In cryptocurrency’s ever-evolving landscape, Bitcoin’s price continues to capture attention as it trades at $29,723, experiencing a slight decrease of nearly 0.50% on Monday.

Amidst the dynamic market conditions, regulatory perspectives play a crucial role in shaping the future of crypto.

Ben Zhou, the CEO of Bybit, a prominent cryptocurrency exchange, sheds light on the regulatory outlook, emphasizing that regulators view the crypto industry as an “opportunity” rather than a crisis.

As the market navigates through fluctuations, gaining insights from industry leaders like Ben Zhou can provide valuable perspectives on the future of Bitcoin and the wider crypto market.

Regulators Embrace Crypto as an “Opportunity” According to Bybit CEO Ben Zhou

The CEO of Bybit, Ben Zhou, recently shared his insights on how regulators perceive the cryptocurrency industry in various regions, highlighting a positive shift towards collaboration and opportunity.

In contrast to the anxiety-driven licensing process of the past, regulators in Asia and the Middle East are now more inclined to work with crypto companies rather than oppose them.

Despite this optimistic outlook, BTC prices did not see a significant upward movement.

Zhou specifically pointed out Hong Kong’s aggressive approach to attracting crypto businesses and Dubai’s advanced regulatory framework for virtual assets.

However, due to the evolving regulatory landscape, Bybit has faced challenges in certain markets like the US and Canada, with plans to re-enter the Canadian market if the rules change.

Bitcoin Price Prediction

Monday’s technical analysis indicates that Bitcoin is currently experiencing low volatility, leading to erratic price movements within a confined trading range.

On the daily chart, Bitcoin is in a consolidation phase, with resistance seen around $31,400 and support identified at approximately $29,600.

A critical factor to observe is whether Bitcoin can conclusively break above the $29,600 level, potentially triggering a bullish rally for the cryptocurrency.

On the other hand, a clear break below $29,600 may lead to support levels around $28,450 and possibly even lower to around $27,450.

To facilitate an upward trend, surpassing the $31,350 level will open the door to the next significant target at approximately $32,500.

Given these price levels, it is vital to closely monitor the $29,600 level as a pivotal point for today’s trading activities.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest happenings in initial coin offering (ICO) projects and alternative cryptocurrencies with our carefully curated selection of the top 15 digital assets to watch in 2023.

This comprehensive list, compiled by industry experts from Industry Talk and Cryptonews, offers professional recommendations and invaluable insights.

By regularly exploring this meticulously crafted collection, you can stay ahead of the competition and gain a deeper understanding of the potential these cryptocurrencies hold.

Navigate the dynamic landscape of digital assets with confidence and seize opportunities to maximize your investment strategies.

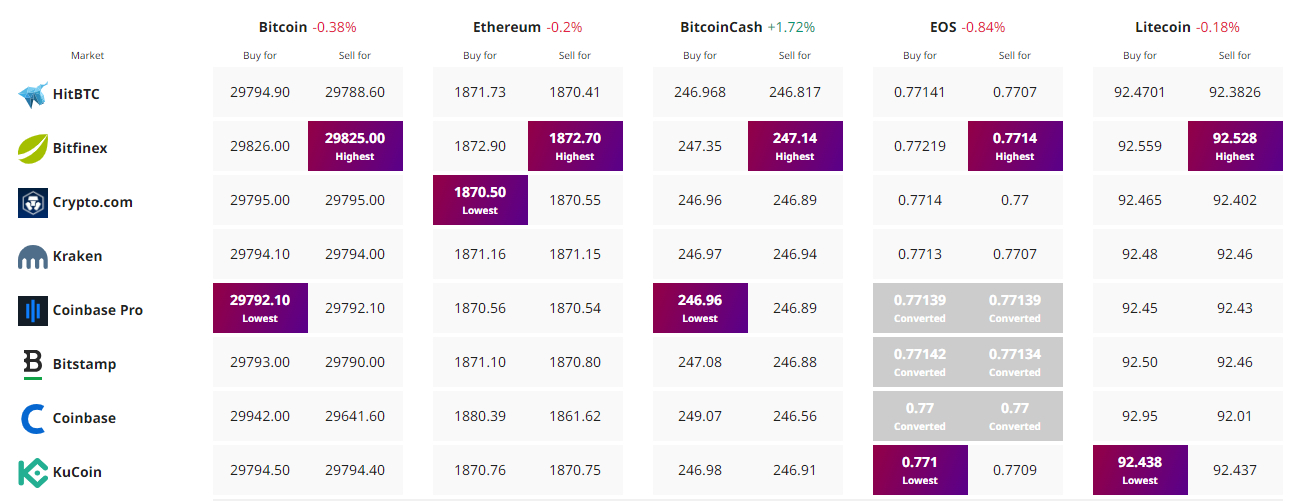

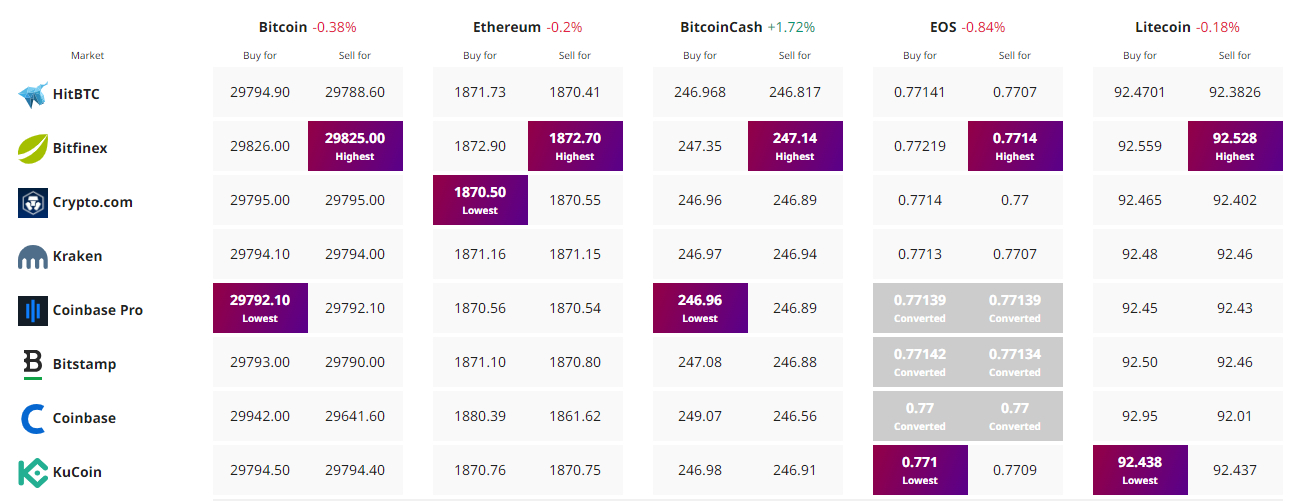

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

In cryptocurrency’s ever-evolving landscape, Bitcoin’s price continues to capture attention as it trades at $29,723, experiencing a slight decrease of nearly 0.50% on Monday.

Amidst the dynamic market conditions, regulatory perspectives play a crucial role in shaping the future of crypto.

Ben Zhou, the CEO of Bybit, a prominent cryptocurrency exchange, sheds light on the regulatory outlook, emphasizing that regulators view the crypto industry as an “opportunity” rather than a crisis.

As the market navigates through fluctuations, gaining insights from industry leaders like Ben Zhou can provide valuable perspectives on the future of Bitcoin and the wider crypto market.

Regulators Embrace Crypto as an “Opportunity” According to Bybit CEO Ben Zhou

The CEO of Bybit, Ben Zhou, recently shared his insights on how regulators perceive the cryptocurrency industry in various regions, highlighting a positive shift towards collaboration and opportunity.

In contrast to the anxiety-driven licensing process of the past, regulators in Asia and the Middle East are now more inclined to work with crypto companies rather than oppose them.

Despite this optimistic outlook, BTC prices did not see a significant upward movement.

Zhou specifically pointed out Hong Kong’s aggressive approach to attracting crypto businesses and Dubai’s advanced regulatory framework for virtual assets.

However, due to the evolving regulatory landscape, Bybit has faced challenges in certain markets like the US and Canada, with plans to re-enter the Canadian market if the rules change.

Bitcoin Price Prediction

Monday’s technical analysis indicates that Bitcoin is currently experiencing low volatility, leading to erratic price movements within a confined trading range.

On the daily chart, Bitcoin is in a consolidation phase, with resistance seen around $31,400 and support identified at approximately $29,600.

A critical factor to observe is whether Bitcoin can conclusively break above the $29,600 level, potentially triggering a bullish rally for the cryptocurrency.

On the other hand, a clear break below $29,600 may lead to support levels around $28,450 and possibly even lower to around $27,450.

To facilitate an upward trend, surpassing the $31,350 level will open the door to the next significant target at approximately $32,500.

Given these price levels, it is vital to closely monitor the $29,600 level as a pivotal point for today’s trading activities.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest happenings in initial coin offering (ICO) projects and alternative cryptocurrencies with our carefully curated selection of the top 15 digital assets to watch in 2023.

This comprehensive list, compiled by industry experts from Industry Talk and Cryptonews, offers professional recommendations and invaluable insights.

By regularly exploring this meticulously crafted collection, you can stay ahead of the competition and gain a deeper understanding of the potential these cryptocurrencies hold.

Navigate the dynamic landscape of digital assets with confidence and seize opportunities to maximize your investment strategies.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.