Bitcoin’s recent performance shows a marginal dip of less than 0.10%, trading at $29,380 as of Tuesday.

This subtle fluctuation in Bitcoin’s price can be attributed to several underlying factors.

Foremost among them is the sentiment expressed by former SEC Chairman John Reed Stark, who opines that the present SEC is likely to reject Bitcoin ETF’s spot approval.

In parallel, TeraWulf has reported an upsurge in its self-mined BTC for Q2, and in another development, Hut 8 is contemplating a merger with USBTC.

Industry insiders are also keenly awaiting a potential decision on Grayscale’s Bitcoin ETF, which is anticipated to be announced this week.

Industry expert predicts Bitcoin ETF approval denial by SEC

The BTC/USD’s downward trend may be due to former SEC attorney John Reed Stark’s insights.

He suggests that the SEC’s current administration is hesitant to approve Bitcoin spot ETFs due to concerns about market manipulation and dependency on a small group for network maintenance.

This speculation aligns with historical SEC denials of Bitcoin ETFs based on similar reasons.

Stark also speculates that a GOP-led administration might take a more crypto-friendly stance after the 2024 presidential election, potentially easing ETF approval.

Bitcoin Mining Update: TeraWulf and Hut 8’s Merger Consideration with USBTC

The recent increase in self-mined BTC by US-based mining firm TeraWulf during Q2 2023, attributed to expanded mining capacity and higher hash rate, may have contributed to the downward momentum in Bitcoin.

This boosted their quarterly revenue by $4 million to $15.5 million.

During Q2 2023, Hut8’s mid-year performance showed a decline in hash rate and self-mined Bitcoin.

The company extracted 399 BTC, marking a 58% drop from Q2 2022. This decrease was attributed to heightened Bitcoin mining difficulty, the pause in operations at the North Bay Facility, and persistent electrical problems at the Drumheller site.

Hut 8 anticipates a boost in its hash rate capacity upon finalizing its anticipated merger with US Bitcoin.

Grayscale Bitcoin ETF Decision Expected This Week, Experts Say

Traders are anticipating the approval of Grayscale Bitcoin ETF. Historical court timelines suggest that the resolution is likely to come around August.

Bloomberg’s James Seyffart suggested August 15 as a plausible decision date, which might be helping keep Bitcoin losses limited for the day.

Additionally, industry figures like Cathie Wood and Nate Geraci have expressed their support for Grayscale against SEC.

Bitcoin Price Prediction

Examining Bitcoin from a technical perspective, its movement has been relatively stagnant, fluctuating between the upper boundary of $29,600 and the lower threshold of $29,250, as evident on the two-hourly chart.

This period presents a volatile session for the BTC/USD currency pair. A breach of this specified range is expected to dictate Bitcoin’s ensuing price trajectory.

Should Bitcoin dip below the $29,250 mark, it would likely find its next support at approximately the $29,000 level.

This would not only signify the perpetuation of a bearish trend but also expose Bitcoin to a subsequent support level at $28,750.

Conversely, a bullish surge past the $29,600 threshold has the potential to push Bitcoin’s valuation toward $29,800.

Beyond this, the next significant resistance stands at the psychological barrier of $30,000.

A continued bullish trend could further propel Bitcoin towards a resistance level of $30,200—a mark that previously acted as a resistance on August 8.

This level is anticipated to cap any significant bullish momentum in the near future.

In summary, traders should closely monitor the $29,250 and $29,600 levels to strategize based on potential price movements.

Top 15 Cryptocurrencies to Watch in 2023

Explore our meticulously chosen collection of the top 15 digital assets to stay up to date on the latest initial coin offering (ICO) projects and alternative cryptocurrencies in 2023.

This expertly curated list is brought to you by Industry Talk and Cryptonews, providing you with professional recommendations and valuable insights.

Keep pace with the constantly evolving world of digital assets by discovering the potential of these cryptocurrencies.

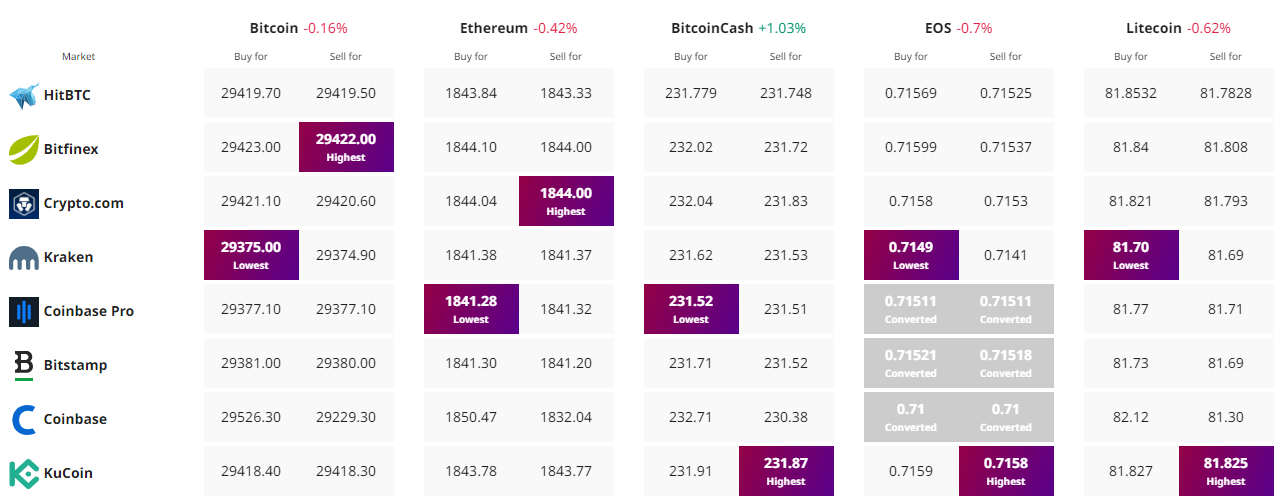

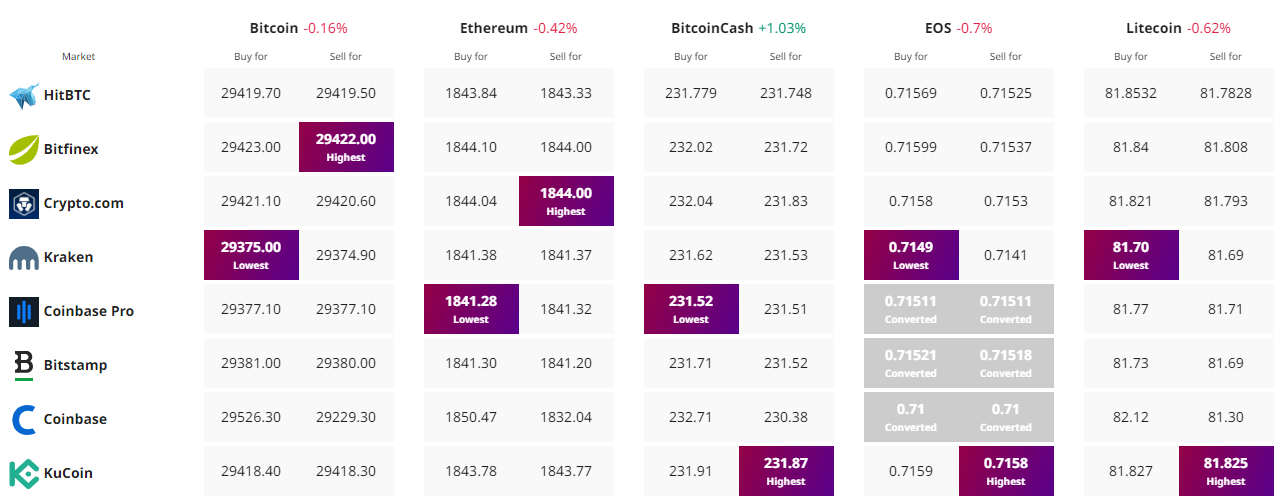

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin’s recent performance shows a marginal dip of less than 0.10%, trading at $29,380 as of Tuesday.

This subtle fluctuation in Bitcoin’s price can be attributed to several underlying factors.

Foremost among them is the sentiment expressed by former SEC Chairman John Reed Stark, who opines that the present SEC is likely to reject Bitcoin ETF’s spot approval.

In parallel, TeraWulf has reported an upsurge in its self-mined BTC for Q2, and in another development, Hut 8 is contemplating a merger with USBTC.

Industry insiders are also keenly awaiting a potential decision on Grayscale’s Bitcoin ETF, which is anticipated to be announced this week.

Industry expert predicts Bitcoin ETF approval denial by SEC

The BTC/USD’s downward trend may be due to former SEC attorney John Reed Stark’s insights.

He suggests that the SEC’s current administration is hesitant to approve Bitcoin spot ETFs due to concerns about market manipulation and dependency on a small group for network maintenance.

This speculation aligns with historical SEC denials of Bitcoin ETFs based on similar reasons.

Stark also speculates that a GOP-led administration might take a more crypto-friendly stance after the 2024 presidential election, potentially easing ETF approval.

Bitcoin Mining Update: TeraWulf and Hut 8’s Merger Consideration with USBTC

The recent increase in self-mined BTC by US-based mining firm TeraWulf during Q2 2023, attributed to expanded mining capacity and higher hash rate, may have contributed to the downward momentum in Bitcoin.

This boosted their quarterly revenue by $4 million to $15.5 million.

During Q2 2023, Hut8’s mid-year performance showed a decline in hash rate and self-mined Bitcoin.

The company extracted 399 BTC, marking a 58% drop from Q2 2022. This decrease was attributed to heightened Bitcoin mining difficulty, the pause in operations at the North Bay Facility, and persistent electrical problems at the Drumheller site.

Hut 8 anticipates a boost in its hash rate capacity upon finalizing its anticipated merger with US Bitcoin.

Grayscale Bitcoin ETF Decision Expected This Week, Experts Say

Traders are anticipating the approval of Grayscale Bitcoin ETF. Historical court timelines suggest that the resolution is likely to come around August.

Bloomberg’s James Seyffart suggested August 15 as a plausible decision date, which might be helping keep Bitcoin losses limited for the day.

Additionally, industry figures like Cathie Wood and Nate Geraci have expressed their support for Grayscale against SEC.

Bitcoin Price Prediction

Examining Bitcoin from a technical perspective, its movement has been relatively stagnant, fluctuating between the upper boundary of $29,600 and the lower threshold of $29,250, as evident on the two-hourly chart.

This period presents a volatile session for the BTC/USD currency pair. A breach of this specified range is expected to dictate Bitcoin’s ensuing price trajectory.

Should Bitcoin dip below the $29,250 mark, it would likely find its next support at approximately the $29,000 level.

This would not only signify the perpetuation of a bearish trend but also expose Bitcoin to a subsequent support level at $28,750.

Conversely, a bullish surge past the $29,600 threshold has the potential to push Bitcoin’s valuation toward $29,800.

Beyond this, the next significant resistance stands at the psychological barrier of $30,000.

A continued bullish trend could further propel Bitcoin towards a resistance level of $30,200—a mark that previously acted as a resistance on August 8.

This level is anticipated to cap any significant bullish momentum in the near future.

In summary, traders should closely monitor the $29,250 and $29,600 levels to strategize based on potential price movements.

Top 15 Cryptocurrencies to Watch in 2023

Explore our meticulously chosen collection of the top 15 digital assets to stay up to date on the latest initial coin offering (ICO) projects and alternative cryptocurrencies in 2023.

This expertly curated list is brought to you by Industry Talk and Cryptonews, providing you with professional recommendations and valuable insights.

Keep pace with the constantly evolving world of digital assets by discovering the potential of these cryptocurrencies.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.