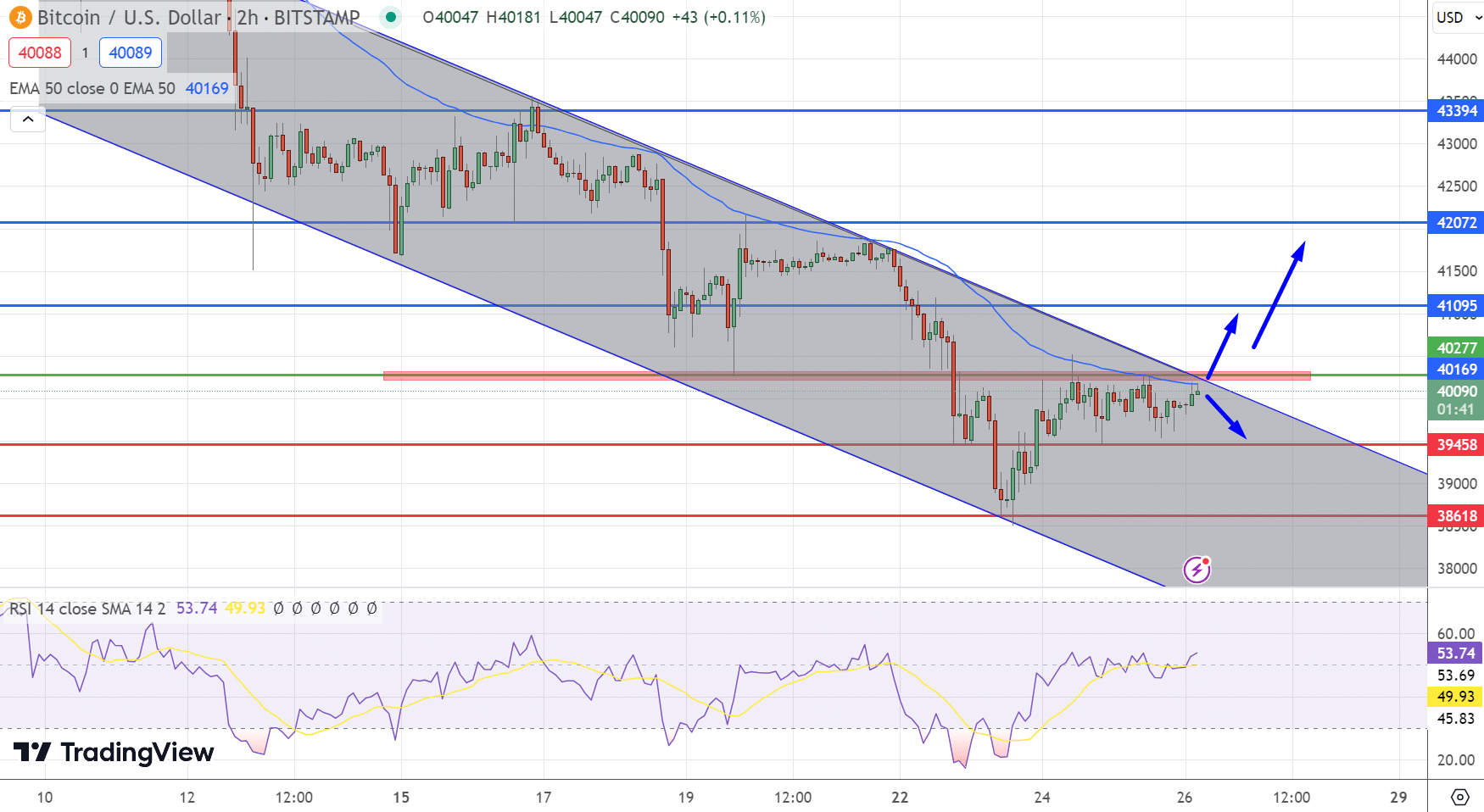

In the realm of cryptocurrency, Bitcoin’s price prediction continues to draw attention as the digital currency experiences a modest increase, trading at $40,125, up by 0.30%. This surge aligns with significant developments in the crypto landscape.

Notably, Tesla’s latest financial disclosure reveals a substantial investment in Bitcoin, with digital assets totaling $184 million on its balance sheet, underscoring a strong corporate endorsement of the cryptocurrency.

Additionally, market analysts from JPMorgan suggest a reduction in selling pressure for Bitcoin, as profit-taking activities on Grayscale’s Bitcoin Trust (GBTC) appear to be subsiding. However, the scenario is not uniformly optimistic.

Fitzgerald Cantor raises concerns about the future profitability of Bitcoin miners, especially in light of the upcoming halving event, which could challenge the financial viability of at least 11 mining entities. These varied factors collectively shape the current and future dynamics of Bitcoin’s valuation.

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.