Bitcoin (BTC), the world’s top cryptocurrency, recently experienced a remarkable surge, surpassing the $28,000 mark on Monday. At that time, the entire cryptocurrency market boasted a total worth of approximately $1.11 trillion, marking a 3.05% growth within the past 24 hours.

However, this sudden upward movement can be attributed to an unexpected surge in demand for Bitcoin and Ethereum.

In a matter of just 15 minutes, the value of two leading cryptocurrencies saw a significant increase of 4%, which came as a surprise to many investors and traders.

As a result, more than $70 million worth of short positions in the cryptocurrency market were quickly liquidated.

This event has generated a lot of excitement among crypto enthusiasts and investors, raising hopes for a bullish trend throughout October.

October Crypto Surge: Bitcoin and Ethereum Show Promising Signs

It is important to note that Bitcoin and Ethereum experienced an increase of about 4% within just 15 minutes on October 1st. This sudden surge gave people hope for a profitable October, but it also caused over $70 million in short trades to incur losses, surprising traders.

Bitcoin’s value rose from around $27,100 to nearly $28,000, while Ethereum briefly touched $1,755 before stabilizing at $1,727.

This occurred during what is commonly known as “Uptober,” a term used to describe the trend of cryptocurrencies performing well during the month of October.

Bitcoin has recently experienced a surge in price, breaking the $27,500 mark after a month of steady prices. The cryptocurrency is now aiming to reach $28,000, and if it manages to maintain this level, it could potentially surpass $30,000.

This would kickstart what is referred to as “Uptober,” a period of positive performance for the crypto market in October.

Cryptocurrency Optimism: ETF Approvals and Market Recovery

Another factor contributing to the increase in BTC’s price is the recent SEC approval given to Valkyrie Funds to introduce Ethereum futures in their Bitcoin futures ETF. This indicates a growing interest in cryptocurrency futures.

Furthermore, in addition to the modest recovery of US stocks, the decrease in the 10-year Treasury yield from a 16-year high has also played a role in the market.

In addition, VanEck’s filing for an Ethereum futures-based ETF has sparked discussions about ETFs for digital assets, generating optimism. Bitcoin’s recognition in Shanghai has added to the positive sentiment, although the delay by the SEC in deciding on cryptocurrency ETFs has caused overall anticipation in the crypto world.

Bitcoin Price Prediction

Bitcoin, often considered the king of cryptocurrencies, has recently seen significant bullish momentum. From a 4-hour chart perspective, key price levels to watch include a pivot point at $27,334. BTC has faced immediate resistance at $28,260; further resistance looms at $28,800 and $29,300.

Conversely, Bitcoin can find support at $26,900, with subsequent supports positioned at $26,500 and $25,995.

Technical Indicators: When we dive into the technical indicators, the story becomes even more interesting. The Relative Strength Index (RSI) stands at a high of 80. Typically, an RSI above 70 indicates overbought conditions, suggesting caution for traders as a pullback might be around the corner.

The Moving Average Convergence Divergence (MACD) registers a value of 106, with its signal line at 202. The price remains comfortably above the 50-day Exponential Moving Average (50 EMA), which is pegged at $26,910. This serves as a bullish indication of the asset’s short-term trajectory.

In terms of chart patterns, the appearance of the ‘Three White Soldiers’ pattern underlines a robust buying sentiment. This is a clear bullish signal, further emphasizing the asset’s strong upward momentum.

On the fundamental front, recent ETF approvals and a general surge in the crypto market in October have positively influenced Bitcoin’s price. These key events have played a significant role in driving Bitcoin’s current bullish momentum.

In conclusion, the overall trend for Bitcoin remains bullish. Investors might consider buying above $27,500, targeting $28,800 or even $29,300. However, caution is advised: if Bitcoin fails to breach the $28,300 level, it might induce a selling trend.

In the short term, we can expect Bitcoin to test the $28,800 resistance and possibly even aim for $29,300 in the subsequent days, depending on the market’s vigor.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

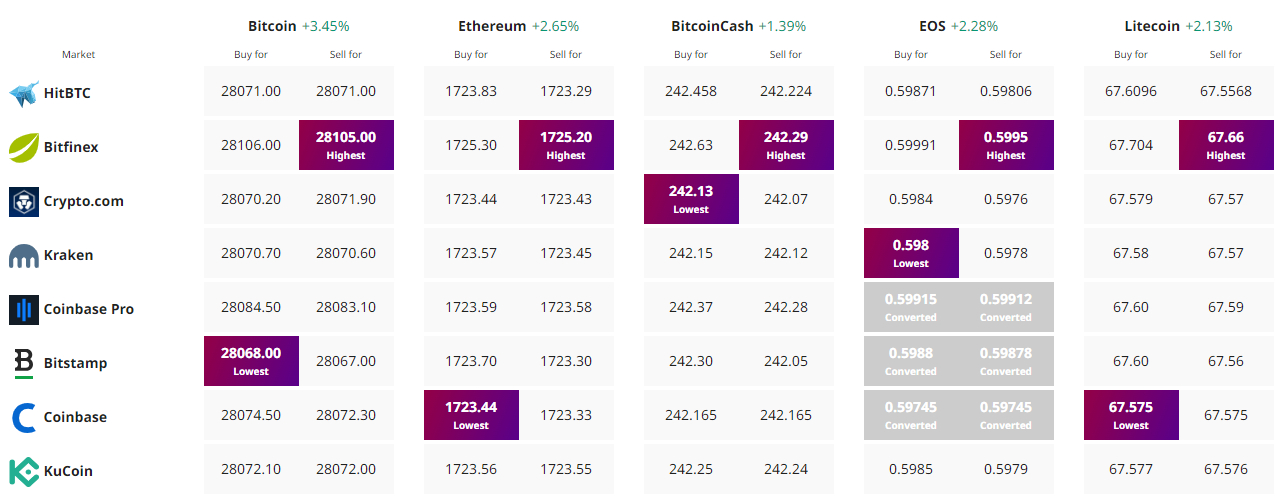

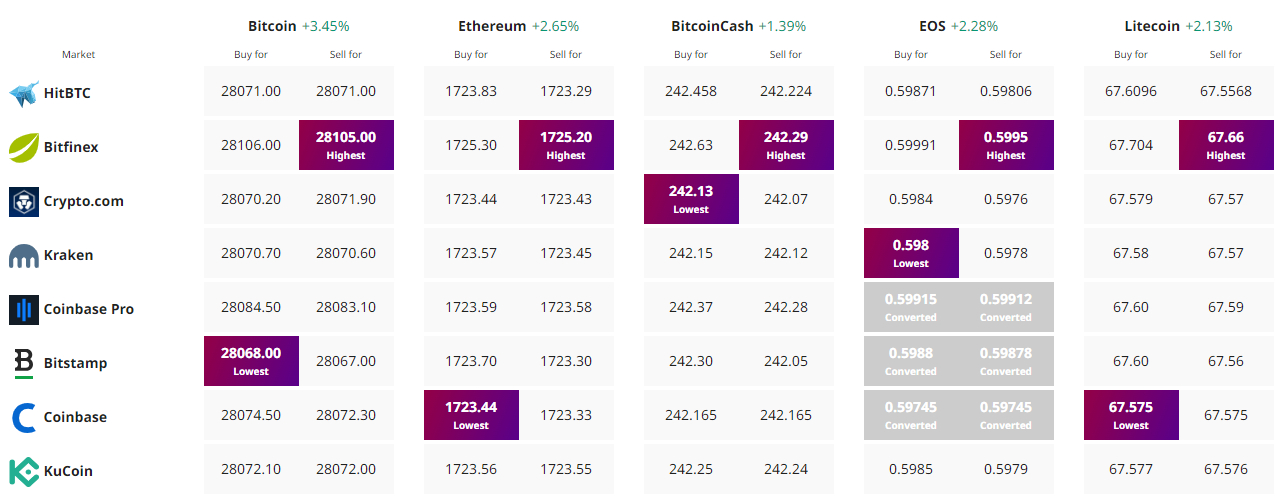

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin (BTC), the world’s top cryptocurrency, recently experienced a remarkable surge, surpassing the $28,000 mark on Monday. At that time, the entire cryptocurrency market boasted a total worth of approximately $1.11 trillion, marking a 3.05% growth within the past 24 hours.

However, this sudden upward movement can be attributed to an unexpected surge in demand for Bitcoin and Ethereum.

In a matter of just 15 minutes, the value of two leading cryptocurrencies saw a significant increase of 4%, which came as a surprise to many investors and traders.

As a result, more than $70 million worth of short positions in the cryptocurrency market were quickly liquidated.

This event has generated a lot of excitement among crypto enthusiasts and investors, raising hopes for a bullish trend throughout October.

October Crypto Surge: Bitcoin and Ethereum Show Promising Signs

It is important to note that Bitcoin and Ethereum experienced an increase of about 4% within just 15 minutes on October 1st. This sudden surge gave people hope for a profitable October, but it also caused over $70 million in short trades to incur losses, surprising traders.

Bitcoin’s value rose from around $27,100 to nearly $28,000, while Ethereum briefly touched $1,755 before stabilizing at $1,727.

This occurred during what is commonly known as “Uptober,” a term used to describe the trend of cryptocurrencies performing well during the month of October.

Bitcoin has recently experienced a surge in price, breaking the $27,500 mark after a month of steady prices. The cryptocurrency is now aiming to reach $28,000, and if it manages to maintain this level, it could potentially surpass $30,000.

This would kickstart what is referred to as “Uptober,” a period of positive performance for the crypto market in October.

Cryptocurrency Optimism: ETF Approvals and Market Recovery

Another factor contributing to the increase in BTC’s price is the recent SEC approval given to Valkyrie Funds to introduce Ethereum futures in their Bitcoin futures ETF. This indicates a growing interest in cryptocurrency futures.

Furthermore, in addition to the modest recovery of US stocks, the decrease in the 10-year Treasury yield from a 16-year high has also played a role in the market.

In addition, VanEck’s filing for an Ethereum futures-based ETF has sparked discussions about ETFs for digital assets, generating optimism. Bitcoin’s recognition in Shanghai has added to the positive sentiment, although the delay by the SEC in deciding on cryptocurrency ETFs has caused overall anticipation in the crypto world.

Bitcoin Price Prediction

Bitcoin, often considered the king of cryptocurrencies, has recently seen significant bullish momentum. From a 4-hour chart perspective, key price levels to watch include a pivot point at $27,334. BTC has faced immediate resistance at $28,260; further resistance looms at $28,800 and $29,300.

Conversely, Bitcoin can find support at $26,900, with subsequent supports positioned at $26,500 and $25,995.

Technical Indicators: When we dive into the technical indicators, the story becomes even more interesting. The Relative Strength Index (RSI) stands at a high of 80. Typically, an RSI above 70 indicates overbought conditions, suggesting caution for traders as a pullback might be around the corner.

The Moving Average Convergence Divergence (MACD) registers a value of 106, with its signal line at 202. The price remains comfortably above the 50-day Exponential Moving Average (50 EMA), which is pegged at $26,910. This serves as a bullish indication of the asset’s short-term trajectory.

In terms of chart patterns, the appearance of the ‘Three White Soldiers’ pattern underlines a robust buying sentiment. This is a clear bullish signal, further emphasizing the asset’s strong upward momentum.

On the fundamental front, recent ETF approvals and a general surge in the crypto market in October have positively influenced Bitcoin’s price. These key events have played a significant role in driving Bitcoin’s current bullish momentum.

In conclusion, the overall trend for Bitcoin remains bullish. Investors might consider buying above $27,500, targeting $28,800 or even $29,300. However, caution is advised: if Bitcoin fails to breach the $28,300 level, it might induce a selling trend.

In the short term, we can expect Bitcoin to test the $28,800 resistance and possibly even aim for $29,300 in the subsequent days, depending on the market’s vigor.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.