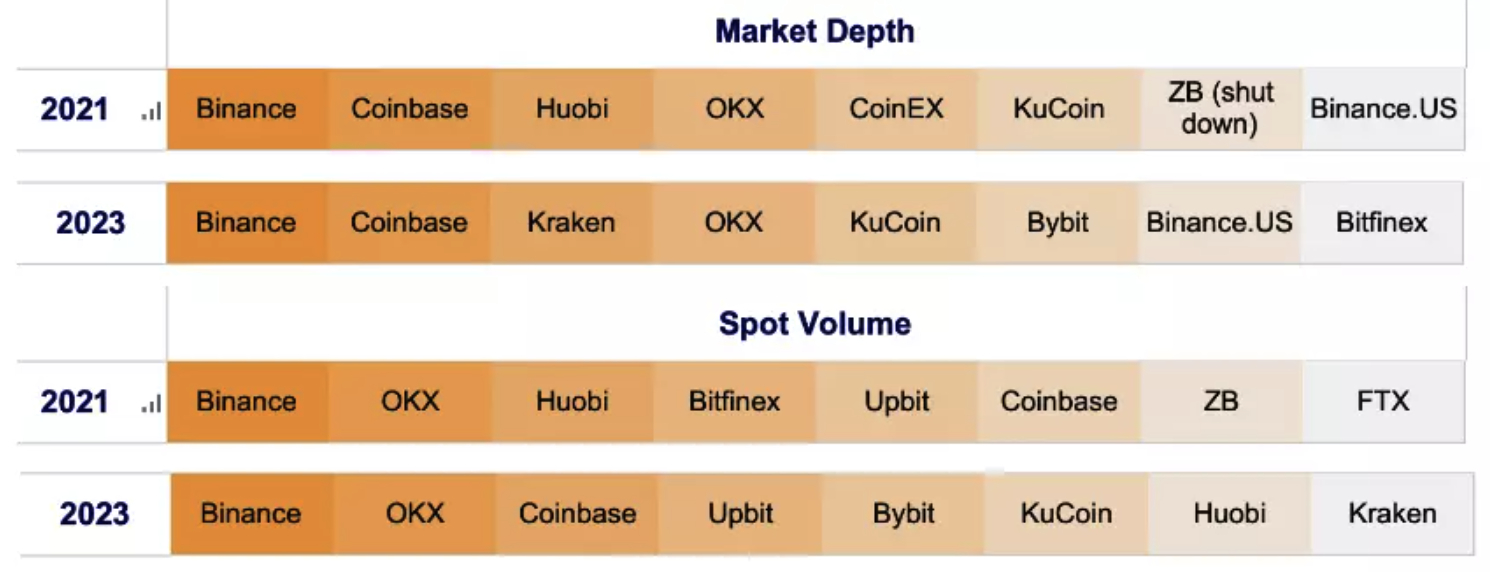

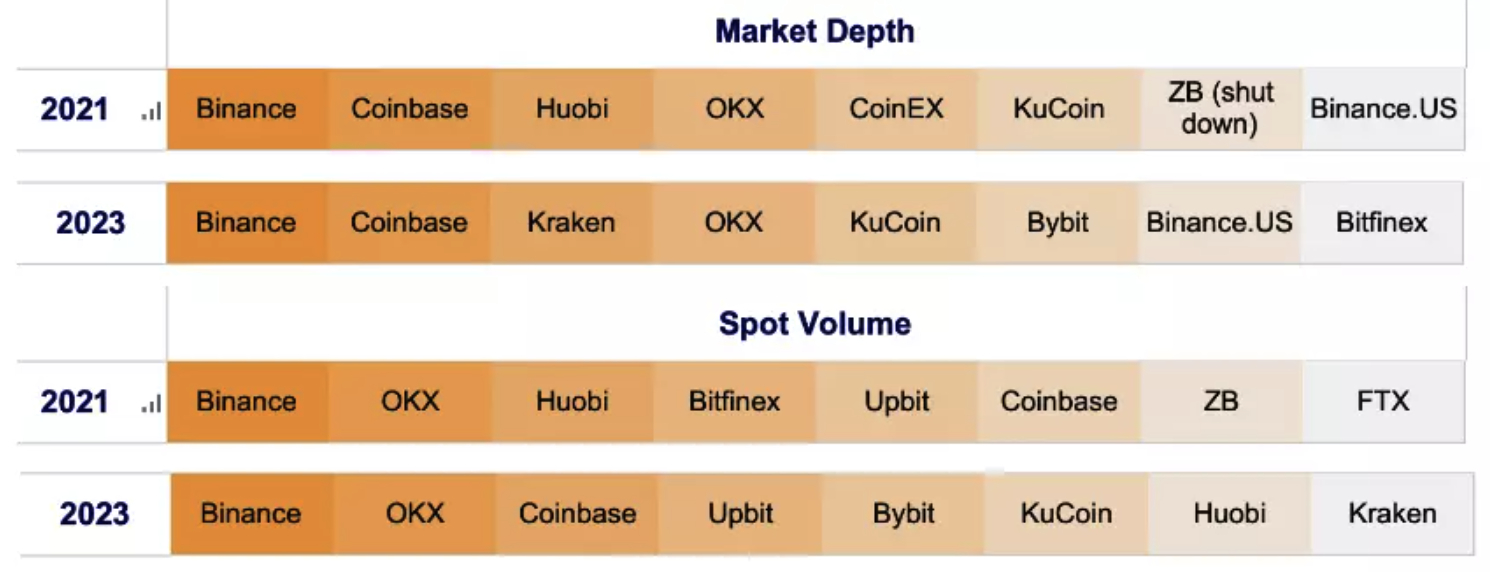

A recent report by crypto researcher Kaiko reveals that crypto trading liquidity is highly concentrated, with eight major exchanges handling almost 90% of the trading volume.

Among these exchanges responsible for the vast majority of volume are Binance, Coinbase, OKX, and Huobi, the Kaiko report said.

Binance, which for a number of years has been the world’s dominant crypto exchange by volume, accounted for over 30% of the global market depth and more than 60% of worldwide trade volumes this year.

According to Kaiko’s researchers, such a concentration of liquidity in markets can have both positive and negative effects.

On one hand, it can lead to better liquidity for traders, which can improve the overall market experience, but it can also increase the risk of market disruptions and points of failure, as demonstrated by the collapse of FTX, the researchers said.

Liquidity concentration combined with thinner volume

This high concentration of liquidity has garnered attention from crypto analysts, as thinner trading volumes can result in more significant price fluctuations.

In August, crypto trading volumes reached their lowest point of the year, declining by 11.5% to $2.09 trillion for combined spot and derivatives trading.

This drop in volume occurred despite positive news in the crypto industry, such as excitement surrounding the potential approval of a Bitcoin ETF.

Volatility on its way back to crypto markets

In an article reporting on the research findings, Bloomberg cited K33 analysts Anders Helseth and Vetle Lunde as saying in a note that despite a slow summer, some signs now indicate that volatility is coming back to the market.

“The jumpy market over the last few weeks signals a changing volatility environment in BTC. This summer saw unusually low volatility, and while prices have yet to see any meaningful breakouts following the Aug. 17 push lower, climbing daily volatility reincentivizes participation from vol-thirsty day traders,” the two analysts were quoted as saying.

A recent report by crypto researcher Kaiko reveals that crypto trading liquidity is highly concentrated, with eight major exchanges handling almost 90% of the trading volume.

Among these exchanges responsible for the vast majority of volume are Binance, Coinbase, OKX, and Huobi, the Kaiko report said.

Binance, which for a number of years has been the world’s dominant crypto exchange by volume, accounted for over 30% of the global market depth and more than 60% of worldwide trade volumes this year.

According to Kaiko’s researchers, such a concentration of liquidity in markets can have both positive and negative effects.

On one hand, it can lead to better liquidity for traders, which can improve the overall market experience, but it can also increase the risk of market disruptions and points of failure, as demonstrated by the collapse of FTX, the researchers said.

Liquidity concentration combined with thinner volume

This high concentration of liquidity has garnered attention from crypto analysts, as thinner trading volumes can result in more significant price fluctuations.

In August, crypto trading volumes reached their lowest point of the year, declining by 11.5% to $2.09 trillion for combined spot and derivatives trading.

This drop in volume occurred despite positive news in the crypto industry, such as excitement surrounding the potential approval of a Bitcoin ETF.

Volatility on its way back to crypto markets

In an article reporting on the research findings, Bloomberg cited K33 analysts Anders Helseth and Vetle Lunde as saying in a note that despite a slow summer, some signs now indicate that volatility is coming back to the market.

“The jumpy market over the last few weeks signals a changing volatility environment in BTC. This summer saw unusually low volatility, and while prices have yet to see any meaningful breakouts following the Aug. 17 push lower, climbing daily volatility reincentivizes participation from vol-thirsty day traders,” the two analysts were quoted as saying.