Bitcoin (BTC), the dominant cryptocurrency, experienced a downturn as it encountered selling pressure near the $30,202 threshold.

The release of the Federal Open Market Committee (FOMC) minutes played a role in this downward trend.

However, amidst the market turbulence, renewed optimism has emerged regarding Bitcoin’s ability to revolutionize the financial landscape, largely due to the positive remarks of Larry Fink, BlackRock’s CEO.

These comments have helped mitigate further declines in BTC, raising questions about its potential for a rebound from the $30,000 level.

BlackRock’s Interest in Bitcoin ETF Boosts Confidence in Cryptocurrency’s Future

The interest shown by BlackRock, one of the world’s largest asset management firms, in a Bitcoin exchange-traded fund (ETF) has further bolstered confidence in Bitcoin’s future.

Larry Fink’s positive remarks regarding Bitcoin’s potential have resonated with market participants, sparking newfound enthusiasm and optimism.

The potential introduction of a Bitcoin ETF by BlackRock could have implications for the cryptocurrency market.

An ETF would provide investors with a regulated and accessible avenue to invest in Bitcoin, potentially attracting a broader range of traditional investors.

This development can potentially increase liquidity and stability in the Bitcoin market, paving the way for further adoption and growth.

Bitcoin Miners Achieve Milestone as Transaction Fees Surpass $100 Million in Q2 2023

During the first half of 2023, Bitcoin trading volume on multiple exchanges surpassed $4.2 trillion, with March hitting a record $1.2 trillion.

This surge indicates increased interest from institutional and retail investors, signaling a revitalized market after a bearish period.

The higher trading volume supports a potentially bullish trend for Bitcoin. In Q2 2023, Bitcoin miners achieved a milestone with transaction fees exceeding $100 million, reflecting growing demand and network activity.

These developments highlight renewed interest and confidence in Bitcoin, paving the way for further adoption.

Bitcoin Price Prediction

Bitcoin is currently experiencing some volatility, but it is holding steady around the $30,000 level, which is acting as a psychological support for BTC.

When considering the broader daily timeframe, Bitcoin is consolidating within a narrow range, with resistance at approximately $31,400 and support around $29,600.

A decisive close above the $29,600 level could trigger a bullish movement for Bitcoin.

Conversely, if there is a clear break below $29,600, Bitcoin may find support around $28,450 and potentially even lower towards $27,450.

On the upside, if Bitcoin successfully surpasses the $31,350 level, the next target to watch out for would be around $32,500.

Therefore, it is recommended to monitor the $29,600 level as a key pivot point for today’s trading activities.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

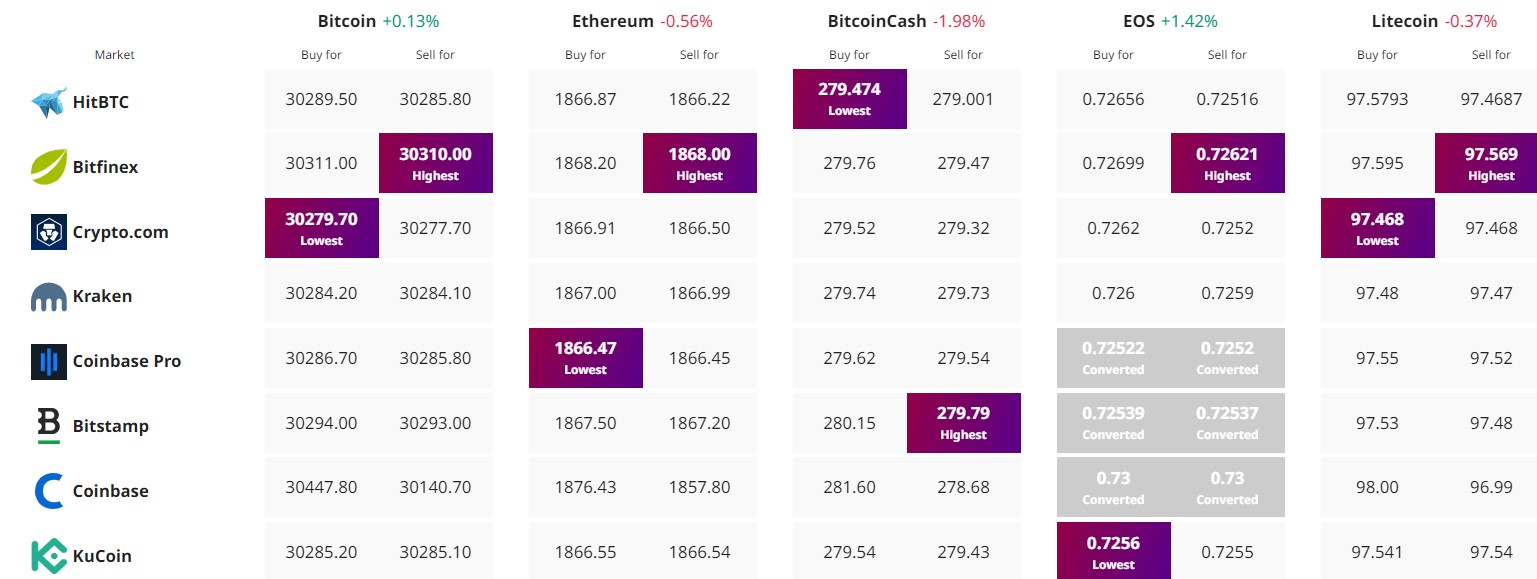

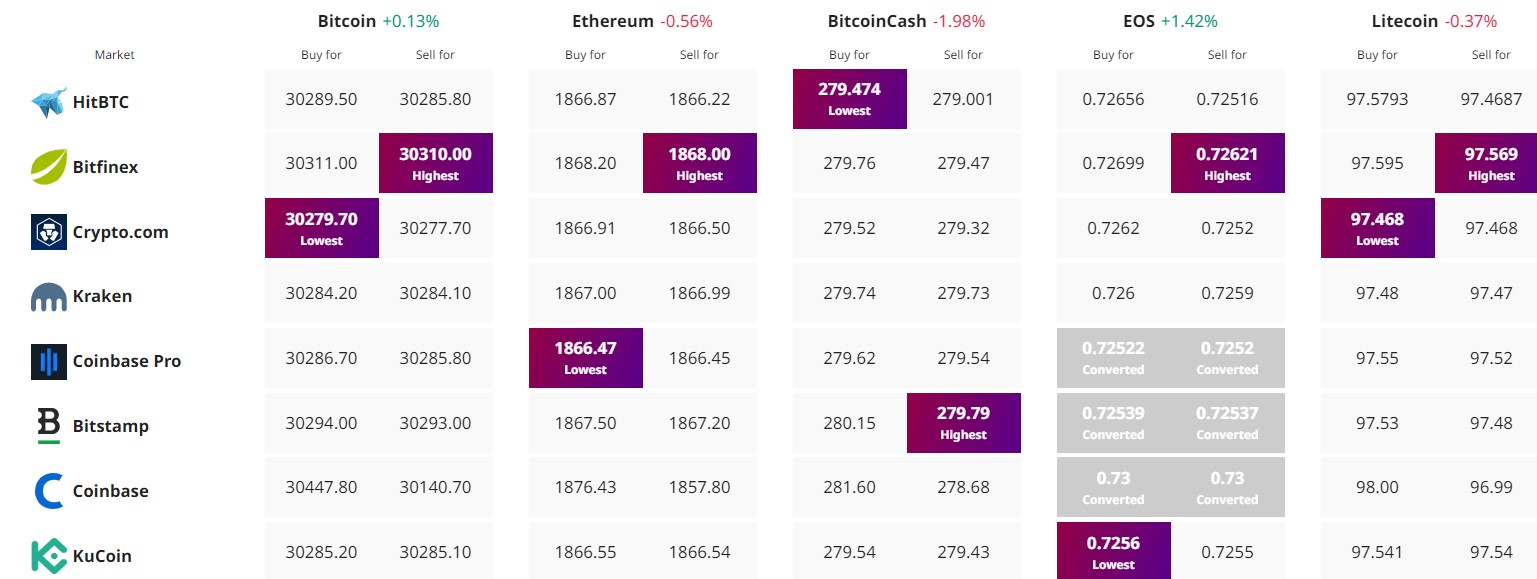

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin (BTC), the dominant cryptocurrency, experienced a downturn as it encountered selling pressure near the $30,202 threshold.

The release of the Federal Open Market Committee (FOMC) minutes played a role in this downward trend.

However, amidst the market turbulence, renewed optimism has emerged regarding Bitcoin’s ability to revolutionize the financial landscape, largely due to the positive remarks of Larry Fink, BlackRock’s CEO.

These comments have helped mitigate further declines in BTC, raising questions about its potential for a rebound from the $30,000 level.

BlackRock’s Interest in Bitcoin ETF Boosts Confidence in Cryptocurrency’s Future

The interest shown by BlackRock, one of the world’s largest asset management firms, in a Bitcoin exchange-traded fund (ETF) has further bolstered confidence in Bitcoin’s future.

Larry Fink’s positive remarks regarding Bitcoin’s potential have resonated with market participants, sparking newfound enthusiasm and optimism.

The potential introduction of a Bitcoin ETF by BlackRock could have implications for the cryptocurrency market.

An ETF would provide investors with a regulated and accessible avenue to invest in Bitcoin, potentially attracting a broader range of traditional investors.

This development can potentially increase liquidity and stability in the Bitcoin market, paving the way for further adoption and growth.

Bitcoin Miners Achieve Milestone as Transaction Fees Surpass $100 Million in Q2 2023

During the first half of 2023, Bitcoin trading volume on multiple exchanges surpassed $4.2 trillion, with March hitting a record $1.2 trillion.

This surge indicates increased interest from institutional and retail investors, signaling a revitalized market after a bearish period.

The higher trading volume supports a potentially bullish trend for Bitcoin. In Q2 2023, Bitcoin miners achieved a milestone with transaction fees exceeding $100 million, reflecting growing demand and network activity.

These developments highlight renewed interest and confidence in Bitcoin, paving the way for further adoption.

Bitcoin Price Prediction

Bitcoin is currently experiencing some volatility, but it is holding steady around the $30,000 level, which is acting as a psychological support for BTC.

When considering the broader daily timeframe, Bitcoin is consolidating within a narrow range, with resistance at approximately $31,400 and support around $29,600.

A decisive close above the $29,600 level could trigger a bullish movement for Bitcoin.

Conversely, if there is a clear break below $29,600, Bitcoin may find support around $28,450 and potentially even lower towards $27,450.

On the upside, if Bitcoin successfully surpasses the $31,350 level, the next target to watch out for would be around $32,500.

Therefore, it is recommended to monitor the $29,600 level as a key pivot point for today’s trading activities.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.