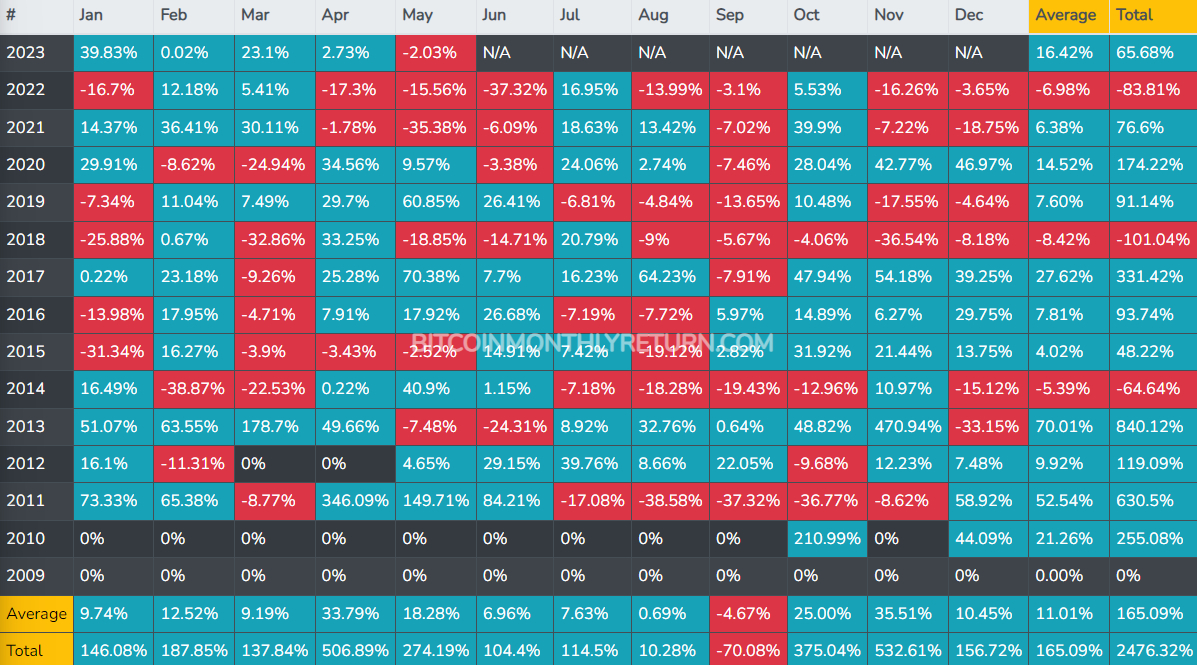

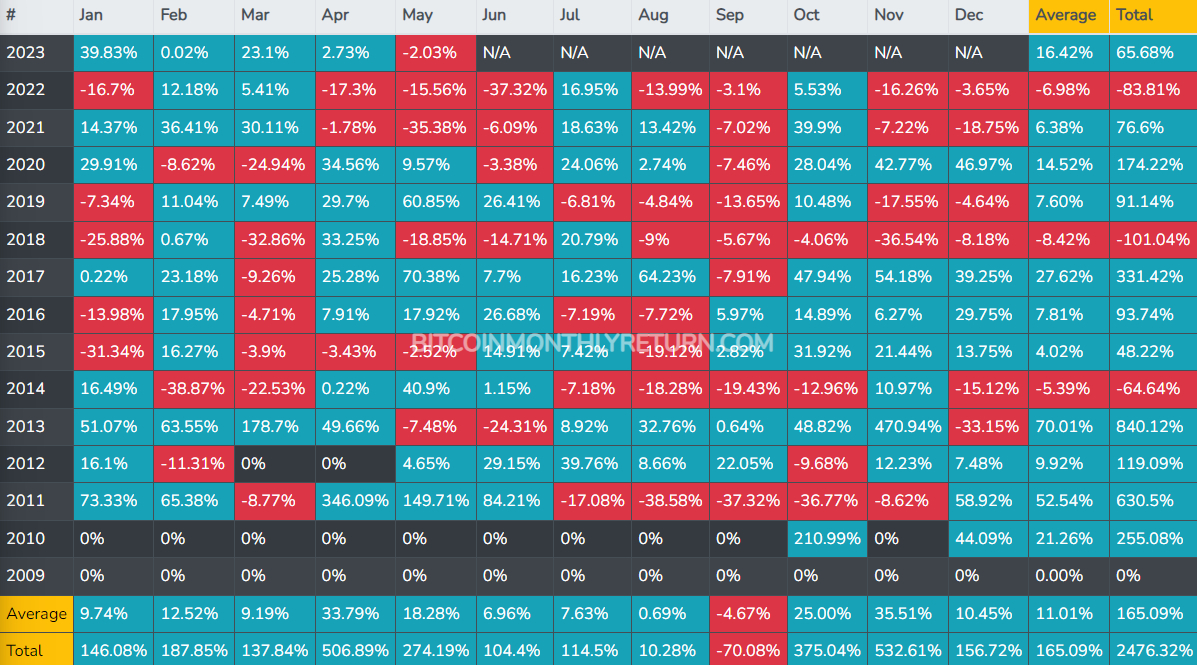

Since 2011, Bitcoin (BTC) has posted an average return of 18.3% in May, according to data presented by bitcoinmonthlyreturn.com.

However, two of the worst three Mays in Bitcoin’s history have come in the last two years.

In May 2021, Bitcoin shed a stunning 35.38% of its value.

In May 2022, Bitcoin dropped a more modest, but still ugly 15.56%.

And it’s not been the best start to May 2023.

The Bitcoin price is already down around 2.0%, with BTC/USD last changing hands across major exchanges in the $28,600s.

That still leaves the cryptocurrency up around 73% for the year.

But traders are nonetheless fretting that history could repeat itself once again and Bitcoin could shed a significant portion of its value between now and the end of the month.

Macro risks certainly hold the possibility of weighing heavily on the Bitcoin price.

The US Federal Reserve announces their latest policy decision on Wednesday – a tenth consecutive rate hike is expected (of 25 bps, taking rates to the 5.0-5.25% range), and Fed Chair Jerome Powell is expected to push back against money market expectations that the Fed will be cutting interest rates later this year.

For now, still elevated inflation and a still robust US labor market justify continued tightening.

There is a risk that if upcoming US jobs and inflation data are sufficiently strong, this could push back against the market’s expectations for rate cuts later this year, resulting in the US dollar and US yields rising, which could hit Bitcoin.

Meanwhile, after a jump in March as the Fed stepped in with liquidity support for the banking sector, US liquidity continues to drop, presenting a further potential macro tailwind for Bitcoin.

Bank Crisis/US Default Concerns to the Rescue?

While Bitcoin is for now holding above its 50-Day Moving Average in the $28,200s, suggesting the market’s near-term bullish momentum hasn’t yet died, the risks of a drop under support in the $26,500-$27,000 remains acute.

A break of this support zone would open the door to a possible retest of the key long-term support-turned-resistance area around $25,250-400.

But one key macro tailwind could save the day for Bitcoin and possibly even catapult it to fresh yearly highs in the $30,000s.

That is a resurgence of US bank crisis fears.

Failing regional bank First Republic was taken into FDIC receivership at the end of last week and swiftly sold off to US bank giant JP Morgan via an auction.

First Republic’s collapse followed the demise of three other regional US banks in March.

The KBW regional banking index fell 5.5% on Tuesday, its largest intra-day drop since bank crisis concerns first emerged in early/mid-March and hit its lowest levels since late-2020.

Investors are concerned that a further string of regional banks could be about to implode and that the broader US financial system is at risk.

In March, bank crisis concerns created safe-haven demand for Bitcoin as investors sought out an alternative, independent and decentralized form of money.

Indeed, Bitcoin was last up over 2.0% on Tuesday, with some analysts citing a bank-related safe-haven bid.

Even if US regulators are able to avert a full-blown bank crisis, recent events substantially increase the risk of a recession via a contraction in bank lending (as banks turn more cautious), whilst also piling on pressure on the Fed not to tighten financial conditions excessively.

That should also act as a long-term macro tailwind for Bitcoin.

Another factor that could offer the Bitcoin price support in May is the rising risk of a US sovereign debt default.

US lawmakers are currently battling over the conditions to raise the US debt ceiling.

If they fail to do so before the US treasury runs out of cash (potentially as soon as June), then this could result in the US government defaulting on some of its debt obligations (as the US government tends to finance expiring debt via the issuance of new debt).

We have been through this merry-go-round dozens of times before and a last-minute deal has, up until now, always been reached to avert a default.

But as the deadline to raise the debt ceiling fast approaches and the probability of a default is deemed as creeping higher, we could see safe-haven flows into Bitcoin.

That’s because a default would deliver a catastrophic blow to the credibility of the US government and its currency the US dollar, currently the world’s reserve currency.

Investors looking for hard-money alternatives would likely pile into gold (the oldest form of money) and Bitcoin (which many refer to as the new digital gold).

Since 2011, Bitcoin (BTC) has posted an average return of 18.3% in May, according to data presented by bitcoinmonthlyreturn.com.

However, two of the worst three Mays in Bitcoin’s history have come in the last two years.

In May 2021, Bitcoin shed a stunning 35.38% of its value.

In May 2022, Bitcoin dropped a more modest, but still ugly 15.56%.

And it’s not been the best start to May 2023.

The Bitcoin price is already down around 2.0%, with BTC/USD last changing hands across major exchanges in the $28,600s.

That still leaves the cryptocurrency up around 73% for the year.

But traders are nonetheless fretting that history could repeat itself once again and Bitcoin could shed a significant portion of its value between now and the end of the month.

Macro risks certainly hold the possibility of weighing heavily on the Bitcoin price.

The US Federal Reserve announces their latest policy decision on Wednesday – a tenth consecutive rate hike is expected (of 25 bps, taking rates to the 5.0-5.25% range), and Fed Chair Jerome Powell is expected to push back against money market expectations that the Fed will be cutting interest rates later this year.

For now, still elevated inflation and a still robust US labor market justify continued tightening.

There is a risk that if upcoming US jobs and inflation data are sufficiently strong, this could push back against the market’s expectations for rate cuts later this year, resulting in the US dollar and US yields rising, which could hit Bitcoin.

Meanwhile, after a jump in March as the Fed stepped in with liquidity support for the banking sector, US liquidity continues to drop, presenting a further potential macro tailwind for Bitcoin.

Bank Crisis/US Default Concerns to the Rescue?

While Bitcoin is for now holding above its 50-Day Moving Average in the $28,200s, suggesting the market’s near-term bullish momentum hasn’t yet died, the risks of a drop under support in the $26,500-$27,000 remains acute.

A break of this support zone would open the door to a possible retest of the key long-term support-turned-resistance area around $25,250-400.

But one key macro tailwind could save the day for Bitcoin and possibly even catapult it to fresh yearly highs in the $30,000s.

That is a resurgence of US bank crisis fears.

Failing regional bank First Republic was taken into FDIC receivership at the end of last week and swiftly sold off to US bank giant JP Morgan via an auction.

First Republic’s collapse followed the demise of three other regional US banks in March.

The KBW regional banking index fell 5.5% on Tuesday, its largest intra-day drop since bank crisis concerns first emerged in early/mid-March and hit its lowest levels since late-2020.

Investors are concerned that a further string of regional banks could be about to implode and that the broader US financial system is at risk.

In March, bank crisis concerns created safe-haven demand for Bitcoin as investors sought out an alternative, independent and decentralized form of money.

Indeed, Bitcoin was last up over 2.0% on Tuesday, with some analysts citing a bank-related safe-haven bid.

Even if US regulators are able to avert a full-blown bank crisis, recent events substantially increase the risk of a recession via a contraction in bank lending (as banks turn more cautious), whilst also piling on pressure on the Fed not to tighten financial conditions excessively.

That should also act as a long-term macro tailwind for Bitcoin.

Another factor that could offer the Bitcoin price support in May is the rising risk of a US sovereign debt default.

US lawmakers are currently battling over the conditions to raise the US debt ceiling.

If they fail to do so before the US treasury runs out of cash (potentially as soon as June), then this could result in the US government defaulting on some of its debt obligations (as the US government tends to finance expiring debt via the issuance of new debt).

We have been through this merry-go-round dozens of times before and a last-minute deal has, up until now, always been reached to avert a default.

But as the deadline to raise the debt ceiling fast approaches and the probability of a default is deemed as creeping higher, we could see safe-haven flows into Bitcoin.

That’s because a default would deliver a catastrophic blow to the credibility of the US government and its currency the US dollar, currently the world’s reserve currency.

Investors looking for hard-money alternatives would likely pile into gold (the oldest form of money) and Bitcoin (which many refer to as the new digital gold).