Bitcoin price prediction continues to be bullish amid Coinbase Global’s revelation of its first quarterly profit in two years, buoyed by the SEC’s approval of Bitcoin ETFs, underscores a significant moment for the cryptocurrency market.

This development, alongside a 57% surge in Bitcoin’s price in Q4 2023, propelled Coinbase’s transaction revenue up by 64% to $529.3 million.

The enthusiasm surrounding Bitcoin ETFs and the anticipated increase in institutional investments have catalyzed optimism for Bitcoin’s future price trajectory.

As Coinbase projects further growth, the crypto market’s valuation soaring past $1 trillion signals a pivotal shift in Bitcoin’s journey towards widespread financial integration and investor confidence.

Coinbase Reports Profit Surge Post-Bitcoin ETF Approval

Coinbase Global Inc. has reported its first quarterly profit in two years, marking a significant turnaround in its financial performance. This achievement comes in the wake of the U.S. Securities and Exchange Commission’s (SEC) approval of spot bitcoin exchange-traded funds (ETFs), sparking renewed interest in the cryptocurrency market.

The approval led to a substantial 57% increase in Bitcoin’s price in the fourth quarter of 2023, contributing to a 64% rise in Coinbase’s transaction revenue, which reached $529.3 million.

Crypto exchange Coinbase posts first profit in two years on robust trading https://t.co/z1DPft2KIj pic.twitter.com/oPRMuFPqwh

— CNA (@ChannelNewsAsia) February 15, 2024

The company’s success in the last quarter has set a positive tone for its future, with projections for its subscription and services division’s revenue to fall between $410 million and $480 million in the coming quarter.

A significant portion of this revenue growth in Q4 can be attributed to stablecoin transactions, particularly through the partnership with Circle for USD Coin.

This recent profitable quarter, coupled with a hopeful outlook, is expected to bolster investor confidence in the cryptocurrency sector, potentially leading to an uptick in Bitcoin prices.

Blackrock’s Bitcoin ETF Soars: A New Chapter in Cryptocurrency Investment

Blackrock’s Ishares Bitcoin Trust (IBIT) has swiftly become a major player in the cryptocurrency space, accumulating nearly $5 billion in net assets and approximately 110,000 bitcoins since its launch about a month ago. This marks it as the leading spot exchange-traded fund (ETF) for bitcoin.

On February 14 alone, spot bitcoin ETFs experienced a remarkable inflow of $339.8 million, with IBIT capturing the largest share at $224.3 million.

Larry Fink, CEO of Blackrock, has publicly voiced his strong belief in bitcoin’s potential, further fueling investor enthusiasm despite concerns expressed by SEC Chairman Gary Gensler regarding bitcoin’s use in ransomware attacks.

The SEC’s endorsement of 11 spot bitcoin ETFs has significantly contributed to this bullish sentiment.

The robust accumulation of assets by IBIT highlights a growing institutional interest in bitcoin, suggesting a positive outlook for its market valuation.

Bitcoin ETFs Fuel Surge in Institutional Investments

Since the approval of ten spot Bitcoin exchange-traded funds (ETFs) in the US on January 11, a significant shift has occurred in the cryptocurrency investment landscape.

These ETFs now represent a striking 75% of all new Bitcoin investments, underscoring a robust institutional interest that has notably contributed to Bitcoin’s price rally.

Here’s a closer look at how Bitcoin ETFs are shaping the market:

- Spot Bitcoin ETFs Propel Market Growth: The introduction of Bitcoin ETFs has been a catalyst for Bitcoin’s price surge, pushing it above $50,000 and lifting its market capitalization to over $1 trillion for the first time since November 2021.

- Dominance of BlackRock’s iShares Bitcoin Trust ETF: Among the Bitcoin ETFs, BlackRock’s iShares Bitcoin Trust ETF leads with the most significant inflows, accumulating about 4,115 Bitcoin, valued at approximately $215 million.

- Market Capitalization and Future Projections: The total market capitalization of cryptocurrencies now stands at $1.96 trillion, reflecting a 2.01% increase. With institutional adoption and demand for ETFs on the rise, analysts predict Bitcoin’s price could soar beyond $56,000, though a resistance level at $52,000 suggests potential short-term challenges.

Bitcoin Price Prediction

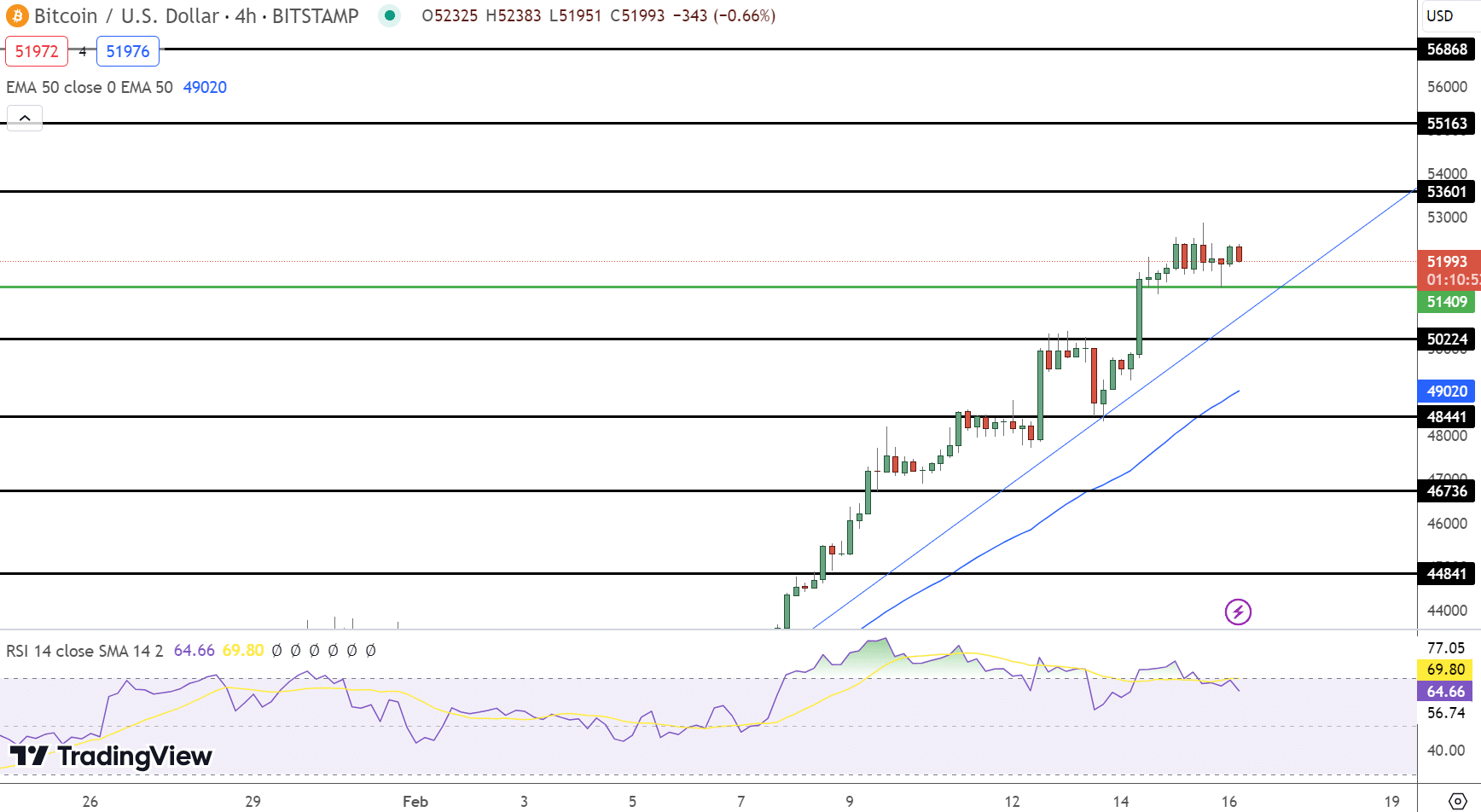

Bitcoin’s current pivot point stands around of $51,500, Bitcoin faces resistance levels between $53,601 and $56,863, delineating the hurdles for upward progression.

Conversely, support levels are established at $50,224, $48,441, and $46,736, offering a safety net against potential declines.

The Relative Strength Index (RSI) indicates a position at 64, hinting at an overbought scenario that may lead to a corrective pullback.

The 50-Day Exponential Moving Average (EMA) at 49,020 supports a bullish outlook, yet the proximity to overbought territory suggests vigilance for a possible near-term retraction.

This intricate balance underscores Bitcoin’s potential for both continued growth and the necessity for caution among investors.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.