Coinbase legal chief Paul Grewal urged the United States Congress on April 9 to swiftly enact stablecoin legislation to counter the illicit use of crypto. The executive’s plea comes ahead of the April 10 Senate Banking trial on countering illicit finance, terrorism, and sanctions evasion.

Paul Grewal expressed his concern in a thread post on X. According to him, the only way to address the issue of illicit financing through crypto, despite being a small fraction, was through effective stablecoins legislation.

Coinbase Legal Chief Believes Stablecoin Regulation Key to Stopping Illicit Crypto Funds

The Coinbase legal chief emphasized the importance of locating dollar-denominated stablecoins in the United States, suggesting that doing so directly benefits the American financial system.

Additionally, the Coinbase chief highlighted key issues that could be resolved through legislation rather than politics, such as reserve management rules and redemption rights, suggesting that these issues can be addressed with determination and a focus on practical solutions. According to Chainalysis, stablecoins were the defacto crypto among criminals in 2023.

US security interests are served by centering dollar-denominated stablecoins in the home of the dollar. Reserve management rules, redemption rights and all that aren’t hard to address if we have the will to do more than politic. 2/3

— paulgrewal.eth (@iampaulgrewal) April 9, 2024

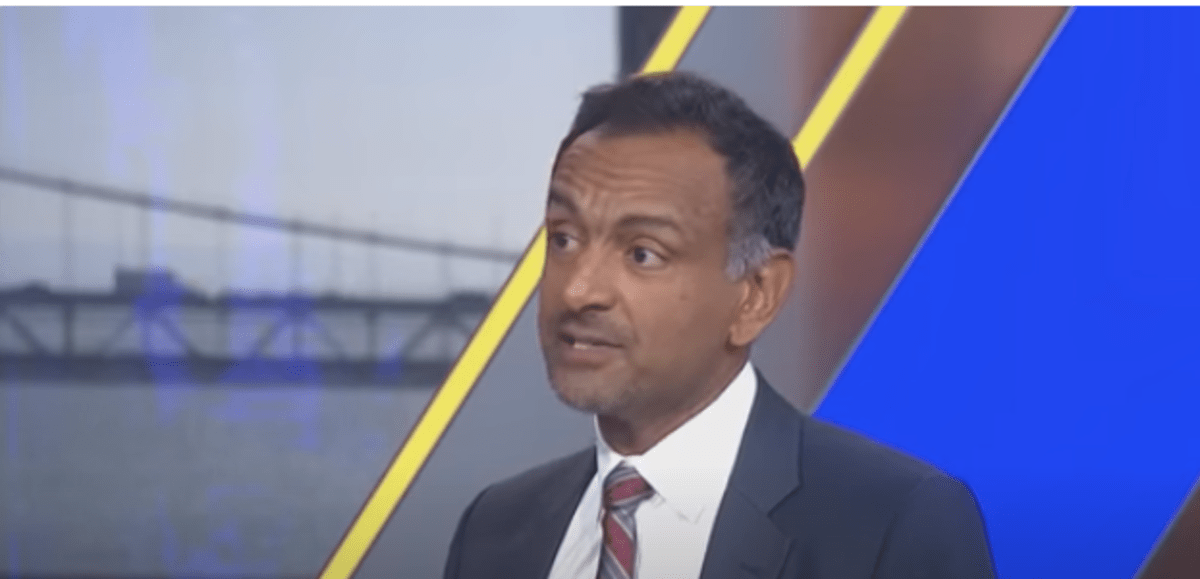

Grewal’s plea was prompted by Wally Adeyemo’s written testimony on the growing concerns amid the use of cryptocurrencies by terrorists and bad actors to finance illicit operations on a global scale.

Senate Banking hearing tomorrow with witness Deputy Secretary Wally Adeyemo from Treasury. How much is about #crypto and its use in illicit finance in his testimony? All of it, so brace yourselves for Treasury news on illicit finance use with #Bitcoin https://t.co/FIrsb1U9aV

— Jason Brett (@RegulatoryJason) April 9, 2024

According to the Deputy Secretary’s three-page testimony, terrorists use cryptocurrencies to maintain anonymity, which allows them to navigate through traditional finance structures easily.

Is Crypto Being Used by Terrorists?

Adeyemo’s testimony gave instances of how terrorist groups like al-Qaeda used Bitcoin to fund their violent crimes.

“For example, five years ago, al-Qaeda and affiliated terrorist groups, largely based out of Syria, operated a bitcoin money laundering network using social media platforms to solicit cryptocurrency donations. After receiving virtual currency, they laundered the proceeds through various online gift card exchanges to be able to purchase what they needed to advance their violent agenda,” Adeyemo’s testimony stated.

The report also highlighted how the Islamic Revolution Guard Corps-Quds Force (IRGC-QF) transferred digital assets to Hamas and the Palestinian Islamic Jihad (PIJ) in Gaza. Although the United States and the United Kingdom have jointly sanctioned Hamas-linked crypto addresses of an online media outlet as a full asset freeze has been announced against the suspects.

While the US Treasury unit has had some success in identifying illicit finance in the cryptocurrency ecosystem, Adeyemo reiterated the need to build an enforcement regime and reforms to prevent the further use of crypto by terrorist groups.

Adeyemo has proposed reforms, such as introducing secondary sanctions to target international digital asset providers that facilitate illicit finance and expanding regulatory coverage to include virtual asset service providers (VASPs).

Earlier this year, Senator Elizabeth Warren teamed up with over 100 lawmakers to drum up support for stablecoin regulation that would curtail illicit crypto activity. Leading the charge, Warren and her colleagues had written a letter to the Treasury. She also penned a Wall Street Journal op-ed in which she argued that “crypto-financed terrorism” was a danger to America and its citizens.