Ethereum may be far younger than the traditional payments giants, such as Visa, but it has shown (yet again) that blockchain, in a single decade, developed into a force to be reckoned with.

As a payment technology, blockchain has grown as much as to rival established players. Recent data from Coingraph has shown that Ethereum, for example, processed $3.01 trillion in transactions, as opposed to Visa, which processed $3.08 trillion.

It is a testament to the growth in mainstream adoption of the nascent technology, which is often perceived – sometimes nearly exclusively – as a vessel for scammers, drug dealers, and cybercriminals.

Ethereum is the second-largest network: its current market capitalization, according to CoinGecko, is $227.8 billion, compared to the 1st-placed Bitcoin’s $538.96 billion and the 3rd-placed Tether’s $82.8 billion.

Notably, as the world’s second-biggest blockchain, Ethereum powers numerous financial technology solutions that are looking to disrupt the global, traditional finance market. These solutions include decentralized finance (DeFI), staking, lending, and flash loans, among many others.

It has grown to become a rich and versatile environment, with plenty of room for further development – which is another advantage it has over traditional financial layers.

Last year, it was reported that Ethereum processed 4.5 times more transactions than Visa in 2021.

Also, a report by Ethereum Foundation‘s Josh Stark claimed that Ethereum surpassed Visa in trading volume in 2021. “Ethereum moved approximately $11.6 trillion USD. That is more than Visa [$10.4 trillion], and more than double Bitcoin,” the report said.

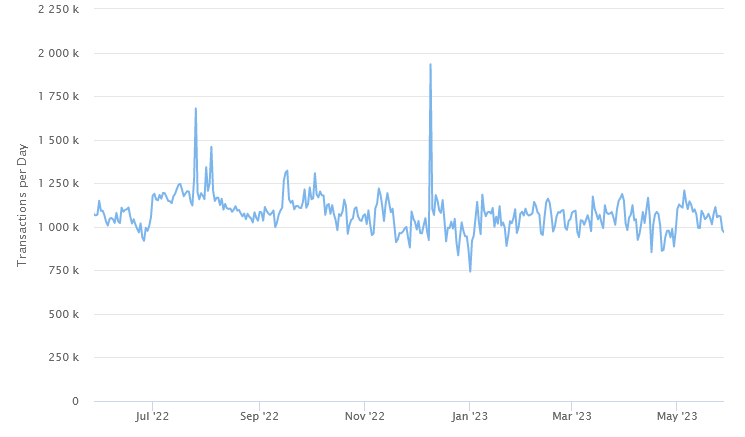

Looking at the latest Ethereum daily transactions, etherscan shows 968,996 on May 28, with the all-time high being 1,932,711 transactions on December 9, 2022.

Ethereum 1-year daily transactions chart:

Ethereum Already Entered TradFi

The popular blockchain is already the network of choice for many established players looking to utilize the novel technology – and among them, Visa.

Besides just writing about Ethereum’s economics, as reported in mid-May, Visa used Ethereum’s Goerli testnet to try out transaction-free payments with the help of account abstraction.

It used a smart contract called Paymaster, allowing the company to take advantage of account abstraction to perform complex tasks on behalf of accounts and manage transaction costs.

“Excited to see Visa deploy our first paymaster smart contract on testnet as we continue to research and experiment with account abstraction and ERC-4337,” Cuy Sheffield, Head of Crypto at Visa, said at the time.

ERC-4337 is an Ethereum standard that achieves account abstraction without a consensus-layer change, allowing users to bundle and automate transactions on the network.

“ERC-4337 lays down interesting future possibilities for improving on-chain user payments experience through a self-custodial smart contract wallet, which can in turn transform the way users engage with digital currencies and digital assets,” Visa said.

Visa first released a proposal that would allow Ethereum users to make automated programmable payments without the involvement of any third party in December last year.

The company also reiterated its commitment to crypto in March this year, refuting reports that it planned to pause its crypto push due to uncertain market conditions.

“We continue to partner with crypto companies to improve fiat on and off ramps as well as progress on our product roadmap to build new products that can facilitate stablecoin payments in a secure, compliant, and convenient way,” Sheffield said.

He added that the previous crypto meltdown did not change their view of digital assets and that “[now] is the time to build!”

At the time of writing (Monday noon UTC), ETH was trading at $1,898, up 3% in a day and 4.5% in a week.

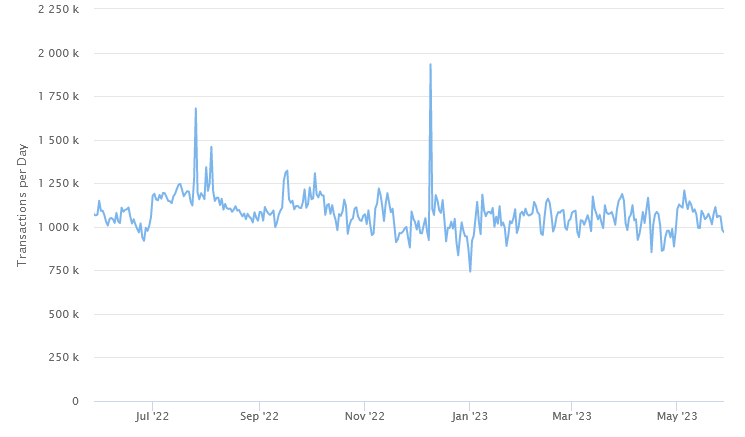

ETH 7-day price chart:

____

Learn more:

– Demand for ETH Staking Soars Despite Nearly Month-Long Waiting Period

– After Eight Years of Dormancy, Long-Forgotten Ethereum ICO Wallet Resurfaces with $15 Million Worth of Funds

– Global Payments Giant Visa Experiments with Ethereum’s Goerli Testnet – Here’s the Latest

– Mastercard Looking to Make Cryptocurrencies Everyday Way to Pay

– Ethereum Gas Fees Explained

– 5 Reasons Why Your Business Should Accept Ethereum

Ethereum may be far younger than the traditional payments giants, such as Visa, but it has shown (yet again) that blockchain, in a single decade, developed into a force to be reckoned with.

As a payment technology, blockchain has grown as much as to rival established players. Recent data from Coingraph has shown that Ethereum, for example, processed $3.01 trillion in transactions, as opposed to Visa, which processed $3.08 trillion.

It is a testament to the growth in mainstream adoption of the nascent technology, which is often perceived – sometimes nearly exclusively – as a vessel for scammers, drug dealers, and cybercriminals.

Ethereum is the second-largest network: its current market capitalization, according to CoinGecko, is $227.8 billion, compared to the 1st-placed Bitcoin’s $538.96 billion and the 3rd-placed Tether’s $82.8 billion.

Notably, as the world’s second-biggest blockchain, Ethereum powers numerous financial technology solutions that are looking to disrupt the global, traditional finance market. These solutions include decentralized finance (DeFI), staking, lending, and flash loans, among many others.

It has grown to become a rich and versatile environment, with plenty of room for further development – which is another advantage it has over traditional financial layers.

Last year, it was reported that Ethereum processed 4.5 times more transactions than Visa in 2021.

Also, a report by Ethereum Foundation‘s Josh Stark claimed that Ethereum surpassed Visa in trading volume in 2021. “Ethereum moved approximately $11.6 trillion USD. That is more than Visa [$10.4 trillion], and more than double Bitcoin,” the report said.

Looking at the latest Ethereum daily transactions, etherscan shows 968,996 on May 28, with the all-time high being 1,932,711 transactions on December 9, 2022.

Ethereum 1-year daily transactions chart:

Ethereum Already Entered TradFi

The popular blockchain is already the network of choice for many established players looking to utilize the novel technology – and among them, Visa.

Besides just writing about Ethereum’s economics, as reported in mid-May, Visa used Ethereum’s Goerli testnet to try out transaction-free payments with the help of account abstraction.

It used a smart contract called Paymaster, allowing the company to take advantage of account abstraction to perform complex tasks on behalf of accounts and manage transaction costs.

“Excited to see Visa deploy our first paymaster smart contract on testnet as we continue to research and experiment with account abstraction and ERC-4337,” Cuy Sheffield, Head of Crypto at Visa, said at the time.

ERC-4337 is an Ethereum standard that achieves account abstraction without a consensus-layer change, allowing users to bundle and automate transactions on the network.

“ERC-4337 lays down interesting future possibilities for improving on-chain user payments experience through a self-custodial smart contract wallet, which can in turn transform the way users engage with digital currencies and digital assets,” Visa said.

Visa first released a proposal that would allow Ethereum users to make automated programmable payments without the involvement of any third party in December last year.

The company also reiterated its commitment to crypto in March this year, refuting reports that it planned to pause its crypto push due to uncertain market conditions.

“We continue to partner with crypto companies to improve fiat on and off ramps as well as progress on our product roadmap to build new products that can facilitate stablecoin payments in a secure, compliant, and convenient way,” Sheffield said.

He added that the previous crypto meltdown did not change their view of digital assets and that “[now] is the time to build!”

At the time of writing (Monday noon UTC), ETH was trading at $1,898, up 3% in a day and 4.5% in a week.

ETH 7-day price chart:

____

Learn more:

– Demand for ETH Staking Soars Despite Nearly Month-Long Waiting Period

– After Eight Years of Dormancy, Long-Forgotten Ethereum ICO Wallet Resurfaces with $15 Million Worth of Funds

– Global Payments Giant Visa Experiments with Ethereum’s Goerli Testnet – Here’s the Latest

– Mastercard Looking to Make Cryptocurrencies Everyday Way to Pay

– Ethereum Gas Fees Explained

– 5 Reasons Why Your Business Should Accept Ethereum