A measure of leverage in the Bitcoin market just fell to its lowest since late 2021, a sign that volatility inducing speculators are increasingly being washed out of the market, meaning that the world’s largest cryptocurrency by market capitalization may be in for calmer waters ahead.

Crypto analytics firm CryptoQuant’s “Estimated Leverage Ratio” (ELR) just fell to 0.195, its lowest since December 2021.

That’s down from a peak of 0.4 just before the collapse of cryptocurrency exchange FTX last November, which was the catalyst for Bitcoin hitting its 2022 bear market lows in the $15,000s.

CryptoQuant calculates its ELR by dividing the dollar value of open perpetual Bitcoin future contract positions by the number of Bitcoin tokens being held by derivatives exchanges (where traders open those perpetual Bitcoin future positions).

A lower number means that traders on derivatives exchanges are opening less leveraged positions proportional to the number of tokens they have on the exchange, essentially implying there is less speculation in the market.

Lower Leverage Could Be Bullish for Bitcoin

As can be seen above, the relationship between CryptoQuant’s ELR and the BTC price is weak.

When Bitcoin was at record highs in late-2021, the ELR was around current levels, before the ELR then peaked when the Bitcoin price was around the $20,000 mark.

But a lower ELR could nonetheless still be bullish for the Bitcoin price, as when the market gets excessively leveraged, this can trigger volatility (as positions are stopped out).

Higher volatility can deter investors. A lower volatility profile ahead could be a key factor in attracting new retail and institutional investors to the space.

The drop in the ELR comes after wild liquidation-induced swings in the Bitcoin price on Wednesday.

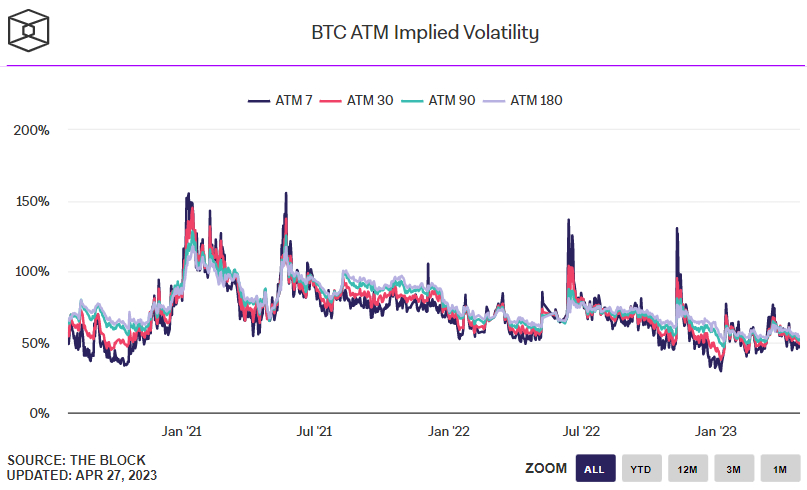

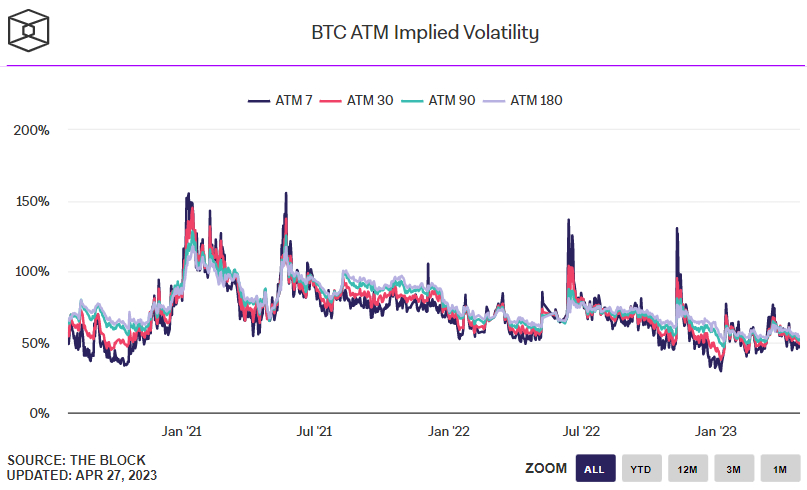

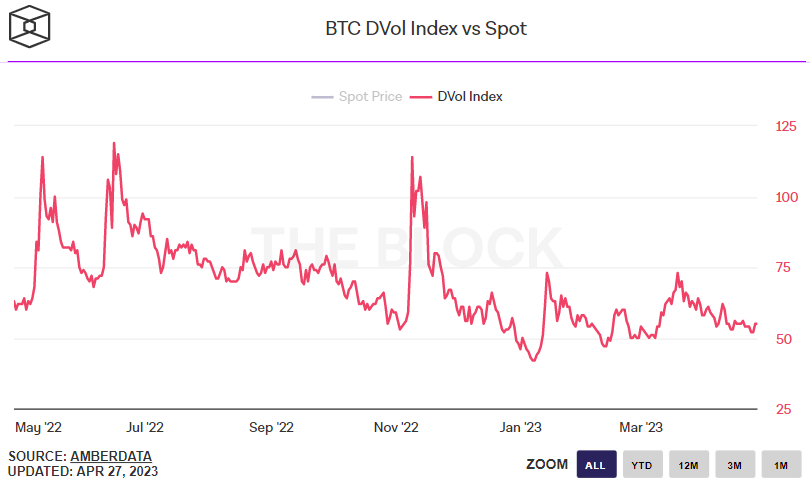

And lower volatility ahead seems to be just what investors are expecting, according to Bitcoin options market pricing.

Implied volatility according to At-The-Money (ATM) Bitcoin options expiring in 7, 30, 90 and 180 days are all in the 45-55% range, which is close to historic lows.

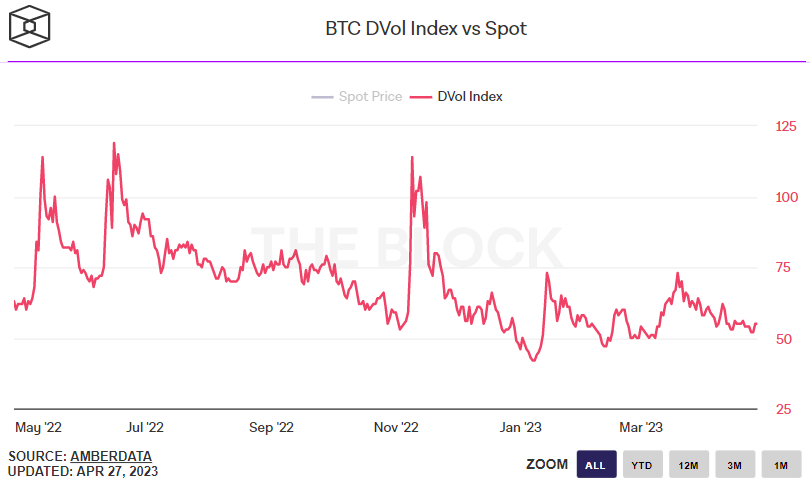

Dominant derivative exchange Deribit’s Bitcoin Volatility Index (DVOL) is also near historic lows at current levels around 55.

Alternative metrics of leverage in the Bitcoin market have also been in decline.

The ratio of the dollar value of open interest in the Bitcoin futures market to Bitcoin’s market capitalization was last around 0.0176.

That’s according to data from The Block, which showed open interest in Bitcoin futures at around $9.7 billion on Wednesday versus Bitcoin’s closing market cap of around $550 billion.

On the first of November 2022, when Bitcoin’s closing market cap was just over $393 billion and future open interest was around $11.56 billion, this ratio was at a much higher level of close to 0.03.

The washing out of speculators and Bitcoin “tourists” has historically been consistent with the market finding a low and then proceeding to recover, before price momentum-related FOMO (fear of missing out) then attracts a new wave of speculators and “tourists”.

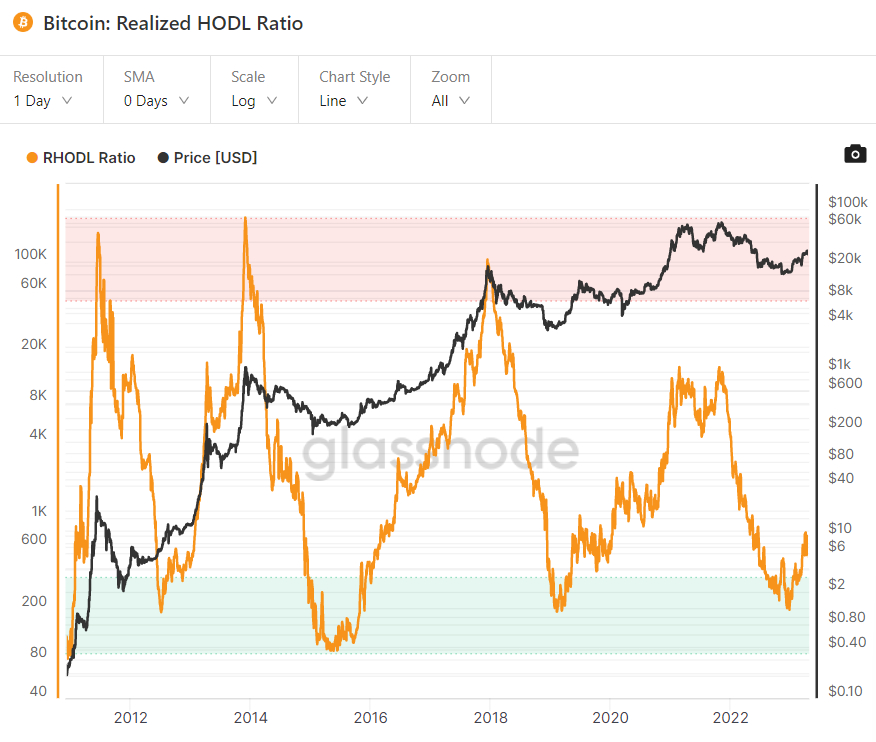

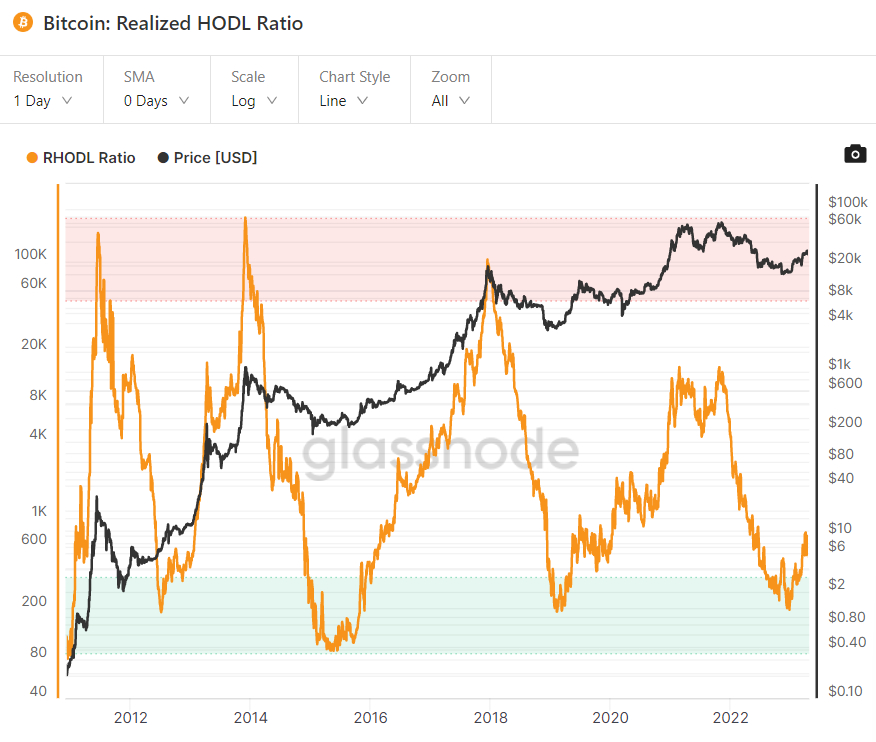

That’s why on-chain analysts like to monitor metrics such as Realized HODL Ratio, which captures the balance between BTC wealth held in 1-week old coins versus 1-2 year old coins.

As can be seen in the above chart presented by crypto analytics firm Glassnode, this ratio tends to bottom in line with bear market bottoms, indicating that weaker conviction speculators and tourists have been wiped out and a higher proportion of high conviction longer-term HODLers remain.

A measure of leverage in the Bitcoin market just fell to its lowest since late 2021, a sign that volatility inducing speculators are increasingly being washed out of the market, meaning that the world’s largest cryptocurrency by market capitalization may be in for calmer waters ahead.

Crypto analytics firm CryptoQuant’s “Estimated Leverage Ratio” (ELR) just fell to 0.195, its lowest since December 2021.

That’s down from a peak of 0.4 just before the collapse of cryptocurrency exchange FTX last November, which was the catalyst for Bitcoin hitting its 2022 bear market lows in the $15,000s.

CryptoQuant calculates its ELR by dividing the dollar value of open perpetual Bitcoin future contract positions by the number of Bitcoin tokens being held by derivatives exchanges (where traders open those perpetual Bitcoin future positions).

A lower number means that traders on derivatives exchanges are opening less leveraged positions proportional to the number of tokens they have on the exchange, essentially implying there is less speculation in the market.

Lower Leverage Could Be Bullish for Bitcoin

As can be seen above, the relationship between CryptoQuant’s ELR and the BTC price is weak.

When Bitcoin was at record highs in late-2021, the ELR was around current levels, before the ELR then peaked when the Bitcoin price was around the $20,000 mark.

But a lower ELR could nonetheless still be bullish for the Bitcoin price, as when the market gets excessively leveraged, this can trigger volatility (as positions are stopped out).

Higher volatility can deter investors. A lower volatility profile ahead could be a key factor in attracting new retail and institutional investors to the space.

The drop in the ELR comes after wild liquidation-induced swings in the Bitcoin price on Wednesday.

And lower volatility ahead seems to be just what investors are expecting, according to Bitcoin options market pricing.

Implied volatility according to At-The-Money (ATM) Bitcoin options expiring in 7, 30, 90 and 180 days are all in the 45-55% range, which is close to historic lows.

Dominant derivative exchange Deribit’s Bitcoin Volatility Index (DVOL) is also near historic lows at current levels around 55.

Alternative metrics of leverage in the Bitcoin market have also been in decline.

The ratio of the dollar value of open interest in the Bitcoin futures market to Bitcoin’s market capitalization was last around 0.0176.

That’s according to data from The Block, which showed open interest in Bitcoin futures at around $9.7 billion on Wednesday versus Bitcoin’s closing market cap of around $550 billion.

On the first of November 2022, when Bitcoin’s closing market cap was just over $393 billion and future open interest was around $11.56 billion, this ratio was at a much higher level of close to 0.03.

The washing out of speculators and Bitcoin “tourists” has historically been consistent with the market finding a low and then proceeding to recover, before price momentum-related FOMO (fear of missing out) then attracts a new wave of speculators and “tourists”.

That’s why on-chain analysts like to monitor metrics such as Realized HODL Ratio, which captures the balance between BTC wealth held in 1-week old coins versus 1-2 year old coins.

As can be seen in the above chart presented by crypto analytics firm Glassnode, this ratio tends to bottom in line with bear market bottoms, indicating that weaker conviction speculators and tourists have been wiped out and a higher proportion of high conviction longer-term HODLers remain.