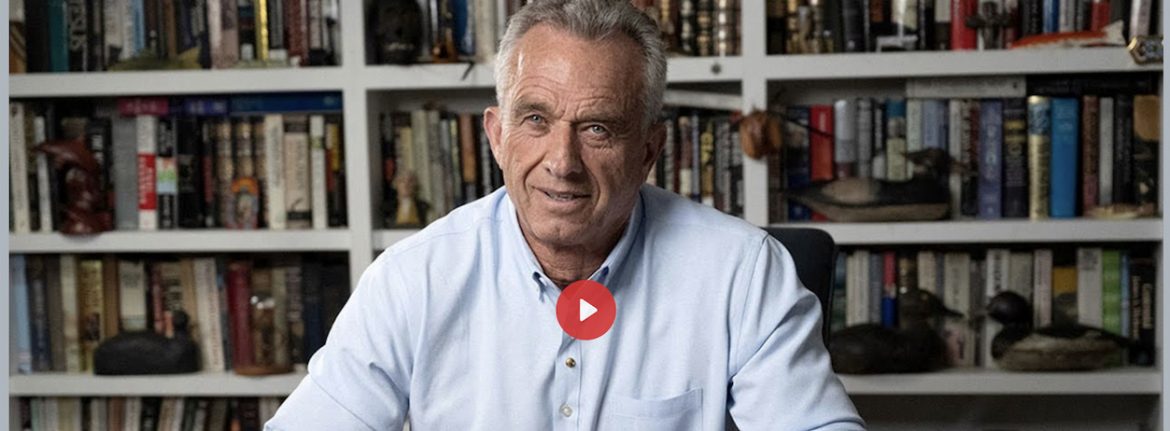

Democratic presidential candidate Robert F. Kennedy Jr. has taken to Twitter over the past day or so to air his thoughts about cryptocurrency regulation.

Kennedy most recently criticized the Biden Administration’s renewed call to propose a 30 percent tax on crypto-mining, calling it a “bad idea.”

“Cryptocurrencies, led by bitcoin, along with other crypto technologies are a major innovation engine,” Kennedy tweeted on Wednesday afternoon. “It is a mistake for the U.S. government to hobble the industry and drive innovation elsewhere. Biden’s proposed 30% tax on cryptocurrency mining is a bad idea.”

Kennedy is the nephew of former President John F. Kennedy and the son of Robert F. Kennedy.

The White House’s Council of Economic Advisers published a blog post on Tuesday calling for what is dubbed the Digital Asset Mining Energy excise tax, or DAME.

Under that proposal, firms would contend with a tax equal to 30 percent of the cost of the electricity used.

The tax would be implemented next year and phased in gradually over a period of three years at a rate of 10 percent a year to then reach the target 30% rate by the end of 2026, according to previous cryptonews reporting.

Electricity used in crypto-mining was similar to what is used to power all of the country’s home computers or residential lighting, the council argued in the post.

Kennedy compares crypto to video games

Kennedy said energy use is a concern, but argued that mining uses the same amount as video games and that “no one is calling for a ban on those.”

“The environmental argument is a selective pretext to suppress anything that threatens elite power structures,” Kennedy said in the tweet thread.

On Tuesday, Kennedy separately tweeted out a blog post that made the case that the Federal Deposit Insurance Corporation and Securities and Exchange Commission’s “war on crypto caused the failures” of Silicon Valley Bank, Signature Bank and Silvergate Bank.

The tech-focused banks began to collapse back in March.

Democratic presidential candidate Robert F. Kennedy Jr. has taken to Twitter over the past day or so to air his thoughts about cryptocurrency regulation.

Kennedy most recently criticized the Biden Administration’s renewed call to propose a 30 percent tax on crypto-mining, calling it a “bad idea.”

“Cryptocurrencies, led by bitcoin, along with other crypto technologies are a major innovation engine,” Kennedy tweeted on Wednesday afternoon. “It is a mistake for the U.S. government to hobble the industry and drive innovation elsewhere. Biden’s proposed 30% tax on cryptocurrency mining is a bad idea.”

Kennedy is the nephew of former President John F. Kennedy and the son of Robert F. Kennedy.

The White House’s Council of Economic Advisers published a blog post on Tuesday calling for what is dubbed the Digital Asset Mining Energy excise tax, or DAME.

Under that proposal, firms would contend with a tax equal to 30 percent of the cost of the electricity used.

The tax would be implemented next year and phased in gradually over a period of three years at a rate of 10 percent a year to then reach the target 30% rate by the end of 2026, according to previous cryptonews reporting.

Electricity used in crypto-mining was similar to what is used to power all of the country’s home computers or residential lighting, the council argued in the post.

Kennedy compares crypto to video games

Kennedy said energy use is a concern, but argued that mining uses the same amount as video games and that “no one is calling for a ban on those.”

“The environmental argument is a selective pretext to suppress anything that threatens elite power structures,” Kennedy said in the tweet thread.

On Tuesday, Kennedy separately tweeted out a blog post that made the case that the Federal Deposit Insurance Corporation and Securities and Exchange Commission’s “war on crypto caused the failures” of Silicon Valley Bank, Signature Bank and Silvergate Bank.

The tech-focused banks began to collapse back in March.