As Bitcoin continues its oscillating dance on the charts, it gives subtle hints of a resurgence. The premier cryptocurrency currently trades at $26,244, marking a nearly 1.25% rise on Thursday.

This surge is juxtaposed against an intriguing backdrop: Economist Peter Schiff has been vociferously warning of a ‘Massive Crisis’ and a swift departure from the US Dollar.

Adding to the momentum, Brian Armstrong, the CEO of Coinbase, confirmed the platform’s integration with the Bitcoin Lightning Network.

Meanwhile, in a significant legal ruling, a Delaware judge has given FTX the nod to sell up to a whopping $100 million worth of coins weekly.

With the daily trading volume now breaching the $10 billion threshold, one is left to wonder: Are the whales re-entering the Bitcoin market?

Renowned Economist Peter Schiff Warns of ‘Massive Crisis’ and Urges a Swift Departure from the US Dollar

Prominent economist Peter Schiff has issued a grave warning of an imminent mass exodus from the US dollar, predicting a severe economic crisis.

Schiff, a proponent of gold as a store of value, underscored the inevitability of this crisis due to the continually expanding US budget deficits, which he foresees becoming unsustainable, especially during future recessions.

With the national debt nearing $33 trillion and interest payments on this debt ranking as a top government expense, Schiff anticipates a crisis to arise before these payments become the sole government expenditure.

Schiff mentioned the growing trend of nations, including BRICS members, to decrease their reliance on the U.S. dollar in international trade.

This shift has been attributed to the US. using the dollar as a tool for sanctions. Consequently, nations like China and Saudi Arabia are exploring alternative currencies.

In the cryptocurrency markets, Bitcoin (BTC) is currently experiencing a surge. Schiff’s warning of US dollar instability may drive increased interest in Bitcoin and other cryptocurrencies as alternative stores of value.

This could lead to a surge in BTC/USD prices, particularly as growing concerns about traditional fiat currencies continue.

Coinbase CEO Brian Armstrong Announces Bitcoin Lightning Network Integration

Coinbase, which is one of the leading cryptocurrency exchanges, has officially confirmed its plan to integrate the Lightning Network (LN). This is a layer-2 payment protocol that allows faster and cheaper Bitcoin transactions, which is something users have been demanding for a while.

The Lightning Network was developed to tackle Bitcoin’s scalability issues and compete with newer cryptocurrencies that offer quicker and more cost-effective transactions. Brian Armstrong, the CEO of Coinbase, has expressed his commitment to facilitating faster and more affordable Bitcoin transactions.

He recognized Bitcoin’s pivotal role in the crypto ecosystem. However, he cautioned that the integration process would take some time and urged users to be patient.

Coinbase has followed in the footsteps of other exchanges like Binance and integrated the Lightning Network for BTC withdrawals and deposits.

This move is expected to improve the efficiency and affordability of microtransactions for Bitcoin users.

As a result, the prices of BTC/USD have gone up today, reflecting optimism surrounding Bitcoin’s increased utility.

Delaware Judge Grants FTX Permission to Sell $100 Million in Coins Weekly

In a significant development, a Delaware District Judge, John Dorsey, has approved FTX, a crypto exchange currently undergoing bankruptcy proceedings, to liquidate billions of dollars in digital assets.

The move addresses FTX’s complex financial situation while ensuring that funds are returned to creditors.

The approved plan imposes specific restrictions, including oversight by a financial advisor and a weekly sales limit of $100 million for most tokens, with the potential for individual token-based adjustments up to $200 million. FTX intends to hedge Bitcoin and Ethereum holdings to mitigate market volatility during sales.

FTX offers an option to stake certain tokens that can increase returns.

DWF Labs, a tech firm, has shown interest in acquiring FTX’s assets to ensure optimal execution prices and prevent significant market fluctuations.

This move aims to safeguard the stability of the cryptocurrency market. The decision to allow FTX to liquidate assets under controlled conditions has instilled confidence in the market, potentially contributing to the rise in Bitcoin’s price.

Bitcoin Price Prediction

Bitcoin is displaying a strong bullish trend, breaking the notable $25,900 resistance, further emphasized by a downward trend on the four-hour chart.

In recent trades, it soared past this, touching a high of $26,500, which now acts as a significant resistance due to a double top pattern.

However, BTC couldn’t hold above $26,500 and retreated near $26,000, hovering above its new support at $25,900.

Key indicators like RSI and MACD are in the buying zone, and the 50-day exponential moving average suggests bullish momentum as long as BTC stays above $25,600.

Dipping below could lead to support at $25,400 and $24,950. Breaking the $26,500 resistance might target $27,000 and $27,500. In summary, the $26,500 level is a decisive factor for Bitcoin’s next moves.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

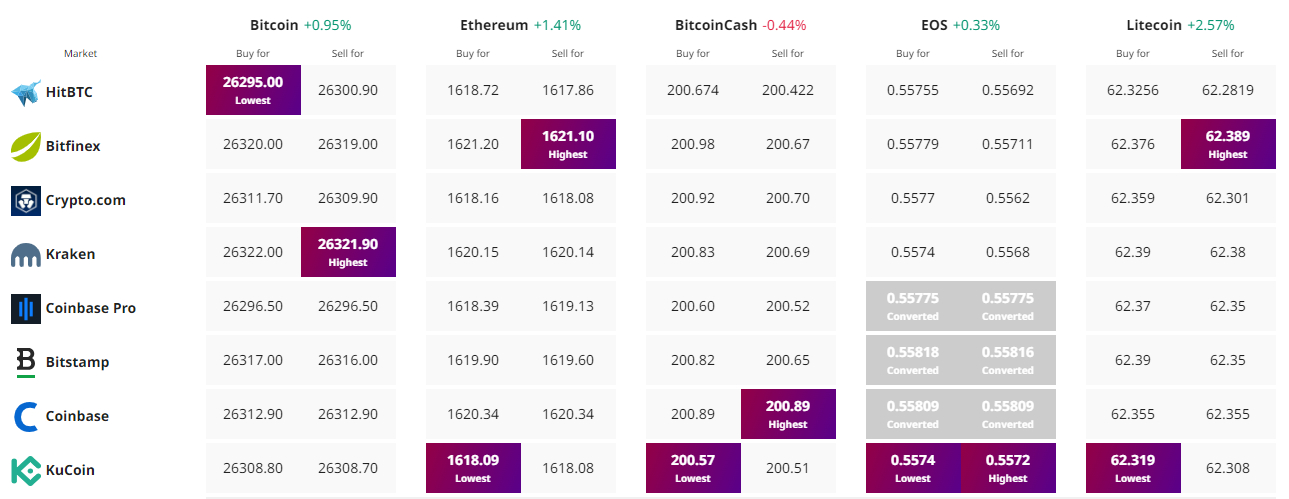

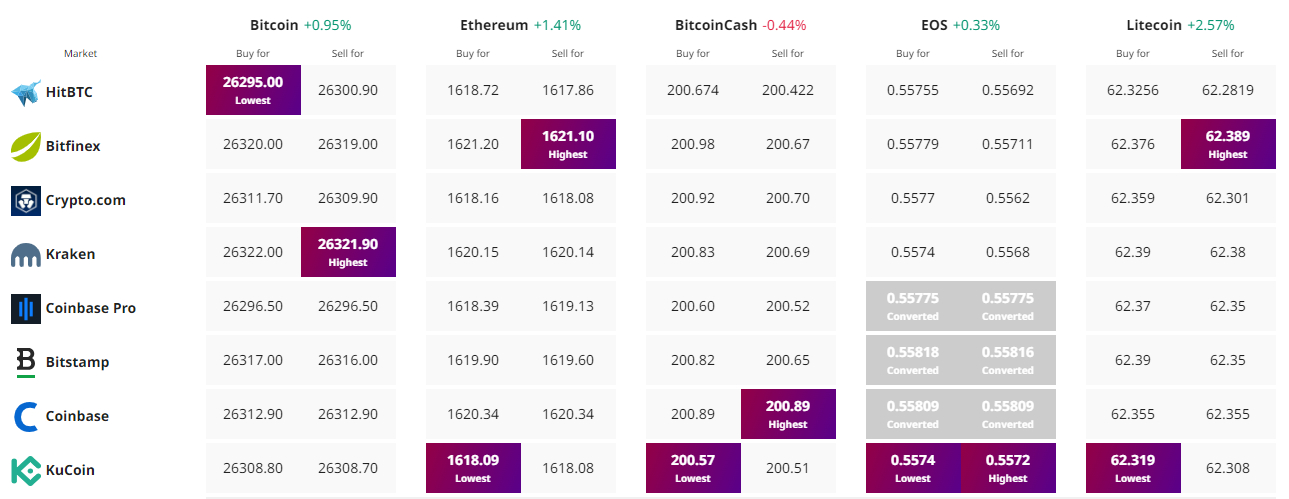

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

As Bitcoin continues its oscillating dance on the charts, it gives subtle hints of a resurgence. The premier cryptocurrency currently trades at $26,244, marking a nearly 1.25% rise on Thursday.

This surge is juxtaposed against an intriguing backdrop: Economist Peter Schiff has been vociferously warning of a ‘Massive Crisis’ and a swift departure from the US Dollar.

Adding to the momentum, Brian Armstrong, the CEO of Coinbase, confirmed the platform’s integration with the Bitcoin Lightning Network.

Meanwhile, in a significant legal ruling, a Delaware judge has given FTX the nod to sell up to a whopping $100 million worth of coins weekly.

With the daily trading volume now breaching the $10 billion threshold, one is left to wonder: Are the whales re-entering the Bitcoin market?

Renowned Economist Peter Schiff Warns of ‘Massive Crisis’ and Urges a Swift Departure from the US Dollar

Prominent economist Peter Schiff has issued a grave warning of an imminent mass exodus from the US dollar, predicting a severe economic crisis.

Schiff, a proponent of gold as a store of value, underscored the inevitability of this crisis due to the continually expanding US budget deficits, which he foresees becoming unsustainable, especially during future recessions.

With the national debt nearing $33 trillion and interest payments on this debt ranking as a top government expense, Schiff anticipates a crisis to arise before these payments become the sole government expenditure.

Schiff mentioned the growing trend of nations, including BRICS members, to decrease their reliance on the U.S. dollar in international trade.

This shift has been attributed to the US. using the dollar as a tool for sanctions. Consequently, nations like China and Saudi Arabia are exploring alternative currencies.

In the cryptocurrency markets, Bitcoin (BTC) is currently experiencing a surge. Schiff’s warning of US dollar instability may drive increased interest in Bitcoin and other cryptocurrencies as alternative stores of value.

This could lead to a surge in BTC/USD prices, particularly as growing concerns about traditional fiat currencies continue.

Coinbase CEO Brian Armstrong Announces Bitcoin Lightning Network Integration

Coinbase, which is one of the leading cryptocurrency exchanges, has officially confirmed its plan to integrate the Lightning Network (LN). This is a layer-2 payment protocol that allows faster and cheaper Bitcoin transactions, which is something users have been demanding for a while.

The Lightning Network was developed to tackle Bitcoin’s scalability issues and compete with newer cryptocurrencies that offer quicker and more cost-effective transactions. Brian Armstrong, the CEO of Coinbase, has expressed his commitment to facilitating faster and more affordable Bitcoin transactions.

He recognized Bitcoin’s pivotal role in the crypto ecosystem. However, he cautioned that the integration process would take some time and urged users to be patient.

Coinbase has followed in the footsteps of other exchanges like Binance and integrated the Lightning Network for BTC withdrawals and deposits.

This move is expected to improve the efficiency and affordability of microtransactions for Bitcoin users.

As a result, the prices of BTC/USD have gone up today, reflecting optimism surrounding Bitcoin’s increased utility.

Delaware Judge Grants FTX Permission to Sell $100 Million in Coins Weekly

In a significant development, a Delaware District Judge, John Dorsey, has approved FTX, a crypto exchange currently undergoing bankruptcy proceedings, to liquidate billions of dollars in digital assets.

The move addresses FTX’s complex financial situation while ensuring that funds are returned to creditors.

The approved plan imposes specific restrictions, including oversight by a financial advisor and a weekly sales limit of $100 million for most tokens, with the potential for individual token-based adjustments up to $200 million. FTX intends to hedge Bitcoin and Ethereum holdings to mitigate market volatility during sales.

FTX offers an option to stake certain tokens that can increase returns.

DWF Labs, a tech firm, has shown interest in acquiring FTX’s assets to ensure optimal execution prices and prevent significant market fluctuations.

This move aims to safeguard the stability of the cryptocurrency market. The decision to allow FTX to liquidate assets under controlled conditions has instilled confidence in the market, potentially contributing to the rise in Bitcoin’s price.

Bitcoin Price Prediction

Bitcoin is displaying a strong bullish trend, breaking the notable $25,900 resistance, further emphasized by a downward trend on the four-hour chart.

In recent trades, it soared past this, touching a high of $26,500, which now acts as a significant resistance due to a double top pattern.

However, BTC couldn’t hold above $26,500 and retreated near $26,000, hovering above its new support at $25,900.

Key indicators like RSI and MACD are in the buying zone, and the 50-day exponential moving average suggests bullish momentum as long as BTC stays above $25,600.

Dipping below could lead to support at $25,400 and $24,950. Breaking the $26,500 resistance might target $27,000 and $27,500. In summary, the $26,500 level is a decisive factor for Bitcoin’s next moves.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.