Experts have explained why Russia is reportedly becoming a crypto mining hotspot, as the nation claims its crypto mining hashrate is second only to that of the USA.

Per Finam, Nikita Zuborev, a Senior Analyst at the domestic crypto platform BestChange, said:

“There are many advantages [of mining crypto in Russia]. These include relatively low electricity tariffs. Even in Central Russia, prices are competitive relative to the rest of the world. But if we talk about regions with even lower tariffs, such as the Irkutsk and Krasnoyarsk regions, Khakassia, and Dagestan, then the benefits are much higher.”

Zuborev added that some regions of the nation had surplus energy reserves that could be made available to miners on “favorable terms.”

The expert also said that “relatively” low taxes on company profits were also attractive for many mining firms.

And Zuborev said that another “minor, but still noticeable” plus for Russia was its proximity to China, the “absolute leader” in the production of crypto mining equipment.

“Direct rail links” between the two nations allow faster and cheaper mining hardware delivery, Zuborev emphasized.

Is Russia Really the World’s Second-biggest Crypto Mining Power?

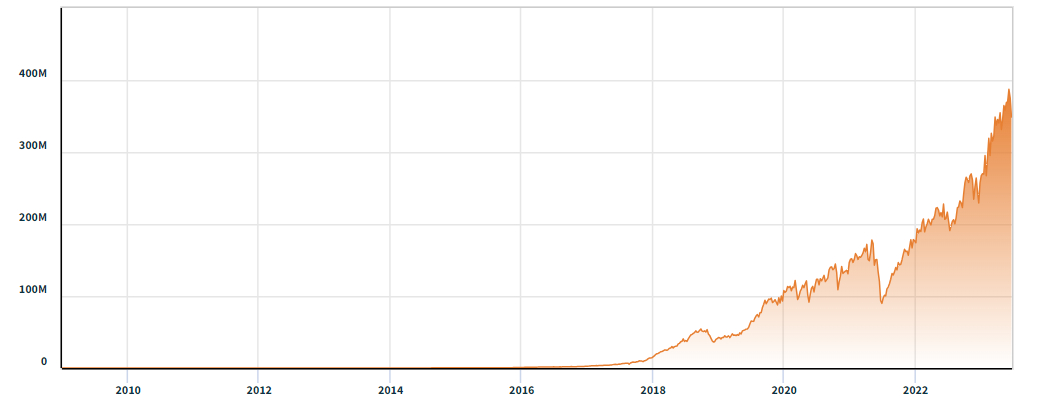

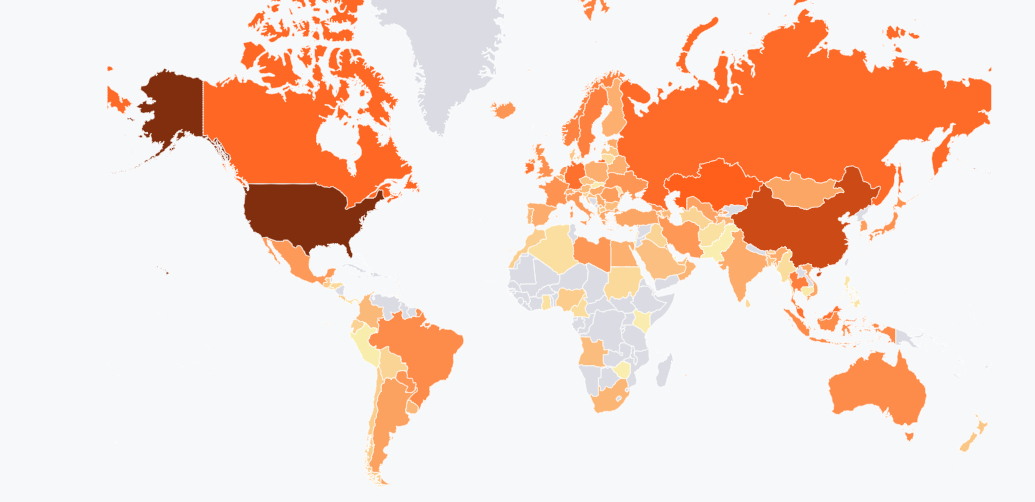

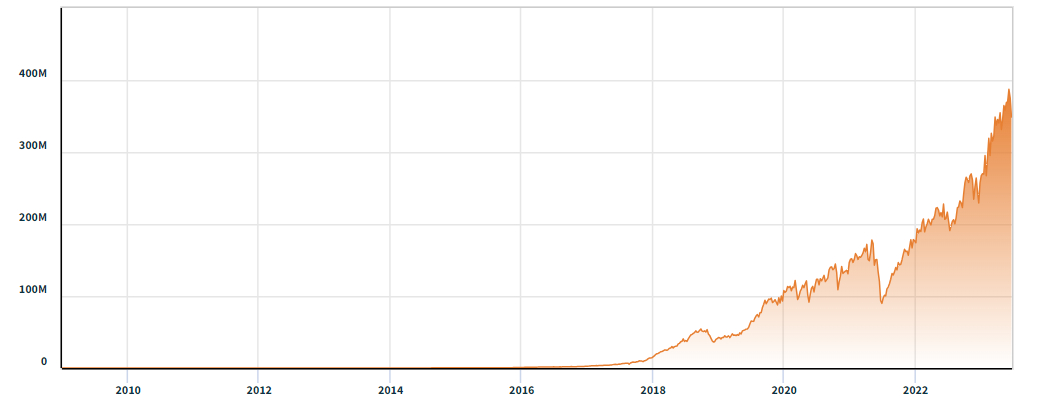

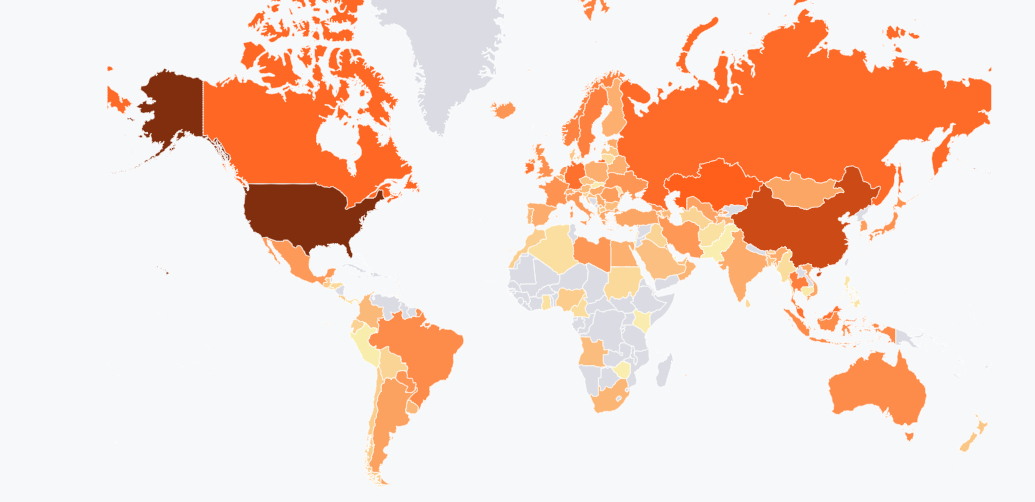

The most recent Cambridge Centre for Alternative Finance Bitcoin electricity consumption index (January 2022) projected the average Russian monthly hashrate at less than 5% of the global total.

The United States, meanwhile, posted almost 38%, with Russian neighbors Kazakhstan and China on over 13% and 21% respectively.

But according to Komersant, the Russian mining giant BitRiver believes the nation actually has some 1GW worth of crypto mining capacity at its disposal.

It claimed that the USA has some 3-4 GW worth of mining power, but that regulatory changes in Kazakhstan last year (due to massive electricity shortages in late 2021) and a 2021 Chinese crackdown on mining have helped Russia eclipse its neighbors in Bitcoin and altcoin hashrates.

No other nation has more than 0.5GW at its disposal, BitRiver claimed.

The Gulf States have a combined 700MW, while Canada has 400MW, the mining firm said.

Furthermore, the crypto mining firm claimed, the United States’ position at the top of the mining tree could be under threat.

The BitRiver CEO Igor Runets said the American mining industry is being “slowed down” by a mix of rising US electricity prices, declining mining profitability, and the abolition of tax incentives.

Runets said:

“The vast majority of equipment [used in the US] was purchased by American miners on credit. That means so many over-leveraged companies are now in the process of bankruptcy or have already gone bankrupt.”

Ivona Gutovich, the COO of Green Crypto Processing, told Fianam:

“Russia is one of the largest electricity producers in the world. And electricity prices in this nation are some of the lowest in the world.”

She added:

“The cold climate also allows miners to save on cooling costs for their mining farms. In general, Russia has all the necessary conditions to become an attractive location for cryptocurrency miners.”

And Evgeny May, the founder of Cryptonomos, said of the future of the industry in Russia:

“I think that there will be enough people in Russia who will continue to invest [in crypto mining], especially when we have some regulatory transparency and understanding in the sector.”

Earlier this week, the country’s energy ministry claimed that Moscow needs to speed up its efforts to legalize crypto mining.

And also this week, the Russian secret services arrested a citizen in the nation’s Far East on charges of treason, claiming the individual had sent crypto to Ukraine’s armed forces.

Experts have explained why Russia is reportedly becoming a crypto mining hotspot, as the nation claims its crypto mining hashrate is second only to that of the USA.

Per Finam, Nikita Zuborev, a Senior Analyst at the domestic crypto platform BestChange, said:

“There are many advantages [of mining crypto in Russia]. These include relatively low electricity tariffs. Even in Central Russia, prices are competitive relative to the rest of the world. But if we talk about regions with even lower tariffs, such as the Irkutsk and Krasnoyarsk regions, Khakassia, and Dagestan, then the benefits are much higher.”

Zuborev added that some regions of the nation had surplus energy reserves that could be made available to miners on “favorable terms.”

The expert also said that “relatively” low taxes on company profits were also attractive for many mining firms.

And Zuborev said that another “minor, but still noticeable” plus for Russia was its proximity to China, the “absolute leader” in the production of crypto mining equipment.

“Direct rail links” between the two nations allow faster and cheaper mining hardware delivery, Zuborev emphasized.

Is Russia Really the World’s Second-biggest Crypto Mining Power?

The most recent Cambridge Centre for Alternative Finance Bitcoin electricity consumption index (January 2022) projected the average Russian monthly hashrate at less than 5% of the global total.

The United States, meanwhile, posted almost 38%, with Russian neighbors Kazakhstan and China on over 13% and 21% respectively.

But according to Komersant, the Russian mining giant BitRiver believes the nation actually has some 1GW worth of crypto mining capacity at its disposal.

It claimed that the USA has some 3-4 GW worth of mining power, but that regulatory changes in Kazakhstan last year (due to massive electricity shortages in late 2021) and a 2021 Chinese crackdown on mining have helped Russia eclipse its neighbors in Bitcoin and altcoin hashrates.

No other nation has more than 0.5GW at its disposal, BitRiver claimed.

The Gulf States have a combined 700MW, while Canada has 400MW, the mining firm said.

Furthermore, the crypto mining firm claimed, the United States’ position at the top of the mining tree could be under threat.

The BitRiver CEO Igor Runets said the American mining industry is being “slowed down” by a mix of rising US electricity prices, declining mining profitability, and the abolition of tax incentives.

Runets said:

“The vast majority of equipment [used in the US] was purchased by American miners on credit. That means so many over-leveraged companies are now in the process of bankruptcy or have already gone bankrupt.”

Ivona Gutovich, the COO of Green Crypto Processing, told Fianam:

“Russia is one of the largest electricity producers in the world. And electricity prices in this nation are some of the lowest in the world.”

She added:

“The cold climate also allows miners to save on cooling costs for their mining farms. In general, Russia has all the necessary conditions to become an attractive location for cryptocurrency miners.”

And Evgeny May, the founder of Cryptonomos, said of the future of the industry in Russia:

“I think that there will be enough people in Russia who will continue to invest [in crypto mining], especially when we have some regulatory transparency and understanding in the sector.”

Earlier this week, the country’s energy ministry claimed that Moscow needs to speed up its efforts to legalize crypto mining.

And also this week, the Russian secret services arrested a citizen in the nation’s Far East on charges of treason, claiming the individual had sent crypto to Ukraine’s armed forces.