Bitcoin price is currently trading at around $30,300, showing less than 0.50% surge during the Asian session on Monday. The recent favorable decision in the SEC vs. Ripple case has impacted the price, bringing it back to the level seen last Thursday.

Bitcoin price is currently trading at around $30,300, showing less than 0.50% surge during the Asian session on Monday. The recent favorable decision in the SEC vs. Ripple case has impacted the price, bringing it back to the level seen last Thursday.

However, a former SEC official expresses skepticism about the ruling on XRP, stating that “the decision rests on shaky ground” and anticipates a potential reversal in the future.

In other news, Blackrock CEO Larry Fink believes cryptocurrencies will surpass any single currency’s influence, highlighting the growing global interest in digital assets.

In this update, let’s discuss the latest developments in the Bitcoin market as legal battles and evolving market sentiments continue to shape its trajectory.

Former SEC Official: SEC vs. Ripple Ruling on XRP Could be Reversed, Decision Questioned

According to a former director of internet enforcement at the US Securities and Exchange Commission, the SEC vs. Ripple case decision is considered uncertain, and the ruling will likely be overturned.

The Ripple ruling provides complete protection to institutional investors by the SEC, while ordinary investors receive no such protection.

As John Reed Stark emphasized, this raises concerns about the decision’s retrogressive nature.

The Ripple ruling introduces a situation where a token may be classified as a security at times but not at others.

This lack of protection for regular investors leads to increased ignorance and willful blindness. Moreover, the less information disclosed about a token by its issuer, the lower its responsibility.

Despite the concerns raised by John Reed Stark, the bullish movement of BTC prices remains unaffected.

Larry Fink, CEO of BlackRock, Envisions Cryptocurrencies Going Beyond Individual Currencies with Global Interest Rising

According to BlackRock CEO Larry Fink, cryptocurrency is not only universal but also has the potential to outlast all other currencies.

Fink emphasized the importance of ensuring safety and security in the cryptocurrency market, especially about BlackRock’s bitcoin exchange-traded fund (ETF) filing with the US Securities and Exchange Commission (SEC).

Fink believes that a global cryptocurrency product can surpass the limitations of individual currencies, considering the fluctuations in the value of the US dollar over the past five years and recent months.

He highlights the increasing interest in cryptocurrencies from individuals worldwide, indicating the significant potential they hold.

Fink also discusses the importance of democratizing investment and acknowledges the transformative impact of exchange-traded funds (ETFs) on investment practices globally. He sees this as just the beginning of a larger revolution in investment.

Regarding BlackRock’s application for a bitcoin ETF, Fink reiterates the collaboration with regulators to ensure the security and protection of investors when the BlackRock name is associated with any market.

The positive remarks and support from Larry Fink contribute to the gains in Bitcoin’s value on Monday.

Bitcoin Price Prediction

On the technical side, Bitcoin has found immediate support around the $30,000 level, which also acts as a significant psychological support level.

The recent series of doji and spinning top candles above this level indicate weakening bearish momentum and a potential shift in favor of the bulls.

Additionally, on the four-hour time frame, an upward trend line acts as resistance, suggesting the possibility of a bullish breakout.

However, it’s worth noting that the 50-period exponential moving average around $30,400 could provide resistance, along with the relative strength index and moving average convergence divergence indicators indicating a neutral stance.

We may not see significant price movement if Bitcoin consolidates between $30,400 to $30,000. A bullish breakout above $30,400 could expose Bitcoin to levels around $30,900 or even $31,500.

On the other hand, a bearish break below the $30,000 level has the potential to push Bitcoin’s price down toward the $29,500 level.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

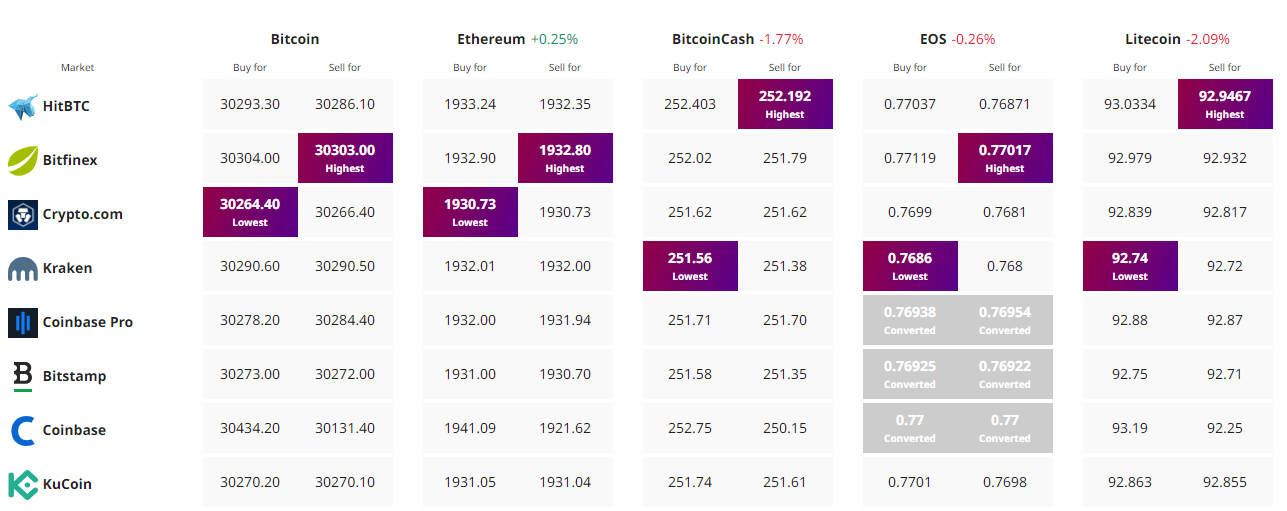

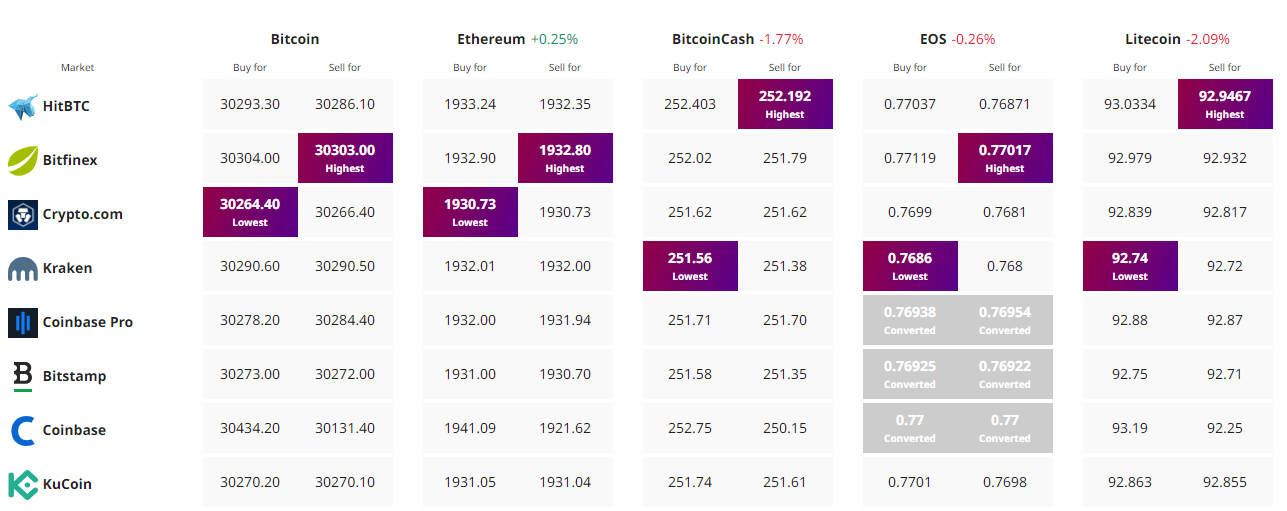

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin price is currently trading at around $30,300, showing less than 0.50% surge during the Asian session on Monday. The recent favorable decision in the SEC vs. Ripple case has impacted the price, bringing it back to the level seen last Thursday.

Bitcoin price is currently trading at around $30,300, showing less than 0.50% surge during the Asian session on Monday. The recent favorable decision in the SEC vs. Ripple case has impacted the price, bringing it back to the level seen last Thursday.

However, a former SEC official expresses skepticism about the ruling on XRP, stating that “the decision rests on shaky ground” and anticipates a potential reversal in the future.

In other news, Blackrock CEO Larry Fink believes cryptocurrencies will surpass any single currency’s influence, highlighting the growing global interest in digital assets.

In this update, let’s discuss the latest developments in the Bitcoin market as legal battles and evolving market sentiments continue to shape its trajectory.

Former SEC Official: SEC vs. Ripple Ruling on XRP Could be Reversed, Decision Questioned

According to a former director of internet enforcement at the US Securities and Exchange Commission, the SEC vs. Ripple case decision is considered uncertain, and the ruling will likely be overturned.

The Ripple ruling provides complete protection to institutional investors by the SEC, while ordinary investors receive no such protection.

As John Reed Stark emphasized, this raises concerns about the decision’s retrogressive nature.

The Ripple ruling introduces a situation where a token may be classified as a security at times but not at others.

This lack of protection for regular investors leads to increased ignorance and willful blindness. Moreover, the less information disclosed about a token by its issuer, the lower its responsibility.

Despite the concerns raised by John Reed Stark, the bullish movement of BTC prices remains unaffected.

Larry Fink, CEO of BlackRock, Envisions Cryptocurrencies Going Beyond Individual Currencies with Global Interest Rising

According to BlackRock CEO Larry Fink, cryptocurrency is not only universal but also has the potential to outlast all other currencies.

Fink emphasized the importance of ensuring safety and security in the cryptocurrency market, especially about BlackRock’s bitcoin exchange-traded fund (ETF) filing with the US Securities and Exchange Commission (SEC).

Fink believes that a global cryptocurrency product can surpass the limitations of individual currencies, considering the fluctuations in the value of the US dollar over the past five years and recent months.

He highlights the increasing interest in cryptocurrencies from individuals worldwide, indicating the significant potential they hold.

Fink also discusses the importance of democratizing investment and acknowledges the transformative impact of exchange-traded funds (ETFs) on investment practices globally. He sees this as just the beginning of a larger revolution in investment.

Regarding BlackRock’s application for a bitcoin ETF, Fink reiterates the collaboration with regulators to ensure the security and protection of investors when the BlackRock name is associated with any market.

The positive remarks and support from Larry Fink contribute to the gains in Bitcoin’s value on Monday.

Bitcoin Price Prediction

On the technical side, Bitcoin has found immediate support around the $30,000 level, which also acts as a significant psychological support level.

The recent series of doji and spinning top candles above this level indicate weakening bearish momentum and a potential shift in favor of the bulls.

Additionally, on the four-hour time frame, an upward trend line acts as resistance, suggesting the possibility of a bullish breakout.

However, it’s worth noting that the 50-period exponential moving average around $30,400 could provide resistance, along with the relative strength index and moving average convergence divergence indicators indicating a neutral stance.

We may not see significant price movement if Bitcoin consolidates between $30,400 to $30,000. A bullish breakout above $30,400 could expose Bitcoin to levels around $30,900 or even $31,500.

On the other hand, a bearish break below the $30,000 level has the potential to push Bitcoin’s price down toward the $29,500 level.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.