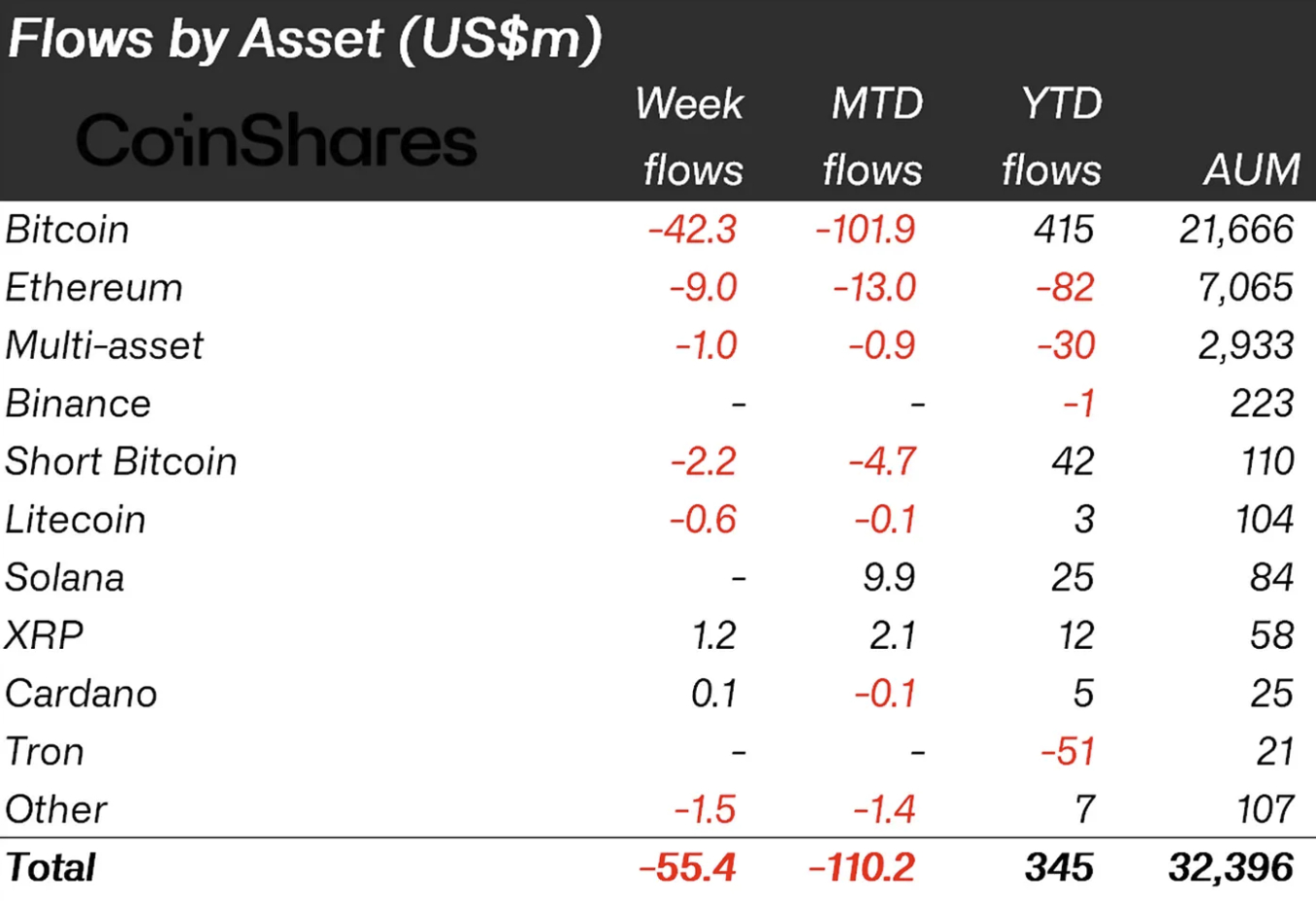

Investors in crypto-backed investment funds have pulled out some $55 million from the market as worries have grown that the US Securities and Exchange Commission (SEC) may not be ready to approve a spot Bitcoin exchange-traded fund (ETF).

Looking at Bitcoin-backed funds only, the outflows for last week came in at $42 million, marking a reversal of the $27 million of inflows seen the week before, the latest Digital Asset Fund Flows report from crypto research and investment firm CoinShares said.

At the same time, short-Bitcoin funds – funds that rise in value as Bitcoin’s price falls – saw outflows of $2.2 million for the week.

The outflows for short-Bitcoin funds marked the 17th consecutive week of outflows for the bearish fund category.

The other fund category with significant changes for the week was Ethereum-backed funds, which saw outflows of $9 million.

Interestingly, funds backed by crypto exchange Binance’s BNB token saw neither inflows nor outflows for the week, despite plenty of negative news surrounding the exchange and a weekly fall of about 10% in the BNB price.

Other altcoin funds saw only minor changes compared to the week before.

Commenting on the flows, CoinShares wrote in the report that it likely has to do with media reports about reluctance from the SEC to approve a spot Bitcoin ETF in the US.

Based on the media report, CoinShares said the prevailing narrative now is that an SEC decision on a spot ETF is “not imminent.”

This narrative, combined with crypto trading volumes that remain “well below average,” and a panic in the markets last week, has led to a worsening sentiment among investors, the CoinShares report said.

It added that outflows have been seen across most of the fund providers, although they were regionally focused mainly on Canada and Germany.

Switzerland and Australia were the two only countries that bucked the trend for the week, seeing inflows of $3.5 million and $0.1 million, respectively.

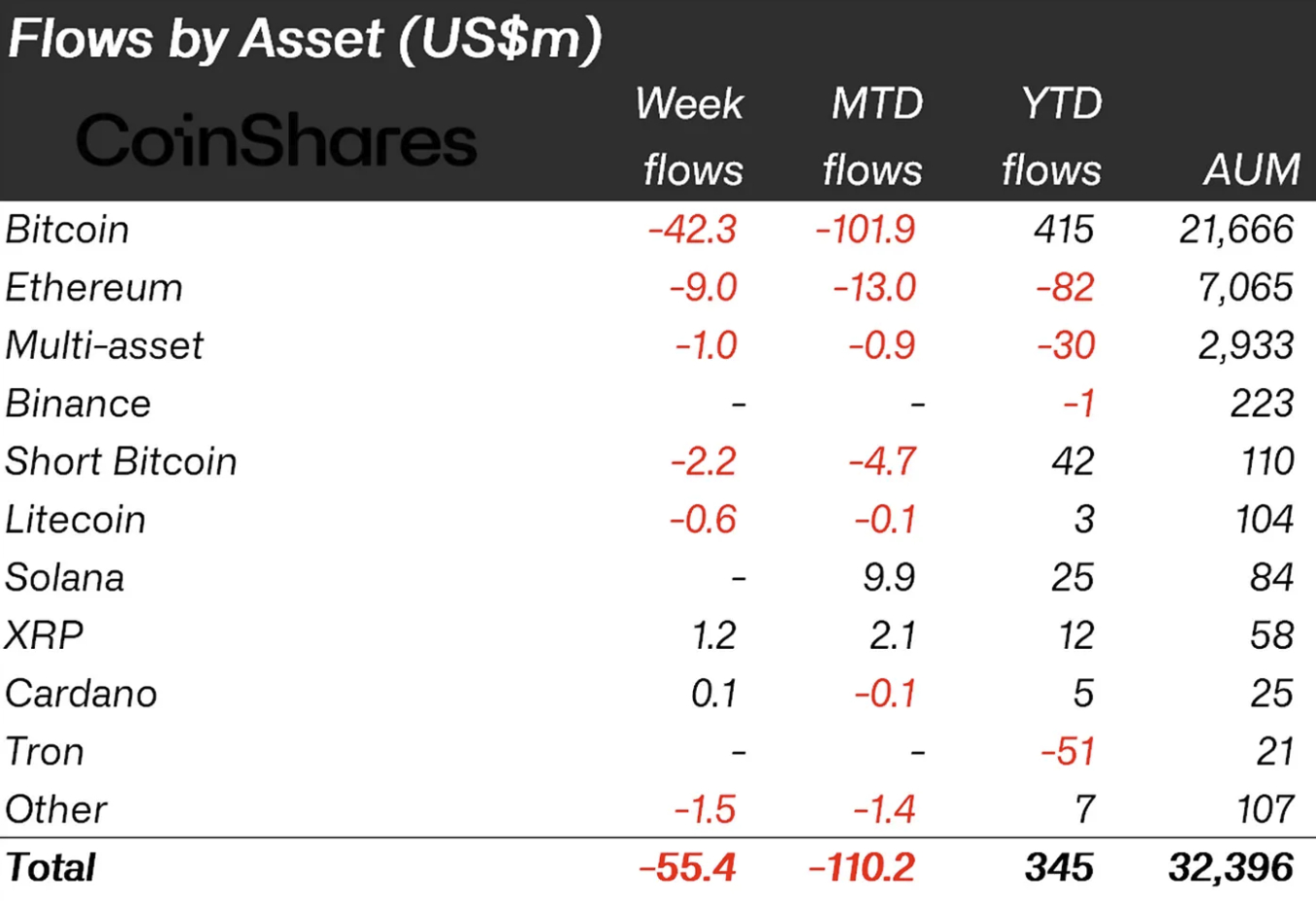

Investors in crypto-backed investment funds have pulled out some $55 million from the market as worries have grown that the US Securities and Exchange Commission (SEC) may not be ready to approve a spot Bitcoin exchange-traded fund (ETF).

Looking at Bitcoin-backed funds only, the outflows for last week came in at $42 million, marking a reversal of the $27 million of inflows seen the week before, the latest Digital Asset Fund Flows report from crypto research and investment firm CoinShares said.

At the same time, short-Bitcoin funds – funds that rise in value as Bitcoin’s price falls – saw outflows of $2.2 million for the week.

The outflows for short-Bitcoin funds marked the 17th consecutive week of outflows for the bearish fund category.

The other fund category with significant changes for the week was Ethereum-backed funds, which saw outflows of $9 million.

Interestingly, funds backed by crypto exchange Binance’s BNB token saw neither inflows nor outflows for the week, despite plenty of negative news surrounding the exchange and a weekly fall of about 10% in the BNB price.

Other altcoin funds saw only minor changes compared to the week before.

Commenting on the flows, CoinShares wrote in the report that it likely has to do with media reports about reluctance from the SEC to approve a spot Bitcoin ETF in the US.

Based on the media report, CoinShares said the prevailing narrative now is that an SEC decision on a spot ETF is “not imminent.”

This narrative, combined with crypto trading volumes that remain “well below average,” and a panic in the markets last week, has led to a worsening sentiment among investors, the CoinShares report said.

It added that outflows have been seen across most of the fund providers, although they were regionally focused mainly on Canada and Germany.

Switzerland and Australia were the two only countries that bucked the trend for the week, seeing inflows of $3.5 million and $0.1 million, respectively.