Bitcoin price prediction remains bullish as BTC‘s climb to $42,830 ignites discussions, with Cathie Wood championing it as the new gold, reshaping investment strategies in the digital age.

Market sentiment appears cautiously optimistic as influential voices like Cathie Wood compare Bitcoin’s utility to that of gold, suggesting a paradigm shift in asset allocation strategies.

Meanwhile, the market assimilates ProShares’ acknowledgment of a spot Bitcoin ETF’s influence on futures contracts.

Amidst this, JPMorgan’s critique of Tether underscores the heightened scrutiny on regulatory compliance within the crypto sphere.

Cathie Wood on Bitcoin and Gold

Cathie Wood, ARK Invest’s CEO, highlights a pivotal shift in investment preferences from gold to Bitcoin, spurred by the launch of spot Bitcoin ETFs.

She describes Bitcoin as becoming a preferred “risk-off” asset, particularly noted during the regional bank crisis in the United States in March 2023.

Fidelity’s 2023 data reveals a significant correlation between Bitcoin and gold, peaking at 0.80, underlining the growing investor sentiment that aligns Bitcoin closely with traditional safe-haven assets.

Wood remains confident in Bitcoin’s potential to eclipse gold, bolstered by the broader adoption of spot Bitcoin ETFs.

Despite a dip in Bitcoin’s price post-ETF launch, Wood interprets the market’s reaction as indicative of a long-term investment horizon.

ARK Invest’s commitment is evident through its substantial holding of $705.8 million in Bitcoin within its ETF.

This move, according to Wood, is likely to foster increased investor engagement and bullish sentiment towards Bitcoin’s value.

ProShares Optimistic About Spot Bitcoin ETFs

ProShares, a leading figure in Bitcoin futures ETFs, anticipates positive outcomes from the US launch of spot Bitcoin ETFs. Simeon Hyman, ProShares Global Investment Strategist, highlights the firm’s advantage from the high trading volumes of its ProShares Bitcoin Strategy ETF (BITO).

He notes that despite the presence of spot ETFs, BITO maintains trading close to its net asset value, with minimal premiums or discounts.

#ProShares embraces spot #Bitcoin #ETF impact on #BITO futures :

ProShares sees benefits of the launch of spot Bitcoin ETFs for its Bitcoin futures products, according to a senior investment strategist.On Jan. 11, BITO’s trading volumes spiked to as high as nearly $2 billion,… pic.twitter.com/4T3MlrOwjM

— TOBTC (@_TOBTC) February 5, 2024

Spot and Futures ETFs: A Synergistic Relationship

Hyman underscores that spot Bitcoin ETFs are expected to bolster the already strong and regulated Bitcoin futures market, benefiting the entire Bitcoin ecosystem.

The initial surge in BITO’s trading volumes post-spot ETF launch has stabilized, indicating a growing synergy between spot and futures Bitcoin products.

This development is poised to attract more participants to the market, potentially elevating BTC prices through increased investor engagement and confidence.

JPMorgan Highlights Risks with Tether’s Regulatory Practices

JPMorgan has raised concerns about the cryptocurrency market’s risk profile, attributing it to Tether’s perceived shortcomings in regulatory compliance and transparency.

The investment bank’s analysis suggests Tether, compared to competitors like Circle’s USDC, faces greater regulatory vulnerabilities.

JPMorgan predicts that stablecoins adhering to regulatory standards could benefit from tighter oversight, potentially gaining market share in the process.

JPMorgan Warns of Increased Risk for Crypto Market Due to Tether’s ‘Lack of Regulatory Compliance and Transparency’ #bitcoin📷 #crypto #CryptoNews #cryptocurrency

— Brandon Lee (@FatexHermit) February 6, 2024

Tether’s Position and Market Impact

In response, Tether’s CEO Paolo Ardoino has defended the stablecoin’s dominance, arguing that its presence is not detrimental to the markets relying on it. Despite a $41 million fine by the CFTC for past infractions, Tether has been working towards greater transparency.

However, JPMorgan warns that increased regulatory scrutiny could prompt a shift in investments towards more compliant stablecoins, influencing Bitcoin prices and the broader market landscape.

Bitcoin Price Prediction

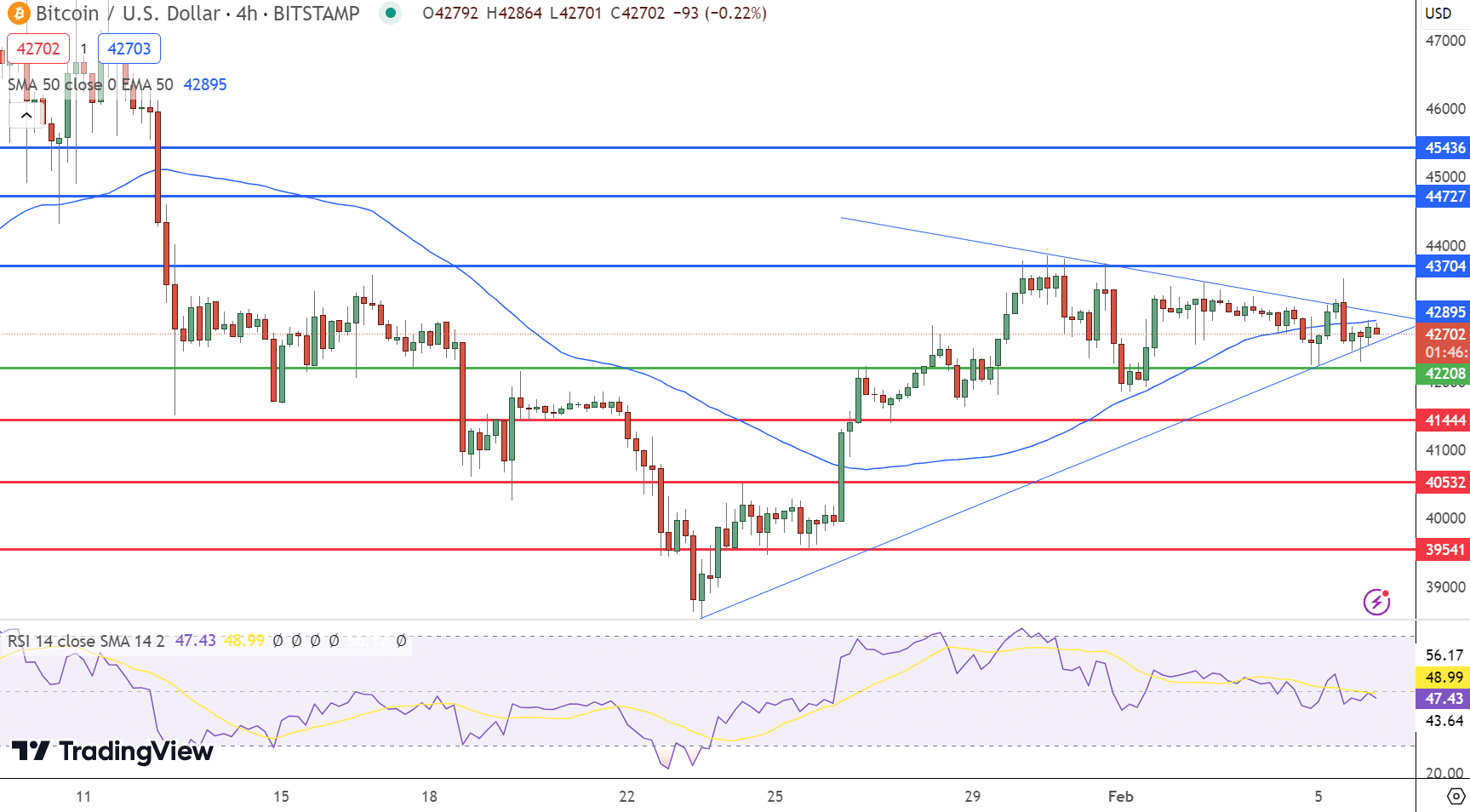

Bitcoin registers a minor setback, trading at $42,626, marking a 0.8% decline. The 4-hour chart reveals a critical juncture with the pivot point at $42,208, guiding immediate market sentiment.

Resistance levels are poised at $42,895, $43,704, and $44,727, delineating potential hurdles for upward momentum.

Conversely, support levels at $41,444, $40,532, and $39,541 offer foundational support for retracements.

Technical indicators present a mixed view. The Relative Strength Index (RSI) stands at 47, suggesting a neutral market stance.

The Moving Average Convergence Divergence (MACD) records a value of -37 against a signal of -31, indicating a slight bearish momentum as the MACD line trails below the signal line.

The 50-day Exponential Moving Average (EMA) aligns with the first resistance level at $42,895, hinting at a pivotal resistance zone.

Bitcoin’s current consolidation phase between the $43,000 and $42,000 marks suggests a cautious market.

The overall trend leans bullish above the pivot point of $42,200, reflecting potential for upward movement if this threshold is maintained.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.