Amid the release of US GDP growth data, the Bitcoin price is being closely observed, raising questions about the possibility of a recession.

As of now, Bitcoin is trading at $29,132, with a 24-hour trading volume of $12.4 billion. Over the last 24 hours, Bitcoin has experienced a nearly 1% decline.

The recent expansion of the US economy at an annualized rate of 2.4% qoq in the second quarter of 2023, surpassing the previous period’s 2% and market expectations of 1.8%, has drawn significant attention and interest in Bitcoin’s performance.

US Economy’s Strong Q2 Growth: Potential Implications for Bitcoin Price

The US economy had a strong performance in the second quarter, as the gross domestic product (GDP) grew by 2.4 percent.

This is the fourth consecutive quarter of positive growth, which shows that the US economy is resilient. Economists had expected a GDP growth of around 1.8 percent, but the actual figure of 2.4 percent was a pleasant surprise.

This is especially true given the recent data showing signs of slowing inflation.

The latest GDP report from the Commerce Department reflects the ongoing strength of the US economy. It comes after the Federal Reserve changed its previous prediction of a “mild recession” that was expected later this year.

Impact on BTC Price:

The recent strong performance of the US economy, with a GDP growth of 2.4 percent in the second quarter, could have an impact on the price of Bitcoin.

As the US economy remains strong, investors may feel more confident in traditional financial markets, causing a decrease in demand for alternative investments like Bitcoin.

However, it’s important to note that there are many factors that can influence the price of Bitcoin, and predicting its future value is difficult.

Bitcoin Price Prediction

Upon analyzing Bitcoin ‘s technical aspects, it becomes evident that the cryptocurrency has found support around the $28,850 level, as indicated by a series of Doji and spinning top candles closing above this threshold.

Presently, Bitcoin hovers just below the notable resistance at $29,500, which is further reinforced by a downward trend line observed in the four-hour timeframe.

This suggests the possibility of a minor correction in BTC’s price today.

It is noteworthy that Bitcoin has already surpassed the 50-period exponential moving average (EMA), previously acting as resistance around $29,250, which now serves as a supportive level.

A close above this stable support level could signal the continuation of the bullish trend.

If BTC manages to breach the $29,500 level, the next technical resistance will likely be around $30,000, which also holds psychological significance.

Beyond this, the next resistance may be found around $30,350. On the contrary, if BTC falls below the $28,850 level, the next support area remains around $29,000.

A drop below this level may lead to a decline toward $28,850.

Overall, the technical analysis suggests a cautiously optimistic outlook for Bitcoin, with potential resistance and support levels to monitor closely in the current market conditions.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the most recent initial coin offering (ICO) ventures and alternative cryptocurrencies by regularly exploring our meticulously chosen assortment of the top 15 digital assets to monitor in 2023.

This carefully curated list has been compiled by industry professionals from Industry Talk and Cryptonews, guaranteeing that you obtain expert recommendations and valuable insights.

Stay ahead of the competition and uncover the possibilities presented by these cryptocurrencies as you navigate the dynamic landscape of digital assets.

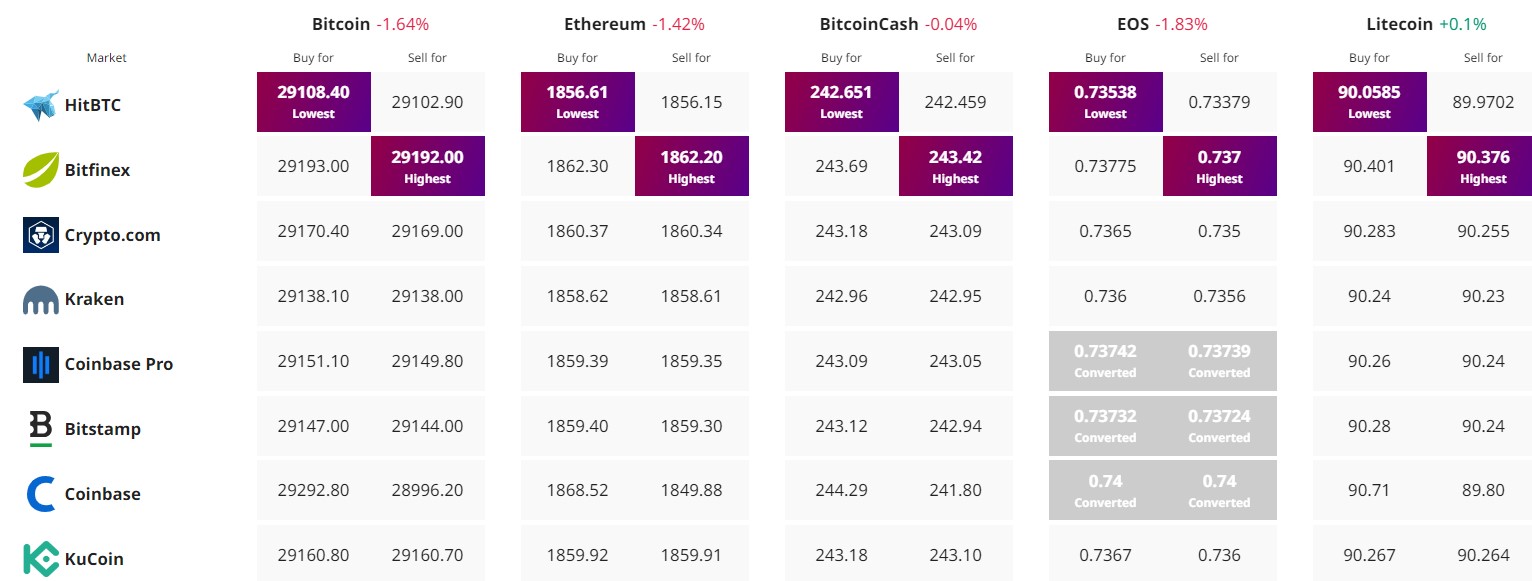

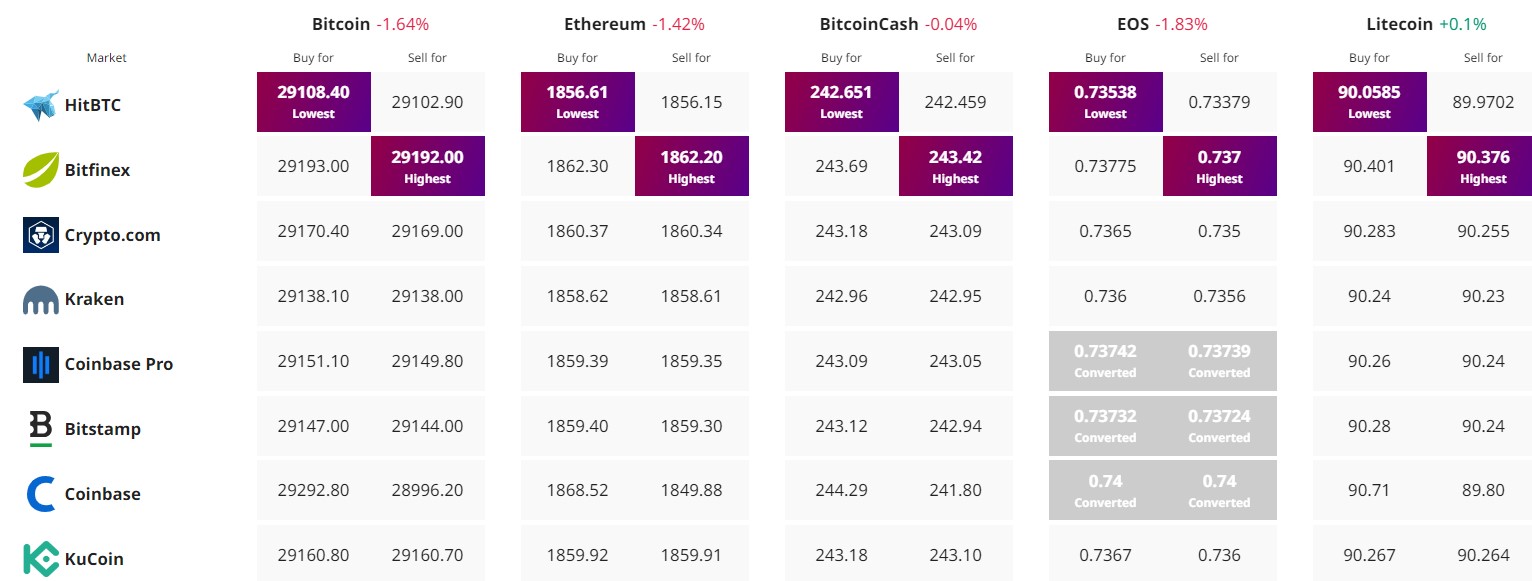

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Amid the release of US GDP growth data, the Bitcoin price is being closely observed, raising questions about the possibility of a recession.

As of now, Bitcoin is trading at $29,132, with a 24-hour trading volume of $12.4 billion. Over the last 24 hours, Bitcoin has experienced a nearly 1% decline.

The recent expansion of the US economy at an annualized rate of 2.4% qoq in the second quarter of 2023, surpassing the previous period’s 2% and market expectations of 1.8%, has drawn significant attention and interest in Bitcoin’s performance.

US Economy’s Strong Q2 Growth: Potential Implications for Bitcoin Price

The US economy had a strong performance in the second quarter, as the gross domestic product (GDP) grew by 2.4 percent.

This is the fourth consecutive quarter of positive growth, which shows that the US economy is resilient. Economists had expected a GDP growth of around 1.8 percent, but the actual figure of 2.4 percent was a pleasant surprise.

This is especially true given the recent data showing signs of slowing inflation.

The latest GDP report from the Commerce Department reflects the ongoing strength of the US economy. It comes after the Federal Reserve changed its previous prediction of a “mild recession” that was expected later this year.

Impact on BTC Price:

The recent strong performance of the US economy, with a GDP growth of 2.4 percent in the second quarter, could have an impact on the price of Bitcoin.

As the US economy remains strong, investors may feel more confident in traditional financial markets, causing a decrease in demand for alternative investments like Bitcoin.

However, it’s important to note that there are many factors that can influence the price of Bitcoin, and predicting its future value is difficult.

Bitcoin Price Prediction

Upon analyzing Bitcoin ‘s technical aspects, it becomes evident that the cryptocurrency has found support around the $28,850 level, as indicated by a series of Doji and spinning top candles closing above this threshold.

Presently, Bitcoin hovers just below the notable resistance at $29,500, which is further reinforced by a downward trend line observed in the four-hour timeframe.

This suggests the possibility of a minor correction in BTC’s price today.

It is noteworthy that Bitcoin has already surpassed the 50-period exponential moving average (EMA), previously acting as resistance around $29,250, which now serves as a supportive level.

A close above this stable support level could signal the continuation of the bullish trend.

If BTC manages to breach the $29,500 level, the next technical resistance will likely be around $30,000, which also holds psychological significance.

Beyond this, the next resistance may be found around $30,350. On the contrary, if BTC falls below the $28,850 level, the next support area remains around $29,000.

A drop below this level may lead to a decline toward $28,850.

Overall, the technical analysis suggests a cautiously optimistic outlook for Bitcoin, with potential resistance and support levels to monitor closely in the current market conditions.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the most recent initial coin offering (ICO) ventures and alternative cryptocurrencies by regularly exploring our meticulously chosen assortment of the top 15 digital assets to monitor in 2023.

This carefully curated list has been compiled by industry professionals from Industry Talk and Cryptonews, guaranteeing that you obtain expert recommendations and valuable insights.

Stay ahead of the competition and uncover the possibilities presented by these cryptocurrencies as you navigate the dynamic landscape of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.