Bitcoin’s price is slightly up at just above $26,200, while the overall crypto market has risen by 0.70% to a valuation of $1.05 trillion.

MicroStrategy’s acquisition of $150 million worth of Bitcoin has boosted confidence in the digital currency market and its role as an economic salve.

Despite concerns about interest rate hikes and rising bond yields, the market’s future performance depends on Federal Reserve Chairman Powell’s upcoming speech.

Expect some market fluctuations in the weeks ahead.

MicroStrategy’s Continuous Bitcoin Accumulation Signals Growing Confidence in Crypto Market

MicroStrategy (MSTR) has purchased 5,445 bitcoins for $147.3 million in cash since August 1, at an average price of $27,053 per bitcoin.

As of September 24, the company owns a total of 158,245 bitcoins, which they acquired at an average price of $29,582 per bitcoin, including costs.

It is well-known that the company’s co-founder and Executive Chairman, Michael Saylor, is a strong advocate of Bitcoin, and their current Bitcoin stash is worth about $4.68 billion.

MicroStrategy’s shares were trading at $324.89 on Monday, and they’ve recently made some accounting changes and raised $147.3 million by selling their common stock.

In 2020, they began purchasing Bitcoin as a hedge against inflation, with Michael Saylor playing a key role in their journey into crypto.

This positive news is likely to increase confidence in the cryptocurrency market, as the ongoing commitment of MicroStrategy to accumulate digital assets demonstrates Bitcoin’s resilience as an inflation hedge.

Michael Saylor’s influential role in crypto may further boost investor confidence, potentially causing upward pressure on BTC prices.

Bitcoin Emerges as a Lifeline in Lebanon’s Economic Crisis

Lebanon’s economy has collapsed with the local currency losing 95% of its value, rendering pensions worthless, banks closed, and ATMs empty. However, Bitcoin has emerged as an unexpected savior.

Lebanese citizens are turning to Bitcoin as a way to protect their wealth from the country’s rapid devaluation.

Bitcoin’s decentralized nature allows it to engage in international transactions when local systems fail. The growing reliance on this digital currency is highlighting its potential as a store of value and safe haven asset.

This increased adoption could contribute to upward pressure on Bitcoin prices.

Bitcoin Price Prediction

Bitcoin’s value is currently trading sideways, having fallen below the important support level of $26,500. There is a risk that it may drop even lower, below the significant benchmark of $26,000 in the near future.

Despite several attempts, Bitcoin has been unable to break through the resistance at $27,500 and has since experienced a significant pullback.

This has caused the digital currency to fall below the critical support levels of $27,000 and $26,500, putting it in a bearish territory.

Additionally, BTC dipped below the $26,200 support level, briefly approaching the $26,000 mark. However, it has since established a recent bottom around the $26,026 mark and is now in a phase of loss consolidation.

BTC presently hovers just above the 23.6% Fibonacci retracement level, with looming resistance at $26,350 and $26,500.

If BTC breaches $26,700, there’s potential for an upswing towards $27,000 and $27,500. If not, BTC might decline to $25,400 or even $25,000.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

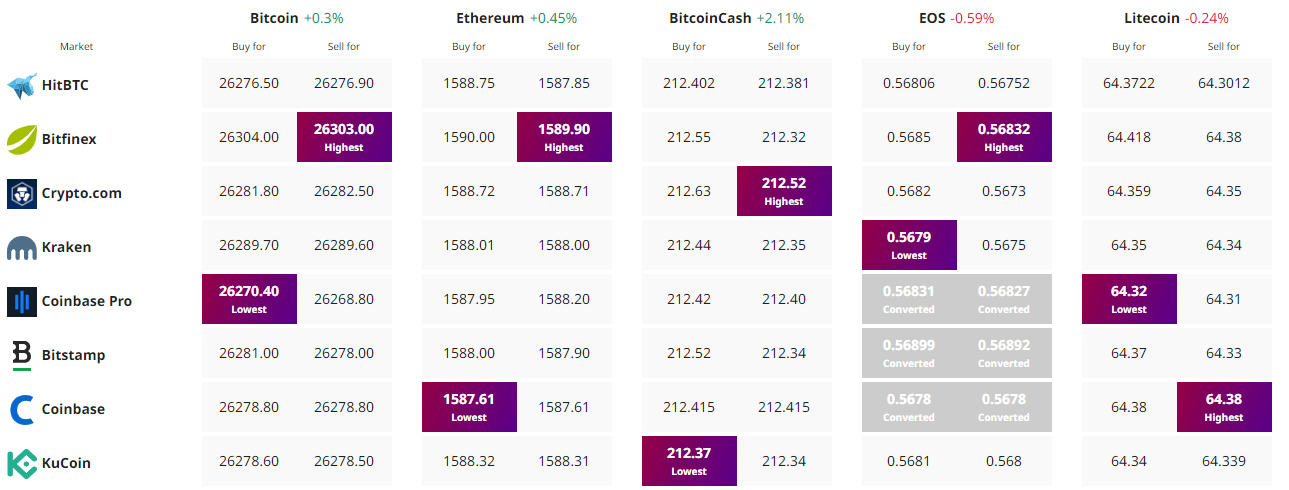

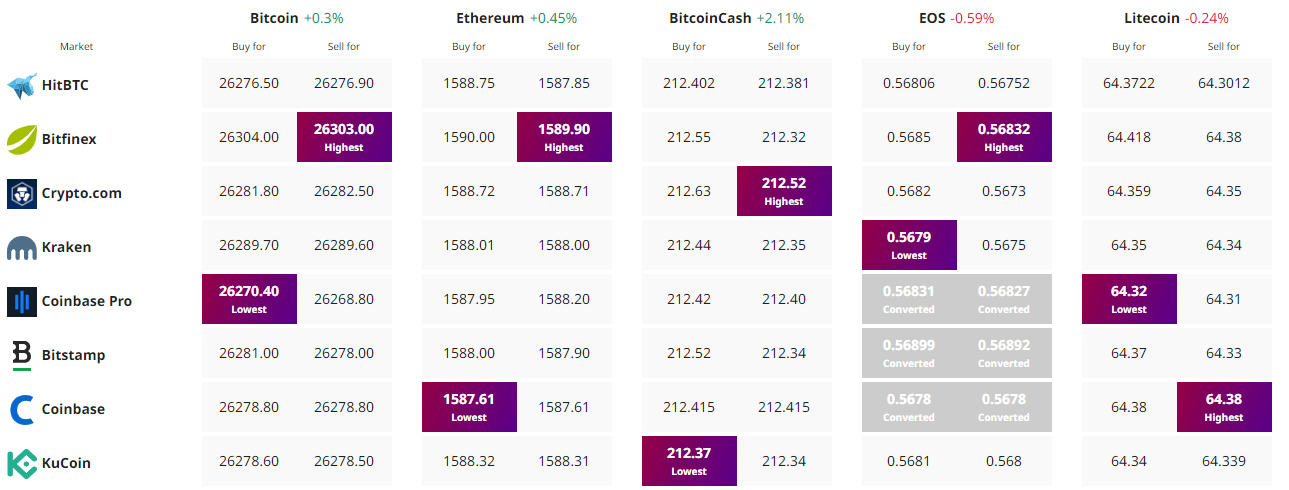

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin’s price is slightly up at just above $26,200, while the overall crypto market has risen by 0.70% to a valuation of $1.05 trillion.

MicroStrategy’s acquisition of $150 million worth of Bitcoin has boosted confidence in the digital currency market and its role as an economic salve.

Despite concerns about interest rate hikes and rising bond yields, the market’s future performance depends on Federal Reserve Chairman Powell’s upcoming speech.

Expect some market fluctuations in the weeks ahead.

MicroStrategy’s Continuous Bitcoin Accumulation Signals Growing Confidence in Crypto Market

MicroStrategy (MSTR) has purchased 5,445 bitcoins for $147.3 million in cash since August 1, at an average price of $27,053 per bitcoin.

As of September 24, the company owns a total of 158,245 bitcoins, which they acquired at an average price of $29,582 per bitcoin, including costs.

It is well-known that the company’s co-founder and Executive Chairman, Michael Saylor, is a strong advocate of Bitcoin, and their current Bitcoin stash is worth about $4.68 billion.

MicroStrategy’s shares were trading at $324.89 on Monday, and they’ve recently made some accounting changes and raised $147.3 million by selling their common stock.

In 2020, they began purchasing Bitcoin as a hedge against inflation, with Michael Saylor playing a key role in their journey into crypto.

This positive news is likely to increase confidence in the cryptocurrency market, as the ongoing commitment of MicroStrategy to accumulate digital assets demonstrates Bitcoin’s resilience as an inflation hedge.

Michael Saylor’s influential role in crypto may further boost investor confidence, potentially causing upward pressure on BTC prices.

Bitcoin Emerges as a Lifeline in Lebanon’s Economic Crisis

Lebanon’s economy has collapsed with the local currency losing 95% of its value, rendering pensions worthless, banks closed, and ATMs empty. However, Bitcoin has emerged as an unexpected savior.

Lebanese citizens are turning to Bitcoin as a way to protect their wealth from the country’s rapid devaluation.

Bitcoin’s decentralized nature allows it to engage in international transactions when local systems fail. The growing reliance on this digital currency is highlighting its potential as a store of value and safe haven asset.

This increased adoption could contribute to upward pressure on Bitcoin prices.

Bitcoin Price Prediction

Bitcoin’s value is currently trading sideways, having fallen below the important support level of $26,500. There is a risk that it may drop even lower, below the significant benchmark of $26,000 in the near future.

Despite several attempts, Bitcoin has been unable to break through the resistance at $27,500 and has since experienced a significant pullback.

This has caused the digital currency to fall below the critical support levels of $27,000 and $26,500, putting it in a bearish territory.

Additionally, BTC dipped below the $26,200 support level, briefly approaching the $26,000 mark. However, it has since established a recent bottom around the $26,026 mark and is now in a phase of loss consolidation.

BTC presently hovers just above the 23.6% Fibonacci retracement level, with looming resistance at $26,350 and $26,500.

If BTC breaches $26,700, there’s potential for an upswing towards $27,000 and $27,500. If not, BTC might decline to $25,400 or even $25,000.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.