Canadian Bitcoin (BTC) mining firm has increased its production capacity this year with eyes locked on better opportunities hinged on the upcoming BTC halving.

According to an Oct. 2 press release on the firm’s mining operation for September, the company increased its hashrate, capacity, and efficiency.

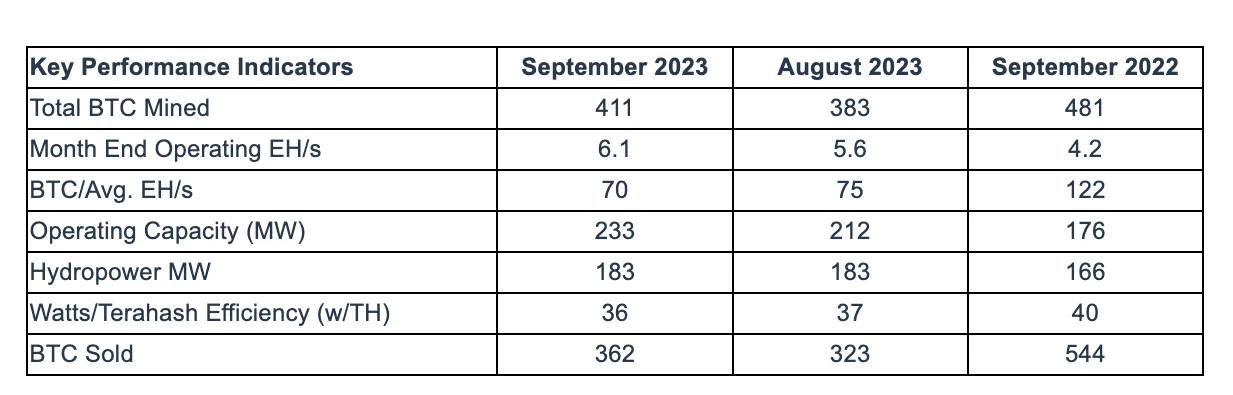

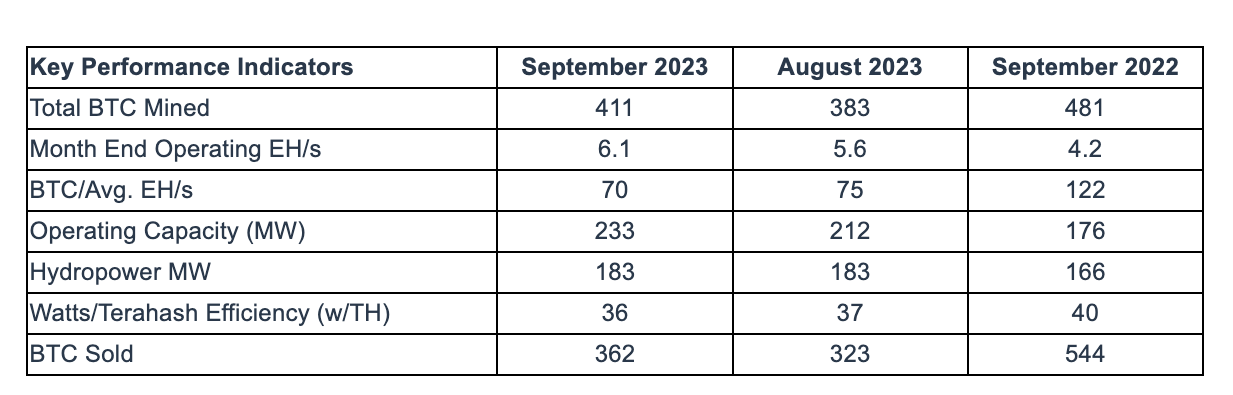

Last month, the miner generated 411 BTC, selling 362 BTC for approximately $9.5 million bringing up its current asset holdings to 703 BTC worth about $20 million.

The company recorded a sharp growth in less than a month as it increased the amount of BTC mined from 383 in August to 411 in September marking a 7.3% growth.

The miner cited added facilities in its mining sites and moderate weather across the continent as reasons for the spike in productivity.

The miner cited added facilities in its mining sites and moderate weather across the continent as reasons for the spike in productivity.

Overall, network difficulty increased 2.7% last month as more investors continued to get attracted to the industry in anticipation of higher Bitcoin prices after the crypto winter.

This year, network difficulty has increased 61.5% while prices have increased 63.2% within the same period.

While the total BTC mined is an improvement from last month, it is a 14.6% decline from the September 2022 figures, a situation blamed on macroeconomic factors, tightening regulations, etc.

With 4,600 miners, the from mined an average of 13.7 BTC raking in approximately $369,000. The company also posted a 45% growth in its hashrate since September 2022 and a 9% growth in the last 30 days.

Despite recent improvements, January remains the miner’s highest month with 486 BTC mined followed by May with 459 ahead of March and September.

The firm has mined 3,692 coins this year almost tapping last year’s total of 3,733 with their operational months left.

Financials in shape ahead of halving

The Nasdaq-listed firm generated $9.5 million from sales, reduced debt by $1.9 million, and maintained a balance of $9.9 million at the end of September.

The firm also holds $46 million in cash or its equivalent with a treasury of 703 BTC marking growth as it competes in the crypto bear market.

Geoff Morphy, the CEO of Bitfarms highlighted the company’s recent growth in new facilities with more upgrades to come in the future.

“In September, we continued to install new miners and fully energized Rio Cuarto to 51 MW, increasing our operating capacity by 9% to 233 MW. Year-to-date, we increased operating capacity by 24% and upgraded and expanded our fleet with over 15,000 additional miners.”

Morphy added that the company sees the next BTC honing as an opportunity for growth while focusing on balance sheet strength.

“We continue to believe that many of our best opportunities for growth and investment will arise around the next Bitcoin halving expected to occur in April 2024.”

Canadian Bitcoin (BTC) mining firm has increased its production capacity this year with eyes locked on better opportunities hinged on the upcoming BTC halving.

According to an Oct. 2 press release on the firm’s mining operation for September, the company increased its hashrate, capacity, and efficiency.

Last month, the miner generated 411 BTC, selling 362 BTC for approximately $9.5 million bringing up its current asset holdings to 703 BTC worth about $20 million.

The company recorded a sharp growth in less than a month as it increased the amount of BTC mined from 383 in August to 411 in September marking a 7.3% growth.

The miner cited added facilities in its mining sites and moderate weather across the continent as reasons for the spike in productivity.

The miner cited added facilities in its mining sites and moderate weather across the continent as reasons for the spike in productivity.

Overall, network difficulty increased 2.7% last month as more investors continued to get attracted to the industry in anticipation of higher Bitcoin prices after the crypto winter.

This year, network difficulty has increased 61.5% while prices have increased 63.2% within the same period.

While the total BTC mined is an improvement from last month, it is a 14.6% decline from the September 2022 figures, a situation blamed on macroeconomic factors, tightening regulations, etc.

With 4,600 miners, the from mined an average of 13.7 BTC raking in approximately $369,000. The company also posted a 45% growth in its hashrate since September 2022 and a 9% growth in the last 30 days.

Despite recent improvements, January remains the miner’s highest month with 486 BTC mined followed by May with 459 ahead of March and September.

The firm has mined 3,692 coins this year almost tapping last year’s total of 3,733 with their operational months left.

Financials in shape ahead of halving

The Nasdaq-listed firm generated $9.5 million from sales, reduced debt by $1.9 million, and maintained a balance of $9.9 million at the end of September.

The firm also holds $46 million in cash or its equivalent with a treasury of 703 BTC marking growth as it competes in the crypto bear market.

Geoff Morphy, the CEO of Bitfarms highlighted the company’s recent growth in new facilities with more upgrades to come in the future.

“In September, we continued to install new miners and fully energized Rio Cuarto to 51 MW, increasing our operating capacity by 9% to 233 MW. Year-to-date, we increased operating capacity by 24% and upgraded and expanded our fleet with over 15,000 additional miners.”

Morphy added that the company sees the next BTC honing as an opportunity for growth while focusing on balance sheet strength.

“We continue to believe that many of our best opportunities for growth and investment will arise around the next Bitcoin halving expected to occur in April 2024.”