In the ever-evolving landscape of cryptocurrency, the price of Bitcoin price currently hovers at $26,051, experiencing a marginal decrease of 0.25% on Tuesday.

While market dynamics remain fluid, recent developments and factors have caught the attention of both investors and enthusiasts.

A significant development involves legalizing US sanctions against the Tornado Cash crypto platform, marking a noteworthy development in regulatory measures.

Furthermore, assertions made by Craig Wright regarding the presence of billions of dollars worth of Bitcoin have been met with skepticism and rejection by the Bitcoin development community.

Amidst these events, the rising prominence of ordinary transaction dominance prompts NFT proponents to raise questions regarding the purported decline of Bitcoin.

This intricate interplay of factors forms the backdrop against which Bitcoin’s price movement is being analyzed, raising the question of whether the current dip presents an opportune moment for strategic acquisitions.

US Judge Gives Green Light to Sanctions Against Tornado Cash Crypto Platform

BTC/USD is declining due to a federal judge’s ruling supporting US sanctions on Tornado Cash, a decentralized cryptocurrency platform.

Sanctions were imposed by the US Treasury Department last year due to alleged money laundering and aiding malicious cyber activities, reinforcing concerns about regulatory pressures on the crypto industry.

Additionally, the lawsuit’s financing by Coinbase underscores the ongoing battle to balance cryptocurrency privacy with regulatory compliance.

The market’s response suggests a cautious sentiment as traders consider the broader implications of increased government intervention.

Meanwhile, BTC/USD’s fall is in line with the broader concerns within the decentralized finance sector, highlighting the ongoing tension between crypto innovation and regulatory oversight

Bitcoin Developers Dismiss Craig Wright’s Claims of Billions of Dollars in Bitcoin

Bitcoin’s drop in value today may be attributed to legal developments surrounding Craig Wright’s ownership claims.

The market sentiment reflects concerns about a lawsuit in which Wright’s assertion that his company, Tulip Trading, owns 111,000 bitcoins was rejected by Bitcoin developers.

The developers claim that Tulip Trading’s documents are fake and allege fraudulent intent to seize control of the funds.

This legal battle amplifies uncertainty in the crypto space, as Wright, who alleges to be Bitcoin’s creator, seeks control over lost crypto through legal means.

The contentious nature of these disputes, coupled with Wright’s history of litigations, contributes to market cautiousness.

These legal intricacies add to the broader regulatory and legal concerns impacting BTC/USD’s movement today.

Controversy Brews as NFT Believers Challenge Reported Decline of Bitcoin Amid Increasing Transaction Volume

Recently, there has been an increase in the use of Ordinal inscriptions on the Bitcoin network, which has sparked discussions among NFT supporters.

The percentage of weekly Bitcoin transaction activity that is attributed to Ordinal transactions has reached a peak of 53.9%, which is significant.

However, there is controversy surrounding the reported 97% drop in Ordinal sales since their peak, with conflicting data suggesting a decline of 67% to 68%.

Despite these fluctuations, experts note that such market dynamics are typical for new assets, including NFTs.

It is worth mentioning that the current high volume of pending transactions (347,640 unconfirmed) contributes to market uncertainty, which highlights the broader concerns affecting the movement of BTC/USD today.

Bitcoin Price Prediction

Recent times have witnessed substantial activity within Bitcoin’s technical landscape, stemming from its descent below the $29,000 threshold on August 6th.

Currently hovering at approximately $25,800, the cryptocurrency has undergone a notable downturn.

The 50-day Exponential Moving Average (EMA) positioned at around $27,300 has notably impacted Bitcoin’s trajectory, as recent candle closures validate an enduring bearish momentum.

Immediate resistance is encountered at $26,200. However, the presence of a bearish engulfing candlestick and a two-day candle pattern below this level suggest the continuation of bearish pressure.

Should this trend persist, Bitcoin’s value could decline to $25,600, and potentially even descend to $25,200.

Yet, the breach of the $26,200 resistance could pave the way for targeting the subsequent resistance at $26,800. Should bullish momentum persist, this could lead BTC’s price toward levels of $27,300 and ultimately $27,600.

Conversely, a breach below $25,200 might signal the potential for more profound losses, potentially extending downward to as low as $24,800.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

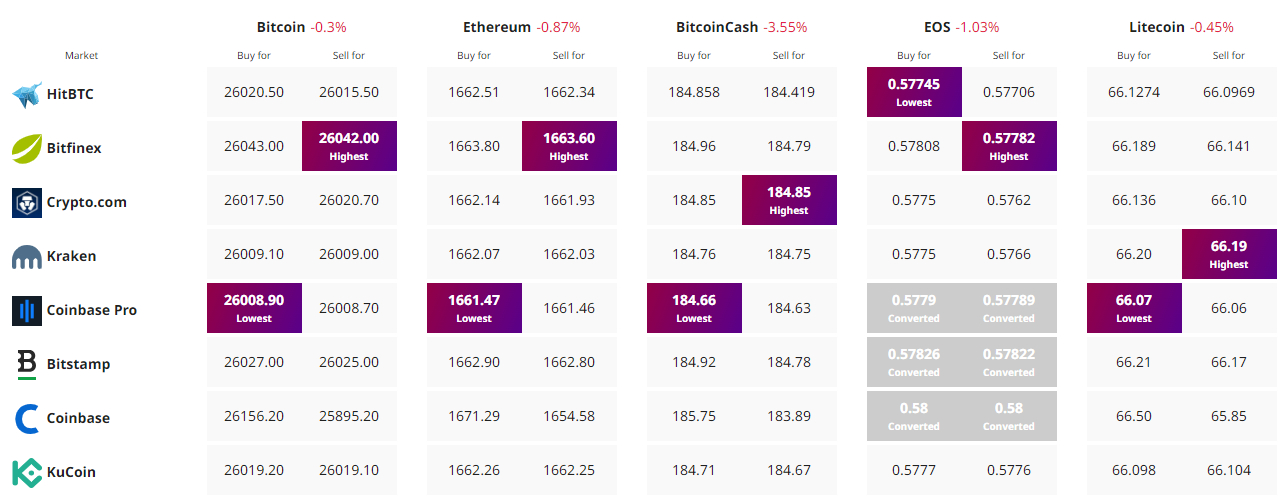

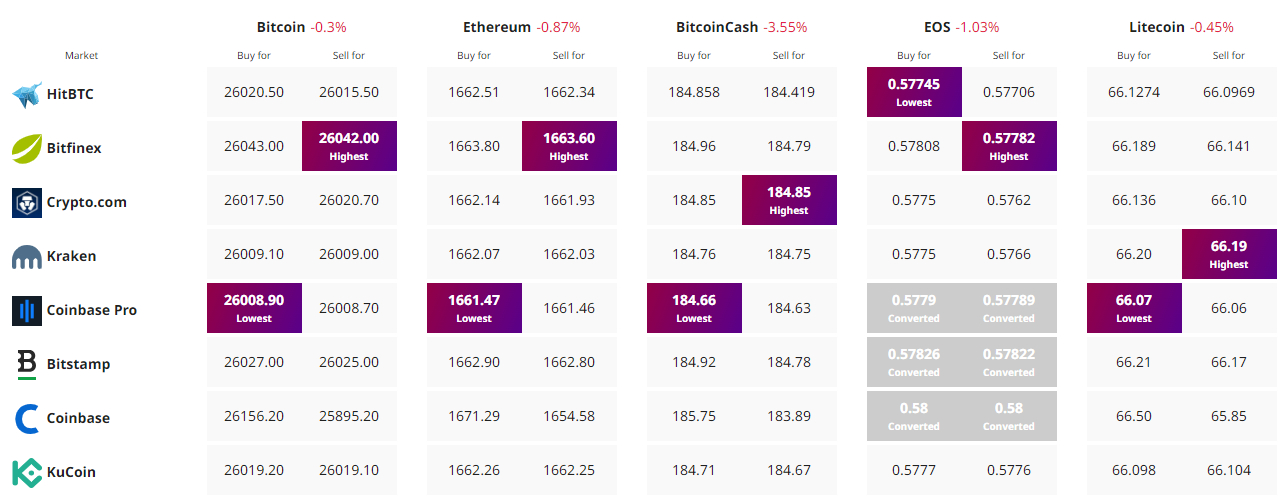

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

In the ever-evolving landscape of cryptocurrency, the price of Bitcoin price currently hovers at $26,051, experiencing a marginal decrease of 0.25% on Tuesday.

While market dynamics remain fluid, recent developments and factors have caught the attention of both investors and enthusiasts.

A significant development involves legalizing US sanctions against the Tornado Cash crypto platform, marking a noteworthy development in regulatory measures.

Furthermore, assertions made by Craig Wright regarding the presence of billions of dollars worth of Bitcoin have been met with skepticism and rejection by the Bitcoin development community.

Amidst these events, the rising prominence of ordinary transaction dominance prompts NFT proponents to raise questions regarding the purported decline of Bitcoin.

This intricate interplay of factors forms the backdrop against which Bitcoin’s price movement is being analyzed, raising the question of whether the current dip presents an opportune moment for strategic acquisitions.

US Judge Gives Green Light to Sanctions Against Tornado Cash Crypto Platform

BTC/USD is declining due to a federal judge’s ruling supporting US sanctions on Tornado Cash, a decentralized cryptocurrency platform.

Sanctions were imposed by the US Treasury Department last year due to alleged money laundering and aiding malicious cyber activities, reinforcing concerns about regulatory pressures on the crypto industry.

Additionally, the lawsuit’s financing by Coinbase underscores the ongoing battle to balance cryptocurrency privacy with regulatory compliance.

The market’s response suggests a cautious sentiment as traders consider the broader implications of increased government intervention.

Meanwhile, BTC/USD’s fall is in line with the broader concerns within the decentralized finance sector, highlighting the ongoing tension between crypto innovation and regulatory oversight

Bitcoin Developers Dismiss Craig Wright’s Claims of Billions of Dollars in Bitcoin

Bitcoin’s drop in value today may be attributed to legal developments surrounding Craig Wright’s ownership claims.

The market sentiment reflects concerns about a lawsuit in which Wright’s assertion that his company, Tulip Trading, owns 111,000 bitcoins was rejected by Bitcoin developers.

The developers claim that Tulip Trading’s documents are fake and allege fraudulent intent to seize control of the funds.

This legal battle amplifies uncertainty in the crypto space, as Wright, who alleges to be Bitcoin’s creator, seeks control over lost crypto through legal means.

The contentious nature of these disputes, coupled with Wright’s history of litigations, contributes to market cautiousness.

These legal intricacies add to the broader regulatory and legal concerns impacting BTC/USD’s movement today.

Controversy Brews as NFT Believers Challenge Reported Decline of Bitcoin Amid Increasing Transaction Volume

Recently, there has been an increase in the use of Ordinal inscriptions on the Bitcoin network, which has sparked discussions among NFT supporters.

The percentage of weekly Bitcoin transaction activity that is attributed to Ordinal transactions has reached a peak of 53.9%, which is significant.

However, there is controversy surrounding the reported 97% drop in Ordinal sales since their peak, with conflicting data suggesting a decline of 67% to 68%.

Despite these fluctuations, experts note that such market dynamics are typical for new assets, including NFTs.

It is worth mentioning that the current high volume of pending transactions (347,640 unconfirmed) contributes to market uncertainty, which highlights the broader concerns affecting the movement of BTC/USD today.

Bitcoin Price Prediction

Recent times have witnessed substantial activity within Bitcoin’s technical landscape, stemming from its descent below the $29,000 threshold on August 6th.

Currently hovering at approximately $25,800, the cryptocurrency has undergone a notable downturn.

The 50-day Exponential Moving Average (EMA) positioned at around $27,300 has notably impacted Bitcoin’s trajectory, as recent candle closures validate an enduring bearish momentum.

Immediate resistance is encountered at $26,200. However, the presence of a bearish engulfing candlestick and a two-day candle pattern below this level suggest the continuation of bearish pressure.

Should this trend persist, Bitcoin’s value could decline to $25,600, and potentially even descend to $25,200.

Yet, the breach of the $26,200 resistance could pave the way for targeting the subsequent resistance at $26,800. Should bullish momentum persist, this could lead BTC’s price toward levels of $27,300 and ultimately $27,600.

Conversely, a breach below $25,200 might signal the potential for more profound losses, potentially extending downward to as low as $24,800.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.