Today’s Bitcoin price stands at $27,033, having experienced a trading volume of $13 billion over the past 24 hours. Bitcoin has witnessed a slight dip, declining around 0.50% during this timeframe.

As the US Federal Reserve holds steady on its decision, keeping the Fed funds target range anchored at 5.25-5.5%, the cryptocurrency market waits with bated breath.

The Fed has not only signalled the potential for another 25 basis point hike this year but has also painted a picture of diminishing prospects for rate cuts in the long run.

Their guidance steers inflation back to the 2% mark, reducing the likelihood of an impending recession. Despite the hurdles the economy currently grapples with, there’s a palpable market scepticism.

Yet, Wednesday’s overarching takeaway from the Federal Reserve’s announcement is a hawkish pause. Policymakers seem convinced that interest rates will persist at heightened levels for an extended period.

Amidst this backdrop, many speculate on Bitcoin’s next move – could BTC surge to the $30,000 mark in response?

Bitcoin Price Prediction

On CoinMarketCap’s ranking, Bitcoin maintains the top spot, boasting a live market capitalization of $526 billion. Presently, there are 19,491,637 BTC coins in circulation, out of a maximum supply of 21,000,000 BTC coins.

Technically, Bitcoin is on the brink of breaking the $27,500 resistance level which could result in a surge towards $28,200. After surpassing the $26,800 resistance level, Bitcoin has stabilized above the $27,000 mark.

However, there is still resistance around $27,500, and the most recent peak reached $27,494.

The cryptocurrency is currently hovering just below the 23.6% Fib retracement level from its recent swing, and remains above the 100 hourly Simple Moving Average with a bullish trend line near $26,800 providing support.

Resistance levels of $27,500 and $28,200 are crucial for Bitcoin, and if these levels are surpassed, it can lead to a potential surge towards the $29,500 or even $30,000 region.

However, if BTC fails to break through the $27,500 resistance, it may experience a decline with support levels at $27,050 and $26,800.

A breach below the latter may result in a further drop in price towards $26,200.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

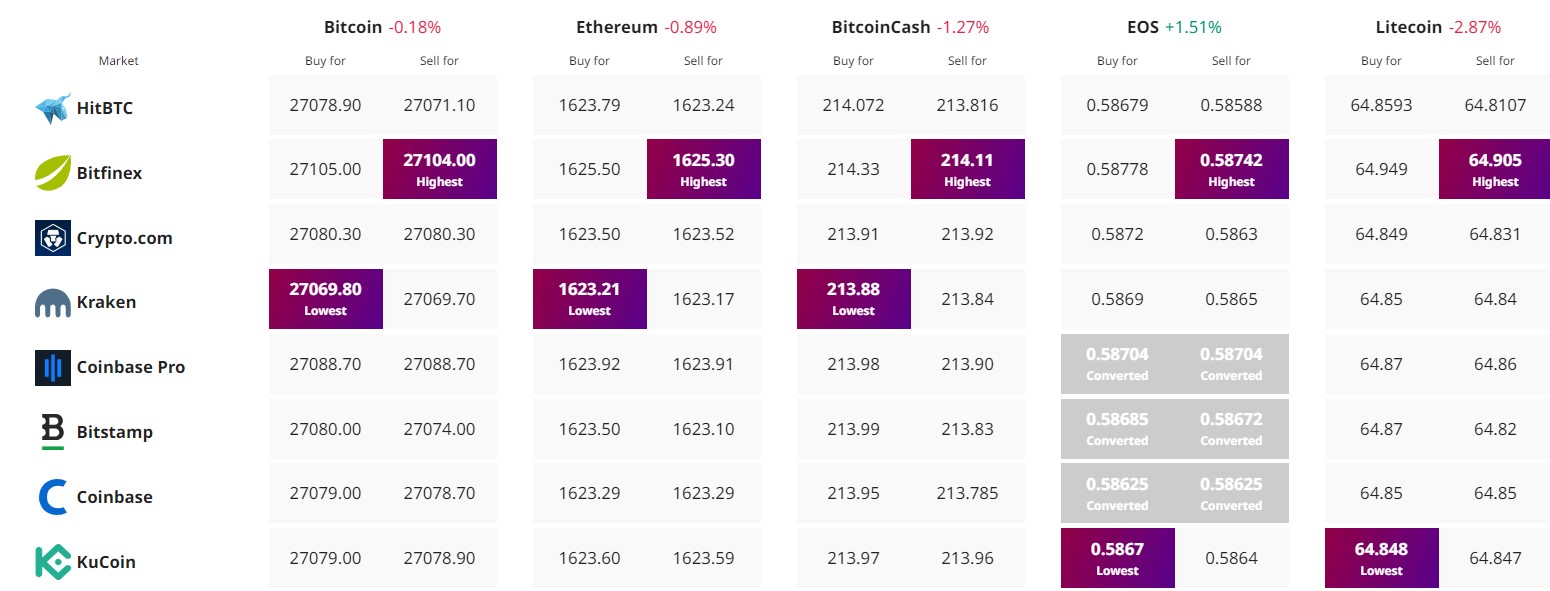

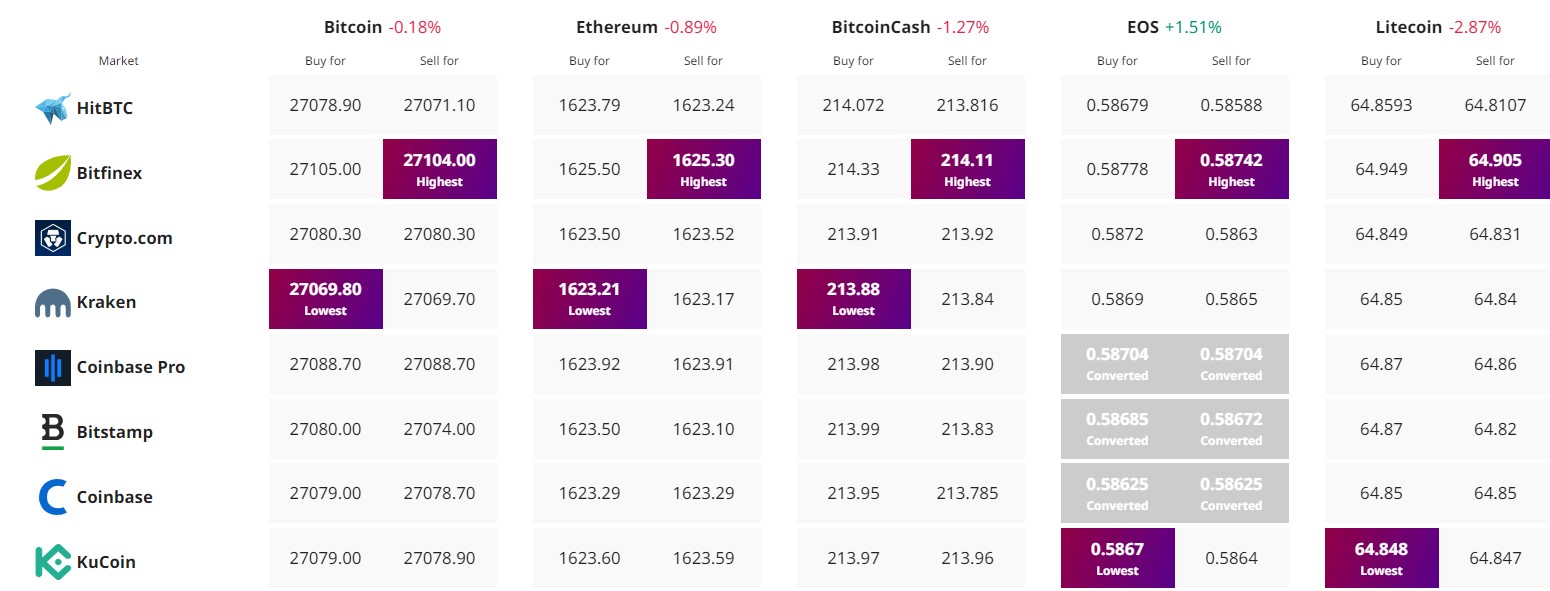

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Today’s Bitcoin price stands at $27,033, having experienced a trading volume of $13 billion over the past 24 hours. Bitcoin has witnessed a slight dip, declining around 0.50% during this timeframe.

As the US Federal Reserve holds steady on its decision, keeping the Fed funds target range anchored at 5.25-5.5%, the cryptocurrency market waits with bated breath.

The Fed has not only signalled the potential for another 25 basis point hike this year but has also painted a picture of diminishing prospects for rate cuts in the long run.

Their guidance steers inflation back to the 2% mark, reducing the likelihood of an impending recession. Despite the hurdles the economy currently grapples with, there’s a palpable market scepticism.

Yet, Wednesday’s overarching takeaway from the Federal Reserve’s announcement is a hawkish pause. Policymakers seem convinced that interest rates will persist at heightened levels for an extended period.

Amidst this backdrop, many speculate on Bitcoin’s next move – could BTC surge to the $30,000 mark in response?

Bitcoin Price Prediction

On CoinMarketCap’s ranking, Bitcoin maintains the top spot, boasting a live market capitalization of $526 billion. Presently, there are 19,491,637 BTC coins in circulation, out of a maximum supply of 21,000,000 BTC coins.

Technically, Bitcoin is on the brink of breaking the $27,500 resistance level which could result in a surge towards $28,200. After surpassing the $26,800 resistance level, Bitcoin has stabilized above the $27,000 mark.

However, there is still resistance around $27,500, and the most recent peak reached $27,494.

The cryptocurrency is currently hovering just below the 23.6% Fib retracement level from its recent swing, and remains above the 100 hourly Simple Moving Average with a bullish trend line near $26,800 providing support.

Resistance levels of $27,500 and $28,200 are crucial for Bitcoin, and if these levels are surpassed, it can lead to a potential surge towards the $29,500 or even $30,000 region.

However, if BTC fails to break through the $27,500 resistance, it may experience a decline with support levels at $27,050 and $26,800.

A breach below the latter may result in a further drop in price towards $26,200.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.