Bitcoin’s price has encountered a setback as it falls back down to the key support level of $30,000. At the time of writing, Bitcoin is trading at around $30,330.

Recent news surrounding the cryptocurrency market includes a Coinbase user’s claim of account closure by Bank of America due to Bitcoin transactions, drawing attention to potential challenges faced by banks in accommodating digital assets.

Additionally, the ruling by Judge Torres that XRP is not considered a security in the SEC vs. Ripple case has received criticism from regulators, further highlighting the ongoing legal and regulatory developments in the cryptocurrency space.

As Bitcoin finds support at the $30,000 level, investors are now curious about the next BTC price movement target.

Bank of America Under Scrutiny for Closing Coinbase User’s Account

After a Coinbase customer voiced concerns about their account being closed by Bank of America due to Bitcoin transactions, the bank faced criticism.

Brian Armstrong, CEO of Coinbase, quickly addressed the issue and questioned if other users had encountered similar problems with Bank of America.

Muneeb Ali, co-founder of Stacks, a Bitcoin smart contract platform, took to Twitter on Wednesday to express that Bank of America had abruptly closed his bank account, which he had been using for 15 years, without providing any explanation.

This incident sparked backlash against the bank. Ali strongly suspects that using the bank account for purchasing Bitcoin through Coinbase led to its closure.

He tweeted, “This is a war on Bitcoin and crypto.”

In response to Armstrong’s inquiry, several individuals shared their own experiences, although some claimed they had not faced any issues.

However, a significant number disclosed that their banks had either closed or restricted their accounts due to Bitcoin transactions.

As a result of this negative sentiment, Bitcoin faced downward pressure on Saturday.

Regulator Challenges Judge Torres’ Ruling on XRP’s Security Status in SEC vs. Ripple Case

The legal battle between the US Securities and Exchange Commission (SEC) and Ripple has resulted in partial wins for both parties, allowing the SEC to proceed with its case.

While facing criticism from the XRP community, the SEC has expressed its position following the court’s decision. Reports suggest that the SEC may choose to continue pursuing the case.

According to the judge’s ruling, Ripple was found to have violated securities laws by offering and selling XRP as investment contracts in certain circumstances.

Notably, the violation pertained to the sale of XRP to institutional investors, while the judge ruled in favor of Ripple for selling the asset to the general public.

This ruling establishes a distinction in the application of securities laws based on the type of investors involved.

The possibility of the SEC continuing its case has added pressure to the value of Bitcoin on Saturday.

Bitcoin Price Prediction

Bitcoin encountered a notable pullback after failing to overcome the crucial resistance level at $31,793, forming a double obstacle for its price movement.

Presently, Bitcoin is trading near $30,300 and finding support around the $30,000 level, reinforced by an upward trendline. The candlestick closures above the trendline indicate a persistent bullish sentiment.

However, potential resistance looms around $30,411, posing a challenge to Bitcoin’s upward momentum.

Immediate support is identified at $30,000, and if breached, the next support level to monitor is around $29,500.

The Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and the 50-day exponential moving average all signal bearish sentiment and act as significant resistance near $30,750.

A decisive break below $30,000 may lead Bitcoin towards the next target at $29,500, continuing the downtrend to $28,700.

Conversely, surpassing the $30,400 level could open doors to further upside potential, targeting $30,700 and $31,350.

Traders and investors should closely watch the price action around $30,000, a crucial pivot point that may determine the trend continuation or resumption.

Conversely, if Bitcoin surpasses the $30,400 level, it could pave the way for further upside potential, with price targets of $30,700 and $31,350.

It is important to closely monitor the price action around the $30,000 level as it is a crucial pivot point.

Immediate support is observed at around $30,000, and a breach below this level could lead to further downward pressure towards $29,500.

Conversely, a break above the $30,400 level could open the doors for potential gains toward $30,700 and $31,350.

Traders and investors should closely monitor these key levels to gain insights into Bitcoin’s short-term price direction and adjust their strategies accordingly.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the newest initial coin offering (ICO) ventures and alternative cryptocurrencies by regularly exploring our meticulously chosen assortment of the top 15 digital assets to monitor in 2023.

This meticulously crafted compilation has been assembled by industry professionals from Industry Talk and Cryptonews, guaranteeing that you receive expert suggestions and valuable perspectives.

Stay at the forefront and uncover the possibilities presented by these cryptocurrencies as you navigate the dynamic landscape of digital assets.

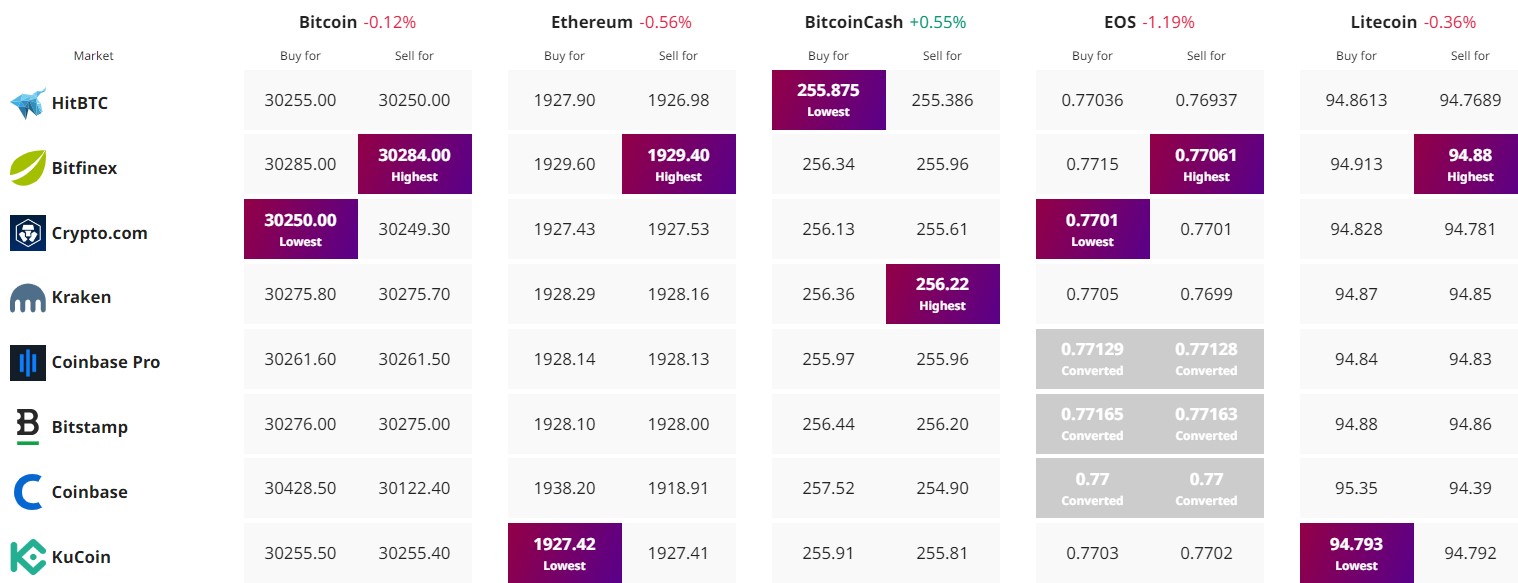

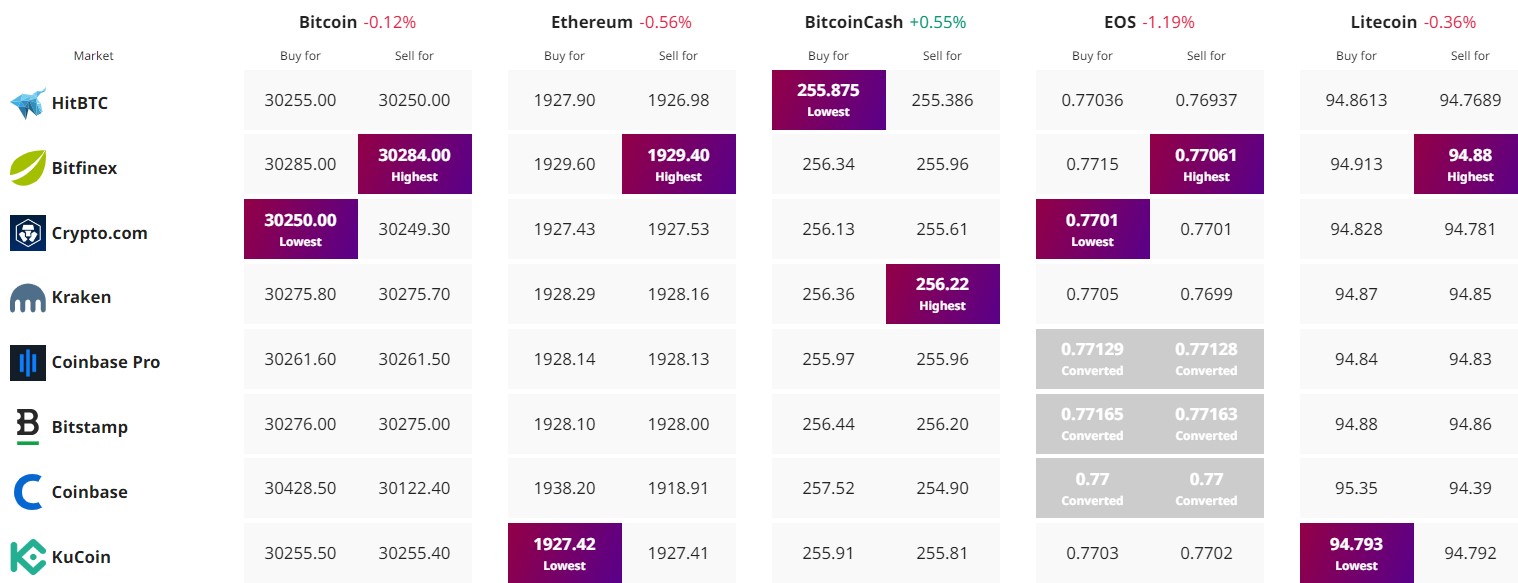

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Bitcoin’s price has encountered a setback as it falls back down to the key support level of $30,000. At the time of writing, Bitcoin is trading at around $30,330.

Recent news surrounding the cryptocurrency market includes a Coinbase user’s claim of account closure by Bank of America due to Bitcoin transactions, drawing attention to potential challenges faced by banks in accommodating digital assets.

Additionally, the ruling by Judge Torres that XRP is not considered a security in the SEC vs. Ripple case has received criticism from regulators, further highlighting the ongoing legal and regulatory developments in the cryptocurrency space.

As Bitcoin finds support at the $30,000 level, investors are now curious about the next BTC price movement target.

Bank of America Under Scrutiny for Closing Coinbase User’s Account

After a Coinbase customer voiced concerns about their account being closed by Bank of America due to Bitcoin transactions, the bank faced criticism.

Brian Armstrong, CEO of Coinbase, quickly addressed the issue and questioned if other users had encountered similar problems with Bank of America.

Muneeb Ali, co-founder of Stacks, a Bitcoin smart contract platform, took to Twitter on Wednesday to express that Bank of America had abruptly closed his bank account, which he had been using for 15 years, without providing any explanation.

This incident sparked backlash against the bank. Ali strongly suspects that using the bank account for purchasing Bitcoin through Coinbase led to its closure.

He tweeted, “This is a war on Bitcoin and crypto.”

In response to Armstrong’s inquiry, several individuals shared their own experiences, although some claimed they had not faced any issues.

However, a significant number disclosed that their banks had either closed or restricted their accounts due to Bitcoin transactions.

As a result of this negative sentiment, Bitcoin faced downward pressure on Saturday.

Regulator Challenges Judge Torres’ Ruling on XRP’s Security Status in SEC vs. Ripple Case

The legal battle between the US Securities and Exchange Commission (SEC) and Ripple has resulted in partial wins for both parties, allowing the SEC to proceed with its case.

While facing criticism from the XRP community, the SEC has expressed its position following the court’s decision. Reports suggest that the SEC may choose to continue pursuing the case.

According to the judge’s ruling, Ripple was found to have violated securities laws by offering and selling XRP as investment contracts in certain circumstances.

Notably, the violation pertained to the sale of XRP to institutional investors, while the judge ruled in favor of Ripple for selling the asset to the general public.

This ruling establishes a distinction in the application of securities laws based on the type of investors involved.

The possibility of the SEC continuing its case has added pressure to the value of Bitcoin on Saturday.

Bitcoin Price Prediction

Bitcoin encountered a notable pullback after failing to overcome the crucial resistance level at $31,793, forming a double obstacle for its price movement.

Presently, Bitcoin is trading near $30,300 and finding support around the $30,000 level, reinforced by an upward trendline. The candlestick closures above the trendline indicate a persistent bullish sentiment.

However, potential resistance looms around $30,411, posing a challenge to Bitcoin’s upward momentum.

Immediate support is identified at $30,000, and if breached, the next support level to monitor is around $29,500.

The Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and the 50-day exponential moving average all signal bearish sentiment and act as significant resistance near $30,750.

A decisive break below $30,000 may lead Bitcoin towards the next target at $29,500, continuing the downtrend to $28,700.

Conversely, surpassing the $30,400 level could open doors to further upside potential, targeting $30,700 and $31,350.

Traders and investors should closely watch the price action around $30,000, a crucial pivot point that may determine the trend continuation or resumption.

Conversely, if Bitcoin surpasses the $30,400 level, it could pave the way for further upside potential, with price targets of $30,700 and $31,350.

It is important to closely monitor the price action around the $30,000 level as it is a crucial pivot point.

Immediate support is observed at around $30,000, and a breach below this level could lead to further downward pressure towards $29,500.

Conversely, a break above the $30,400 level could open the doors for potential gains toward $30,700 and $31,350.

Traders and investors should closely monitor these key levels to gain insights into Bitcoin’s short-term price direction and adjust their strategies accordingly.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the newest initial coin offering (ICO) ventures and alternative cryptocurrencies by regularly exploring our meticulously chosen assortment of the top 15 digital assets to monitor in 2023.

This meticulously crafted compilation has been assembled by industry professionals from Industry Talk and Cryptonews, guaranteeing that you receive expert suggestions and valuable perspectives.

Stay at the forefront and uncover the possibilities presented by these cryptocurrencies as you navigate the dynamic landscape of digital assets.

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.