Executives in the crypto industry are still positive about the sector’s long-term prospects despite a slump in venture capital funding.

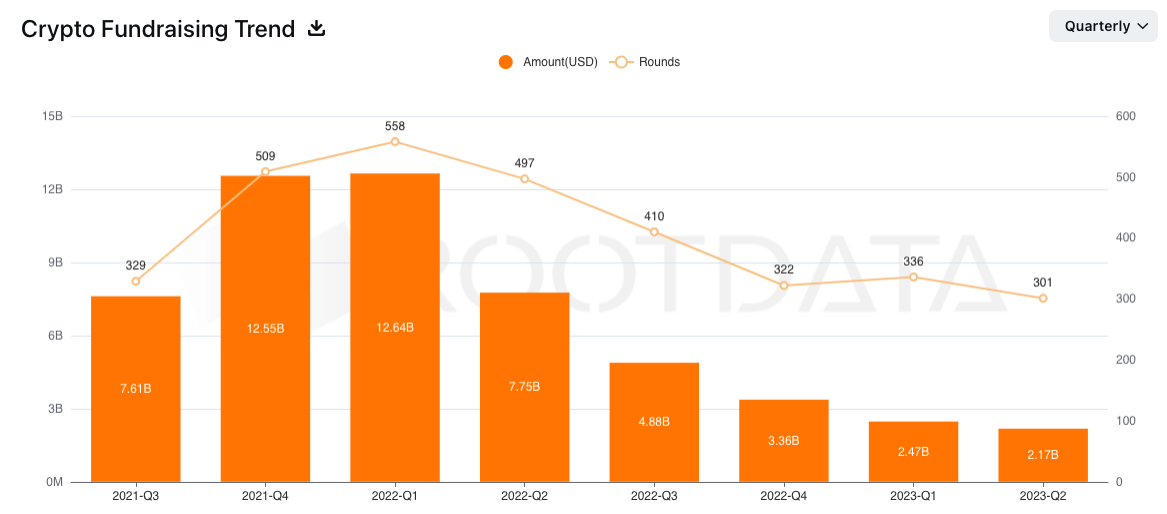

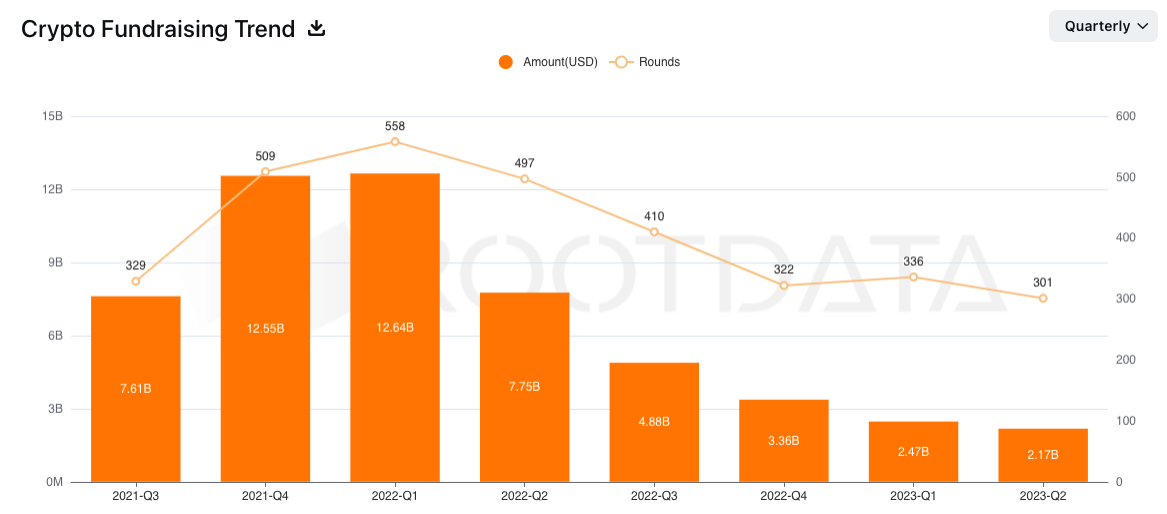

Based on numbers from the crypto data provider RootData, the second quarter of last year saw the lowest amount of funds raised by crypto firms since tracking of the data started in Q3 2021, with $2.17 billion raised.

The amount compared to $2.47 billion in the prior quarter, and $3.36 billion in the fourth quarter of 2022.

At its peak in Q1 2022, start-ups in the crypto industry raised $12.64 billion over a whopping 558 fundraising rounds, the data showed.

Improvement can already be seen

Commenting on the bearish trend to Cointelegraph, Web3 accelerator Outlier Ventures’ head of structuring and fundraising, Gvantsa Chkuaseli, said that things have already started to improve following a slowdown in the fourth quarter last year.

“We can see with our own portfolio, such as Mawari’s recent $6.5 million seed round co-led by Blockchange Ventures and Decasonic, and Zinc’s $5 million Series A, that there is interest despite the challenging conditions,” Chkuaseli said.

He added that some investors even appear undeterred by the downturn, and are investing in early-stage crypto companies as before.

“[…] there are reasons to be optimistic,” Chkuaseli said.

Others, such as Saqr Ereiqat, co-founder of Dubai-based venture capital firm Crypto Oasis, pointed out that there are many positive lessons that firms can draw from the recent downturn.

“On the positive side, this shift allows for a more discerning selection process, ensuring that only the most promising projects receive funding,” he explained, while adding:

“Moreover, the challenging times serve to crystallize the winners, separating the truly innovative ventures from the rest.”

But while positive lessons can be drawn, Ereiqat also admitted that the bear market and slump in VC funding has been difficult for the industry.

“It’s disheartening to witness numerous companies facing the risk of extinction due to the scarcity of funding opportunities,” he said, while noting that the situation highlights the importance of proper strategic decision-making for all companies.

Executives in the crypto industry are still positive about the sector’s long-term prospects despite a slump in venture capital funding.

Based on numbers from the crypto data provider RootData, the second quarter of last year saw the lowest amount of funds raised by crypto firms since tracking of the data started in Q3 2021, with $2.17 billion raised.

The amount compared to $2.47 billion in the prior quarter, and $3.36 billion in the fourth quarter of 2022.

At its peak in Q1 2022, start-ups in the crypto industry raised $12.64 billion over a whopping 558 fundraising rounds, the data showed.

Improvement can already be seen

Commenting on the bearish trend to Cointelegraph, Web3 accelerator Outlier Ventures’ head of structuring and fundraising, Gvantsa Chkuaseli, said that things have already started to improve following a slowdown in the fourth quarter last year.

“We can see with our own portfolio, such as Mawari’s recent $6.5 million seed round co-led by Blockchange Ventures and Decasonic, and Zinc’s $5 million Series A, that there is interest despite the challenging conditions,” Chkuaseli said.

He added that some investors even appear undeterred by the downturn, and are investing in early-stage crypto companies as before.

“[…] there are reasons to be optimistic,” Chkuaseli said.

Others, such as Saqr Ereiqat, co-founder of Dubai-based venture capital firm Crypto Oasis, pointed out that there are many positive lessons that firms can draw from the recent downturn.

“On the positive side, this shift allows for a more discerning selection process, ensuring that only the most promising projects receive funding,” he explained, while adding:

“Moreover, the challenging times serve to crystallize the winners, separating the truly innovative ventures from the rest.”

But while positive lessons can be drawn, Ereiqat also admitted that the bear market and slump in VC funding has been difficult for the industry.

“It’s disheartening to witness numerous companies facing the risk of extinction due to the scarcity of funding opportunities,” he said, while noting that the situation highlights the importance of proper strategic decision-making for all companies.