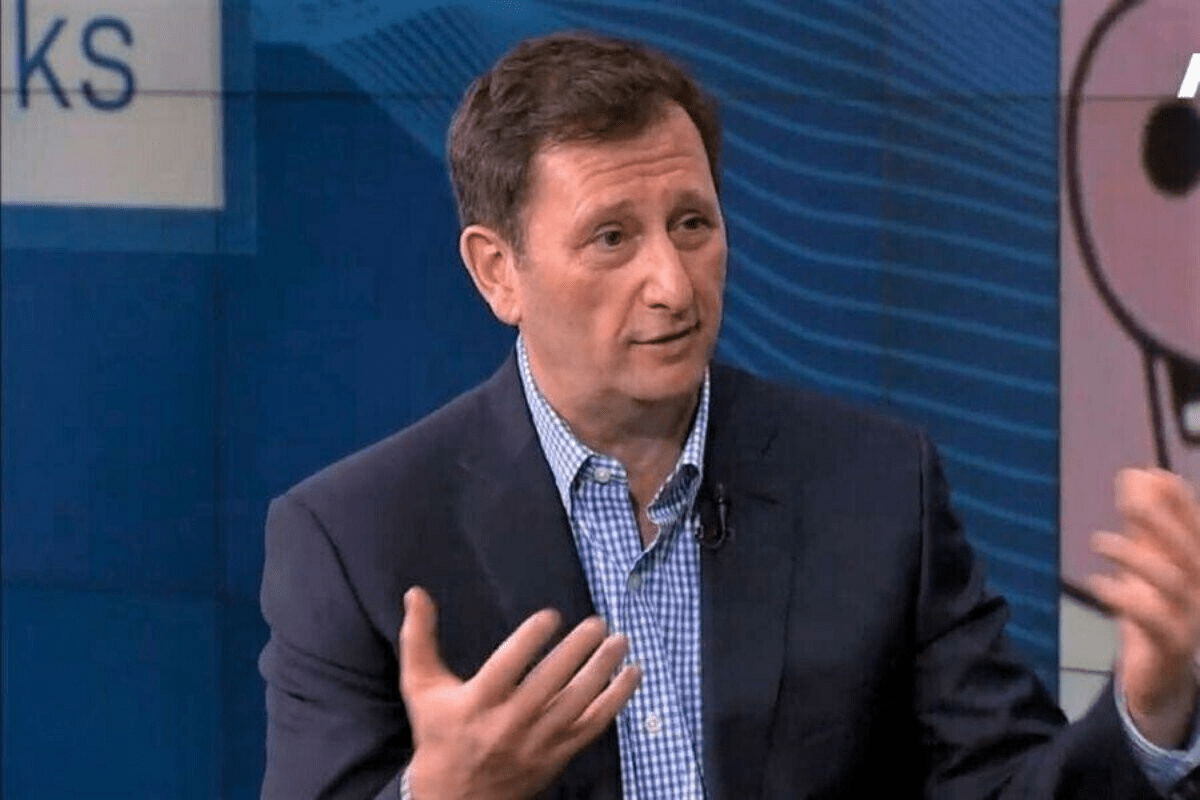

The former CEO of the Celsius Network, Alex Mashinsky, has filed a motion requesting the dismissal of charges related to commodities fraud and market manipulation. This request was made through his legal team.

Giving reasons for this request, Mashinsky noted in the January 12 filing to the court that the commodities fraud charges were “repugnant” and inconsistent with the unclear position the US government has taken on whether crypto assets should be classified as securities or commodities.

According to him, it is unclear if the US government wants to debate whether the defunct Celsius’ Earn program constituted the purchase of a security and the sale of a commodity simultaneously.

Given the dual position, which could result in a longer legal journey, the legal team insisted that the commodities fraud charges should be dismissed.

Furthermore, Mashinsky’s representatives argued that the court should strike out count six involving market manipulation due to the US government’s lack of a “fair notice,” as the prosecuting team was accused of creating a criminal offense for a civil violation.

The defense team also requested that all mentions of Celsius’ bankruptcy proceedings should be struck off the court’s records.

The former boss of the popular “unbank yourself” blockchain protocol is scheduled for a trial come September 2024.

Mashinsky is also charged by several US authorities, including the Commodity Futures Trading Commission (CFTC), the Federal Trade Commission (FTC), the New York Department of Justice (NYDOJ), and a civil class-action lawsuit initiated by millions of former disgruntled customers.

Alex Mashinsky’s crimes are catching up to him. To keep you caught up, here’s a compilation of the key docket listings for each of his trials:

Ongoing:

DOJ: https://t.co/Z0jC1Rwo85 (starts 9/24)

FTC: https://t.co/4kEmjuaiC5 (stayed by DOJ)

CFTC: https://t.co/EMMO5ETTkj (stayed by… pic.twitter.com/EYQkd4Go2p— Hellsius Network🛡️🎥 (@HellsiusNetwork) January 14, 2024

Meanwhile, the US Securities and Exchange Commission (SEC), led by Gary Gensler, has since concluded its case against the former CEO.

In its final judgment on the case by the US District Court of the Southern District of New York, Mashinsky was duly banned from participating in any dubious business and the sale of any financial instrument deemed to be a security in the future.

Mashinsky Joins a Long List of Crypto Fails

The Celsius Network played a crucial role in the onboarding of several investors into the nascent industry.

However, the 2022 market downturn saw its business tumbling down due to over-exposure to risky financial instruments like the UST stablecoin. In that same year, the DeFi protocol filed for a bankruptcy claim, following in the footsteps of the FTX exchange.

However, Mashinsky has not been the only one impacted by the inglorious phase of the crypto market. Binance’s founder and former CEO, Changpeng Zhao (CZ), has also seen himself stripped of his powers by US authorities.

After an extensive multi-year investigation, the world’s largest crypto exchange was found to have violated anti-money laundering (AML) and counter-terrorism financing (CFT) laws and Bank Secrecy Acts by US authorities, leading to a substantial penalty of $4.3 billion in fees.

– CZ to step down as CEO of Binance as part of plea deal for violating anti money laundering rules

– CZ will maintain his majority ownership of firm (similar to Arthur Hayes’s arrangement with US authorities when he made a deal)

– Binance to pay $4 billion settlement to DOJ;…

— Frank Chaparro (@fintechfrank) November 21, 2023

As part of the deal, CZ was asked to step down from his role as the CEO and is facing separate charges for fraud and money laundering.

The Chinese national is expected to face trial in February 2024 with an anticipated jail term of 18 months.