Bitcoin’s fourth halving event is imminent to occur just after midnight UTC on April 20 (8 pm ET today), which will reduce the block subsidy reward for miners from 6.25 BTC to 3.125 BTC per block, potentially impacting the cryptocurrency’s price and mining operations.

Bitcoin halvings occur automatically every 210,000 blocks or approximately every four years.

To understand the importance of this event, let’s examine previous halving events and their historical impact on the industry.

A Look Back at Previous Bitcoin Halving Events

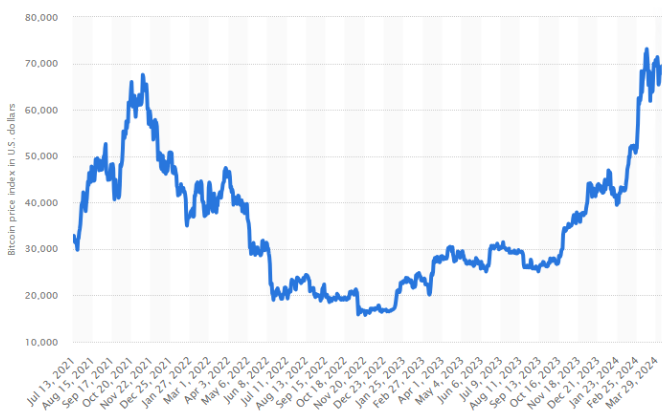

Bitcoin halving events have historically contributed to major Bitcoin price rallies, and its increasing adoption highlights its growing potential.

Bitcoin’s protocol has mandated three halving events thus far, gradually decreasing the block reward for miners from 50 BTC to 25 BTC in 2012, then to 12.5 BTC in 2016, and most recently to 6.25 BTC on May 11, 2020.

The 2024 halving event will see the subsidy reward for miners on the network drop from 6.25 BTC to 3.125 BTC per block. In the long term, 21 million Bitcoins will only exist.

What comes after 2024’s Halving Event?

Bernstein predicts that Bitcoin will continue on its bullish path after the halving event and could reach $150,000 by the end of 2025.

Coinify CEO Rikke Staer warned about #Bitcoin sales after halving in the @TheBlock__ interview.

☑️ He attributed his expectations to the strengthening presence of institutional investors and the increased experience of retail investors

☑️ “Historically, the main growth after… pic.twitter.com/iaVrCAQ8qj— Web3_Vibes (@W3Vibes) April 18, 2024

However, Coinify’s Rikke Staer believes that the halving event is a “sell-the-news” event as less efficient miners may need to sell their existing BTC holdings, which could potentially create sell pressure.

While Bitcoin miners have profited this year, the extent of the impact halving will have on less efficient mining operations has yet to be determined.

Bitcoin’s price is hovering around $64,500 as of writing, representing a 1.33% increase over the past 24 hours, as reported by CoinMarketCap.

Bitcoin’s price fell below $60,000 earlier today amid reports of Israeli missiles hitting a site in Iran but has rebounded strongly since.