The share price of Grayscale Bitcoin Trust (GBTC) reached a one-year high on Tuesday, fueled by renewed optimism surrounding the potential conversion of the trust into an exchange-traded fund (ETF).

The surge came in response to reports that asset manager Fidelity Investments is preparing to follow BlackRock’s lead in filing for a spot Bitcoin ETF.

Closing at $19.47 on Tuesday, GBTC experienced a 7.1% gain throughout the day yesterday, marking its highest closing price since June of last year.

At the same time, the spot price of Bitcoin (BTC) rose just 1.4% for the day, ending the day (by UTC time) at $30,692 after spiking to almost $31,000 on the news that Fidelity is joining the Bitcoin ETF race.

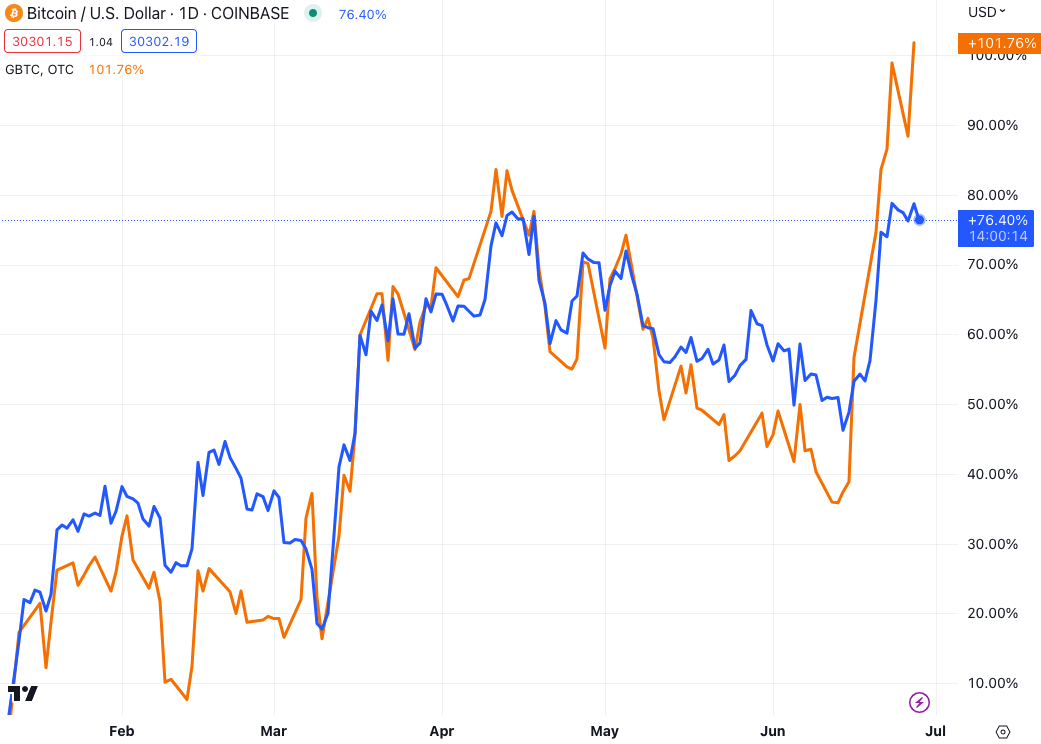

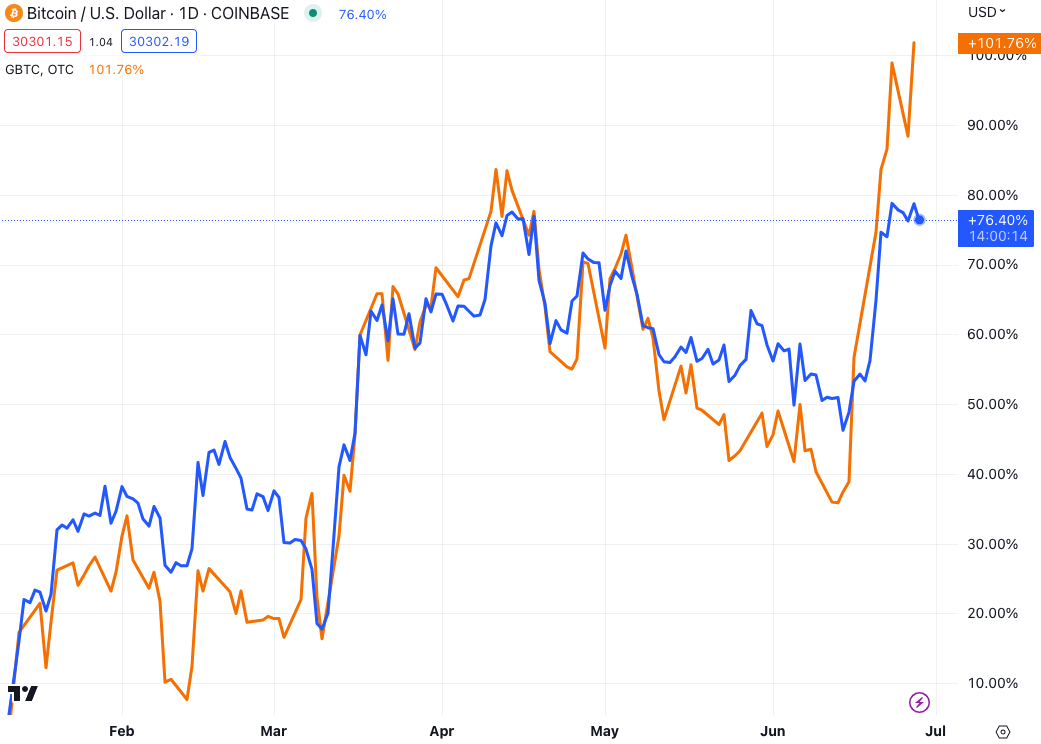

50% surge since BlackRock’s filing

GBTC’s recent rally gained momentum after BlackRock filed for a Bitcoin ETF on June 15.

In the almost two weeks since BlackRock’s application, GBTC has now surged by nearly 50%.

BlackRock, which manages a staggering $9.1 trillion and is regarded as the world’s largest asset manager, holds substantial influence in the investment world.

The surge in price for GBTC relative to BTC narrowed the discount that GBTC for a long time has traded at.

According to data from Ycharts, the GBTC’s discount to its net asset value (NAV) now stands at 30%, its lowest level since September.

Optimism around ETF conversion

The GBTC rally continued as financial services giants Invesco and WisdomTree also applied to offer spot-based Bitcoin ETFs, after previously seeing their applications rejected by the Securities and Exchange Commission (SEC).

Investors are now optimistic about GBTC due to the possibility that BlackRock’s filing may pave the way for a successful ETF launch, which could also benefit Grayscale in converting its trust to an ETF.

This has long been a goal for Grayscale, and some investors have made the bet that a successful conversion would eliminate the discount GBTC is trading at.

Meanwhile, market participants are also watching the outcome of a lawsuit between Grayscale and the SEC with increasing positivity.

Grayscale sued the SEC earlier this year after an application to convert its Bitcoin Trust into an ETF was denied, and a favorable outcome for Grayscale is therefore likely to narrow the GBTC discount further.

The share price of Grayscale Bitcoin Trust (GBTC) reached a one-year high on Tuesday, fueled by renewed optimism surrounding the potential conversion of the trust into an exchange-traded fund (ETF).

The surge came in response to reports that asset manager Fidelity Investments is preparing to follow BlackRock’s lead in filing for a spot Bitcoin ETF.

Closing at $19.47 on Tuesday, GBTC experienced a 7.1% gain throughout the day yesterday, marking its highest closing price since June of last year.

At the same time, the spot price of Bitcoin (BTC) rose just 1.4% for the day, ending the day (by UTC time) at $30,692 after spiking to almost $31,000 on the news that Fidelity is joining the Bitcoin ETF race.

50% surge since BlackRock’s filing

GBTC’s recent rally gained momentum after BlackRock filed for a Bitcoin ETF on June 15.

In the almost two weeks since BlackRock’s application, GBTC has now surged by nearly 50%.

BlackRock, which manages a staggering $9.1 trillion and is regarded as the world’s largest asset manager, holds substantial influence in the investment world.

The surge in price for GBTC relative to BTC narrowed the discount that GBTC for a long time has traded at.

According to data from Ycharts, the GBTC’s discount to its net asset value (NAV) now stands at 30%, its lowest level since September.

Optimism around ETF conversion

The GBTC rally continued as financial services giants Invesco and WisdomTree also applied to offer spot-based Bitcoin ETFs, after previously seeing their applications rejected by the Securities and Exchange Commission (SEC).

Investors are now optimistic about GBTC due to the possibility that BlackRock’s filing may pave the way for a successful ETF launch, which could also benefit Grayscale in converting its trust to an ETF.

This has long been a goal for Grayscale, and some investors have made the bet that a successful conversion would eliminate the discount GBTC is trading at.

Meanwhile, market participants are also watching the outcome of a lawsuit between Grayscale and the SEC with increasing positivity.

Grayscale sued the SEC earlier this year after an application to convert its Bitcoin Trust into an ETF was denied, and a favorable outcome for Grayscale is therefore likely to narrow the GBTC discount further.