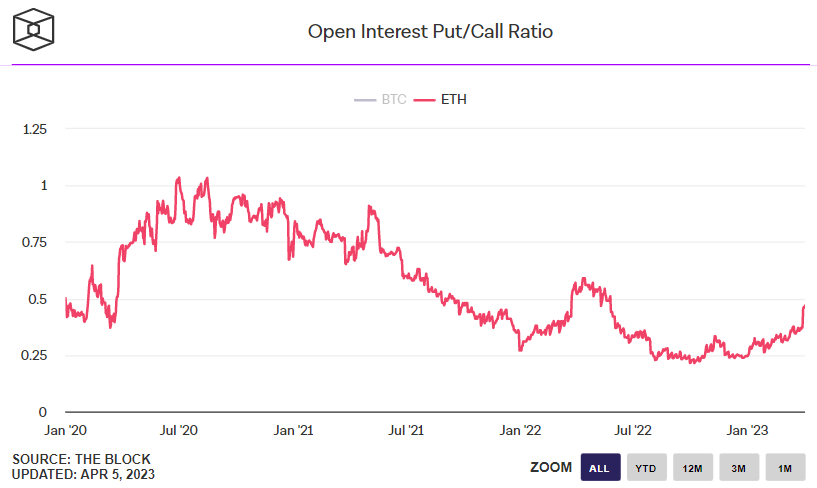

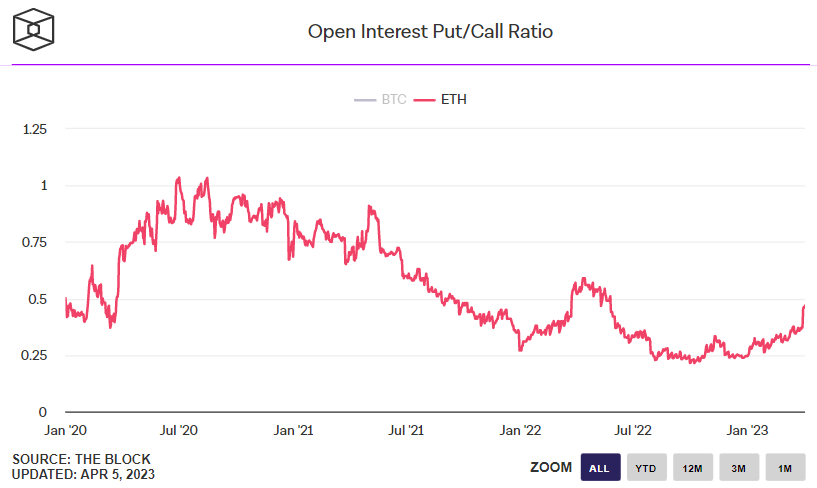

The ratio between the open interest of Ether (ETH) put and call options jumped to its highest level since last May at 0.47 on Tuesday, according to data presented by crypto data analytics and news firm The Block.

That could suggest a build-up of bearish bets in the market ahead of an upcoming series of major upgrades to the Ethereum network on the 12th of April that will, amongst other things, allow for the withdrawal of staked Ether tokens.

A ratio in open interest of put and call options below 1 means that investors favor owning call options (bets on the price rising) over put options (bets on the price dropping).

While the ratio is still well below 1, meaning investors still resoundingly favor bullish option bets, the recent rise in the ratio suggests these bullish bets have been pulled back on sharply in recent days.

Ether’s Put/Call open interest ratio has seen a rapid jump from its end-of-March levels of around 0.37.

As well as possibly reflecting bets that there will a post-upgrade sell-off, the rise in the ratio could also reflect that more traders have become interested in shorting Ether in wake of recent price gains.

ETH was last changing hands just above $1,900, having made decent progress towards $2,000 in recent days.

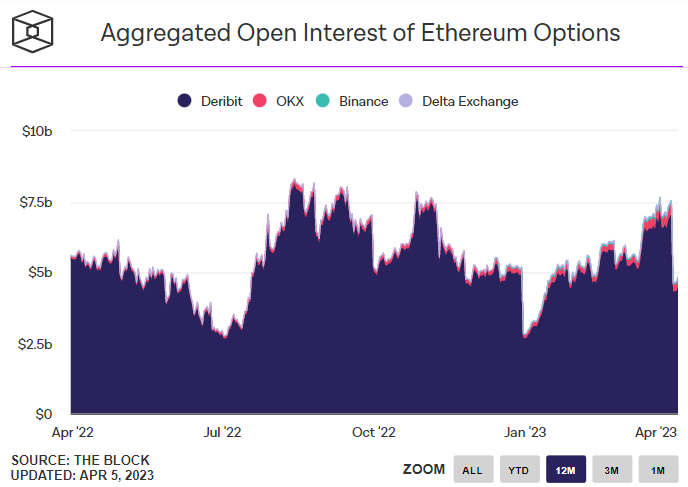

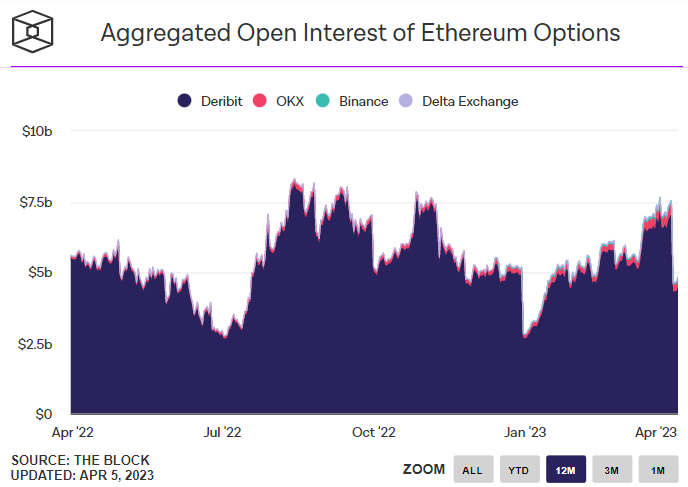

It’s worth noting that a large fall in the dollar value of aggregated Ether option open interest since the end of March might also explain the rise in Ether’s put/call ratio.

Open interest in Ether options was last just under $5.0 billion having recently been as high as $7.5 billion.

Open interest often sees a big drop at the end of each quarter as investors amid a wave of option expiries and it seems that the expiry of bullish call option bets likely dominated.

It will be interesting to see whether investors rebuild their option exposure over the coming quarter and to what degree this (if at all) pushes the put/call ratio lower again.

Staked ETH Withdrawals Are Coming – Will ETH Dump?

On the 12th of April, the Ethereum network will undergo a series of upgrades that will, first and foremost, enable the withdrawal of staked Ether tokens from the staking smart contract.

The series of upgrades has been termed “Shapella”, to represent a combination of the names Shanghai and Capella.

Shanghai refers to a hard fork taking place on the Ethereum blockchain’s execution layer, while Capella is the name for the upgrade taking place on the consensus layer.

While analysts view the development as a long-term positive for the network – it is assumed that more flexible staking withdrawals will eventually attract many more ETH owners into staking their tokens – some have warned that there could be short-term price pressures, as investors sell ETH tokens that have been stuck in staking contracts for a long time.

ETH staking has been active since late-2020 on Ethereum’s beacon chain, prior to the Ethereum blockchain’s merge to proof-of-stake last September.

Others have warned that in wake of ETH’s stunning more than 55% gains since the turn of the year, a successful Shanghai upgrade might trigger profit-taking that could cause ETH price downside in the short term.

ETH Bulls Would Likely Pounce on Any Dip

However, ETH’s short-term technicals are looking very nice right now. The cryptocurrency recently pushed to the north of a key resistance area around $1,850 and is eyeing an imminent test of the $2,000 level.

In recent weeks, the cryptocurrency has continually found good support at its 21-Day Moving Average. All of its major moving averages are all pointing higher in consecutive order, another bullish sign.

In the longer term, technicals are also positive. ETH’s 14-Day Relative Strength Index (RSI) is not yet in overbought territory, suggesting a reduced risk of near-term profit-taking.

ETH also saw a strong bounce from its 200DMA last month, a strong medium-term bullish indicator.

The “golden cross” (when the 50-Day Moving Average crosses above the 200-Day Moving Average) in early February is another good sign for ETH’s medium-term technical outlook.

Moreover, macro tailwinds, such as expectations that the Fed will be cutting interest rates later this year to stave off a bank crisis and recession, continue to offer crypto markets broad support.

In the near term, bulls will likely continue buying any Ether price dips.

A post-Shanghai upgrade sell-the-news driven dip back to the resistance-turned-support $1,700 area, which also roughly coincides with ETH’s 50-Day Moving Average, could present a nice buying opportunity.

The ratio between the open interest of Ether (ETH) put and call options jumped to its highest level since last May at 0.47 on Tuesday, according to data presented by crypto data analytics and news firm The Block.

That could suggest a build-up of bearish bets in the market ahead of an upcoming series of major upgrades to the Ethereum network on the 12th of April that will, amongst other things, allow for the withdrawal of staked Ether tokens.

A ratio in open interest of put and call options below 1 means that investors favor owning call options (bets on the price rising) over put options (bets on the price dropping).

While the ratio is still well below 1, meaning investors still resoundingly favor bullish option bets, the recent rise in the ratio suggests these bullish bets have been pulled back on sharply in recent days.

Ether’s Put/Call open interest ratio has seen a rapid jump from its end-of-March levels of around 0.37.

As well as possibly reflecting bets that there will a post-upgrade sell-off, the rise in the ratio could also reflect that more traders have become interested in shorting Ether in wake of recent price gains.

ETH was last changing hands just above $1,900, having made decent progress towards $2,000 in recent days.

It’s worth noting that a large fall in the dollar value of aggregated Ether option open interest since the end of March might also explain the rise in Ether’s put/call ratio.

Open interest in Ether options was last just under $5.0 billion having recently been as high as $7.5 billion.

Open interest often sees a big drop at the end of each quarter as investors amid a wave of option expiries and it seems that the expiry of bullish call option bets likely dominated.

It will be interesting to see whether investors rebuild their option exposure over the coming quarter and to what degree this (if at all) pushes the put/call ratio lower again.

Staked ETH Withdrawals Are Coming – Will ETH Dump?

On the 12th of April, the Ethereum network will undergo a series of upgrades that will, first and foremost, enable the withdrawal of staked Ether tokens from the staking smart contract.

The series of upgrades has been termed “Shapella”, to represent a combination of the names Shanghai and Capella.

Shanghai refers to a hard fork taking place on the Ethereum blockchain’s execution layer, while Capella is the name for the upgrade taking place on the consensus layer.

While analysts view the development as a long-term positive for the network – it is assumed that more flexible staking withdrawals will eventually attract many more ETH owners into staking their tokens – some have warned that there could be short-term price pressures, as investors sell ETH tokens that have been stuck in staking contracts for a long time.

ETH staking has been active since late-2020 on Ethereum’s beacon chain, prior to the Ethereum blockchain’s merge to proof-of-stake last September.

Others have warned that in wake of ETH’s stunning more than 55% gains since the turn of the year, a successful Shanghai upgrade might trigger profit-taking that could cause ETH price downside in the short term.

ETH Bulls Would Likely Pounce on Any Dip

However, ETH’s short-term technicals are looking very nice right now. The cryptocurrency recently pushed to the north of a key resistance area around $1,850 and is eyeing an imminent test of the $2,000 level.

In recent weeks, the cryptocurrency has continually found good support at its 21-Day Moving Average. All of its major moving averages are all pointing higher in consecutive order, another bullish sign.

In the longer term, technicals are also positive. ETH’s 14-Day Relative Strength Index (RSI) is not yet in overbought territory, suggesting a reduced risk of near-term profit-taking.

ETH also saw a strong bounce from its 200DMA last month, a strong medium-term bullish indicator.

The “golden cross” (when the 50-Day Moving Average crosses above the 200-Day Moving Average) in early February is another good sign for ETH’s medium-term technical outlook.

Moreover, macro tailwinds, such as expectations that the Fed will be cutting interest rates later this year to stave off a bank crisis and recession, continue to offer crypto markets broad support.

In the near term, bulls will likely continue buying any Ether price dips.

A post-Shanghai upgrade sell-the-news driven dip back to the resistance-turned-support $1,700 area, which also roughly coincides with ETH’s 50-Day Moving Average, could present a nice buying opportunity.