The rate at which the Ether (ETH) supply is deflating, which has been accelerating in recent weeks, recently saw a spike higher. Ether is the cryptocurrency that powers the smart-contract-enabled Ethereum blockchain. ETH is the world’s second most valuable cryptocurrency by market capitalization and Ethereum is the dominant blockchain in Decentralized Finance.

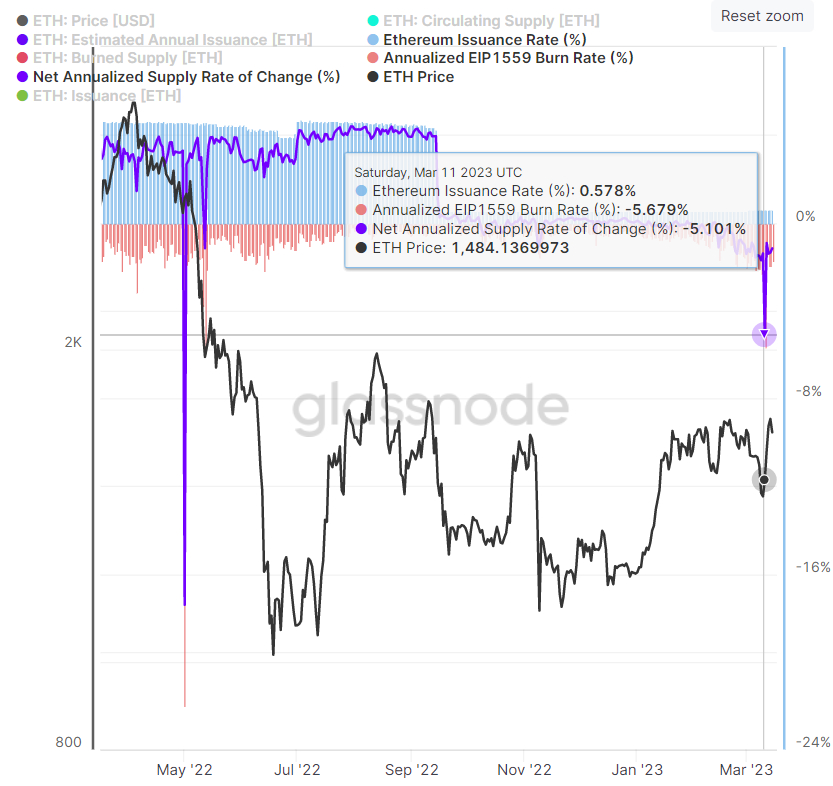

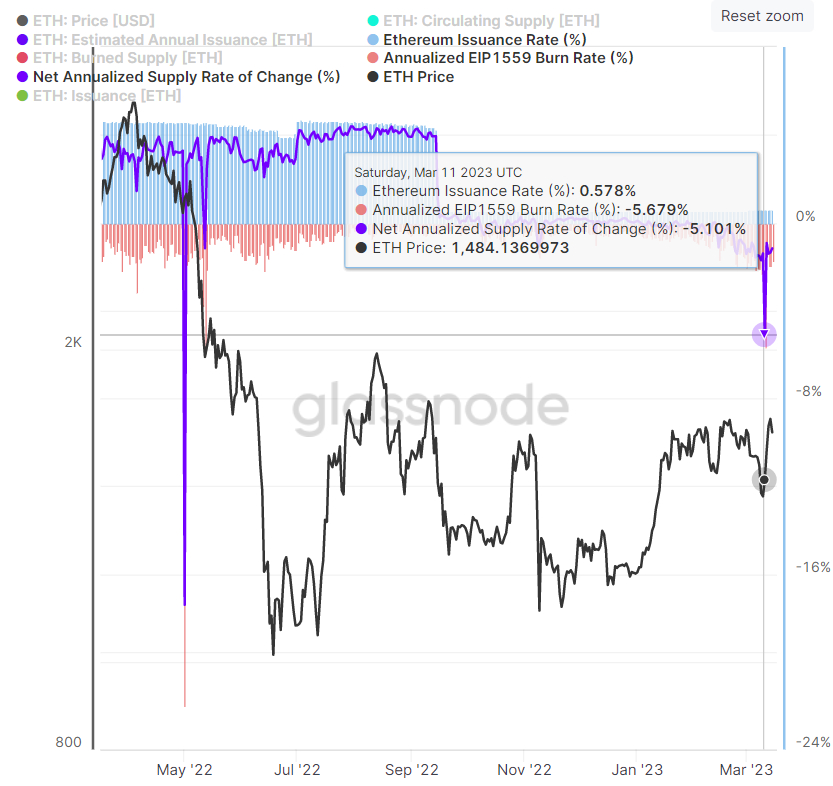

Last Saturday, the annualized burn rate as a result of Ethereum Improvement Proposal 1559 jumped to its highest since last May at 5.679%, outstripping the Ether issuance rate of 0.578% by a whopping 5.101%. The deflation rate has since dropped to around 1.75% as of Wednesday the 15th of March.

Cryptocurrency markets saw extreme volatility last weekend and at the beginning of this week amid uncertainty relating to last week’s series of major regional US bank collapses and the policymaker response. Ether was last changing hands on exchanges in the upper-$1,600s, having hit multi-month highs above $1,700 earlier this week.

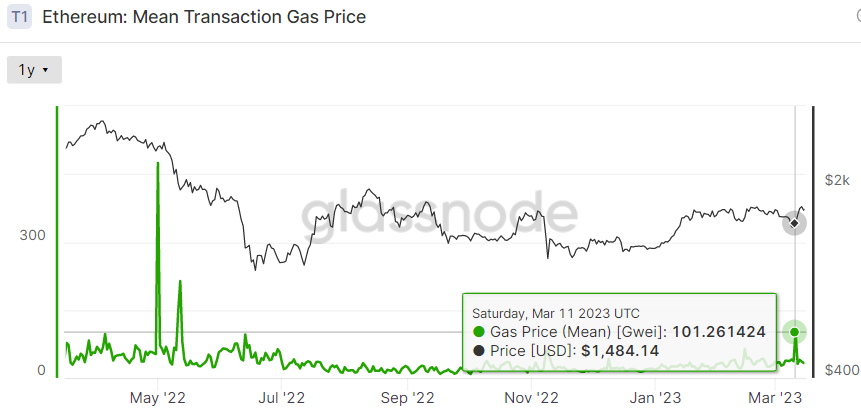

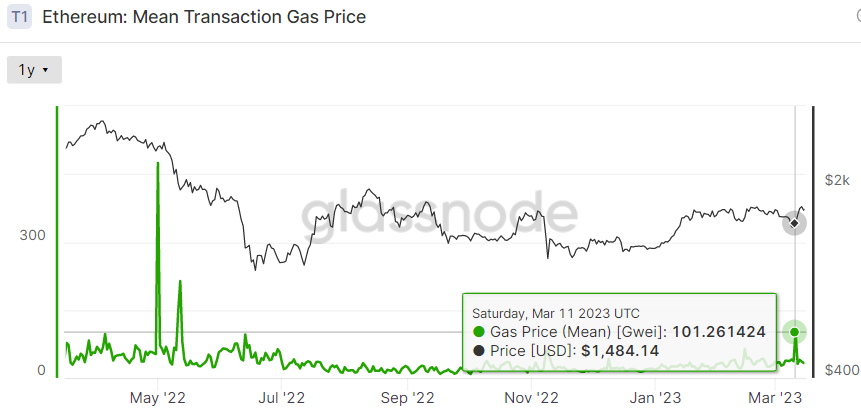

The spike in the Ether burn rate came amid a jump in the Ethereum gas price, a fee charged to users of the network, to its highest level since last May. If demand for the Ethereum network continues to rise, causing a rise in network congestion, that will cause further upside in Ethereum gas fees, which will translate to a further acceleration in the cryptocurrency’s rate of deflation. An accelerating deflation rate is likely to be a long-term tailwind for the ETH price.

Explainer – What is Driving the Accelerating ETH Deflation Rate?

Before answering the question as to what is driving the increase in the ETH deflation rate, we need to understand why ETH deflation even happens at all and that requires an understanding of how the Ethereum network fee structure works. Network fees are split into two components. The first is a base fee that all users must pay to ensure that their transaction is accepted and processed on the blockchain.

There is then an optional tip that users can pay to have their transaction processed more quickly. The Ethereum network automatically calculates the base fee, which rises at times of heavy network traffic. Ethereum Improvement Proposal (EIP) 1559, which was implemented into the Ethereum code in the London hardfork in August 2021, requires that all of these base fees paid by users are then burned, removing the tokens from circulation permanently.

As a result, when the base gas fee rises, the rate at which Ether is burned also rises. When this burn rate exceeds the ETH Issuance Rate, which is around 0.55%, the ETH supply will decline. ETH is issued to the nodes and stakers that secure the Ethereum network.

The rate at which the Ether (ETH) supply is deflating, which has been accelerating in recent weeks, recently saw a spike higher. Ether is the cryptocurrency that powers the smart-contract-enabled Ethereum blockchain. ETH is the world’s second most valuable cryptocurrency by market capitalization and Ethereum is the dominant blockchain in Decentralized Finance.

Last Saturday, the annualized burn rate as a result of Ethereum Improvement Proposal 1559 jumped to its highest since last May at 5.679%, outstripping the Ether issuance rate of 0.578% by a whopping 5.101%. The deflation rate has since dropped to around 1.75% as of Wednesday the 15th of March.

Cryptocurrency markets saw extreme volatility last weekend and at the beginning of this week amid uncertainty relating to last week’s series of major regional US bank collapses and the policymaker response. Ether was last changing hands on exchanges in the upper-$1,600s, having hit multi-month highs above $1,700 earlier this week.

The spike in the Ether burn rate came amid a jump in the Ethereum gas price, a fee charged to users of the network, to its highest level since last May. If demand for the Ethereum network continues to rise, causing a rise in network congestion, that will cause further upside in Ethereum gas fees, which will translate to a further acceleration in the cryptocurrency’s rate of deflation. An accelerating deflation rate is likely to be a long-term tailwind for the ETH price.

Explainer – What is Driving the Accelerating ETH Deflation Rate?

Before answering the question as to what is driving the increase in the ETH deflation rate, we need to understand why ETH deflation even happens at all and that requires an understanding of how the Ethereum network fee structure works. Network fees are split into two components. The first is a base fee that all users must pay to ensure that their transaction is accepted and processed on the blockchain.

There is then an optional tip that users can pay to have their transaction processed more quickly. The Ethereum network automatically calculates the base fee, which rises at times of heavy network traffic. Ethereum Improvement Proposal (EIP) 1559, which was implemented into the Ethereum code in the London hardfork in August 2021, requires that all of these base fees paid by users are then burned, removing the tokens from circulation permanently.

As a result, when the base gas fee rises, the rate at which Ether is burned also rises. When this burn rate exceeds the ETH Issuance Rate, which is around 0.55%, the ETH supply will decline. ETH is issued to the nodes and stakers that secure the Ethereum network.