Despite a challenging day for the crypto market, Bitcoin price remained steadfast above the $29,000 threshold. This stability can likely be attributed to Fidelity’s recent modifications to its Bitcoin ETF proposal.

Within these changes, Fidelity delineated its strategies to safeguard customer Bitcoin assets and transparently communicate associated risks.

It’s worth highlighting that ARK Invest and Invesco undertook similar actions last week, adding momentum to ongoing dialogues with the SEC. Presently, investor focus has shifted towards Federal Reserve Chair Jerome Powell’s anticipated speech at the Economic Club of New York.

The race for Bitcoin ETF draws attention as it presents a regulated avenue to tap into Bitcoin price dynamics. Despite regulatory hitches, there’s strong anticipation for approval as the traditional finance sector increasingly embraces crypto.

The market remains upbeat, with potentially sizeable inflows if ETFs are approved. While Bitcoin holds firm above $29,000, Ethereum hovers around $1,600, with overarching macroeconomic uncertainties persisting.

BlackRock Updates Bitcoin ETF Application

Notably, BlackRock, the globe’s premier asset manager, has recently updated its application for a Bitcoin exchange-traded fund (ETF) to the US SEC. In this recent submission, they acknowledge the burgeoning competition for Bitcoin ETF ratification and expand on their product’s pricing and reporting mechanisms.

BlackRock’s inaugural ETF application was tabled in June 2023. By July, they had refiled, embedding a surveillance-sharing agreement with Coinbase and Nasdaq. Their newest filing emphasizes that the Trust’s success is far from guaranteed, especially given the fierce competition. Among their rivals is Grayscale, a leading Bitcoin trust fund.

The application delves into how the Trust’s price source is ascertained, offering clarity absent in prior versions. Furthermore, BlackRock provides insights into their benchmark index computation, aggregating Bitcoin prices from multiple exchanges to underpin their ETF.

Recently, BlackRock joined Ark Invest and Fidelity as the third contender to refresh its Bitcoin ETF application. Many industry analysts interpret these revisions as progressive moves toward obtaining endorsement.

The buzz surrounding BlackRock’s updated Bitcoin ETF application, and those of its peers, can foster a positive atmosphere. This, in turn, might exert upward thrust on Bitcoin’s value, strengthening investor trust.

Grayscale Advances Bitcoin ETF Plans After Legal Triumph

Significantly, Grayscale Investments is propelling its vision for a Bitcoin ETF, emboldened by a recent court verdict in its favour.

This development marks a pivotal phase for Grayscale, especially considering their historical legal tussles with the SEC over previous ETF ventures.

After an August judicial win – wherein the court chastised the SEC’s earlier rejection as “arbitrary and capricious” – Grayscale returns with a renewed application for the SEC’s consideration.

This court win has heightened expectations of an imminent verdict, which could redefine the crypto ETF terrain. Currently, Grayscale is utilizing an S-3 form to register GBTC shares, a deviation from the traditional S-1 form, due to GBTC’s recognition as an SEC-reporting entity since January 2020.

For this ETF metamorphosis to materialize, Grayscale requires three green lights: NYSE Arca’s submission, Regulation M relief, and the SEC’s affirmation of the S-3 form’s validity. Undeterred, Grayscale remains resolute in its mission, keen on collaborating with the SEC to prioritize their investors’ welfare.

Consequently, Grayscale’s court victory and its progress on the Bitcoin ETF front may amplify investor faith in the crypto realm, potentially ushering in an affirmative sway on Bitcoin’s valuation.

Bitcoin Price Prediction

The dynamic nature of the cryptocurrency market is evident, with Bitcoin (BTC/USD) being the centrepiece of attention today. Bitcoin, the digital titan, trades at $29,255.17 USD, marking an impressive 3.43% rise in the past 24 hours.

Diving deeper into the technical analysis, the 4-hour chart offers significant insights. Let’s dissect the vital levels and indicators:

- BTC Key Price Levels

The pivot point for Bitcoin stands at $28,723.92. On the upside, resistances are plotted at $29,441.95, followed by $30,124.08 and then at $30,842.11.

Conversely, if the asset were to descend, immediate support would be found at $27,969.98, with subsequent supports at $27,251.95 and $26,480.07.

- Technical Indicators

The RSI (Relative Strength Index) is currently at 78. This elevated value indicates an overbought scenario, suggesting caution for traders. Generally, an RSI above 50 is a sign of bullish momentum.

The MACD (Moving Average Convergence Divergence) presents a different narrative. While the MACD line is at 44.6000, it remains below the signal line, set at 349.2000, indicating potential bearishness in the near term.

As for the 50 EMA (50-Day Exponential Moving Average), it’s priced at $28,023.84. With Bitcoin trading above this level, the short-term trend leans bullish.

The overarching trend suggests a bearish bias below the $29,250 mark, but this could flip bullish if prices rally above.

In the short term, should Bitcoin maintain its momentum above the pivotal $29,250, it’s plausible to see it challenge the immediate resistance at $29,441.95.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

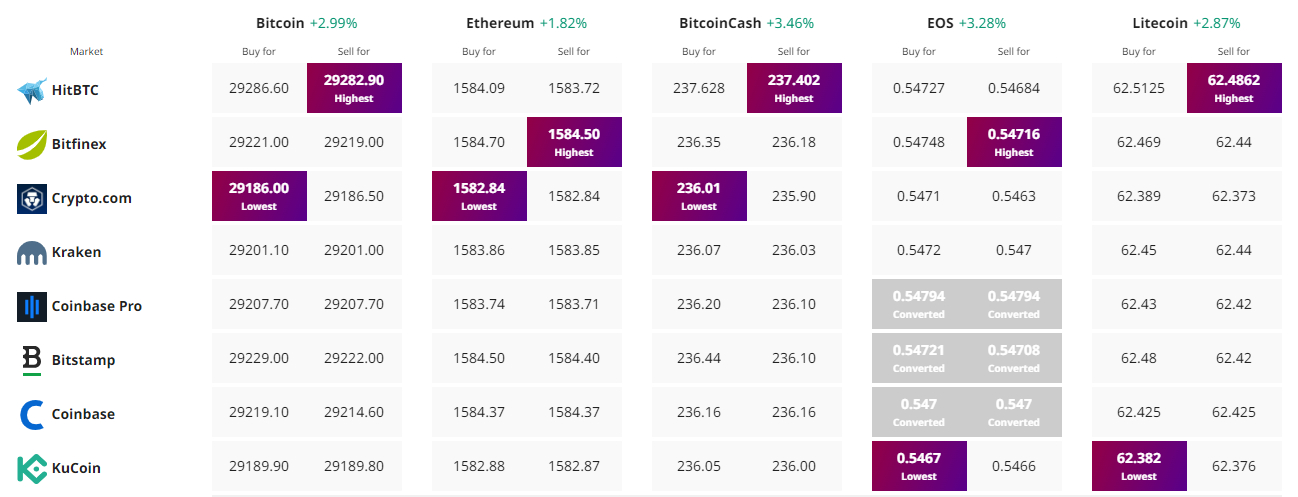

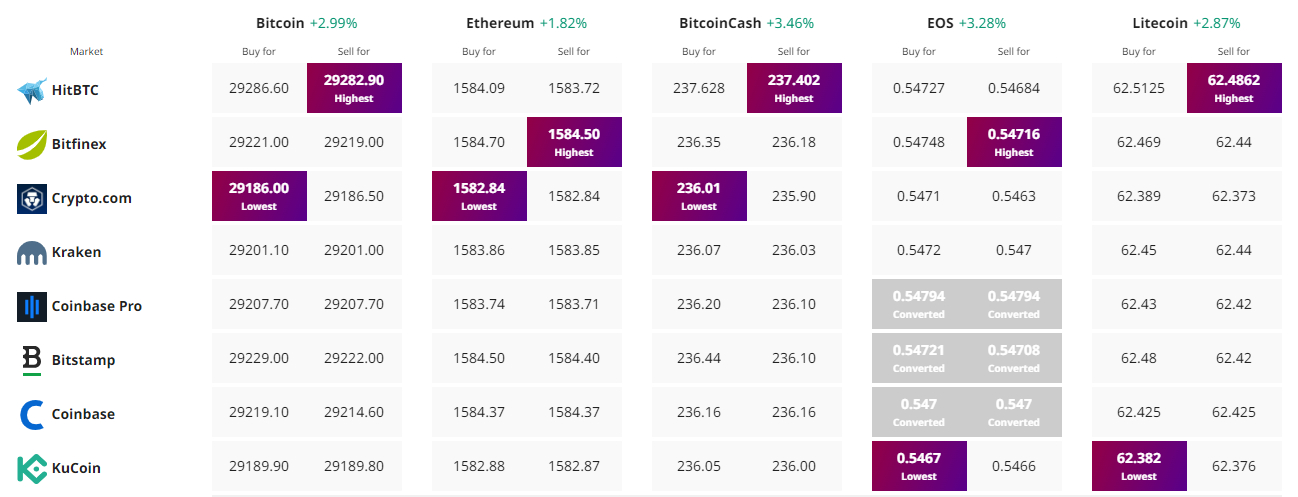

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Despite a challenging day for the crypto market, Bitcoin price remained steadfast above the $29,000 threshold. This stability can likely be attributed to Fidelity’s recent modifications to its Bitcoin ETF proposal.

Within these changes, Fidelity delineated its strategies to safeguard customer Bitcoin assets and transparently communicate associated risks.

It’s worth highlighting that ARK Invest and Invesco undertook similar actions last week, adding momentum to ongoing dialogues with the SEC. Presently, investor focus has shifted towards Federal Reserve Chair Jerome Powell’s anticipated speech at the Economic Club of New York.

The race for Bitcoin ETF draws attention as it presents a regulated avenue to tap into Bitcoin price dynamics. Despite regulatory hitches, there’s strong anticipation for approval as the traditional finance sector increasingly embraces crypto.

The market remains upbeat, with potentially sizeable inflows if ETFs are approved. While Bitcoin holds firm above $29,000, Ethereum hovers around $1,600, with overarching macroeconomic uncertainties persisting.

BlackRock Updates Bitcoin ETF Application

Notably, BlackRock, the globe’s premier asset manager, has recently updated its application for a Bitcoin exchange-traded fund (ETF) to the US SEC. In this recent submission, they acknowledge the burgeoning competition for Bitcoin ETF ratification and expand on their product’s pricing and reporting mechanisms.

BlackRock’s inaugural ETF application was tabled in June 2023. By July, they had refiled, embedding a surveillance-sharing agreement with Coinbase and Nasdaq. Their newest filing emphasizes that the Trust’s success is far from guaranteed, especially given the fierce competition. Among their rivals is Grayscale, a leading Bitcoin trust fund.

The application delves into how the Trust’s price source is ascertained, offering clarity absent in prior versions. Furthermore, BlackRock provides insights into their benchmark index computation, aggregating Bitcoin prices from multiple exchanges to underpin their ETF.

Recently, BlackRock joined Ark Invest and Fidelity as the third contender to refresh its Bitcoin ETF application. Many industry analysts interpret these revisions as progressive moves toward obtaining endorsement.

The buzz surrounding BlackRock’s updated Bitcoin ETF application, and those of its peers, can foster a positive atmosphere. This, in turn, might exert upward thrust on Bitcoin’s value, strengthening investor trust.

Grayscale Advances Bitcoin ETF Plans After Legal Triumph

Significantly, Grayscale Investments is propelling its vision for a Bitcoin ETF, emboldened by a recent court verdict in its favour.

This development marks a pivotal phase for Grayscale, especially considering their historical legal tussles with the SEC over previous ETF ventures.

After an August judicial win – wherein the court chastised the SEC’s earlier rejection as “arbitrary and capricious” – Grayscale returns with a renewed application for the SEC’s consideration.

This court win has heightened expectations of an imminent verdict, which could redefine the crypto ETF terrain. Currently, Grayscale is utilizing an S-3 form to register GBTC shares, a deviation from the traditional S-1 form, due to GBTC’s recognition as an SEC-reporting entity since January 2020.

For this ETF metamorphosis to materialize, Grayscale requires three green lights: NYSE Arca’s submission, Regulation M relief, and the SEC’s affirmation of the S-3 form’s validity. Undeterred, Grayscale remains resolute in its mission, keen on collaborating with the SEC to prioritize their investors’ welfare.

Consequently, Grayscale’s court victory and its progress on the Bitcoin ETF front may amplify investor faith in the crypto realm, potentially ushering in an affirmative sway on Bitcoin’s valuation.

Bitcoin Price Prediction

The dynamic nature of the cryptocurrency market is evident, with Bitcoin (BTC/USD) being the centrepiece of attention today. Bitcoin, the digital titan, trades at $29,255.17 USD, marking an impressive 3.43% rise in the past 24 hours.

Diving deeper into the technical analysis, the 4-hour chart offers significant insights. Let’s dissect the vital levels and indicators:

- BTC Key Price Levels

The pivot point for Bitcoin stands at $28,723.92. On the upside, resistances are plotted at $29,441.95, followed by $30,124.08 and then at $30,842.11.

Conversely, if the asset were to descend, immediate support would be found at $27,969.98, with subsequent supports at $27,251.95 and $26,480.07.

- Technical Indicators

The RSI (Relative Strength Index) is currently at 78. This elevated value indicates an overbought scenario, suggesting caution for traders. Generally, an RSI above 50 is a sign of bullish momentum.

The MACD (Moving Average Convergence Divergence) presents a different narrative. While the MACD line is at 44.6000, it remains below the signal line, set at 349.2000, indicating potential bearishness in the near term.

As for the 50 EMA (50-Day Exponential Moving Average), it’s priced at $28,023.84. With Bitcoin trading above this level, the short-term trend leans bullish.

The overarching trend suggests a bearish bias below the $29,250 mark, but this could flip bullish if prices rally above.

In the short term, should Bitcoin maintain its momentum above the pivotal $29,250, it’s plausible to see it challenge the immediate resistance at $29,441.95.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.