Bitcoin’s price is trading choppy above the $29,000 threshold, and has captured the attention of traders and investors.

With a current price of $29,216 and a 24-hour trading volume of $12.4 billion, Bitcoin’s performance is being closely monitored by market participants.

However, all eyes are also on the upcoming release of the US Non-Farm Payrolls (NFP) figures, as the data could potentially have a significant impact on Bitcoin’s trajectory.

Let’s examine the Bitcoin price prediction and how the NFP figures might impact the cryptocurrency market.

USD Strengthens Ahead of Anticipated Non-Farm Employment Data Release

Ahead of Friday’s scheduled release of Non-Farm Employment data, the USD has shown signs of strength.

This positive outlook is due to the anticipation of July’s figures, with the market expecting a decrease of 6K jobs from June, bringing the total to around 203K.

Additionally, the Average Hourly Earnings for July are predicted to be at 0.3%, a slight drop from June’s 0.4%. Overall, there are expectations for a better-than-average report.

Surprising Numbers Lead to Changes in Market Pricing

The recent increase in the price of Bitcoin is mainly due to its strong performance on the Cash App platform by Block.

Although there was a small decrease in Bitcoin profits in comparison to the first quarter of 2023, they are still 7% higher than last year.

Block Inc., a payment technology company, announced impressive Q2 results, with a 34% YoY increase in Bitcoin revenue, reaching $29,216.

During the Q2 earnings call, the company revealed that they made a staggering $2.4 billion in Bitcoin sales on the Cash App, resulting in a gross profit of $44 million, which is a 7% increase from the previous year.

It’s worth noting that Bitcoin sales contributed to almost half of Block’s total Q2 revenue of $5.53 billion, marking a 25.6% YoY increase.

This surge is attributed to customers’ resilience in purchasing the crypto asset, despite its year-long price decline.

Investors’ Drive Surge in Cryptocurrency Purchases

Binance’s recent announcement of new trading pairs and a zero-fee trading program may have contributed to the surge in Bitcoin’s value.

Users can now trade Bitcoin/First Digital USD (BTC/FDUSD) and Ether/First Digital USD (ETH/FDUSD) pairs without any maker or taker fees through the Zero-Fee Bitcoin Trading Program.

In addition, the availability of the First Digital USD (FDUSD) stablecoin on Binance has expanded trading options.

It’s important to note that some investors are cautious about FDUSD’s impact on the market due to its relatively low market cap of $257 million.

However, its availability on Binance could potentially increase its market cap. This move by Binance follows recent changes in its fee structure, which have affected market share and trading volumes.

Bitcoin Price Prediction

Bitcoin’s recent market movements were carefully analyzed using a 4-hour timeframe, revealing a constrained trading range.

During this period, the cryptocurrency encountered resistance near the $30,000 level, while finding support at approximately $29,000.

As of now, prominent technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) signal a bearish trend for Bitcoin.

Looking at the Bitcoin price chart from Tradingview, we observe that the digital currency has witnessed a downward trajectory, reaching the $29,100 mark.

This decline could potentially continue, pushing Bitcoin’s price further down to $28,700. Nevertheless, there is a possibility that Bitcoin might discover support around the $28,700 level during this ongoing descent.

If it breaks below this support, the next targeted level could be at $28,200.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

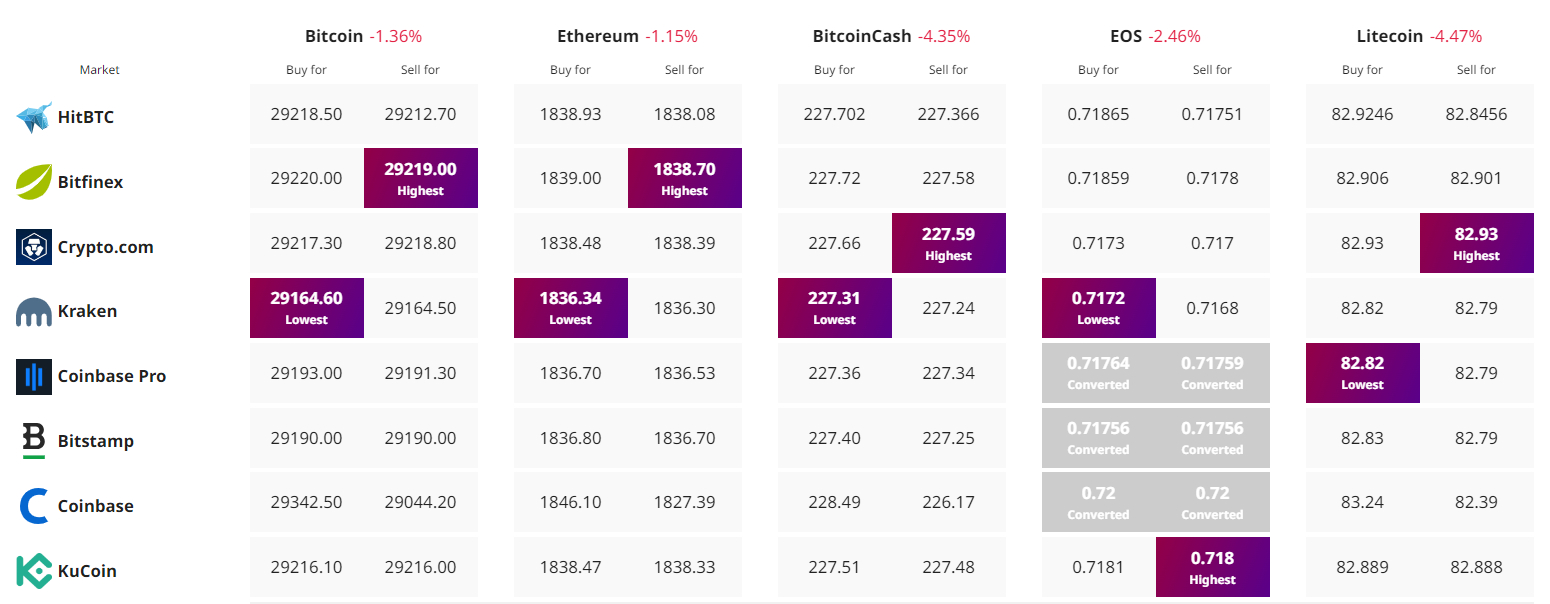

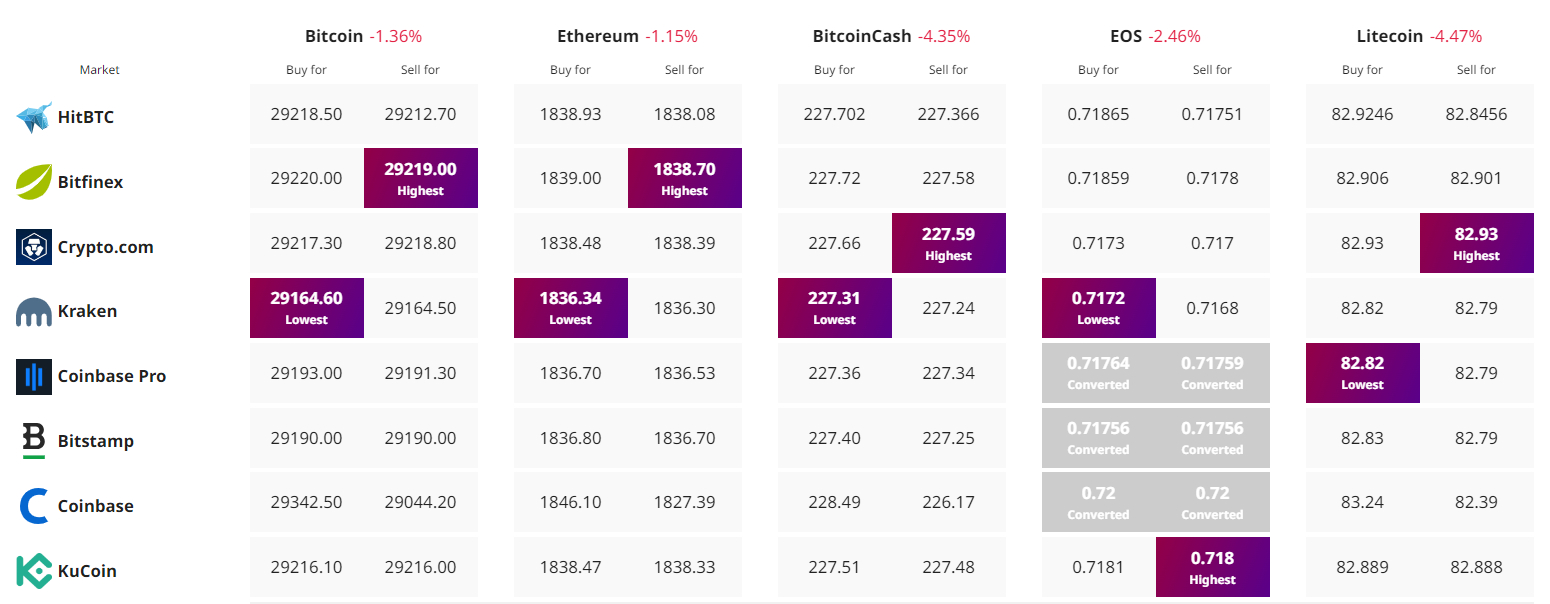

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin’s price is trading choppy above the $29,000 threshold, and has captured the attention of traders and investors.

With a current price of $29,216 and a 24-hour trading volume of $12.4 billion, Bitcoin’s performance is being closely monitored by market participants.

However, all eyes are also on the upcoming release of the US Non-Farm Payrolls (NFP) figures, as the data could potentially have a significant impact on Bitcoin’s trajectory.

Let’s examine the Bitcoin price prediction and how the NFP figures might impact the cryptocurrency market.

USD Strengthens Ahead of Anticipated Non-Farm Employment Data Release

Ahead of Friday’s scheduled release of Non-Farm Employment data, the USD has shown signs of strength.

This positive outlook is due to the anticipation of July’s figures, with the market expecting a decrease of 6K jobs from June, bringing the total to around 203K.

Additionally, the Average Hourly Earnings for July are predicted to be at 0.3%, a slight drop from June’s 0.4%. Overall, there are expectations for a better-than-average report.

Surprising Numbers Lead to Changes in Market Pricing

The recent increase in the price of Bitcoin is mainly due to its strong performance on the Cash App platform by Block.

Although there was a small decrease in Bitcoin profits in comparison to the first quarter of 2023, they are still 7% higher than last year.

Block Inc., a payment technology company, announced impressive Q2 results, with a 34% YoY increase in Bitcoin revenue, reaching $29,216.

During the Q2 earnings call, the company revealed that they made a staggering $2.4 billion in Bitcoin sales on the Cash App, resulting in a gross profit of $44 million, which is a 7% increase from the previous year.

It’s worth noting that Bitcoin sales contributed to almost half of Block’s total Q2 revenue of $5.53 billion, marking a 25.6% YoY increase.

This surge is attributed to customers’ resilience in purchasing the crypto asset, despite its year-long price decline.

Investors’ Drive Surge in Cryptocurrency Purchases

Binance’s recent announcement of new trading pairs and a zero-fee trading program may have contributed to the surge in Bitcoin’s value.

Users can now trade Bitcoin/First Digital USD (BTC/FDUSD) and Ether/First Digital USD (ETH/FDUSD) pairs without any maker or taker fees through the Zero-Fee Bitcoin Trading Program.

In addition, the availability of the First Digital USD (FDUSD) stablecoin on Binance has expanded trading options.

It’s important to note that some investors are cautious about FDUSD’s impact on the market due to its relatively low market cap of $257 million.

However, its availability on Binance could potentially increase its market cap. This move by Binance follows recent changes in its fee structure, which have affected market share and trading volumes.

Bitcoin Price Prediction

Bitcoin’s recent market movements were carefully analyzed using a 4-hour timeframe, revealing a constrained trading range.

During this period, the cryptocurrency encountered resistance near the $30,000 level, while finding support at approximately $29,000.

As of now, prominent technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) signal a bearish trend for Bitcoin.

Looking at the Bitcoin price chart from Tradingview, we observe that the digital currency has witnessed a downward trajectory, reaching the $29,100 mark.

This decline could potentially continue, pushing Bitcoin’s price further down to $28,700. Nevertheless, there is a possibility that Bitcoin might discover support around the $28,700 level during this ongoing descent.

If it breaks below this support, the next targeted level could be at $28,200.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.