An Ethereum bot run by pseudonymous crypto user Jaredfromsubway.eth has made $40 million in just three months by using a technique known as “sandwiching” on decentralized exchanges (DEXs).

The bot operated by Jaredfromsubway.eth is a so-called MEV bot designed to use “sandwiching” techniques – essentially front-running other traders – on DEXs where popular meme coins such as Pepe Coin (PEPE) are traded.

MEV is short for maximal extractable value, and represents the maximum value validators can extract from a block on the Ethereum blockchain by reordering, inserting or censoring transactions within blocks.

According to a report by EigenPhi, a site that analyzes the decentralized finance (DeFi) market, jaredfromsubway’s bot earned a total of $40 million over the course of the 3 months through a combination of front-running and holding on to the right tokens.

When subtracting blockchain fees of approximately $6 million, the total profit comes in at $34 million.

“The bot is not limited to performing sandwich attacks; it also holds onto some of the altcoins in the back-run transactions when their prices are increasing. By holding onto PEPE, for example, the bot is able to generate even more profits,” the EigenPhi report said.

Rising transaction fees caused by bot

The bot has since its creation in February become extremely active, and transactions from the bot are now present in more than 60% of all Ethereum blocks.

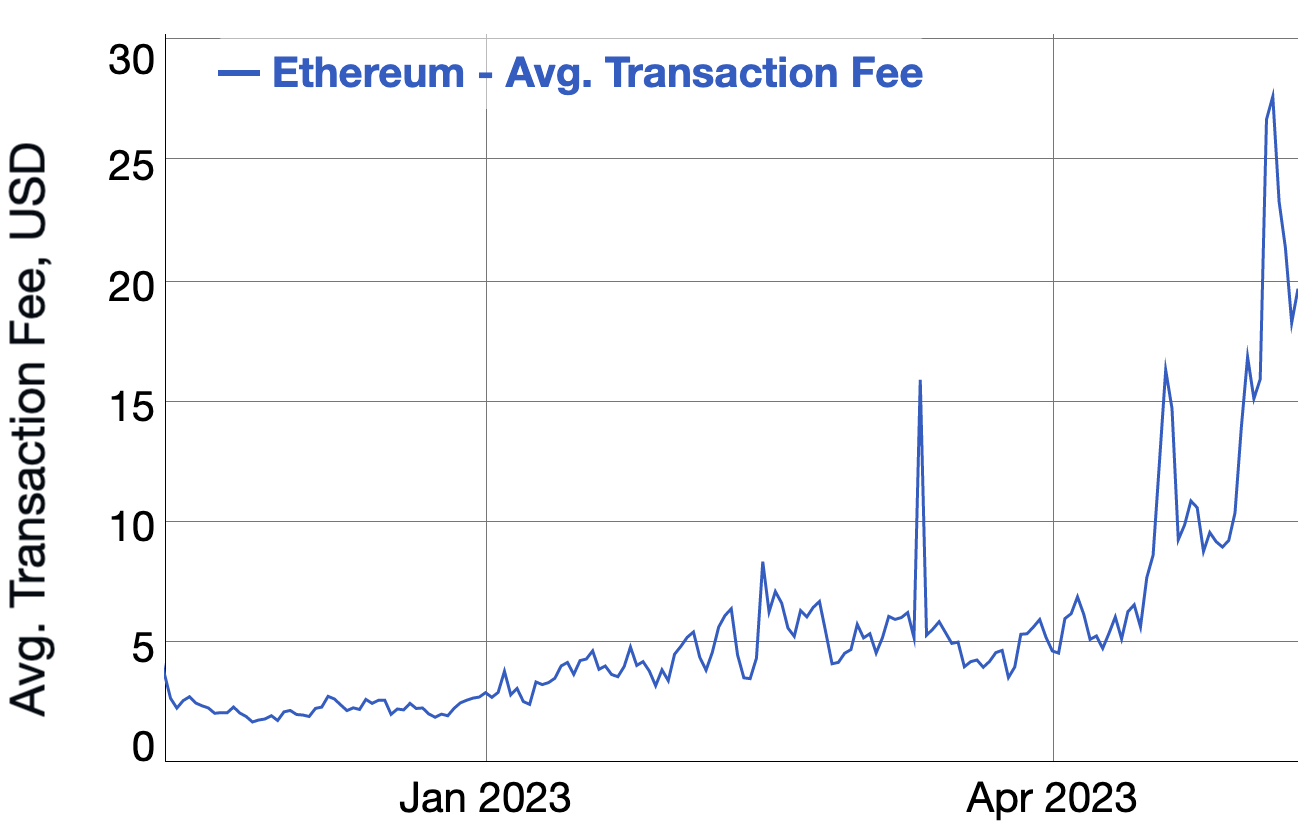

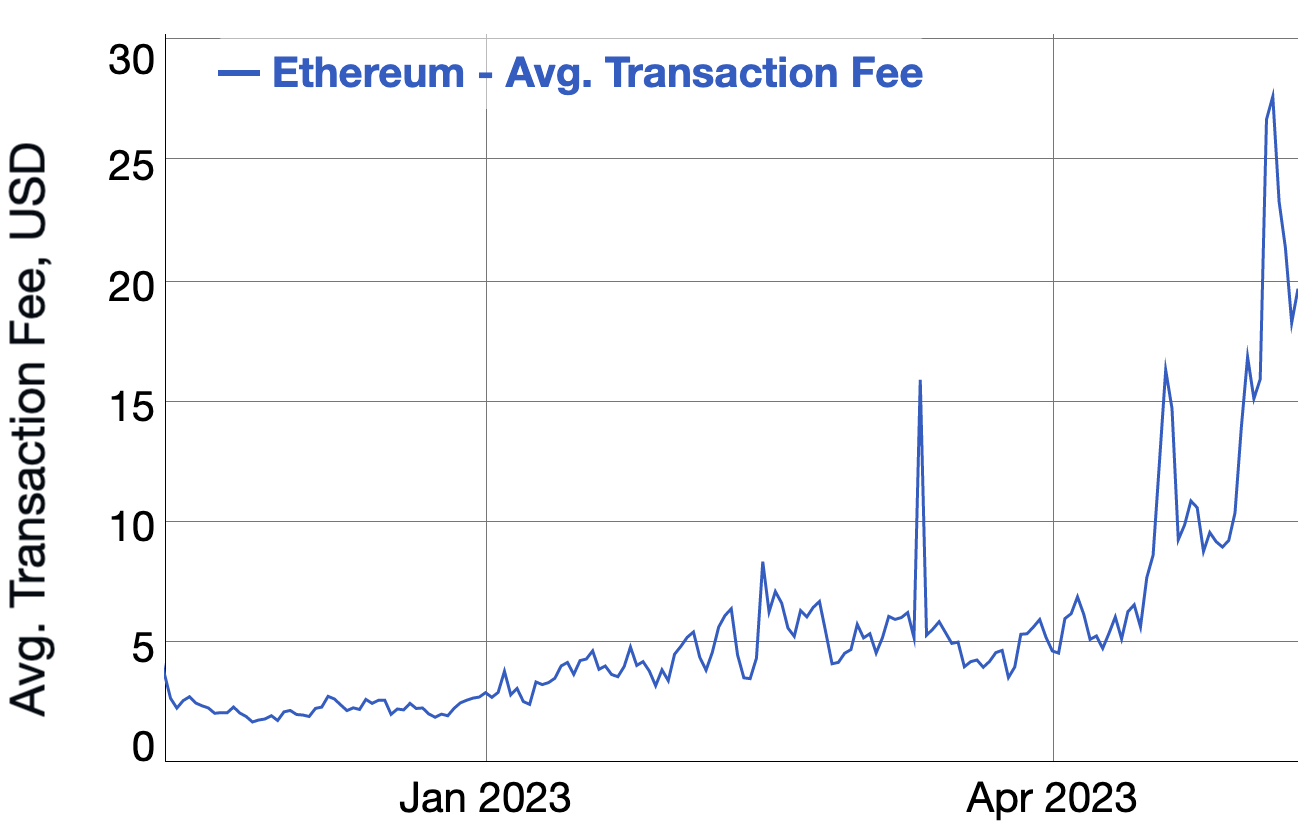

The massive number of transactions generated by the bot has also led to a noticeable uptick in transaction fees on the Ethereum network this year, with the average fee paid reaching a high above $27 last Saturday.

Success comes from “skill, strategy, and tech”

According to a pseudonymous crypto developer known as Nox, the success of these types of bots comes as a result of “skill, strategy, and tech.”

MEV bots have in the past been profitable by leveraging information about transactions that are about to be executed, often through arbitrage trading that capitalizes on price differences between decentralized exchanges.

MEV bots utilizing “sandwich” attacks basically front-run other trades, purchasing currency slightly cheaper than other traders, which results in their practices being viewed as a form of “invisible” tax on regular DEX users.

To date, 27 Ethereum-based projects have joined forces to launch MEV Blocker, aiming to minimize the value extracted from traders by MEV bots.

Last month, stablecoin issuer Tether took action and blacklisted an Ethereum validator address linked to $25 million worth of crypto drained from DEXs with MEV bots.

An Ethereum bot run by pseudonymous crypto user Jaredfromsubway.eth has made $40 million in just three months by using a technique known as “sandwiching” on decentralized exchanges (DEXs).

The bot operated by Jaredfromsubway.eth is a so-called MEV bot designed to use “sandwiching” techniques – essentially front-running other traders – on DEXs where popular meme coins such as Pepe Coin (PEPE) are traded.

MEV is short for maximal extractable value, and represents the maximum value validators can extract from a block on the Ethereum blockchain by reordering, inserting or censoring transactions within blocks.

According to a report by EigenPhi, a site that analyzes the decentralized finance (DeFi) market, jaredfromsubway’s bot earned a total of $40 million over the course of the 3 months through a combination of front-running and holding on to the right tokens.

When subtracting blockchain fees of approximately $6 million, the total profit comes in at $34 million.

“The bot is not limited to performing sandwich attacks; it also holds onto some of the altcoins in the back-run transactions when their prices are increasing. By holding onto PEPE, for example, the bot is able to generate even more profits,” the EigenPhi report said.

Rising transaction fees caused by bot

The bot has since its creation in February become extremely active, and transactions from the bot are now present in more than 60% of all Ethereum blocks.

The massive number of transactions generated by the bot has also led to a noticeable uptick in transaction fees on the Ethereum network this year, with the average fee paid reaching a high above $27 last Saturday.

Success comes from “skill, strategy, and tech”

According to a pseudonymous crypto developer known as Nox, the success of these types of bots comes as a result of “skill, strategy, and tech.”

MEV bots have in the past been profitable by leveraging information about transactions that are about to be executed, often through arbitrage trading that capitalizes on price differences between decentralized exchanges.

MEV bots utilizing “sandwich” attacks basically front-run other trades, purchasing currency slightly cheaper than other traders, which results in their practices being viewed as a form of “invisible” tax on regular DEX users.

To date, 27 Ethereum-based projects have joined forces to launch MEV Blocker, aiming to minimize the value extracted from traders by MEV bots.

Last month, stablecoin issuer Tether took action and blacklisted an Ethereum validator address linked to $25 million worth of crypto drained from DEXs with MEV bots.