As Bitcoin’s (BTC) price tests the key psychological level of $31,000, investors are closely watching to assess whether this presents a favorable opportunity to enter the market.

Bitcoin’s price has been hovering near this crucial level, with the market eagerly anticipating its next move.

In this Bitcoin price prediction, we will analyze the current market conditions, focusing specifically on the technical aspects of BTC.

By examining key indicators and studying market movements, we aim to provide insights into the potential future direction of Bitcoin.

Bitcoin Price

As of today, the current price of Bitcoin stands at $30,763, accompanied by a 24-hour trading volume of $13.6 billion.

Over the past 24 hours, Bitcoin has experienced a decrease of 1.45%. Bitcoin holds the top position on CoinMarketCap’s ranking, with a live market capitalization of $597,418,210,834.

The circulating supply of Bitcoin coins is approximately 19,419,987 BTC; the maximum supply is capped at 21,000,000 BTC.

Bitcoin Price Prediction

According to the technical analysis, Bitcoin is currently facing resistance near the $31,000 level.

However, the cryptocurrency currently holds just above this level, around $31,050.

The presence of a bullish engulfing candle on the daily timeframe suggests that there is a strong possibility of a bullish trend.

Bitcoin is currently encountering resistance of around $31,350, and if it manages to break above this level, the next target could be around $32,500 or potentially even higher at $34,150.

Various technical indicators, such as the relative strength index (RSI) and the moving average convergence divergence (MACD), indicate a positive sentiment for Bitcoin.

The 50-day exponential moving average is also providing support for the upward trend.

On the downside, immediate support for Bitcoin can be expected at around $30,500 or possibly around $29,650.

A break below $29,650 may lead to a decline toward $28,650 or even lower to $27,900.

Therefore, monitoring the $31,000 level is crucial as it could serve as a signal for a buying trend.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our handpicked selection of the top 15 digital assets to watch in 2023.

This meticulously curated list has been assembled by industry experts from Industry Talk and Cryptonews, guaranteeing you professional recommendations and valuable insights.

Stay ahead of the curve and explore the potential of these cryptocurrencies as you navigate the ever-evolving landscape of digital assets.

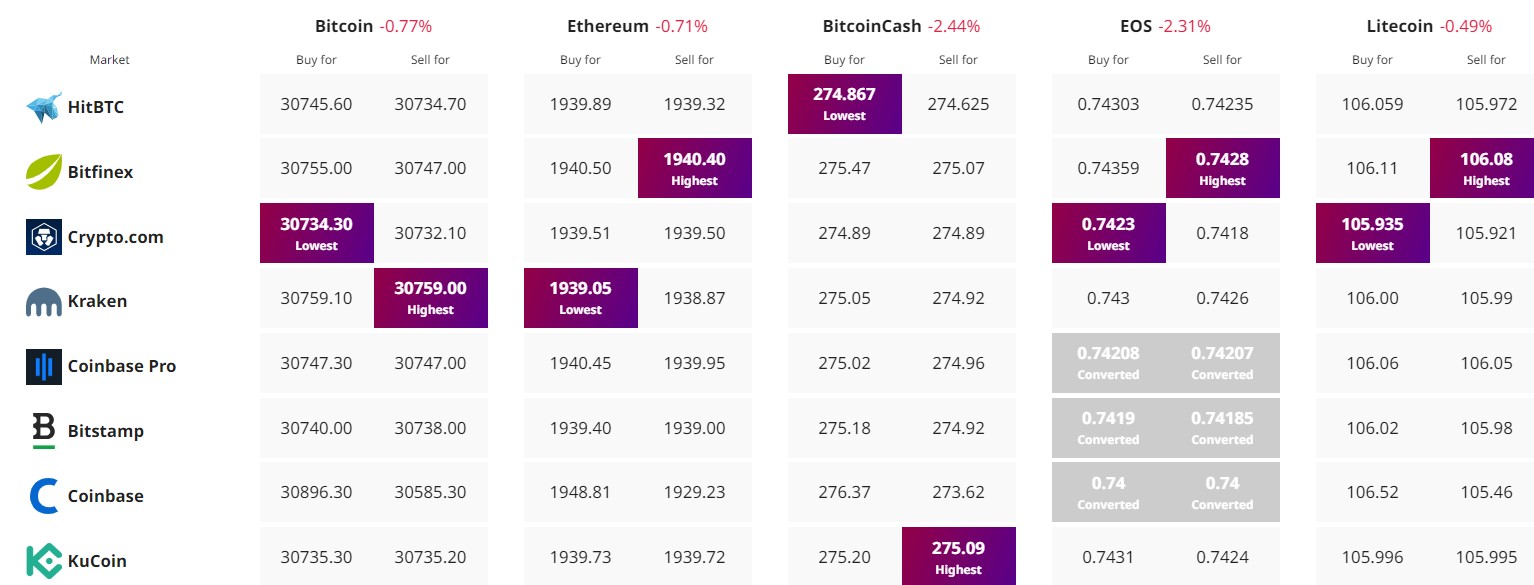

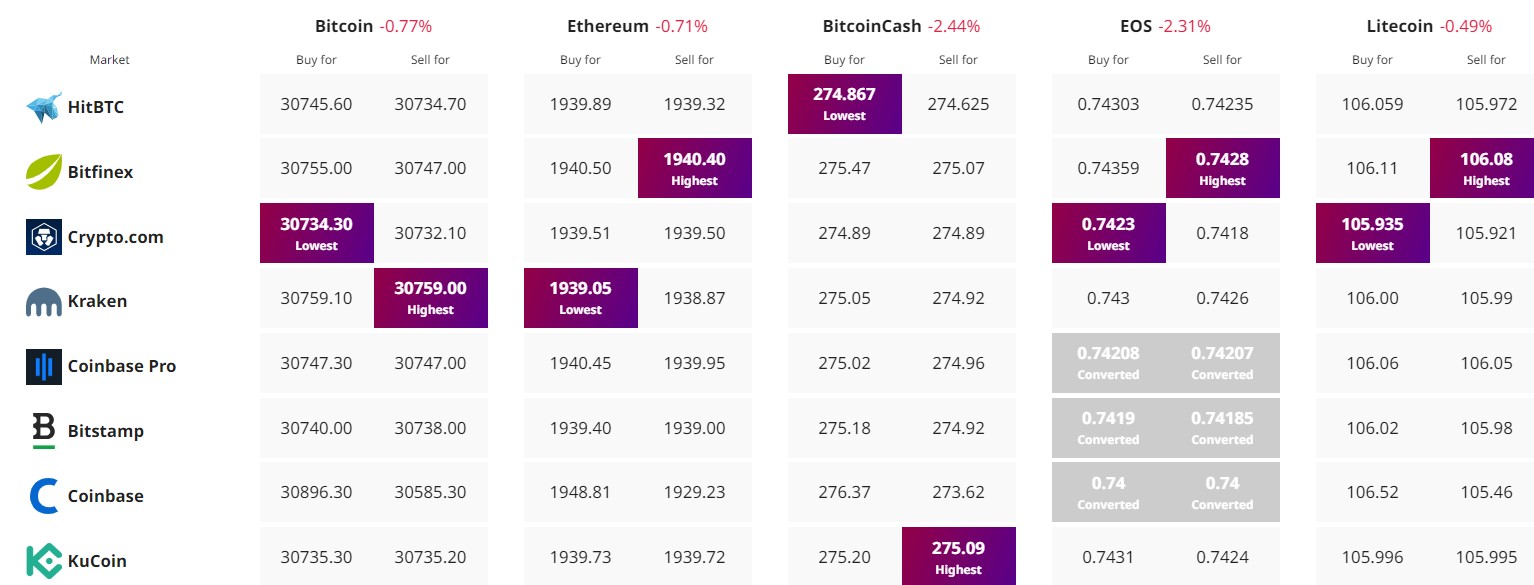

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

As Bitcoin’s (BTC) price tests the key psychological level of $31,000, investors are closely watching to assess whether this presents a favorable opportunity to enter the market.

Bitcoin’s price has been hovering near this crucial level, with the market eagerly anticipating its next move.

In this Bitcoin price prediction, we will analyze the current market conditions, focusing specifically on the technical aspects of BTC.

By examining key indicators and studying market movements, we aim to provide insights into the potential future direction of Bitcoin.

Bitcoin Price

As of today, the current price of Bitcoin stands at $30,763, accompanied by a 24-hour trading volume of $13.6 billion.

Over the past 24 hours, Bitcoin has experienced a decrease of 1.45%. Bitcoin holds the top position on CoinMarketCap’s ranking, with a live market capitalization of $597,418,210,834.

The circulating supply of Bitcoin coins is approximately 19,419,987 BTC; the maximum supply is capped at 21,000,000 BTC.

Bitcoin Price Prediction

According to the technical analysis, Bitcoin is currently facing resistance near the $31,000 level.

However, the cryptocurrency currently holds just above this level, around $31,050.

The presence of a bullish engulfing candle on the daily timeframe suggests that there is a strong possibility of a bullish trend.

Bitcoin is currently encountering resistance of around $31,350, and if it manages to break above this level, the next target could be around $32,500 or potentially even higher at $34,150.

Various technical indicators, such as the relative strength index (RSI) and the moving average convergence divergence (MACD), indicate a positive sentiment for Bitcoin.

The 50-day exponential moving average is also providing support for the upward trend.

On the downside, immediate support for Bitcoin can be expected at around $30,500 or possibly around $29,650.

A break below $29,650 may lead to a decline toward $28,650 or even lower to $27,900.

Therefore, monitoring the $31,000 level is crucial as it could serve as a signal for a buying trend.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our handpicked selection of the top 15 digital assets to watch in 2023.

This meticulously curated list has been assembled by industry experts from Industry Talk and Cryptonews, guaranteeing you professional recommendations and valuable insights.

Stay ahead of the curve and explore the potential of these cryptocurrencies as you navigate the ever-evolving landscape of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.