Since the implementation of the Shanghai upgrade to the Ethereum mainnet just over one month ago, which allowed Ethereum validators to withdraw all or some of their staked Ether (ETH) tokens from the staking smart contract for the first time, demand for ETH staking has soared.

According to wenmerge.com, the waiting period for an ETH owner to enter the Ethereum network as a new validator has surged to 27 days and 7 hours, with 50,398 prospective validators current in the queue.

Ether owners can set up as network validators and earn a yield of around 4-5% annually via token staking.

ETH staking has been available on the Beacon chain since December 2020, but staking withdrawals were only enabled at last month’s upgrade.

The addition of withdrawal flexibility to ETH staking reduces its risk in the eyes of many investors, who may have been deterred from staking their ETH tokens prior to the implementation of withdrawals for fear their funds would be locked up for a prohibitively long period of time.

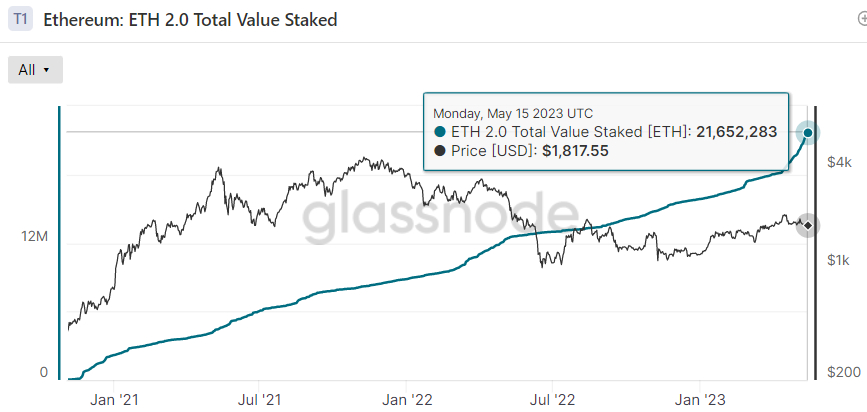

The surge in the number of validators queueing up to join the network comes hand in hand with a surge in the number of ETH tokens being entered into the staking smart contract.

As of Monday, the number of staked ETH tokens had hit 21.652 million, up around 3.5 million in the one month since the Shanghai upgrade, as per Glassnode data.

Given the total supply of ETH tokens was last around 120.08 million, that means the staking participation rate is now just over 18%.

That’s up from around 15% prior to the upgrade, when the number of staked ETH tokens was around 18.1 million and the total ETH token supply was around 120.4 million.

Dual Deflationary Trends Set to Provide Major ETH Price Tailwind

Competitor proof-of-stake chains with flexible staking contract withdrawals like Cardano have staking participation rates in the 60-70% range.

While only just over 50,000 ETH are allowed to be withdrawn from the staking contract each day, Ether staking isn’t completely flexible and thus might not be able to achieve a staking participation rate of quite this high.

Bet let’s say the Ether staking participation rate hits 50% – which might take less than a year given that the participation rate is currently rising by around 3% per month.

That would mean a further 38.4 million ETH tokens moving into the less liquid ETH staking contract.

Unstaked ETH token will all of a sudden become a lot scarcer, which should be a tailwind for the price.

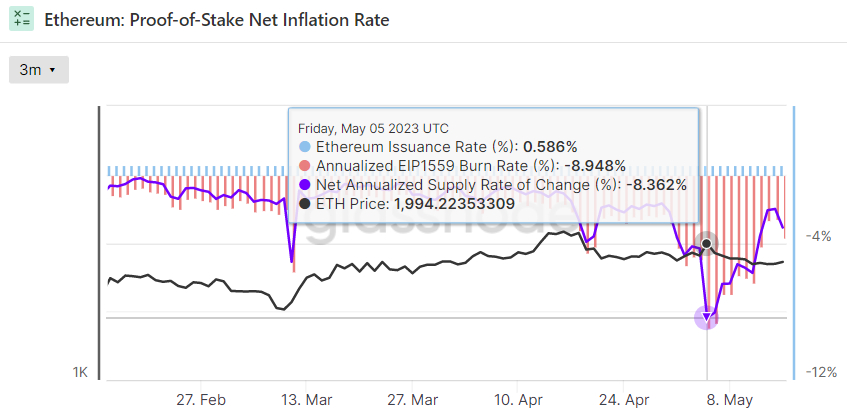

Now factor in the fact that the Ether supply is also rapidly deflating.

According to Glassnode data, the recent spike in transaction fees as a result of meme coin-related network congestion resulted in a spike in the ETH burn rate (essentially, the Ethereum network burns all ETH tokens that are used to pay transaction fees, as per EIP1559 from back in August 2021) saw Ether’s deflation rate surge above 8% earlier this month.

Supply deflation should act as another major long-term tailwind for the ETH price.

Since the implementation of the Shanghai upgrade to the Ethereum mainnet just over one month ago, which allowed Ethereum validators to withdraw all or some of their staked Ether (ETH) tokens from the staking smart contract for the first time, demand for ETH staking has soared.

According to wenmerge.com, the waiting period for an ETH owner to enter the Ethereum network as a new validator has surged to 27 days and 7 hours, with 50,398 prospective validators current in the queue.

Ether owners can set up as network validators and earn a yield of around 4-5% annually via token staking.

ETH staking has been available on the Beacon chain since December 2020, but staking withdrawals were only enabled at last month’s upgrade.

The addition of withdrawal flexibility to ETH staking reduces its risk in the eyes of many investors, who may have been deterred from staking their ETH tokens prior to the implementation of withdrawals for fear their funds would be locked up for a prohibitively long period of time.

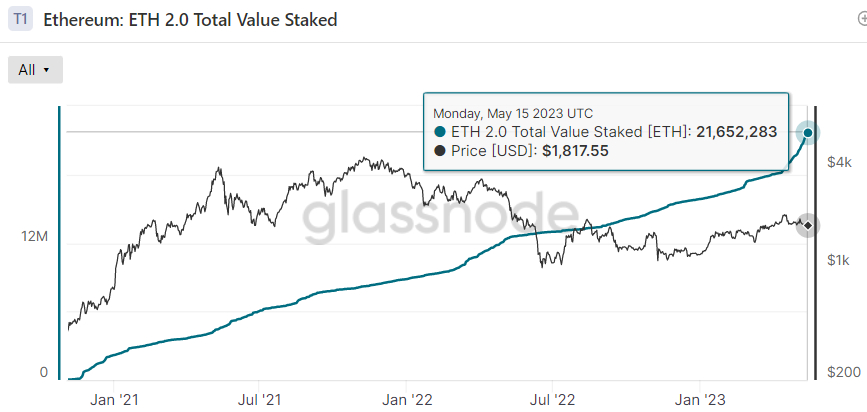

The surge in the number of validators queueing up to join the network comes hand in hand with a surge in the number of ETH tokens being entered into the staking smart contract.

As of Monday, the number of staked ETH tokens had hit 21.652 million, up around 3.5 million in the one month since the Shanghai upgrade, as per Glassnode data.

Given the total supply of ETH tokens was last around 120.08 million, that means the staking participation rate is now just over 18%.

That’s up from around 15% prior to the upgrade, when the number of staked ETH tokens was around 18.1 million and the total ETH token supply was around 120.4 million.

Dual Deflationary Trends Set to Provide Major ETH Price Tailwind

Competitor proof-of-stake chains with flexible staking contract withdrawals like Cardano have staking participation rates in the 60-70% range.

While only just over 50,000 ETH are allowed to be withdrawn from the staking contract each day, Ether staking isn’t completely flexible and thus might not be able to achieve a staking participation rate of quite this high.

Bet let’s say the Ether staking participation rate hits 50% – which might take less than a year given that the participation rate is currently rising by around 3% per month.

That would mean a further 38.4 million ETH tokens moving into the less liquid ETH staking contract.

Unstaked ETH token will all of a sudden become a lot scarcer, which should be a tailwind for the price.

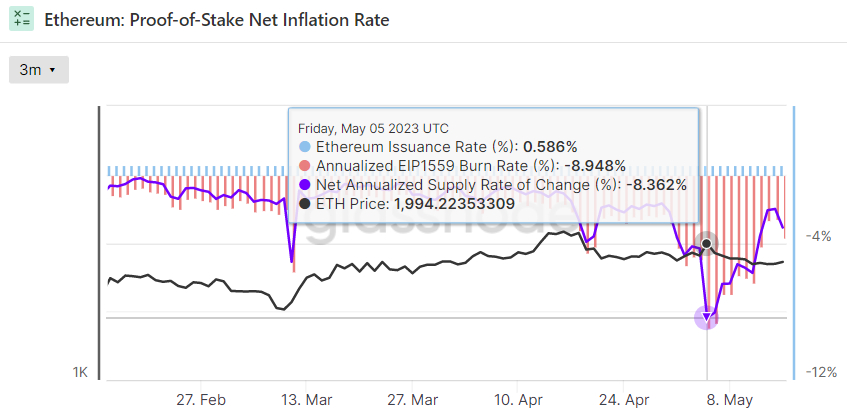

Now factor in the fact that the Ether supply is also rapidly deflating.

According to Glassnode data, the recent spike in transaction fees as a result of meme coin-related network congestion resulted in a spike in the ETH burn rate (essentially, the Ethereum network burns all ETH tokens that are used to pay transaction fees, as per EIP1559 from back in August 2021) saw Ether’s deflation rate surge above 8% earlier this month.

Supply deflation should act as another major long-term tailwind for the ETH price.