The recent resurgence in the crypto market, triggered by BlackRock’s unexpected filing for a spot Bitcoin exchange-traded fund (ETF), has led to a significant increase in inflows into ProShares’ Bitcoin futures-based ETF.

ProShares’ fund, which trades under the ticker code BITO, experienced inflows of $14.9 million on June 29 and $11.9 million on July 3, bringing its total assets under management (AuM) to $1.04 billion, according to ETF.com.

On the day BlackRock’s ETF application was submitted, the fund’s AuM stood at $822 million.

Introduced to the market in October of 2021, BITO offers exposure to the Bitcoin price using Bitcoin futures contracts traded on the regulated CME exchange as its underlying asset.

While many issuers are now competing to launch the first spot Bitcoin ETF, the approval of such a product would bring further legitimacy to Bitcoin and its underlying market structure.

The US Securities and Exchange Commission (SEC) has previously denied spot Bitcoin ETFs over concerns that prices on opaque and unregulated crypto exchanges can easily be manipulated.

Strong weekly inflows to crypto investment funds

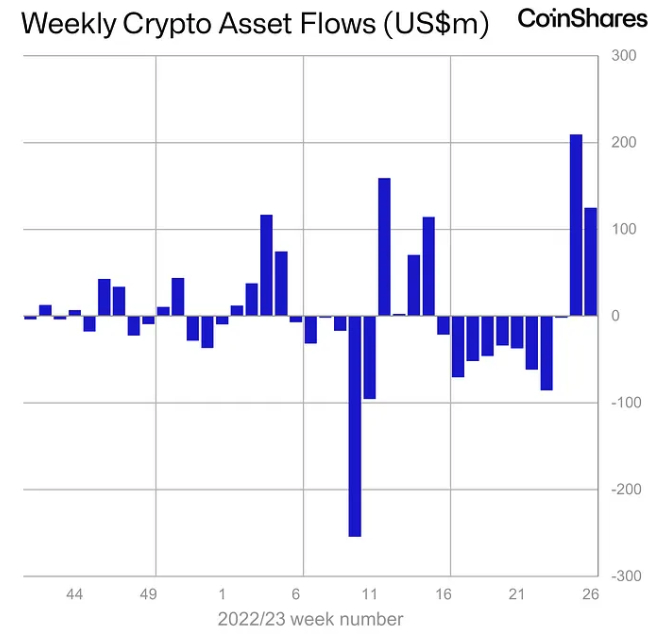

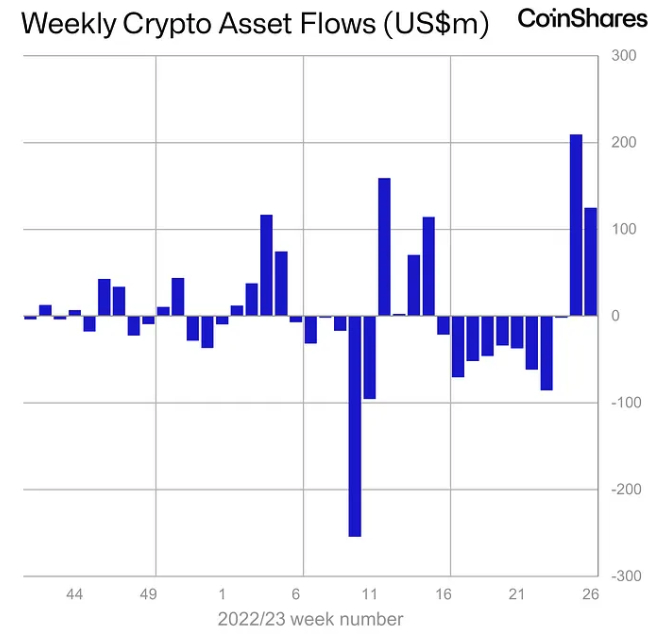

The excitement surrounding the potential launch of a spot Bitcoin ETF has also benefited the crypto investment fund space, as highlighted in the latest report from crypto research and investment firm CoinShares.

For the second consecutive week, crypto-backed investment funds recorded strong weekly inflows, with $125 million flowing into the industry on a net basis last week alone.

According to CoinShares, this brings the total inflows into such products to $334 million over the past two weeks.

The growing interest in ProShares’ bitcoin futures-based fund and the sustained inflows into the broader crypto fund market indicate a renewed enthusiasm among investors.

The potential for a spot Bitcoin ETF, combined with improving market sentiment, has sparked renewed confidence in the crypto space, with even traditionally minded ETF investors now appearing to bet that the SEC could finally approve such a product.

The recent resurgence in the crypto market, triggered by BlackRock’s unexpected filing for a spot Bitcoin exchange-traded fund (ETF), has led to a significant increase in inflows into ProShares’ Bitcoin futures-based ETF.

ProShares’ fund, which trades under the ticker code BITO, experienced inflows of $14.9 million on June 29 and $11.9 million on July 3, bringing its total assets under management (AuM) to $1.04 billion, according to ETF.com.

On the day BlackRock’s ETF application was submitted, the fund’s AuM stood at $822 million.

Introduced to the market in October of 2021, BITO offers exposure to the Bitcoin price using Bitcoin futures contracts traded on the regulated CME exchange as its underlying asset.

While many issuers are now competing to launch the first spot Bitcoin ETF, the approval of such a product would bring further legitimacy to Bitcoin and its underlying market structure.

The US Securities and Exchange Commission (SEC) has previously denied spot Bitcoin ETFs over concerns that prices on opaque and unregulated crypto exchanges can easily be manipulated.

Strong weekly inflows to crypto investment funds

The excitement surrounding the potential launch of a spot Bitcoin ETF has also benefited the crypto investment fund space, as highlighted in the latest report from crypto research and investment firm CoinShares.

For the second consecutive week, crypto-backed investment funds recorded strong weekly inflows, with $125 million flowing into the industry on a net basis last week alone.

According to CoinShares, this brings the total inflows into such products to $334 million over the past two weeks.

The growing interest in ProShares’ bitcoin futures-based fund and the sustained inflows into the broader crypto fund market indicate a renewed enthusiasm among investors.

The potential for a spot Bitcoin ETF, combined with improving market sentiment, has sparked renewed confidence in the crypto space, with even traditionally minded ETF investors now appearing to bet that the SEC could finally approve such a product.