The exchange rate between Bitcoin (BTC), the world’s first and largest cryptocurrency by market capitalization, and Ether (ETH), the world’s second-largest cryptocurrency by market capitalization that powers the Ethereum blockchain, has fallen rapidly in recent weeks.

ETH/BTC was last changing hands on Binance (as per TradingView) around 0.0625, down around 15% from earlier monthly highs in the 0.0735 area and at its lowest level since July 2022.

ETH/BTC’s downside isn’t a result of Ether performing poorly. On the contrary, at current levels in the $1,750s, Ether is up just shy of 10% this month and is up over 27% versus earlier monthly lows under $1,400.

The problem for Ether is that it, like most other cryptocurrencies, hasn’t been able to keep pace with Bitcoin. Bitcoin has been leading a charge higher in cryptocurrency markets amid what analysts have referred to as a “safe haven” bid as cracks form in the global banking system.

Financial Stability Concerns Disproportionately Benefit Bitcoin

After three major regional US banks went under earlier this month, Credit Suisse was bought out by Swiss rival UBS over the weekend. Meanwhile, a consortium of US banks came together last week to provide a $30 billion bailout for US bank First Republic.

Despite efforts from authorities to calm the situation, investors remain on edge that more banks, in the US and elsewhere, might be about to go under. And while this is hampering sentiment in US stock markets, it is helping safe haven assets like gold, and also appears to be helping cryptocurrencies like Bitcoin.

Gold formed the bedrock of most civilizations’ financial systems for thousands of years, hence when troubles in the fiat-based, central bank-centered fractional reserve banking system surface, many investors like to flock back to gold, which many view as the ultimate haven.

But Bitcoin, which many refer to as “digital gold”, is increasingly viewed as a safe haven. After all, it is a highly robust, highly decentralized payment system that operates entirely separately from the traditional financial system.

Ether can also make the claim to be robust, decentralized, and independent of the traditional financial system. Indeed, given its smart programmability, it arguably goes beyond Bitcoin in that an independent decentralized finance ecosystem can be built directly on top of its blockchain (and already is being built).

But Ether is only about half the age of Bitcoin. In the eyes of many investors, Bitcoin has more trust, particularly given that its future prospects don’t depend on the efforts of programmers (like the Ethereum Foundation who are still working to upgrade the Ethereum blockchain). Bitcoin is expected to remain pretty much exactly how it is right now, more or less like gold.

Even though the Fed’s rate hiking cycle might not yet be over (they could hike rates by 25 bps this week), markets are already placing bets on the cutting cycle, with many expecting it to come soon amid turbulence in the banking sector. Easing financial conditions could well help lift cryptocurrencies broadly (including Ether), though Bitcoin is likely to maintain its lead on the added safe-haven bid.

On-chain Trends Favor Further ETH/BTC Downside

Just as investors increasingly turn to Bitcoin as a safe haven, various core on-chain activity metrics are trending higher, showing a growing demand for network utilization. On many of the same metrics, the Ethereum blockchain is showing no such pick-up in activity.

While this probably won’t outright prevent Ether from continuing to rally (not if the broader crypto market keeps pumping), it may make it difficult for ETH to keep up with Bitcoin, meaning potential further downside for the ETH/BTC exchange rate.

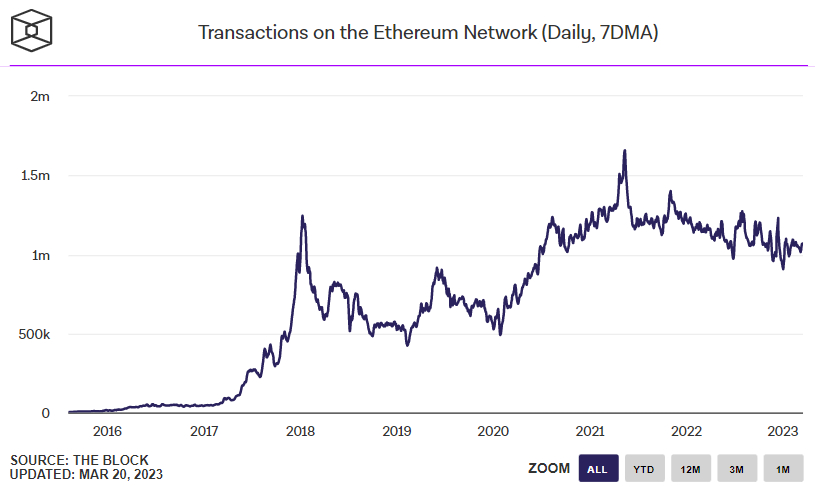

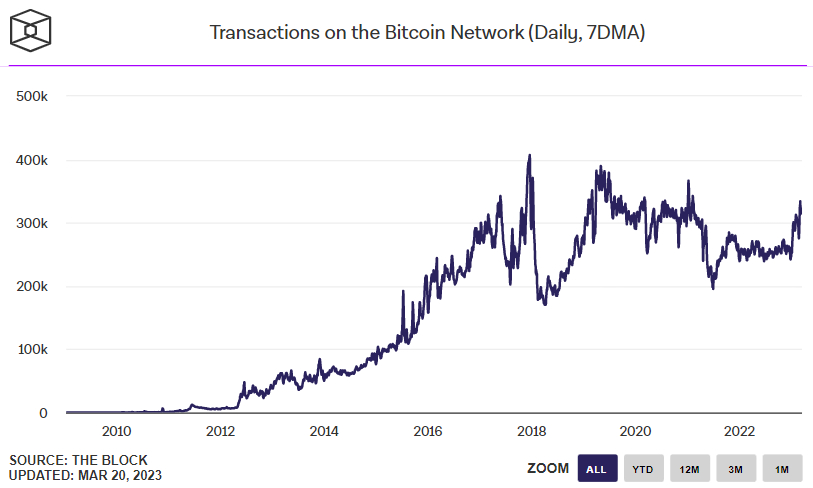

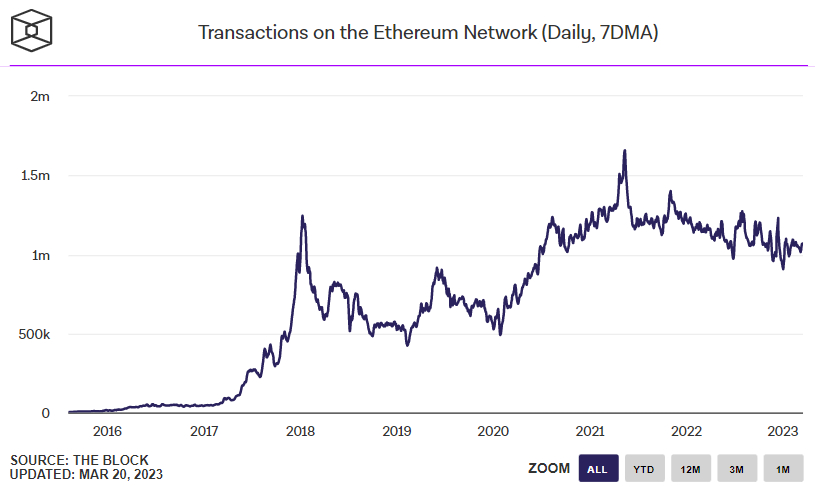

The first metric of note is the number of transactions taking place on a daily basis. As can be seen in the below graphs presented by The Block, this metric recently hit its highest level since early 2021 for the Bitcoin network, but remains subdued and within recent levels for the Ethereum network.

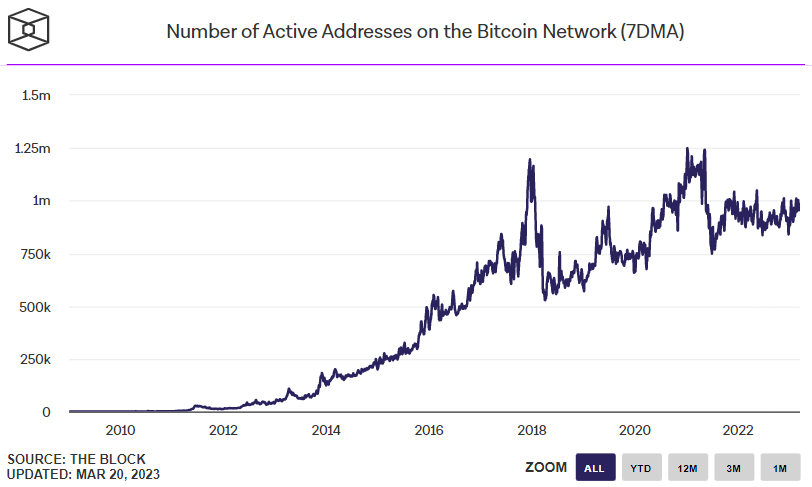

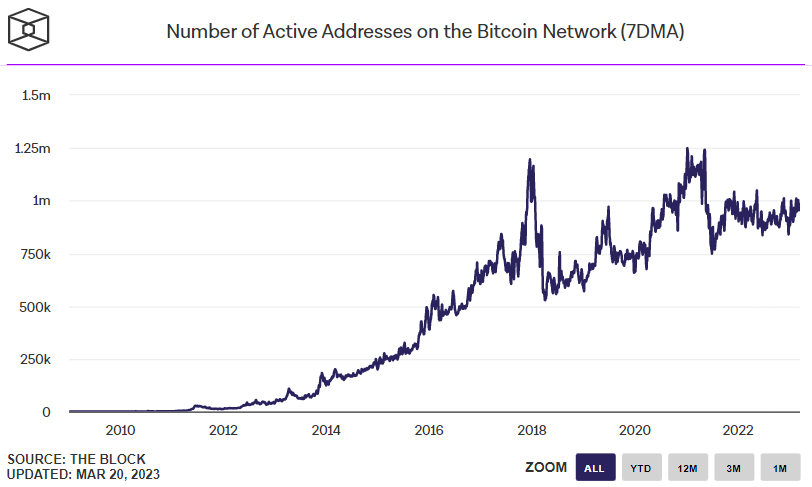

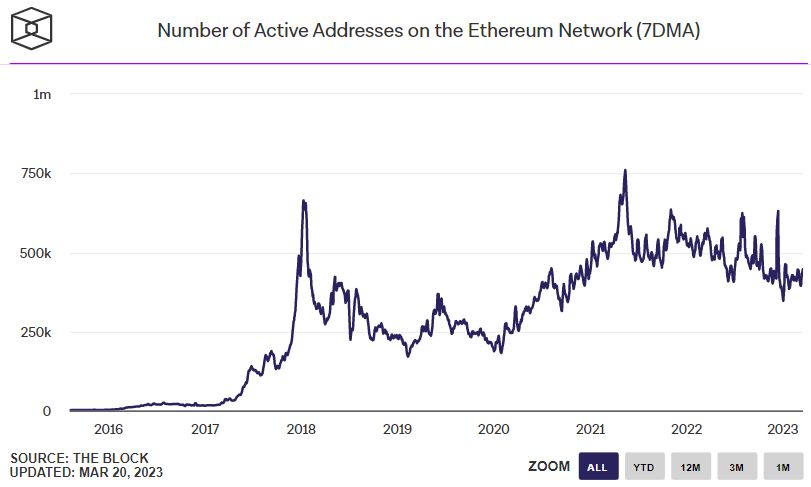

Meanwhile, though the rise in the number of active addresses on the Bitcoin network in recent weeks hasn’t been quite as impressive, the metric is still close to multi-month highs. The same cannot be said for the number of active addresses on the Ethereum network.

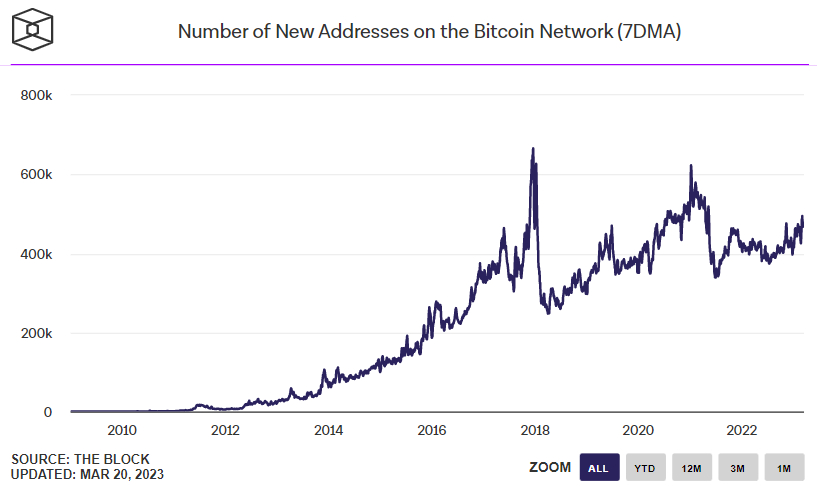

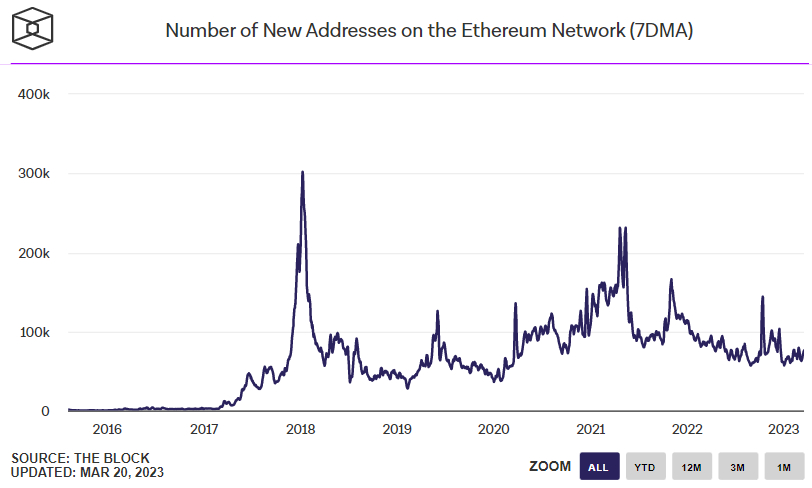

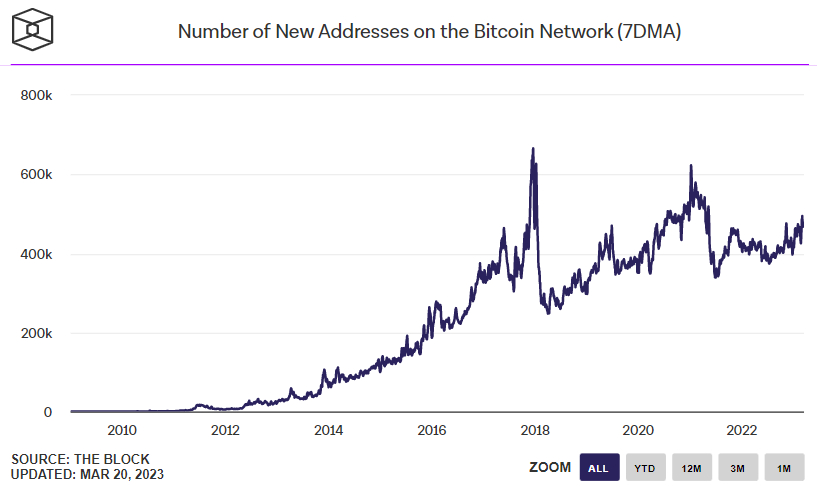

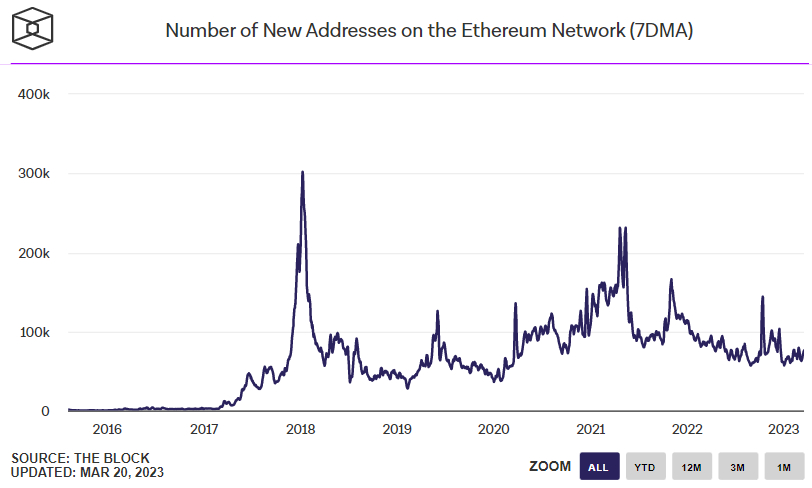

Elsewhere, the rate at which new addresses are interacting with the Bitcoin network for the first time has also been trending higher. The same cannot be said for the Ethereum network, with new addresses remaining close to multi-year lows.

The exchange rate between Bitcoin (BTC), the world’s first and largest cryptocurrency by market capitalization, and Ether (ETH), the world’s second-largest cryptocurrency by market capitalization that powers the Ethereum blockchain, has fallen rapidly in recent weeks.

ETH/BTC was last changing hands on Binance (as per TradingView) around 0.0625, down around 15% from earlier monthly highs in the 0.0735 area and at its lowest level since July 2022.

ETH/BTC’s downside isn’t a result of Ether performing poorly. On the contrary, at current levels in the $1,750s, Ether is up just shy of 10% this month and is up over 27% versus earlier monthly lows under $1,400.

The problem for Ether is that it, like most other cryptocurrencies, hasn’t been able to keep pace with Bitcoin. Bitcoin has been leading a charge higher in cryptocurrency markets amid what analysts have referred to as a “safe haven” bid as cracks form in the global banking system.

Financial Stability Concerns Disproportionately Benefit Bitcoin

After three major regional US banks went under earlier this month, Credit Suisse was bought out by Swiss rival UBS over the weekend. Meanwhile, a consortium of US banks came together last week to provide a $30 billion bailout for US bank First Republic.

Despite efforts from authorities to calm the situation, investors remain on edge that more banks, in the US and elsewhere, might be about to go under. And while this is hampering sentiment in US stock markets, it is helping safe haven assets like gold, and also appears to be helping cryptocurrencies like Bitcoin.

Gold formed the bedrock of most civilizations’ financial systems for thousands of years, hence when troubles in the fiat-based, central bank-centered fractional reserve banking system surface, many investors like to flock back to gold, which many view as the ultimate haven.

But Bitcoin, which many refer to as “digital gold”, is increasingly viewed as a safe haven. After all, it is a highly robust, highly decentralized payment system that operates entirely separately from the traditional financial system.

Ether can also make the claim to be robust, decentralized, and independent of the traditional financial system. Indeed, given its smart programmability, it arguably goes beyond Bitcoin in that an independent decentralized finance ecosystem can be built directly on top of its blockchain (and already is being built).

But Ether is only about half the age of Bitcoin. In the eyes of many investors, Bitcoin has more trust, particularly given that its future prospects don’t depend on the efforts of programmers (like the Ethereum Foundation who are still working to upgrade the Ethereum blockchain). Bitcoin is expected to remain pretty much exactly how it is right now, more or less like gold.

Even though the Fed’s rate hiking cycle might not yet be over (they could hike rates by 25 bps this week), markets are already placing bets on the cutting cycle, with many expecting it to come soon amid turbulence in the banking sector. Easing financial conditions could well help lift cryptocurrencies broadly (including Ether), though Bitcoin is likely to maintain its lead on the added safe-haven bid.

On-chain Trends Favor Further ETH/BTC Downside

Just as investors increasingly turn to Bitcoin as a safe haven, various core on-chain activity metrics are trending higher, showing a growing demand for network utilization. On many of the same metrics, the Ethereum blockchain is showing no such pick-up in activity.

While this probably won’t outright prevent Ether from continuing to rally (not if the broader crypto market keeps pumping), it may make it difficult for ETH to keep up with Bitcoin, meaning potential further downside for the ETH/BTC exchange rate.

The first metric of note is the number of transactions taking place on a daily basis. As can be seen in the below graphs presented by The Block, this metric recently hit its highest level since early 2021 for the Bitcoin network, but remains subdued and within recent levels for the Ethereum network.

Meanwhile, though the rise in the number of active addresses on the Bitcoin network in recent weeks hasn’t been quite as impressive, the metric is still close to multi-month highs. The same cannot be said for the number of active addresses on the Ethereum network.

Elsewhere, the rate at which new addresses are interacting with the Bitcoin network for the first time has also been trending higher. The same cannot be said for the Ethereum network, with new addresses remaining close to multi-year lows.