Exchange balances of Bitcoin (BTC) and Ether (ETH) fell significantly in June as more crypto holders chose to take self-custody, a report by investment bank Goldman Sachs has said.

Analyzing on-chain data, the Goldman Sachs report said it is likely that many crypto investors have moved their holdings away from exchanges due to fears over regulatory crackdowns and potential security issues related to hacking and theft.

Another possible explanation is that staking of ETH has now become possible through self-custodial solutions, which incentivizes the withdrawal of tokens from exchanges.

As a result of this move to self-custody, exchange’s supply of the two largest cryptocurrencies by market capitalization, BTC is now close to its lowest level since December 2022.

Similarly, the supply of ETH on exchanges is also down, reaching levels not seen since May 2018.

The news was first reported by CoinDesk.

Bitcoin miners selling

The Goldman Sachs report also mentioned that June marked a record month for Bitcoin miners’ inventory sales.

Miners took advantage of the cryptocurrency’s strong performance, resulting in nearly doubled monthly BTC inflows from miners to exchanges, amounting to $99 million.

During this period, the price of Bitcoin rose by approximately 12% to a price of $30,472 as of the end of the month.

Transaction fees returning to normal

In addition to the factors mentioned above, another key development in June was that transaction fees finally returned to normal levels after the network congestion witnessed in May.

As a result, both Bitcoin and Ether experienced a rebound in monthly address activity, with a 15.5% increase for Bitcoin and a notable 37.5% surge for Ether.

Goldman Sachs also observed a significant decline in average daily ether burnt, which fell by 65.1%, and average daily fees, which dropped by 63.3% on a month-on-month basis.

Increased on-chain activity

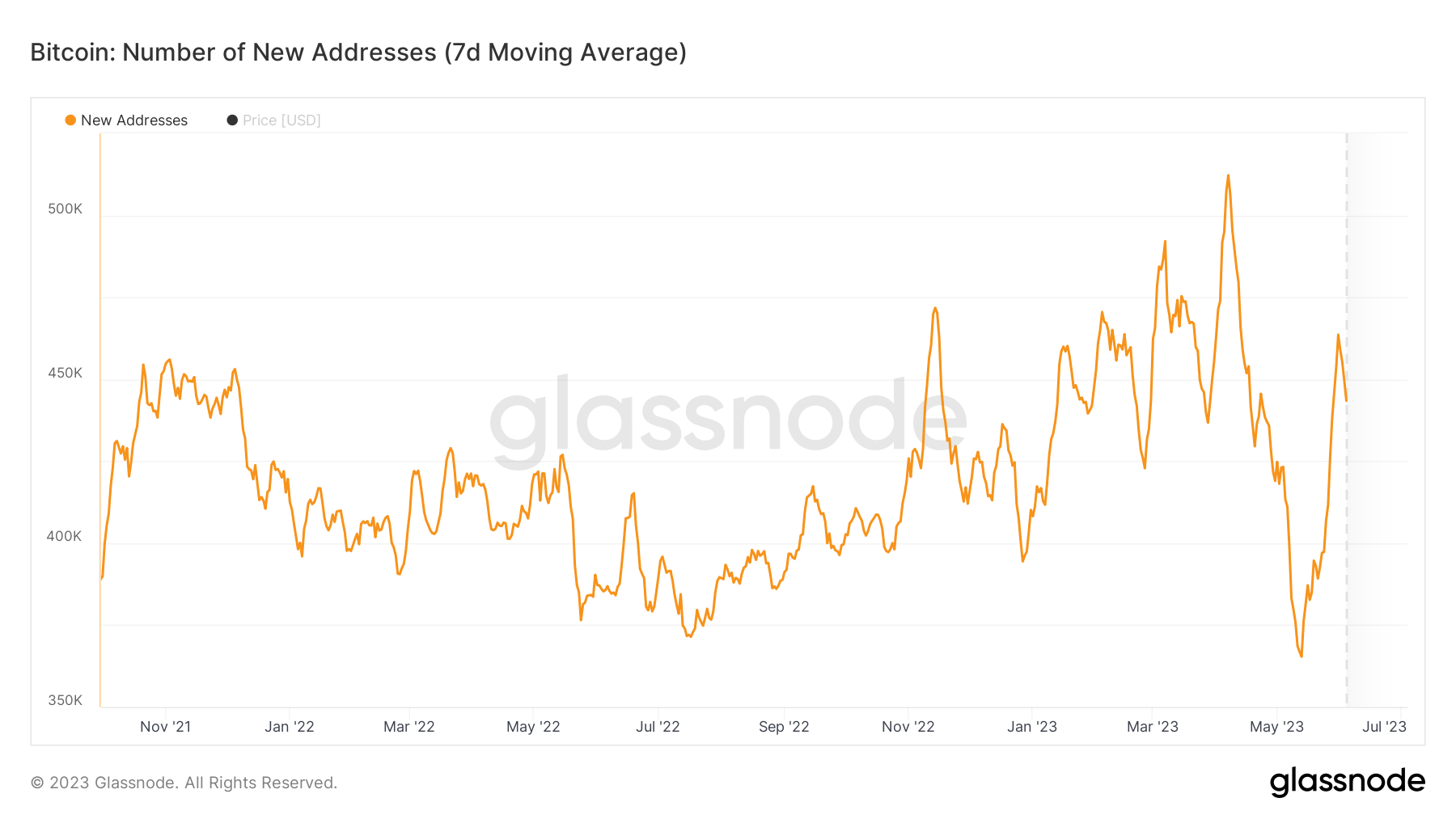

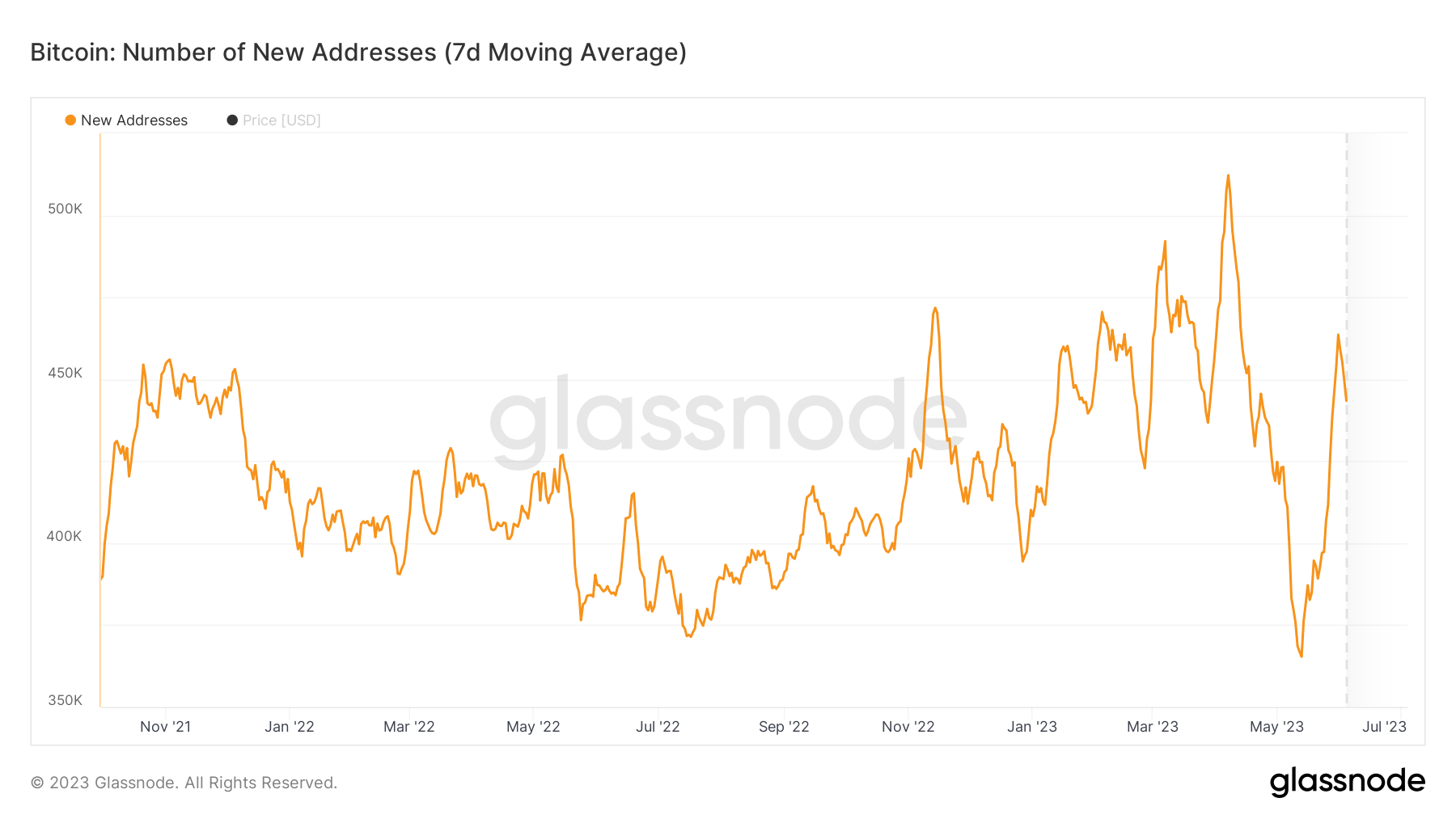

Lastly, the report highlighted an increase in new on-chain activity.

The daily average count of new addresses for both Bitcoin and Ether rose by 9.8% and 48.2%, respectively, compared to the previous month.

Based on these developments, it seems that the decline in Bitcoin and Ether supply on exchanges, coupled with increased on-chain activity, may suggest the return of a bullish market.

Exchange balances of Bitcoin (BTC) and Ether (ETH) fell significantly in June as more crypto holders chose to take self-custody, a report by investment bank Goldman Sachs has said.

Analyzing on-chain data, the Goldman Sachs report said it is likely that many crypto investors have moved their holdings away from exchanges due to fears over regulatory crackdowns and potential security issues related to hacking and theft.

Another possible explanation is that staking of ETH has now become possible through self-custodial solutions, which incentivizes the withdrawal of tokens from exchanges.

As a result of this move to self-custody, exchange’s supply of the two largest cryptocurrencies by market capitalization, BTC is now close to its lowest level since December 2022.

Similarly, the supply of ETH on exchanges is also down, reaching levels not seen since May 2018.

The news was first reported by CoinDesk.

Bitcoin miners selling

The Goldman Sachs report also mentioned that June marked a record month for Bitcoin miners’ inventory sales.

Miners took advantage of the cryptocurrency’s strong performance, resulting in nearly doubled monthly BTC inflows from miners to exchanges, amounting to $99 million.

During this period, the price of Bitcoin rose by approximately 12% to a price of $30,472 as of the end of the month.

Transaction fees returning to normal

In addition to the factors mentioned above, another key development in June was that transaction fees finally returned to normal levels after the network congestion witnessed in May.

As a result, both Bitcoin and Ether experienced a rebound in monthly address activity, with a 15.5% increase for Bitcoin and a notable 37.5% surge for Ether.

Goldman Sachs also observed a significant decline in average daily ether burnt, which fell by 65.1%, and average daily fees, which dropped by 63.3% on a month-on-month basis.

Increased on-chain activity

Lastly, the report highlighted an increase in new on-chain activity.

The daily average count of new addresses for both Bitcoin and Ether rose by 9.8% and 48.2%, respectively, compared to the previous month.

Based on these developments, it seems that the decline in Bitcoin and Ether supply on exchanges, coupled with increased on-chain activity, may suggest the return of a bullish market.