Bitcoin price stands at $30,163, experiencing a slight decline of around 0.50% on Tuesday. However, the cryptocurrency market faces additional challenges, with the Securities and Exchange Commission (SEC) expressing disappointment over XRP investors’ decision.

These developments occur within a challenging macroeconomic environment, further adding to the complexities of predicting Bitcoin’s future price movements.

SEC ‘Disappointed’ With XRP Investors’ Decision

Gary Gensler, the chairman of the US Securities and Exchange Commission (SEC), expressed the agency’s disappointment with the SEC vs. Ripple decision regarding XRP and its impact on retail investors.

Gensler stated that the SEC is currently evaluating the opinion and reaffirmed their commitment to enforcing laws within the cryptocurrency sector to ensure compliance by crypto businesses.

Gensler emphasized the significance of safeguarding institutional investors and acknowledged the court’s position on “fair notice.”

While the SEC was unhappy with the ruling’s implications for retail investors, they are still considering and evaluating the decision.

Gensler emphasized the agency’s role in protecting the markets, investing public, and capital formation when asked about the future direction of the SEC’s crypto enforcement efforts.

The SEC will continue to work towards bringing non-compliant entities into compliance to safeguard the interests of the investing public.

The judge’s decision in the SEC vs. Ripple case has prompted calls from American legislators for the establishment of regulations to govern the cryptocurrency market.

With the SEC still pursuing legal action against Ripple’s ruling, the overall sentiment in the crypto market has come under pressure.

Navigating Turbulent Waters in a Challenging Macroeconomic Environment

The decline in Bitcoin prices can be attributed to various macroeconomic factors, with notable influence from China’s economic performance and regulatory actions.

In the second quarter, China’s gross domestic product growth slowed down to 6.3%, falling short of market expectations and adding to the challenging external conditions.

The economic deceleration in China can be attributed to several factors, including the ongoing trade war with the United States and the government’s efforts to address debt-related issues.

In this challenging macroeconomic environment, Bitcoin has faced additional pressures due to pending court decisions that could have a negative impact on the two largest exchanges.

Bitcoin Price Prediction

Taking a closer look at the technical analysis of Bitcoin, we can observe that it is currently finding immediate support around the $29,750 level. This support is further reinforced by a triple bottom pattern visible in the four-hour timeframe, indicating the potential for a bullish rebound in Bitcoin’s price.

However, it’s important to note that the relative strength index (RSI) and moving average convergence divergence (MACD) indicators are holding in a bearish zone, along with the 50-day exponential moving average, all suggesting a strong possibility of a downtrend.

In the event of a bearish break below the $29,750 level, it could open up further selling pressure, potentially leading Bitcoin’s price toward $29,300 or even lower towards $28,750.

On the other hand, a bullish break above the $30,400 level could expose Bitcoin to higher price levels, with potential targets at $30,900 or $31,750.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

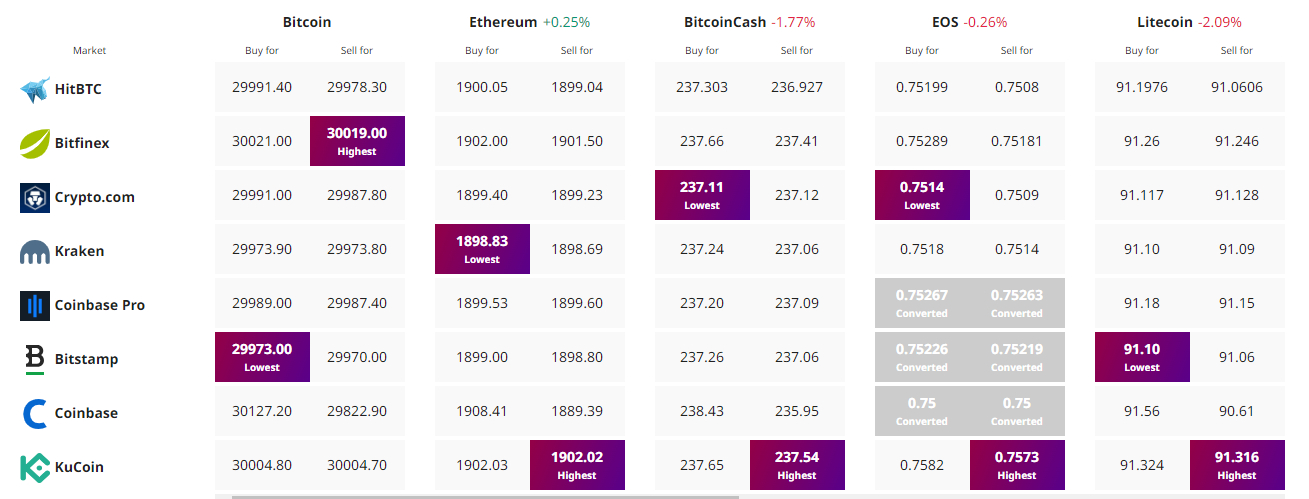

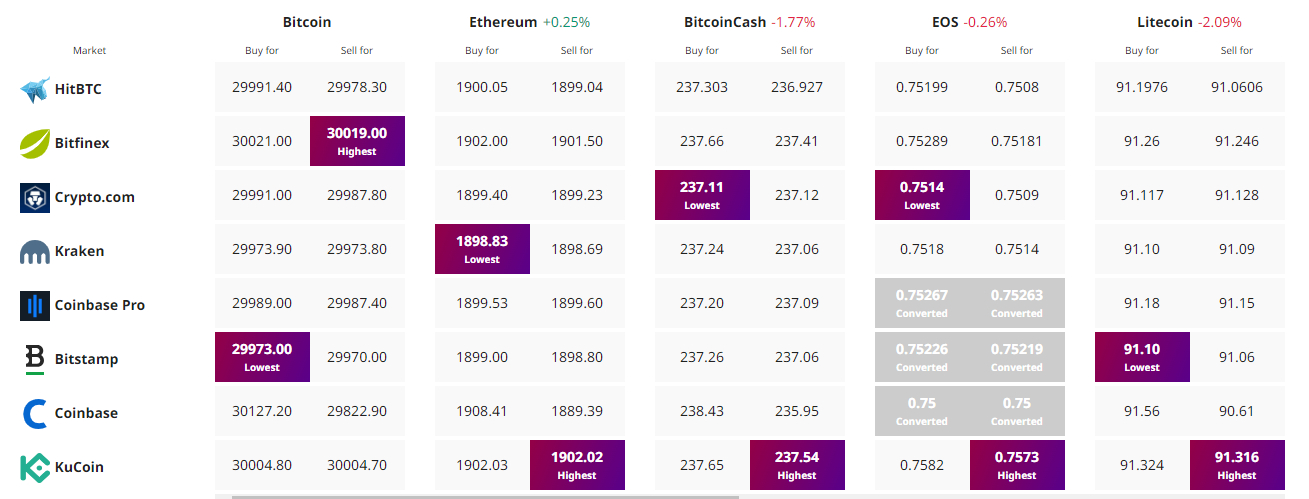

Find The Best Price to Buy/Sell Cryptocurrency

Bitcoin price stands at $30,163, experiencing a slight decline of around 0.50% on Tuesday. However, the cryptocurrency market faces additional challenges, with the Securities and Exchange Commission (SEC) expressing disappointment over XRP investors’ decision.

These developments occur within a challenging macroeconomic environment, further adding to the complexities of predicting Bitcoin’s future price movements.

SEC ‘Disappointed’ With XRP Investors’ Decision

Gary Gensler, the chairman of the US Securities and Exchange Commission (SEC), expressed the agency’s disappointment with the SEC vs. Ripple decision regarding XRP and its impact on retail investors.

Gensler stated that the SEC is currently evaluating the opinion and reaffirmed their commitment to enforcing laws within the cryptocurrency sector to ensure compliance by crypto businesses.

Gensler emphasized the significance of safeguarding institutional investors and acknowledged the court’s position on “fair notice.”

While the SEC was unhappy with the ruling’s implications for retail investors, they are still considering and evaluating the decision.

Gensler emphasized the agency’s role in protecting the markets, investing public, and capital formation when asked about the future direction of the SEC’s crypto enforcement efforts.

The SEC will continue to work towards bringing non-compliant entities into compliance to safeguard the interests of the investing public.

The judge’s decision in the SEC vs. Ripple case has prompted calls from American legislators for the establishment of regulations to govern the cryptocurrency market.

With the SEC still pursuing legal action against Ripple’s ruling, the overall sentiment in the crypto market has come under pressure.

Navigating Turbulent Waters in a Challenging Macroeconomic Environment

The decline in Bitcoin prices can be attributed to various macroeconomic factors, with notable influence from China’s economic performance and regulatory actions.

In the second quarter, China’s gross domestic product growth slowed down to 6.3%, falling short of market expectations and adding to the challenging external conditions.

The economic deceleration in China can be attributed to several factors, including the ongoing trade war with the United States and the government’s efforts to address debt-related issues.

In this challenging macroeconomic environment, Bitcoin has faced additional pressures due to pending court decisions that could have a negative impact on the two largest exchanges.

Bitcoin Price Prediction

Taking a closer look at the technical analysis of Bitcoin, we can observe that it is currently finding immediate support around the $29,750 level. This support is further reinforced by a triple bottom pattern visible in the four-hour timeframe, indicating the potential for a bullish rebound in Bitcoin’s price.

However, it’s important to note that the relative strength index (RSI) and moving average convergence divergence (MACD) indicators are holding in a bearish zone, along with the 50-day exponential moving average, all suggesting a strong possibility of a downtrend.

In the event of a bearish break below the $29,750 level, it could open up further selling pressure, potentially leading Bitcoin’s price toward $29,300 or even lower towards $28,750.

On the other hand, a bullish break above the $30,400 level could expose Bitcoin to higher price levels, with potential targets at $30,900 or $31,750.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency