Crypto asset adoption is accelerating, with over half a billion people becoming users or owners in 2023, according to a Crypto.com report.

Making its disclosure in an 18-page report from its Research and Insights Team, the centralized Bitcoin exchange pointed out that 580 million people became digital asset users and owners in the past year.

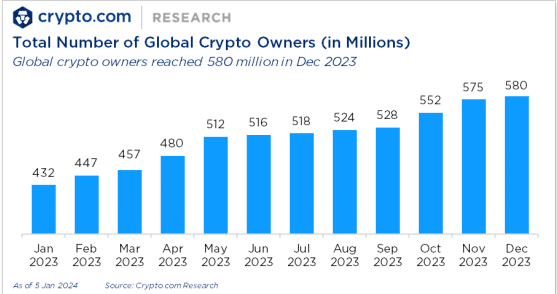

This figure shows an increase of 34%, rising from 432 million people in January 2023 to 580 million by the end of the year.

Examining the specifics, the Crypto.com report highlights that Bitcoin and Ethereum were the most owned or used blockchain-based assets.

According to the Research and Insights Team, the number of Bitcoin owners grew 33%, from 222 million in January to 296 million people by December. This figure accounts for 51% of global Bitcoin owners.

Ethereum, on the other hand, experienced a more significant percentage increase, with 39% of crypto owners incorporating the smart contract-powered digital asset into their portfolio.

Ethereum owners rose from 89 million in the beginning of 2023 to 124 million by the close of the year, accounting for 21% of global owners.

https://t.co/vCNztATkNg’s Market Sizing Report for 2023 is out.

The industry grew 35% to 580M users in 2023, adding 150M new users.

Get more insights on global crypto growth in 2023 👉https://t.co/2zTkTv71cK pic.twitter.com/axkfKHvAJk

— Crypto.com (@cryptocom) January 22, 2024

The report is remarkable, considering the challenging period the emerging crypto industry endured in 2022 when more than 50% of its $2.9 trillion valuation was shaved off.

In 2023, the digital asset ecosystem also faced turbulence, with mixed performance attributed to inflation-curbing measures introduced by several central banks, including the Federal Reserve.

Additionally, the ongoing conflicts in Europe and the Middle East made it a tough year for the virtual asset space to witness a bullish trend following a strong bear market in 2022.

Pointing out the underlying reasons for massive crypto adoption, the Crypto.com Research and Insights team noted that the growing confidence surrounding the approval of a spot Bitcoin exchange-traded fund (ETF) by the US Securities and Exchange Commission (SEC) spurred interest in the industry.

Furthermore, the introduction of non-fungible token (NFT) capability on the Bitcoin network through the BRC-20 token standards and Bitcoin Ordinals contributed to user growth. Institutional interest in BTC also contributed to an expansion of the Bitcoin ownership bracket.

For Ethereum, the research team pointed to the singular Shanghai upgrade, which allowed for the withdrawals of staked Ether (ETH) from the Beacon Chain as part of the migration to a proof-of-stake (PoS) network.

Centralized Exchange Platforms Still Best in Aiding Crypto Adoption

While the crypto ecosystem operates on a decentralized and permissionless ethos, centralized trading platforms have served as the most robust vehicle for onboarding and boosting adoption over the years.

This truth is further emphasized by the recent Crypto.com report, which discovers that a large number of new crypto owners have purchased Bitcoin and Ethereum on centralized crypto exchanges.

According to the report, Crypto.com conducted on-chain market data analysis on 20+ crypto exchanges, including popular names like Binance, Crypto.com, Bitfinex, Bittrex, Gemini, and 18 others.

Further details showed that 40.9% of Bitcoin owners also hold ETH in their wallets, while 42% owned neither Bitcoin nor ETH but other digital assets.

The adoption ratio for crypto exchanges was notably high at 89%, highlighting the substantial appeal that Web2-like trading platforms have for Web3 investors.